- United States

- /

- Machinery

- /

- NYSE:CAT

Uncertainty Demands Defensive Stocks, and Caterpillar Inc. (NYSE:CAT) Might be one of Them

Caterpillar Inc. (NYSE:CAT) has been known to the investment community as a dividend stock. Today we are going to re-evaluate its performance in light of the new strong earnings release and put it into context for existing investors and those that are looking to invest in CAT.

Earnings Results

On 30th of January, CAT released the full FY 2021 results. We note some highlights:

- EPS: US$11.93 (up from US$5.51 in FY 2020).

- Revenue: US$51.0b (up 22% from FY 2020).

- Net income: US$6.49b (up 116% from FY 2020).

- Profit margin: 13% (up from 7.2% in FY 2020). The increase in margin was driven by higher revenue.

Revenue exceeded analyst estimates by 1.1%. Earnings per share (EPS) also surpassed analyst estimates by 18%.

Over the next year, revenue is forecast to grow 13%, compared to a 37% growth forecast for the industry in the US. This is mostly a reflection of the maturity of the company, since CAT has already a developed presence and is seeking to re-capture pre-pandemic income levels.

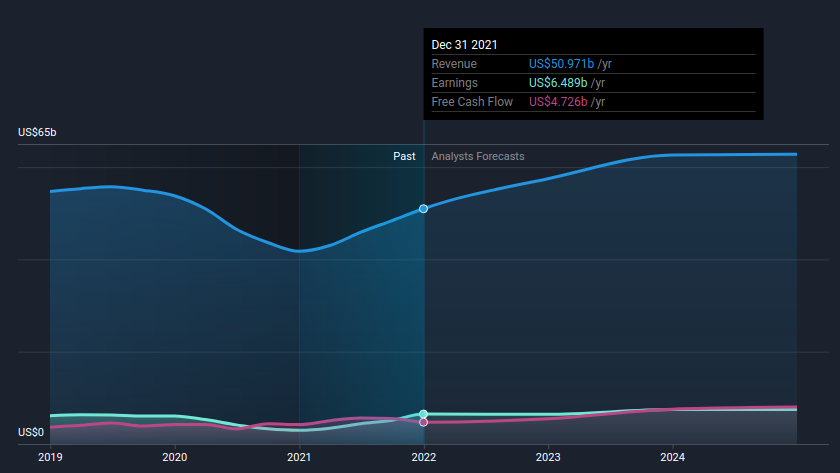

Numbers can sometimes be hard to evaluate, that is why we will put them into a chart to get the full context. Note that the chart is comprised both of past income and future expectations. That way we get a good sense of the direction for CAT.

As we can see, CAT is still recovering income levels to pre-2020 highs, and it seems that it will fully recover by the end of 2020, after which it is projected to slowly grow.

Investors ultimately get returns from the free cash flows that a company makes. For CAT, we can see that the free cash flows are closely in-line with profits, giving investors a portion of the US$4.7b in free cash flows.

Dividend Analysis

Investors look for dividend stock for different reasons, these include a high yield, stable payments, de-risking of a portfolio, reliable income, etc.

With CAT, we can see that the company fares good on the stability of payments which can provide a reliable income, as well as provide an opportunity to de-risk a portfolio. Since CAT is less volatile than 75% of the stocks in the market, we can see why investors might want to consider this as a stabilization option.

The dividend yield for CAT is currently modest, at 2.2%. However, that is still a bit higher than the market (S&P 500) dividend yield of 1.27%. Investors are possibly valuing this company higher because of its connection to primary industries (Mining, Construction, Transport), the expected future industrial activity, as well as the pricing ability of the company to pass on inflated costs to clients. In that regard, a 2.2% dividend yield is a mixed proposition, as it helps with future stability but provides little in terms of absolute returns.

Keep in mind that dividends are not the only way a company can provide returns for investors. CAT also returned around 2.3% of its market capitalization to shareholders in the form of stock buybacks over the past year.

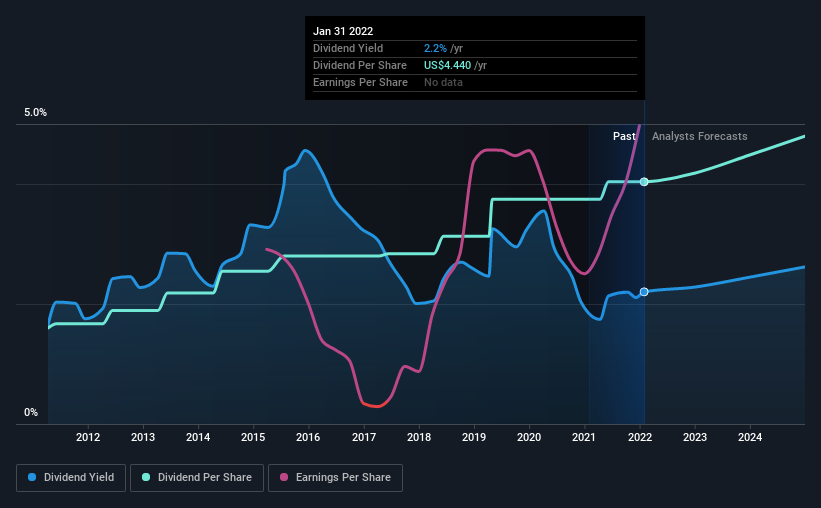

In the cart below, we will get insight to the relative strength for CAT's dividends.

Explore this interactive chart for our latest analysis on Caterpillar!

Payout ratios

Caterpillar paid out 37% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Caterpillar paid out 49% of its free cash flow as dividends last year.

It's positive to see that Caterpillar's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable.

We update our data on Caterpillar every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend.

During the past 10-year period, the dividend has been stable and increasing. The first annual payment was US$1.8 in 2012, compared to US$4.4 last year. This works out to be a compound annual growth rate (CAGR) of approximately 9.7% a year over that time.

While the past indicates healthy growth, we can argue that the company is reaching maturity, which means a stable state of earnings. This will allow the company to maintain dividends per share, however it will make it increasingly more difficult to increase dividends, unless it unlocks new avenues of growth.

Conclusion

To summarize, shareholders should always check that Caterpillar's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend.

CAT seems to be recovering income nicely to pre-2020 levels. The market is also putting more value on the company, perhaps in a bid to rotate to more resilient companies with stable cash flows.

If you want to know more on the rationale behind a rotation to stable companies, check out our educational video!

The dividends from CAT are stable and should be satisfactory for investors that are already holding the stock. However, the company has limited utility for new investors, primarily because the level of the stock price today allows for a modest 2.2% dividend yield. Alternatively, new investors may utilize CAT to de-risk and stabilize their portfolio.

Taking the debate a bit further, we've identified 1 warning sign for Caterpillar that investors need to be conscious of moving forward.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives