- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (FLNC): Assessing Valuation After Sizing John Phase 1 Launch and UK Expansion Momentum

Reviewed by Simply Wall St

Fluence Energy (FLNC) just flipped the switch on Phase 1 of the Sizing John battery project in the UK, and investors are watching closely as Phase 2 ramps up in a heavily constrained grid region.

See our latest analysis for Fluence Energy.

That backdrop of rising demand and contract wins has been a big part of the story behind Fluence Energy’s recent rally, with the share price at $21.52 after a 20.16 percent 1 month share price return and a powerful 186.93 percent 3 month share price return, while the 1 year total shareholder return of 26.96 percent points to momentum that is still building rather than fading.

If this kind of grid scale story has your attention, it could be a good time to see what else is shaping the energy transition through high growth tech and AI stocks.

Yet with Fluence Energy now trading above consensus price targets after a steep multi month rally, investors have to ask if the market is underestimating its long term earnings power, or if it is already pricing in most of that future growth.

Most Popular Narrative: 43.7% Overvalued

With Fluence Energy last closing at $21.52 against a narrative fair value of $14.97, the spread signals a punchy optimism baked into the price.

The analysts have a consensus price target of $7.737 for Fluence Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $2.0.

Want to see what kind of revenue surge, margin lift, and future earnings power could justify a fair value far below today’s price? The narrative lays out a detailed growth runway, a profitability pivot, and a future valuation multiple usually reserved for more mature compounders, but the exact assumptions might surprise you. Curious how those moving parts combine into that fair value math? Read on and test whether those projections match your own expectations.

Result: Fair Value of $14.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff uncertainty and potential policy shifts around domestic content could delay backlog conversion and undermine the earnings trajectory implied in the narrative.

Find out about the key risks to this Fluence Energy narrative.

Another View: Multiples Send a Softer Warning

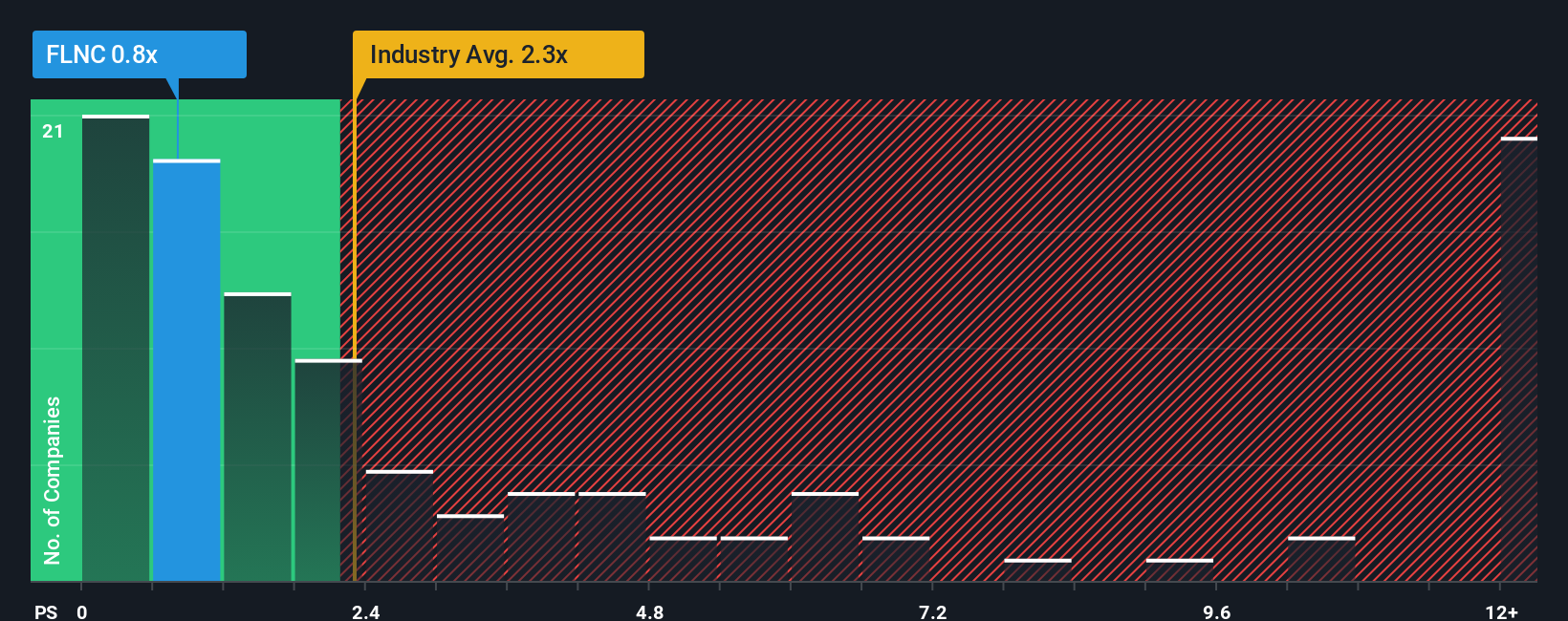

While the narrative fair value flags Fluence Energy as overvalued, its price to sales ratio of 1.2 times tells a more forgiving story. It sits well below the US Electrical industry at 2.2 times and the peer average of 4.1 times, and under a fair ratio of 2 times that the market could drift toward over time.

That gap suggests less downside risk than the narrative implies if growth holds up. It also raises a harder question: is the crowd too cautious on Fluence’s future, or simply bracing for a bumpier road than the models assume?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If this perspective does not quite line up with your own, you can dig into the numbers yourself and build a custom narrative in minutes: Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Markets move fast, and sitting still means falling behind. Use the Simply Wall St Screener to uncover fresh, data driven opportunities that match your strategy today.

- Target value-focused opportunities by running with these 908 undervalued stocks based on cash flows that appear mispriced based on the strength of their future cash flows.

- Explore the rise of intelligent automation with these 26 AI penny stocks, highlighting companies involved in productivity and business transformation.

- Identify potential income streams with these 13 dividend stocks with yields > 3% that offer yields while still clearing fundamental quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)