Quote of the Week: “In the end banking is a very good business unless you do dumb things. You get your money extraordinarily cheap and you don't have to do dumb things. But periodically banks do it, and they do it as a flock, like international loans in the 80s. You don't have to be a rocket scientist when your raw material cost is less than 1.5%.” - Warren Buffett

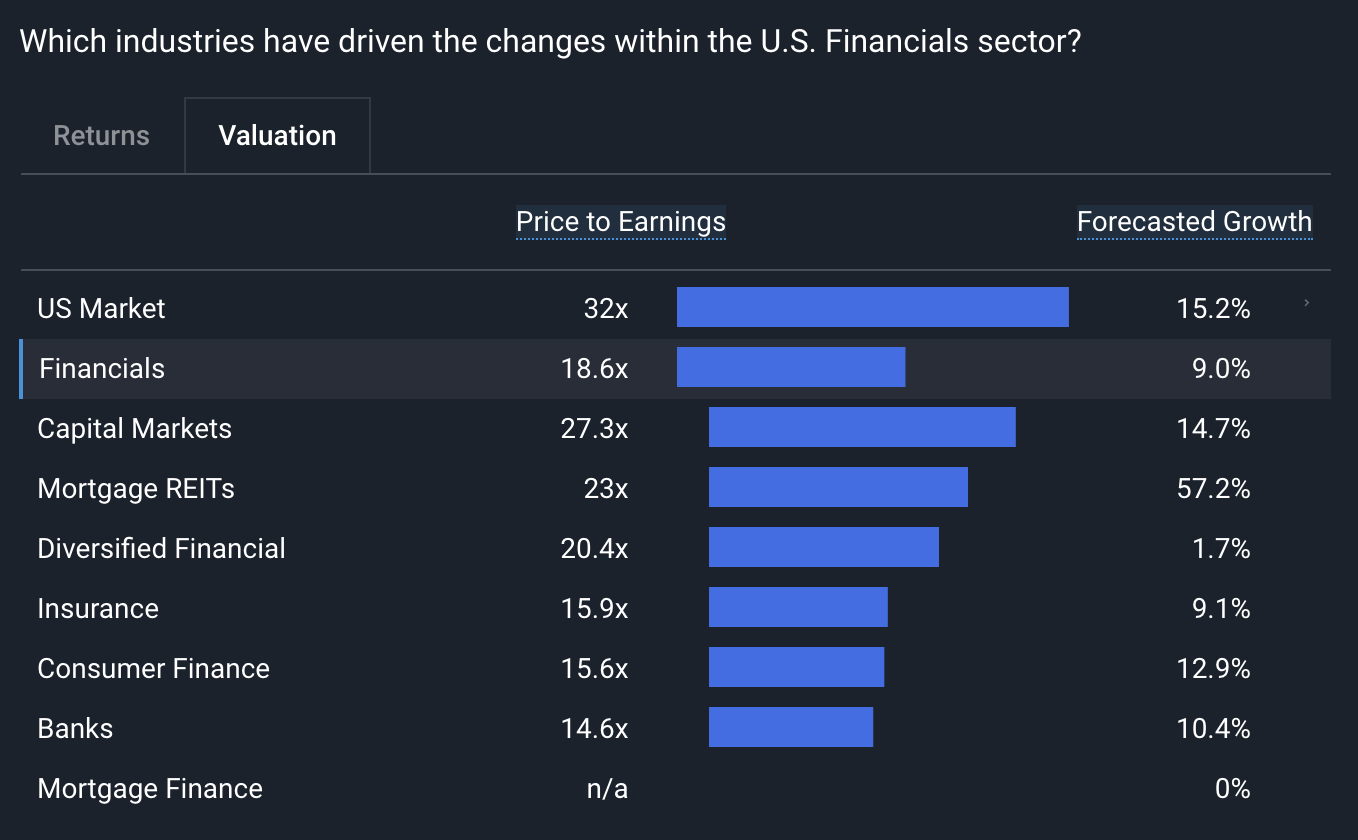

In last week’s third-quarter review , we mentioned that financial sector stocks are showing signs of life and beginning to outperform. In the era of ‘easy money’, cloud computing, and AI, the financial sector has taken a back seat for a lot of investors.

Banks, insurers, and other financial service providers are also very different from most companies, and they can be tricky to understand and analyze. With that in mind, we decided to do a two-part primer on financial sector companies and how they make money.

