- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Undervalued Small Caps With Insider Buying Opportunities For July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has seen a notable rise of 15%, with earnings forecasted to grow by another 15% annually. In this environment, identifying small-cap stocks that are currently undervalued and exhibit insider buying can present intriguing opportunities for investors seeking growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 28.41% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 41.95% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.0x | 35.81% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 38.59% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 46.76% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.7x | 38.29% | ★★★★☆☆ |

| S&T Bancorp | 11.2x | 3.9x | 40.47% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 35.69% | ★★★★☆☆ |

| Farmland Partners | 9.1x | 9.2x | -11.41% | ★★★☆☆☆ |

| BlueLinx Holdings | 15.4x | 0.2x | -143.60% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Advantage Solutions (ADV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Advantage Solutions provides a range of marketing and business solutions, including branded, retailer, and experiential services, with a market capitalization of approximately $1.07 billion.

Operations: The company generates revenue primarily through its Branded, Retailer, and Experiential Services. The gross profit margin has shown variability, with recent figures around 12.44%. Operating expenses include significant allocations for general and administrative purposes, which have impacted net income levels in recent periods.

PE: -1.2x

Advantage Solutions, a small company in the U.S., faces challenges with unprofitability and a volatile share price, yet shows potential through insider confidence. David Peacock's purchase of 75,000 shares for US$86,123 in early 2025 indicates belief in future prospects. Despite a net loss of US$56 million for Q1 2025 and declining sales to US$822 million from the previous year, the company completed a significant buyback program. Leadership changes aim to bolster operational focus amidst these financial hurdles.

- Click here to discover the nuances of Advantage Solutions with our detailed analytical valuation report.

Understand Advantage Solutions' track record by examining our Past report.

Fluence Energy (FLNC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fluence Energy specializes in energy storage solutions, with a focus on batteries and battery systems, and has a market cap of approximately $3.10 billion.

Operations: Fluence Energy's primary revenue stream is from its Batteries/Battery Systems segment, generating $2.33 billion. The company has experienced fluctuations in its gross profit margin, reaching 13.07% as of March 2025, indicating variations in cost management and pricing strategies over time.

PE: -49.0x

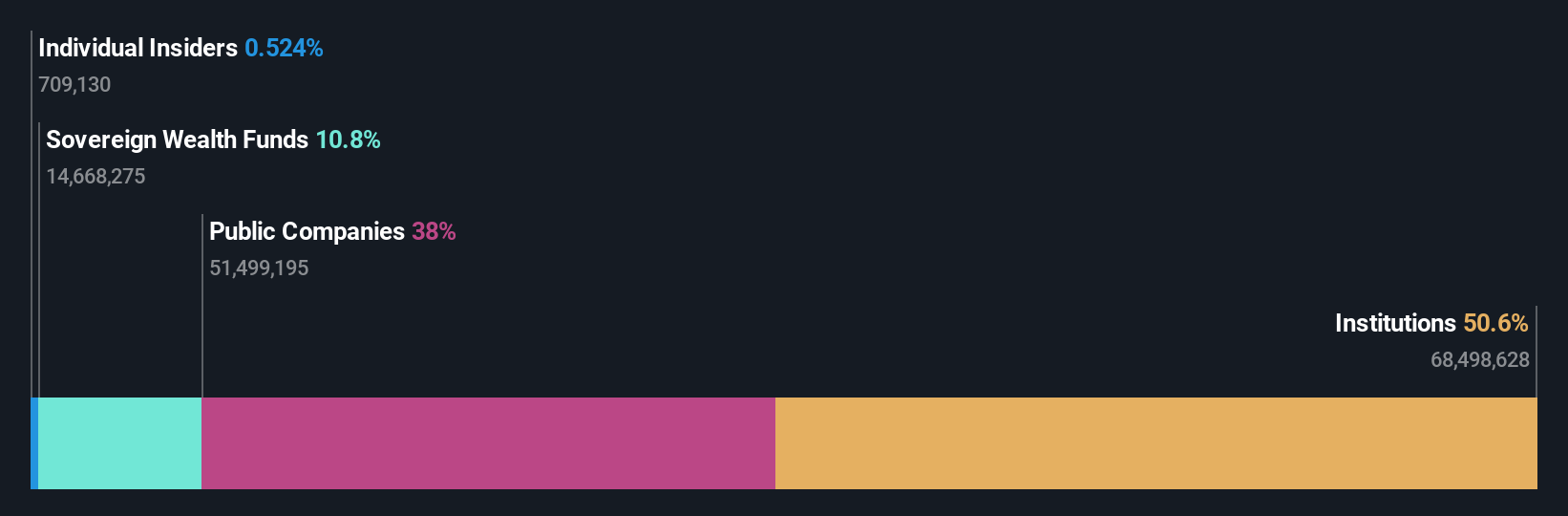

Fluence Energy, a player in the energy storage sector, has been making strides with significant projects like the 300 MW Wellington Stage 1 Battery Energy Storage System in Australia. Despite recent revenue guidance cuts due to U.S. market uncertainties and tariff impacts, insider confidence is evident as an individual purchased 33,000 shares valued at US$194,641. Their addition to several Russell indices highlights recognition of potential value amidst volatility and external funding risks.

- Dive into the specifics of Fluence Energy here with our thorough valuation report.

Examine Fluence Energy's past performance report to understand how it has performed in the past.

Helen of Troy (HELE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Helen of Troy is a consumer products company that designs, develops, and markets a diverse portfolio of brands across its Home & Outdoor and Beauty & Wellness segments, with a market capitalization of approximately $2.66 billion.

Operations: The company generates its revenue primarily from the Beauty & Wellness and Home & Outdoor segments, with recent figures showing $976.62 million and $885.86 million, respectively. The gross profit margin has shown a notable increase over time, reaching 48.07% in the latest period. Operating expenses are significant, with Sales & Marketing and General & Administrative expenses being major components.

PE: -1.5x

Helen of Troy, a smaller U.S. company, recently faced challenges with sales dropping to US$371.66 million in Q1 2025 from US$416.85 million the previous year and reporting a net loss of US$450.72 million. Despite these setbacks, the company's inclusion in the Russell 2000 Dynamic Index suggests potential for future growth. Leadership changes have occurred with Brian Grass stepping in as interim CEO following Noel Geoffroy's departure, indicating a transitional phase that could influence strategic direction positively or negatively depending on new leadership decisions and market conditions.

- Navigate through the intricacies of Helen of Troy with our comprehensive valuation report here.

Gain insights into Helen of Troy's historical performance by reviewing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 81 Undervalued US Small Caps With Insider Buying by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives