- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Intuitive Machines (NasdaqGM:LUNR) Appoints James J. Frelk Amid 25% Price Dip

Reviewed by Simply Wall St

Intuitive Machines (NasdaqGM:LUNR) recently experienced a price decline of 25% last quarter. While the successful launch of its IM-2 mission and executive appointment of James J. Frelk should bolster confidence, broader market forces may have influenced the company's share performance. Intuitive Machines' decline aligns with heightened market volatility, with the tech-heavy Nasdaq down by 3.7% amidst concerns over ongoing tariffs, economic uncertainty, and weak performances by major tech companies like Tesla and Nvidia. Despite Intuitive Machines' strides in lunar exploration, market trends underscore how external factors can impact even innovative companies. The ongoing fluctuations in major indexes, such as the S&P 500's recent 2% drop, demonstrate the extent of investor caution, which seems to have overshadowed the company's individual achievements. These macroeconomic pressures appear to have played a significant role in Intuitive Machines' quarterly share price movement.

Click here to discover the nuances of Intuitive Machines with our detailed analytical report.

Over the last year, Intuitive Machines achieved a total shareholder return of 47.39%, outperforming both the US Market's 12.1% increase and the Aerospace & Defense industry's 19.8% growth. This impressive return can be partly attributed to the company's focus on lunar exploration, highlighted by the successful IM-2 mission launched in late February 2025. Additionally, the expansion of partnerships, such as with Columbia Sportswear for thermal management technologies, supports its technological advancements. The inclusion in the S&P Aerospace & Defense Select Industry Index in December 2024 further strengthened its market presence.

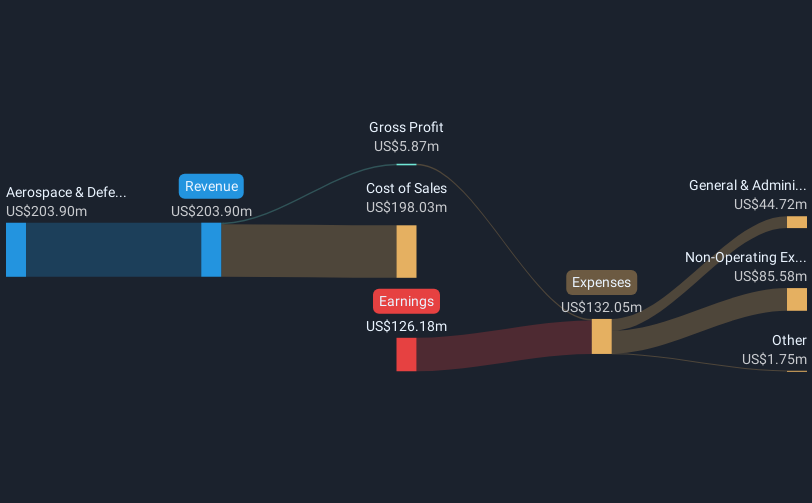

Financially, the company has shown robust revenue forecasts, with expected growth significantly outpacing the broader US market. However, the challenging profitability scenario, evidenced by increasing net losses and shareholder dilution, remains a concern. Despite setbacks, continued support from NASA, including a US$116.9 million contract for lunar payload deliveries in August 2024, showcases the value of Intuitive Machines' contributions to space exploration.

- See how Intuitive Machines measures up with our analysis of its intrinsic value versus market price.

- Assess the downside scenarios for Intuitive Machines with our risk evaluation.

- Got skin in the game with Intuitive Machines? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Intuitive Machines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential and fair value.