- United States

- /

- Machinery

- /

- NYSE:CMI

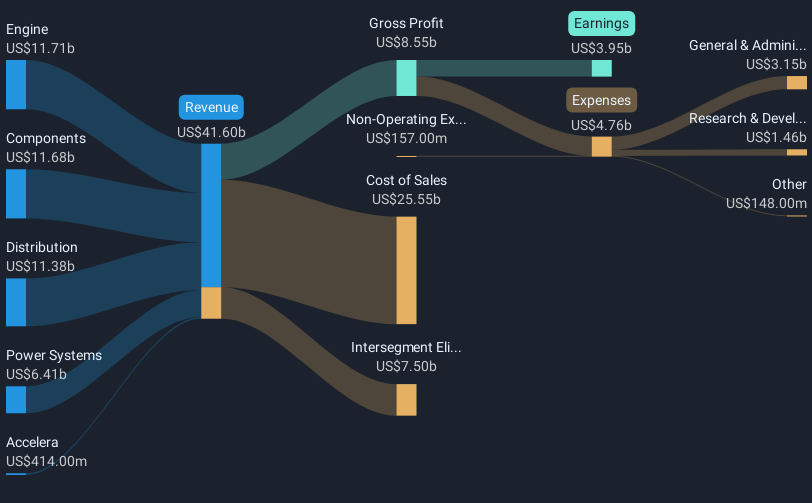

Cummins (NYSE:CMI) Reports Decline In Sales And Net Income In Latest Earnings Report

Reviewed by Simply Wall St

Cummins (NYSE:CMI) has recently been in the spotlight due to its significant 17% share price increase last month. This move followed key events, including AVAIO Digital's substantial commitment to purchase over $200 million worth of generators from Cummins for its data centers, enhancing reliability and efficiency. The agreement reflects the strength of Cummins's offerings in backup power solutions. However, this positive move contrasts with the company's latest earnings report, which showed declines in sales and net income compared to the previous year. Despite these challenges, the recent partnership may have bolstered market confidence, aligning with broader market gains.

Be aware that Cummins is showing 2 risks in our investment analysis and 1 of those is concerning.

The recent 17% share price increase for Cummins reflects positive sentiment following AVAIO Digital's commitment to purchase over $200 million worth of generators. This deal could potentially strengthen Cummins's revenue streams and bolster future earnings by tapping into the growing demand for data center power solutions. Despite recent declines in sales and net income, the strategic collaboration with AVAIO could signal enhanced operational efficiency and increased market confidence.

Over a longer-term period, Cummins’s total shareholder return, including dividends, was 140.64% over five years, demonstrating substantial growth. Compared to the past year, Cummins outperformed both the U.S. Machinery industry, which returned 2.7%, and the broader U.S. market, which gained 11.6%. This performance illustrates Cummins's ability to weather recent challenges and emerge with strong shareholder returns.

With the new engine platforms and partnerships such as the one with AVAIO, analysts anticipate future revenue growth and improved net margins. Cummins is expected to capitalize on decarbonization opportunities and increased demand for power generation. Current forecasts predict annual revenue growth of 4.2% and a rise in profit margins, but risks like trade tariffs and regulatory challenges could affect these projections. The share price, while benefiting from recent news, remains at $298.34, which is still at a discount compared to the consensus price target of $349.02, suggesting potential for further appreciation if growth expectations materialize.

Examine Cummins' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMI

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)