- United States

- /

- Machinery

- /

- NYSE:CAT

Investors Have 11 days To Get In On Caterpillar's Inc. (NYSE:CAT) 2.3% Dividend

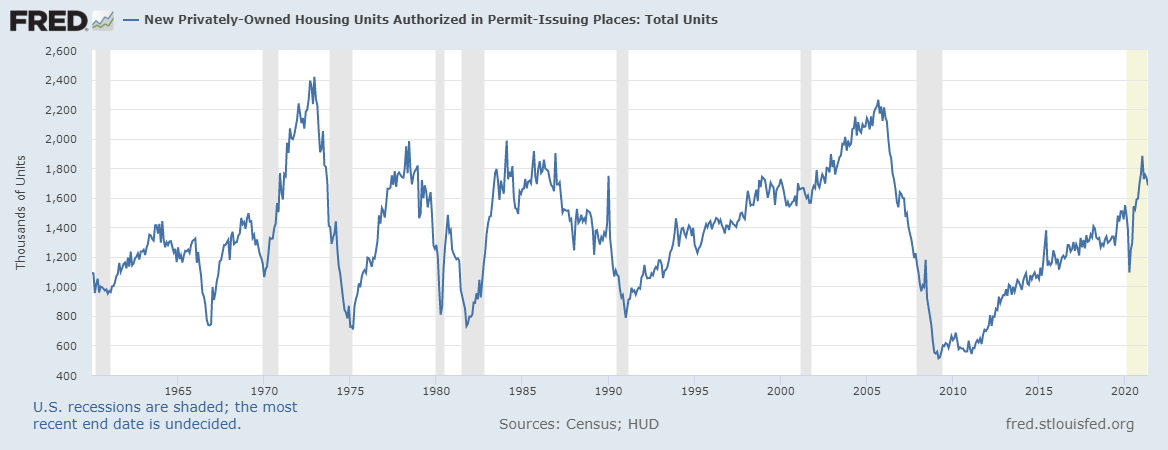

Caterpillar Inc. (NYSE:CAT), has seen its ups and downs in revenue as a cyclical stock, and investors know full well that a recovering economy is great for the future of the company. In the chart below, we can find clues for the demand of future construction services, and it seems that the industry is still in a general uptrend.

U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Total Units [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis, July 7, 2021.

This gives the company solid standing as a resilient and a dividend-stable player.

We also see signals that Caterpillar is primed for more market exposure, as it has been recently included in multiple indices:

- Russell 3000E Growth Index

- Russell 3000 Growth Index

- Russell 1000 Growth-Defensive Index

- Russell 1000 Value-Defensive Index

- Russell 1000 Defensive Index

- Russell 1000 Growth Index

- Russell Top 200 Growth Index

Dividend Analysis

Investors are often drawn to strong and reliable companies with the idea of reinvesting the dividends.

If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments.

While Caterpillar's 2.1% dividend yield is not the highest, we think its lengthy payment history is quite interesting. The chart below shows the dividend yield, dividend per share and corresponding earnings per share. Even though it seems to be a bumpy ride for EPS, the dividend per share seems to be consistently rising.

Explore this interactive chart for our latest analysis on Caterpillar!

Investors should take note of the fact that they can receive the next dividend payment scheduled for the 20th August 2021, by buying Caterpillar stock within 11 days, or before 19th July. They must also hold the stock until the dividend is paid out.

Let's further examine how much the company pays and how sustainable are payments.

Payout Ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable.

So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax.

Caterpillar paid out 65% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Caterpillar's cash payout ratio in the last year was 44%, which suggests dividends were well covered by cash generated by the business.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on Caterpillar every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well.

Caterpillar has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. During this period, the dividend has been stable, which could imply the business could have relatively consistent earnings power.

During the past 10-year period, the first annual payment was US$1.8 in 2011, compared to US$4.4 last year. This works out to be an annual growth rate of around 9.7% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term.

Strong earnings might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Caterpillar has been mostly profitable in the last 5 years.

Earnings per share have also been growing up until 2020 after which they slipped and have now started recovering. However, given that it is paying out more than half of its earnings as dividends, we wonder how Caterpillar will keep funding its growth projects in the future.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable.

Caterpillar's payout ratios are within a normal range for the average corporation, and we like that its cashflow was stronger than reported profits. That said, we were glad to see it growing earnings and paying a fairly consistent dividend.

Caterpillar performs reliably under this analysis, and it seems investors are also counting on the possibility of growth in construction and an economic recovery. At the right valuation, it could be a solid dividend prospect.

However, there are other things to consider for investors when analyzing stock performance. Case in point: We've spotted 2 warning signs for Caterpillar (of which 1 is concerning!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you're looking to trade Caterpillar, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives