- United States

- /

- Machinery

- /

- NYSE:CAT

Does CAT’s Steady Dividend Reflect Prudent Capital Discipline or a Cautious Growth Outlook?

Reviewed by Sasha Jovanovic

- Caterpillar's Board of Directors voted to maintain the quarterly dividend at US$1.51 per share, payable on November 20, 2025, to shareholders of record as of October 20, 2025.

- This decision extends Caterpillar's track record of uninterrupted annual cash dividends and underscores management's ongoing commitment to shareholder returns despite industry uncertainties.

- To assess how Caterpillar’s consistent dividend policy fits into its broader investment narrative, we’ll explore its impact on capital allocation discipline and investor confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Caterpillar Investment Narrative Recap

To be a Caterpillar shareholder today, you need to believe in the lasting power of global infrastructure demand, resilient order backlogs, and the company's ability to return capital despite ongoing macro and industry headwinds. The latest decision to maintain the US$1.51 quarterly dividend does not meaningfully impact the most important near-term catalyst, strong backlog and infrastructure spend, or the main risk, which remains the potential margin pressure from anticipated 2025 tariffs.

Among Caterpillar’s recent moves, management’s June 2025 dividend hike stands out as particularly relevant. That 7% increase, followed by the latest affirmation, reflects ongoing capital allocation discipline and underscores a deliberate effort to foster investor confidence even through periods of industry volatility. For investors focused on cash flow reliability and defensive qualities, this kind of dividend consistency ties directly to one of Caterpillar’s core investment theses.

Yet, despite this steady dividend track record, investors should keep in mind the potential impact of looming US$1.3–$1.5 billion tariffs on margins, because...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's narrative projects $74.0 billion revenue and $13.5 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $4.1 billion earnings increase from $9.4 billion today.

Uncover how Caterpillar's forecasts yield a $467.96 fair value, a 5% downside to its current price.

Exploring Other Perspectives

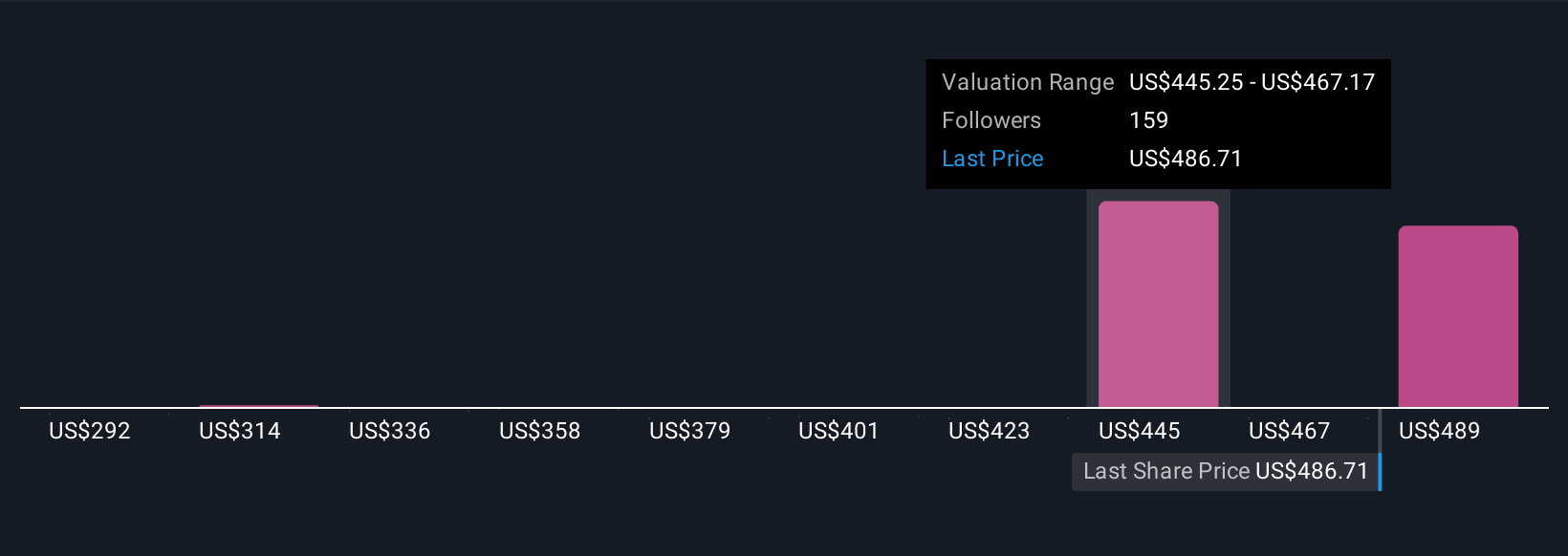

Twenty-four individual fair value estimates from the Simply Wall St Community range from US$291.79 to US$510.81 per share. While views differ, looming tariff-related margin risks could shape how you see Caterpillar’s future performance, be sure to compare these perspectives before making up your mind.

Explore 24 other fair value estimates on Caterpillar - why the stock might be worth as much as $510.81!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAT

Caterpillar

Manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives