- United States

- /

- Trade Distributors

- /

- NasdaqCM:HDSN

Hudson Technologies And 2 Other Undervalued Small Caps In US With Insider Buying

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it has experienced a remarkable 28% increase over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that are potentially undervalued and exhibit insider buying can be an attractive strategy for investors seeking opportunities within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Capital Bancorp | 15.6x | 3.2x | 42.43% | ★★★★☆☆ |

| Franklin Financial Services | 10.4x | 2.0x | 35.88% | ★★★★☆☆ |

| McEwen Mining | 4.5x | 2.3x | 41.93% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 36.33% | ★★★★☆☆ |

| German American Bancorp | 16.1x | 5.3x | 40.67% | ★★★☆☆☆ |

| First United | 14.3x | 3.2x | 44.77% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -222.48% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -67.01% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -86.83% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hudson Technologies (NasdaqCM:HDSN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hudson Technologies is a company engaged in the wholesale distribution of miscellaneous products, with a market capitalization of $1.09 billion.

Operations: Hudson Technologies generates revenue primarily from its wholesale operations, with a notable gross profit margin of 44.53% in March 2022. The company's cost of goods sold (COGS) significantly impacts its profitability, as seen in various periods where COGS closely aligns with or exceeds revenue figures. Operating expenses and non-operating expenses also contribute to the financial performance, affecting net income margins over time.

PE: 8.4x

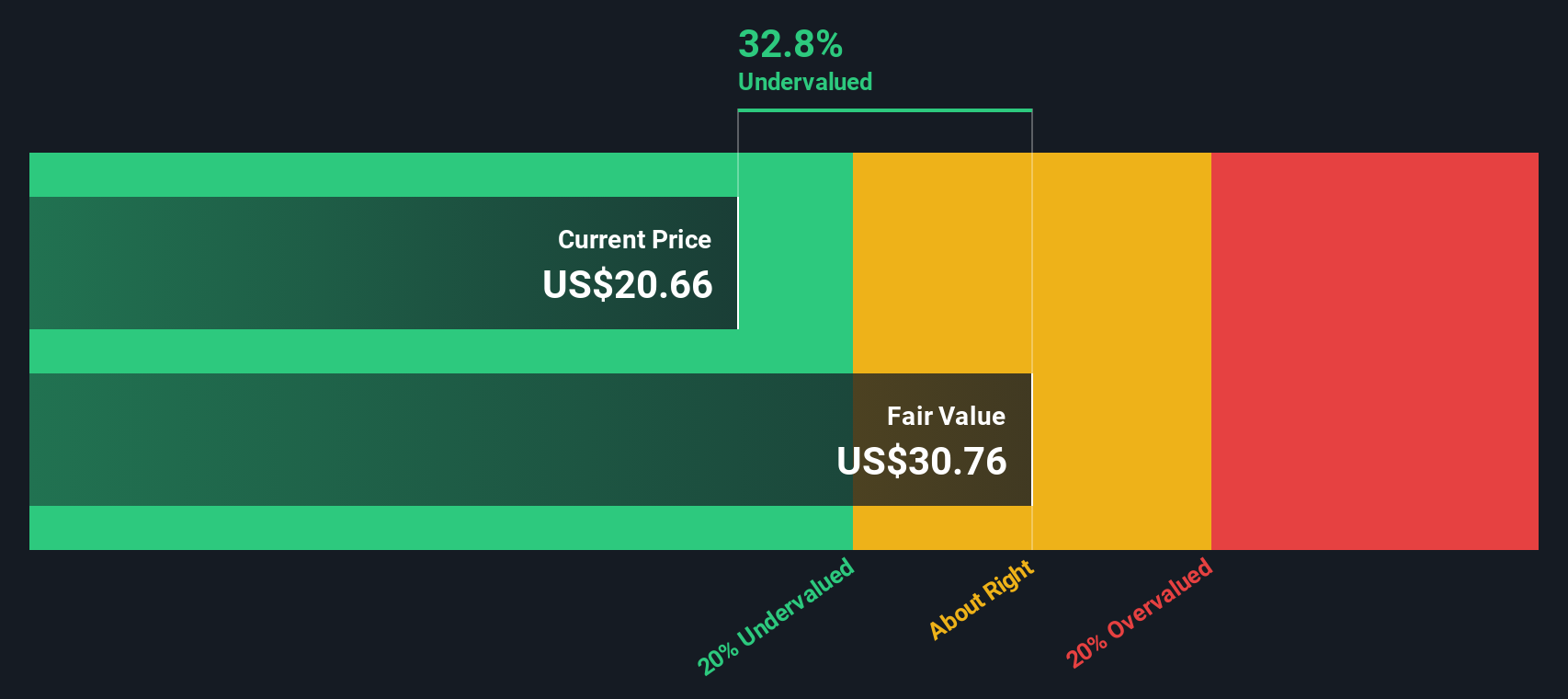

Hudson Technologies, a small company in the U.S., recently reported third-quarter sales of US$61.94 million, down from US$76.5 million a year ago, with net income also falling to US$7.81 million from US$13.58 million. Despite this decline and lowered 2024 revenue guidance, insider confidence remains evident as they repurchased 326,028 shares between August and September for US$2.63 million under an expanded buyback plan now authorized up to US$20 million. The company's funding relies entirely on external borrowing, adding risk but potentially positioning it for strategic growth if managed well amidst forecasted earnings declines over the next three years.

Capital Southwest (NasdaqGS:CSWC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Capital Southwest is a business development company that provides capital to middle-market companies, with a market cap of approximately $0.61 billion.

Operations: The company's primary revenue stream is from its investment segment, with recent figures showing $195.06 million in revenue. Operating expenses have been a significant part of the cost structure, recently recorded at $26.26 million. The gross profit margin consistently remains at 100%, indicating that all revenues translate directly into gross profit due to the absence of COGS. Net income margins have shown variability, with recent data reflecting a margin of approximately 37.77%.

PE: 14.6x

Capital Southwest, a smaller U.S. company, is gaining attention for its potential growth and strategic financial moves. Despite recent shareholder dilution and reliance on external funding, the company's earnings are projected to grow by 25.52% annually. Recent events include a $197 million fixed-income offering and plans for acquisitions to enhance portfolio value. Insider confidence is evident with no insider purchases reported recently but the company maintains flexibility to repurchase shares if conditions favor it. With strong balance sheet liquidity, Capital Southwest aims to capitalize on market opportunities while providing dividends of US$0.58 per share for Q4 2024 alongside a supplemental dividend of US$0.05 per share, highlighting its commitment to returning value to shareholders amidst evolving market dynamics.

Dave & Buster's Entertainment (NasdaqGS:PLAY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dave & Buster's Entertainment operates a chain of entertainment and dining venues offering a combination of games, food, and beverages with a market capitalization of approximately $2.05 billion.

Operations: The primary revenue stream comes from the restaurant sector, with a recent gross profit margin of 32.06%. Cost of goods sold is a significant expense, impacting overall profitability.

PE: 11.5x

Dave & Buster's Entertainment, a dynamic player in the entertainment sector, is experiencing mixed financial signals. Recent earnings show a net loss of US$32.7 million for Q3 2024, contrasting with last year's US$5.2 million loss. Despite this, insider confidence is evident as Kevin Sheehan acquired 37,735 shares valued at approximately US$961k in November 2024. The company repurchased over two million shares recently and continues expanding its footprint with new locations and innovative offerings like Interactive Social Bays and revamped menus to attract customers.

- Get an in-depth perspective on Dave & Buster's Entertainment's performance by reading our valuation report here.

Understand Dave & Buster's Entertainment's track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 46 Undervalued US Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudson Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HDSN

Hudson Technologies

Through its subsidiary, Hudson Technologies Company, provides solutions to recurring problems within the refrigeration industry in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives