- United States

- /

- Consumer Finance

- /

- NasdaqGS:PRAA

Undervalued Small Caps In United States With Insider Buying To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.2%, and over the past 12 months, it is up by a notable 30%. In this promising environment where earnings are forecast to grow by 15% annually, identifying undervalued small-cap stocks with insider buying can present compelling opportunities for investors.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.4x | 0.9x | 43.91% | ★★★★★★ |

| Hanover Bancorp | 9.4x | 2.2x | 48.86% | ★★★★★☆ |

| Citizens & Northern | 13.2x | 2.9x | 42.39% | ★★★★☆☆ |

| MYR Group | 33.5x | 0.5x | 43.58% | ★★★★☆☆ |

| Franklin Financial Services | 9.9x | 2.0x | 37.58% | ★★★★☆☆ |

| Vital Energy | 4.3x | 0.6x | -48.01% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -232.01% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -108.51% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -253.37% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

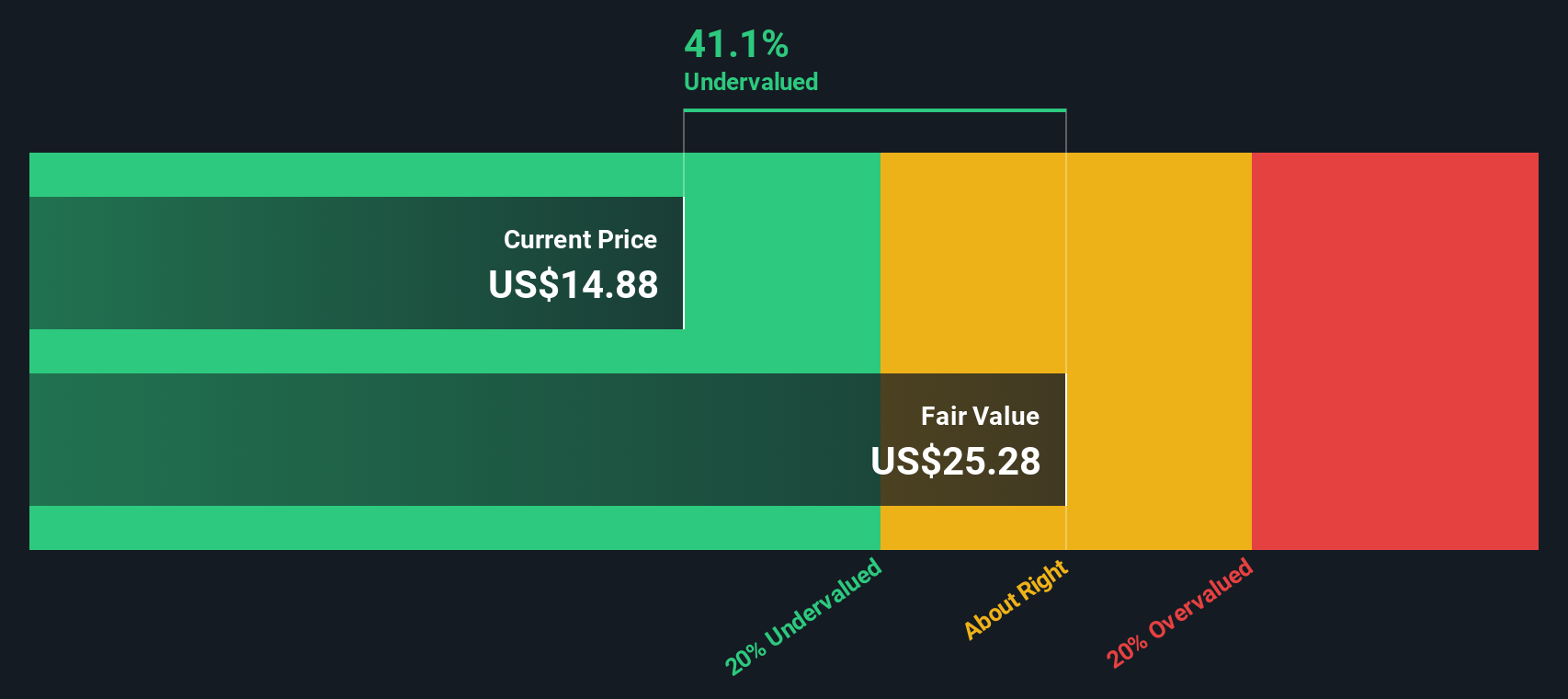

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company that develops, manufactures, and markets a broad range of animal health and mineral nutrition products, with a market cap of approximately $0.57 billion.

Operations: Phibro Animal Health generates revenue primarily from three segments: Animal Health, Mineral Nutrition, and Performance Products. The company reported a gross profit margin of 30.82% for the quarter ending June 30, 2024. Operating expenses in the same period were $254.27 million, with non-operating expenses amounting to $56.93 million.

PE: 368.7x

Phibro Animal Health, a smaller U.S. company, has seen insider confidence with recent share purchases in the past quarter. Despite a dip in profit margins to 0.2% from 3.3% last year, earnings are forecasted to grow by 51.46% annually. Recent guidance for fiscal year 2025 projects net sales between US$1.04 billion and US$1.09 billion, driven by growth in its Animal Health segment and recovery in Mineral Nutrition and Performance Products segments.

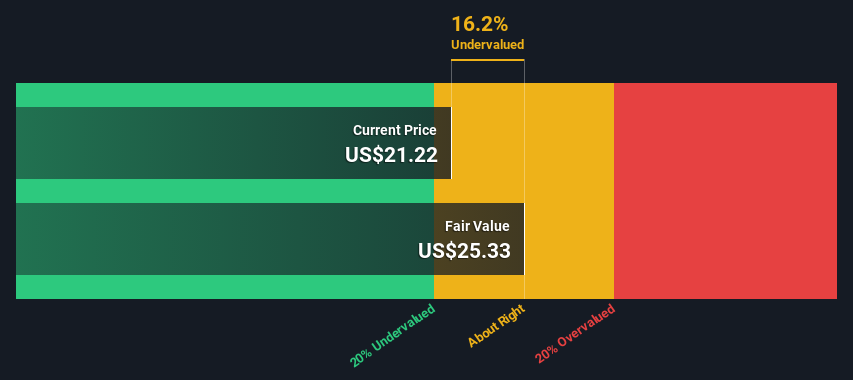

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Columbus McKinnon is a company specializing in machinery and industrial equipment with operations generating approximately $1.02 billion in revenue.

Operations: Machinery & Industrial Equipment generated $1.02 billion in revenue for the latest period. Gross profit margin has shown an upward trend, reaching 37.08% recently.

PE: 20.4x

Columbus McKinnon, a smaller U.S. company, has shown potential for growth with earnings forecast to increase by 29.84% annually. Despite the recent executive change with Jon Adams stepping in as President of Americas post-September 2024, the company remains steady. They reported Q1 sales of US$239.73 million and net income of US$8.63 million, slightly down from last year’s figures but still solid performance indicators. Insider confidence is evident through share purchases within the past six months, reflecting optimism about future prospects despite current financial challenges like high-risk funding sources and modest dividend payouts at $0.07 per share.

- Dive into the specifics of Columbus McKinnon here with our thorough valuation report.

Evaluate Columbus McKinnon's historical performance by accessing our past performance report.

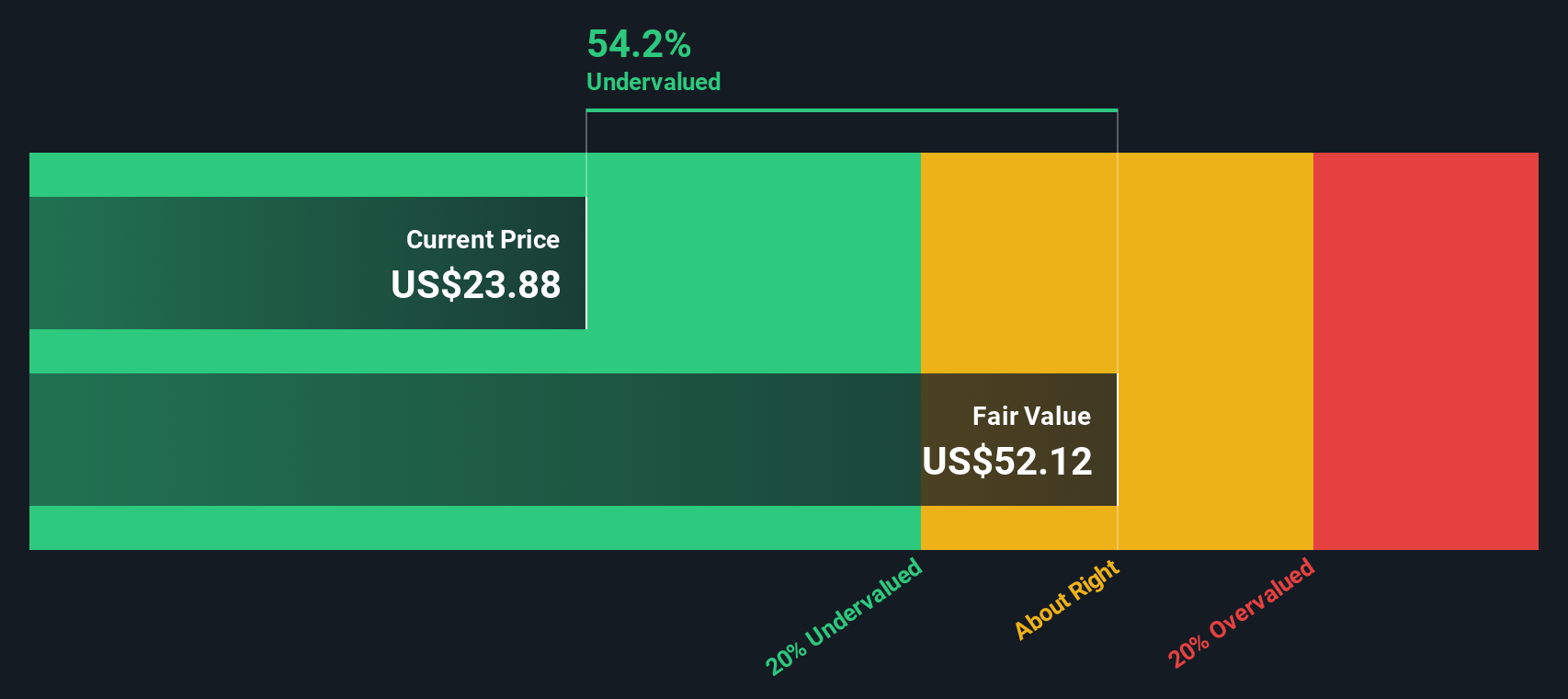

PRA Group (NasdaqGS:PRAA)

Simply Wall St Value Rating: ★★★★★☆

Overview: PRA Group is a financial services company specializing in the purchase and collection of nonperforming loans, with a market cap of approximately $1.42 billion.

Operations: The company generates revenue primarily from accounts receivable management, with operating expenses and non-operating expenses being significant cost components. Notably, the net income margin has shown fluctuations, reaching as high as 23.85% and dipping to -10.40% in recent periods.

PE: 217.6x

PRA Group's recent earnings report shows a significant turnaround, with Q2 2024 revenue at US$284.23 million, up from US$209.24 million the previous year, and net income of US$21.52 million compared to a net loss of US$3.8 million a year ago. Insider confidence is evident as Independent Director Geir Olsen purchased 11,750 shares worth approximately US$251,332 in June 2024, increasing their holdings by over 250%. This activity suggests optimism about the company's future performance despite its recent drop from several Russell indexes and board changes.

- Click here to discover the nuances of PRA Group with our detailed analytical valuation report.

Examine PRA Group's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 51 Undervalued US Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAA

PRA Group

A financial and business services company, engages in the purchase, collection, and management of portfolios of nonperforming loans worldwide.

Undervalued with moderate growth potential.