This week we’ll cover banks and companies in the capital markets industry, and next week we’ll look at insurance, diversified financials, payments, and fintech.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube !

What Happened in Markets this Week?

-

🤑🤝OpenAI Closes Funding At $157 Billion Valuation As Microsoft, Nvidia, SoftBank Join ( CNBC )

- What’s our take?

- $157 billion is a helluva lot for a non-profit!

- To be fair, OpenAI is reported to be considering restructuring as a for-profit business, which makes sense with that sort of valuation.

- The valuation itself is also interesting. The company raised $6.6 billion at a price that represented a post-money valuation of $157 billion. That implies that it will earn a fortune from its model, while competing with several open source competitors.

- For Nvidia and Microsoft, the cash they have put in could be viewed as more of a business expense than an investment. By investing in OpenAI they are developing the market for their chips and cloud services. They don’t necessarily need to make a profit on the investment itself.

- We will have to wait to see how the other investors do on their investments.

- What’s our take?

-

🇮🇳 India Tightens Derivatives Trading Rules After Retail Options Frenzy ( FT )

- What’s our take?

- Reigning in derivative trading can suck liquidity out of a market very quickly.

- Derivatives like futures and options have several functions - but for many the attraction is leverage and the opportunity to increase gains. For brokers and exchanges, leverage translates into higher volumes and more fees. And banks are quite happy to earn interest by financing derivative trades.

- The problem is that when stock prices inevitably correct, the owners of derivative securities become forced sellers. If your margin on a futures contract is 10% and the price of the underlying asset falls 10%, you need to sell the contract or cough up more margin. Forced sellers drive prices lower, which creates more forced sellers.

- Regulators get nervous when they see speculative derivative trading increasing. They can curb that activity in several ways, including increasing the margin requirements. But doing so can also trigger a wave of forced selling - and it has on several occasions.

- For patient investors, this can create great opportunities once the dust settles, so keep your eyes peeled and your cash ready.

- What’s our take?

-

🇧🇷 Moody’s Upgrades Brazil’s Credit Rating, While Fitch Warns Of Trouble Ahead ( Bloomberg & ET )

- What’s our take?

- Government reforms and robust economic growth were enough to convince Moody’s to upgrade, but Fitch has it’s concerns.

- Brazil's government bonds are now on par with Oman and Morrocco in terms of their credit-worthiness, but still shy of it’s investment grade rating it lost almost a decade ago.

- The country’s central bank now expects GDP to grow at 3.2% rather than the 2.3% it expected in June this year. But some investors, and rating agencies like Fitch, are concerned about the government spending and impact on its fiscal accounts.

- While the agency acknowledged improved economic performance, it anticipates challenges for the country in 2025 and higher country debt levels. While the expanding economic performance was occurring at the same time as increased leverage from the government, it was cautious about what would occur during an economic slowdown, which is typically when governments expand their debt levels to provide support to the economy.

- While the economy seems to be on the mend thanks to heavy government intervention, the country’s bonds haven’t reached investment-grade just yet, and the reasons to be cautious could mean it stays that way.

- What’s our take?

-

🎮 Video game profitability ticks down in H1'24 despite headcount reductions ( S&P Global )

- What’s our take?

- The video game industry may be due for another round of belt-tightening, or margins may be about to expand.

- Despite many companies in the industry conducting layoffs and studio closures over the last 12 months, their profitability has still reduced.

- Total revenue for the 100 companies in this bracket declined 6.3% year-on-year to June 30, 2024, while EBITDA (earnings before interest, tax, depreciation, and amortization) fell 10.2%.

- Some names you might recognize in this list include Sony, NetEase, Electronic Arts, Nintendo, Take-Two Interactive, Roblox, CD Projekt SA, and Microsoft’s gaming division.

- Layoffs can take time to flow through to the bottom line due to severance packages and separation agreements taking months.

- So the relatively small decline in margins could be seen as a win for now, considering the past 12 months was pretty light on software releases and had a few high-profile misfires. Watch these companies over the next 12 months to see if the layoffs finish and profitability climbs.

- What’s our take?

-

🤖 Nvidia launches a new, open-source LLM to rival GPT-4 ( Venturebeat )

- What’s our take?

- Nvidia isn’t just acquiring new customers, it’s competing with them too.

- Nvidia has just launched NVLM 1.0, which is a family of a large language models (LLMs) that is looking to take the fight to some of the heaviest hitters on the market.

- Nvidia claims to be heading down the open-source route, offering the training weights and training code to the public, which is a nice win for researchers and developers.

- Like other ‘open source’ LLMs, the model is not truly open source, with no information on the training data made publicly available, but it’s a step in the right direction.

- The model seems to match up quite well with other LLMs like Llama 3, GPT-4, Gemini 1.5 and Claude in certain benchmarks and interestingly, it seems to perform better at text-only tasks after multi-modal training, something which other models fail to do.

- This is a really interesting business move for Nvidia, as they’re undoubtedly hoping to create a positive feedback loop. Consumers will buy Nvidia hardware to use the model, and with more people using this open model, there will be more contributors who are making improvements to it, which should see performance and demand both climb.

- What’s our take?

-

👷 Dockworkers and operators reach a tentative deal, ending the East Coast Strike ( Reuters )

- What’s our take?

- The power of the International Longshoremen Association (ILA) was on full display as workers secured a handy pay rise.

- The deal reached between the ILA and the United States Maritime Alliance brought an end to the three-day strike that saw 45,000 dockworkers strike on the U.S. East Coast and Gulf Coast

- The strike was the first major work stoppage for the ILA since 1977, which arose as negotiations over a new work deal broke down.

- While the ILA was seeking a 77% pay rise, but after negotiations, a tentative agreement was reached for a wage hike of around 62% over six years, increasing average wages from $39 per hour to $62.

- The deal ends the strike which prevented the unloading of container ships from Maine to Texas and threatened shortages of almost ll good coming into the US, which triggered a backlog of anchored ships outside major ports.

- The strikes show just how strong the ILA is, as the US’s reliance on ports mean that a longer-lasting strike could cripple industries that rely on goods or materials imported from overseas.

- What’s our take?

⏱️ What Makes Financial Sector Stocks Tick?

If you look at the sector composition of most stock markets, the financial sector accounts for between 20% and 35% of the total value of listed companies. It’s lower for the US market (13%), but that’s due to the dominance of technology companies.

Needless to say, ‘financials’ plays a crucial role in developed and developing economies.

Historically, banks, insurers and other financial service providers have proved to be compounding machines over long periods of time. That hasn’t generally been the case over the last decade, and there are two reasons for this:

- 🙅 Near-zero interest rates aren’t ideal for banks

- B ut they are great for growth companies, and that’s what investors have been focussing on.

- 🏗️ Many of the largest financial institutions have been repairing the damage caused by the GFC of 2008.

If the ‘easy money’ era is a thing of the past and interest rate cycles look more like they did prior to 2008, financials might be worth more attention.

But financials, like banks and insurers in particular, are very different from most other companies.

✨ Hot tip: Financial companies can be tricky to classify, as they often operate several different businesses. This means that competing financial companies are often categorized in different industries:

-

If you are using the stock screener , it’s worth casting a wide net. To include all financial sector companies, make sure you add the following categories to your search

- Banks

- Insurers

- Diversified Financials

-

Alternatively, if you are looking at a specific company, you can find their competitors and peers on the company report, within the Company Overview and within sections 1.3 and 1.5 under the Valuation tab .

🏦 Banks

Banks are at the heart of the financial system and the financial sector. They provide the financing that allows consumers to buy houses and vehicles, and for most businesses they are the primary source of finance.

The core business of a bank is to make loans and hold deposits. The bank makes money by charging a higher interest rate on the money it lends out than it pays on the deposits.

✨ NB: From a bank’s point of view, a loan made to a borrower is an asset, while deposits held on behalf of a customer are a liability.

When it comes to the business of borrowing and lending, standard metrics like revenue and net income don’t tell the whole story. The following are the most important metrics and ratios for a bank:

- Net Interest Margin:

- The NIM is the difference between the weighted average interest rate a bank receives and pays. This determines a bank’s net interest income, which is its primary ‘banking’ income.

- Asset to Equity Ratio :

- This ratio tells us how big a bank's loan book is compared to its equity value (i.e. assets minus liabilities). The higher the ratio, the more risk the bank is taking.

- Efficiency Ratio :

- A bank's efficiency ratio reflects its operating expenses as a percentage of revenue, which includes net interest income and other revenue. This tells us how much it costs to run the bank compared to the revenue it earns, and is a good way to compare the efficiency of competing banks.

- Loans to Deposits Ratio:

- This LDR reflects a bank’s liquidity by comparing loans to deposits. It indicates how easily a bank can cover loan losses or withdrawals.

- Non-Performing Loans:

- NPLs are the percentage of a bank's loans that are delinquent or have been written off. This number reflects the credit quality of a bank’s loans.

- Allowance for bad loans:

- Banks set aside capital to cover the loans they expect to write off. This number needs to increase when economic conditions worsen.

- Price to Tangible Book Value:

- A bank’s tangible book value is the value of its equity, minus intangible assets like goodwill and trademarks. This is a common valuation ratio for banks, and compares the share price to the equity value per share.

- ROE and ROA:

- Profitability ratios like return on equity and return on assets are a useful way to see how efficiently a bank is using its resources, and to compare it to other banks.

For large banks, you can find some of the key ratios and data points on the company report under section 4 (financial health)

🏢 Investment Banks

Most of the biggest and well-known banks have investment banking divisions. Investment banks earn revenue in several ways:

- Fee income for advising on, and underwriting IPOs, corporate bond issues, mergers and acquisitions.

- Profits generated from sales and trading of securities.

- Commission on trades executed on behalf of institutions.

Investment banking can be very lucrative, but is also dependent on market conditions. Profits can be sporadic, and trading desks can suffer from occasional large losses.

💹 Capital Markets

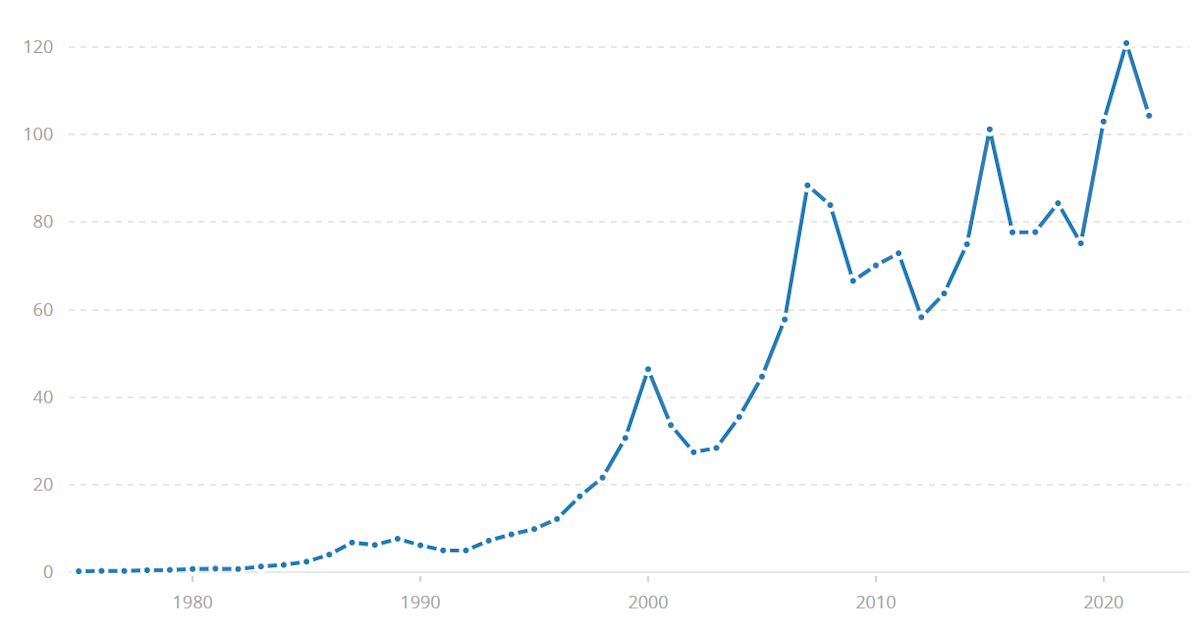

Some of the best-performing financial companies of the last 20 years have been those that facilitate financial market activity in various ways. That shouldn’t really be surprising, as the value of financial assets and trading volumes have grown exponentially.

💰 Asset Management

The asset management industry includes companies that manage assets on behalf of pension funds, other institutions, individuals, and on behalf of their own shareholders. They manage ETFs, mutual funds, private equity and venture capital funds.

The first distinction to make is between asset managers that earn fees managing money on behalf of customers, and those that invest shareholder funds directly.

- BlackRock , the largest asset manager in the world, earns fee income managing ETFs and other funds for clients. This means it doesn’t put its own capital at risk.

- KKR is one of the largest private equity and real estate companies in the world. KKR does manage funds for clients, but also invests directly in other companies and in real estate.

Asset managers that invest on behalf of clients typically earn a fee which is a percentage of the assets under management (AUM). Their fees go up when they attract new funds, and when the value of those funds increase as stock prices rise.

🤝🧑💼 Brokers

Online trading platforms have made investing accessible to millions of people around the world. Technology has also meant stockbrokers can service more customers without increasing headcount. Paradoxically, while trading fees have fallen, the increase in volumes have resulted in increased revenue.

Most brokers also offer asset management services, and there’s a good reason for this. Trading activity is closely correlated with the direction of the stock market, which means trading commissions drop off during bear markets.

Asset management generates ongoing management fees, which are less sensitive to market activity. This means brokers with a large wealth management business like Charles Schwab have more predictable revenue streams than those like Robinhood , which is more reliant on trading commissions.

🏛️ Financial Exchanges and Data Providers

Stock exchanges have themselves become some of the most successful companies in the stock market. As an example, the London Stock Exchange Group is now the 11th most valuable company listed on itself… hope that makes sense.

Other exchanges include Hong Kong Exchanges and Clearing , Deutsche Borse and Nasdaq .

Exchanges benefit from the number of companies that become publicly listed and increasing trading volumes. Barriers to entry are also very high, which helps exchanges protect their margins.

Companies that collect, manage and disseminate financial market data also have very distinct competitive advantages. The benchmark indexes that we all use to track the market are owned by a handful of companies like MSCI and S&P Global . These companies, along with Moody’s and Fitch Ratings also provide research and credit ratings.

The revenue generated by providing data, benchmark indexes and ratings is more reliable than most other companies in the capital markets industry - but ultimately it is still correlated to growth in investment activity.

💡 The Insight: There’s a Big Difference Between Recurring and Non-Recurring Revenue

Banks and other financial sector companies generate revenue in various ways.

Some of this is like annuity revenue that trickles in year after year. There will be fluctuations as a business wins or loses customers, but recurring revenue is reasonably predictable. Examples of recurring revenue include:

- Interest and principal payments on mortgages, auto loans and credit card accounts.

- Fund management fees.

- Subscriptions for data and research.

Other sources of revenue are less reliable, but can contribute significantly to the bottom line. Examples include:

- Mark-to-market gains (or losses) on securities.

- Profits generated from the sale of a stake in a private company.

- Underwriting fees on IPOs, mergers, and acquisitions.

- Trading profits.

Some sources of revenue, like trading commissions, fall somewhere between the two.

When assessing a potential investment, one of the first things to do is work out how much of a company's revenue and net income is recurring. This is true for all companies, but particularly for financial companies.

✨ Sometimes a share may look ‘cheap’ when compared to recent earnings - but those earnings may be inflated by non-recurring revenue. Section 3.2 of the company report (Past Performance) will do this check for you.

Keep an eye out for part 2 in next week’s newsletter….

Key Events During the Next Week

Tuesday

- 🇦🇺 The Reserve Bank of Australia will release the minutes from the last monetary policy meeting.

- 🇦🇺 Australia's NAB Business Confidence index will be released and is expected to swing from -4 to +2.

Wednesday

- 🇺🇸 The US Fed will publish the minutes from the recent FOMC meeting.

Thursday

- 🇺🇸 US initial jobless claims are due. Economists are forecasting 330k, up from 225k

- 🇺🇸 The US inflation rate is projected to be 2.3%, down from 2.5%. Prices are expected to be just 0.1% higher over the last month. The core inflation rate is expected to be marginally lower.

Friday

- 🇬🇧 UK GDP data will be published. The UK economy is expected to have grown by 0.1% in August - an improvement on June and July’s 0%!

- 🇨🇦 Canada's unemployment rate for September is due and is expected to remain at 6.6%.

- 🇺🇸 US PPI is forecast to be 0.1% higher month-on-month and just 1.3% higher over 12 months. This monthly increase is lower than the 0.2% increase last month

Third quarter earnings season starts this week. The first of the big banks are due to report on Friday, with a few other companies reporting earlier in the week.

- PepsiCo

- Infosys Limited

- Delta Air Lines, Inc

- Domino's Pizza Inc

- J P Morgan Chase & Co

- Wells Fargo & Company

- Progressive Corporation

- BlackRock

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.