- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Why Intuitive Machines (LUNR) Is Down 7.4% After Cutting Revenue Guidance and Posting a Surprise Loss

Reviewed by Simply Wall St

- Intuitive Machines, Inc. recently reported second-quarter 2025 results, with sales rising to US$50.31 million from US$41.64 million a year earlier, but shifting from a US$15.87 million net income to a US$38.59 million net loss alongside a downward revision in full-year revenue targets.

- Although six-month sales remained largely steady year-over-year, the company's reduction in net loss from over US$103 million to US$38 million highlights some operational improvement despite new profitability challenges in the most recent quarter.

- We'll explore how the revised full-year revenue outlook and swing to losses impact Intuitive Machines' investment narrative amid evolving sector prospects.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Intuitive Machines Investment Narrative Recap

Intuitive Machines’ investment case hinges on long-term growth in commercial and government-funded lunar and space infrastructure. The recent downward revision in 2025 revenue guidance and larger Q2 net loss may weigh on near-term optimism, but do not materially affect the immediate catalyst: contract execution and milestone delivery. The biggest risk for shareholders continues to be the company’s reliance on a few large government contracts, where delays or re-prioritization could cause significant revenue swings, as evidenced by updated guidance.

Among recent announcements, the new full-year revenue projection to the lower end of earlier guidance stands out, directly reinforcing the importance of the timing and execution of current government contracts for near-term results. This shift sharpens the focus on operational discipline and schedule reliability as Intuitive Machines works toward key project deliveries.

Yet, despite signs of operational improvement, investors should pay particular attention to the effects of concentrated government contract exposure, especially as...

Read the full narrative on Intuitive Machines (it's free!)

Intuitive Machines' outlook anticipates $502.2 million in revenue and $41.2 million in earnings by 2028. This projection requires a 30.5% annual revenue growth rate and a $283 million earnings increase from the current -$241.8 million.

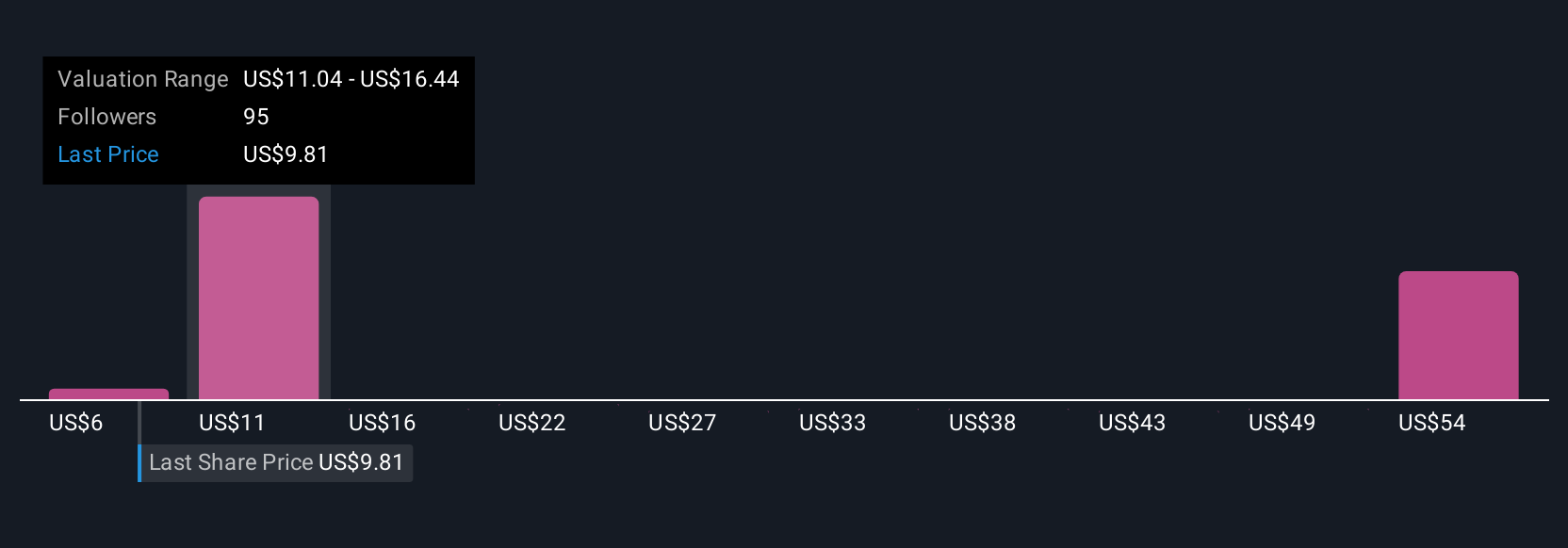

Uncover how Intuitive Machines' forecasts yield a $14.83 fair value, a 63% upside to its current price.

Exploring Other Perspectives

Private investor estimates for Intuitive Machines' fair value, sourced from 23 members of the Simply Wall St Community, range widely from US$5.64 to US$60.05. With updated corporate guidance placing renewed attention on contract outcomes, investor perspectives span from caution to high conviction about the company’s earning potential.

Explore 23 other fair value estimates on Intuitive Machines - why the stock might be worth over 6x more than the current price!

Build Your Own Intuitive Machines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intuitive Machines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Intuitive Machines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intuitive Machines' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)