- United States

- /

- Trade Distributors

- /

- NasdaqGS:RUSH.A

Rush Enterprises (NASDAQ:RUSH.A) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Rush Enterprises, Inc. (NASDAQ:RUSH.A) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Rush Enterprises

What Is Rush Enterprises's Debt?

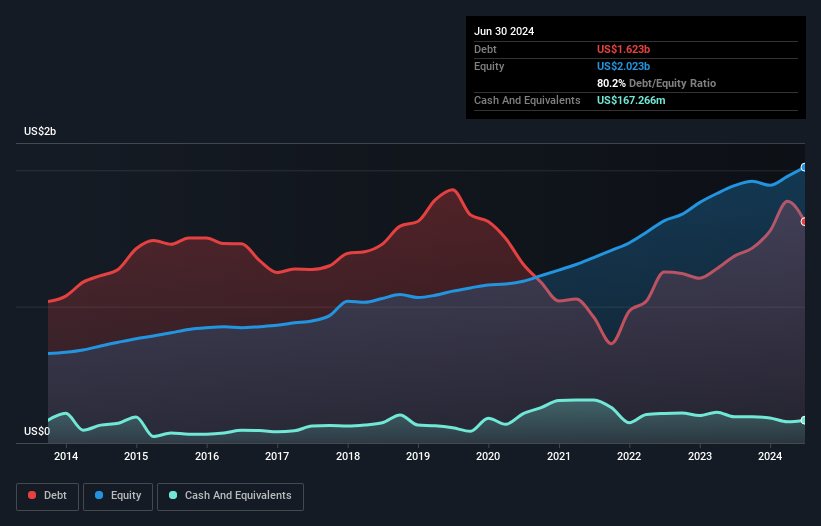

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Rush Enterprises had US$1.62b of debt, an increase on US$1.37b, over one year. However, because it has a cash reserve of US$167.3m, its net debt is less, at about US$1.46b.

A Look At Rush Enterprises' Liabilities

Zooming in on the latest balance sheet data, we can see that Rush Enterprises had liabilities of US$1.70b due within 12 months and liabilities of US$785.7m due beyond that. On the other hand, it had cash of US$167.3m and US$292.9m worth of receivables due within a year. So its liabilities total US$2.02b more than the combination of its cash and short-term receivables.

Rush Enterprises has a market capitalization of US$3.74b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Rush Enterprises's net debt of 2.1 times EBITDA suggests graceful use of debt. And the alluring interest cover (EBIT of 7.1 times interest expense) certainly does not do anything to dispel this impression. The bad news is that Rush Enterprises saw its EBIT decline by 10% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Rush Enterprises can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Rush Enterprises basically broke even on a free cash flow basis. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

On the face of it, Rush Enterprises's EBIT growth rate left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Rush Enterprises stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Rush Enterprises you should be aware of, and 1 of them doesn't sit too well with us.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RUSH.A

Rush Enterprises

Through its subsidiaries, operates as an integrated retailer of commercial vehicles and related services in the United States and Canada.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026