Quote of the Week: “Equities are a claim on uncertain future earnings.” - Peter Bernstein

It’s the end of another quarter, and it’s been an eventful one, too.

In fact, we’ve had a bit of everything during the quarter:

- 🎢 Increased volatility,

- ✂️ The first US rate cut in years,

- 🛢️ A collapsing oil price, and

- 📈Equity indexes trading at new all-time highs.

This week we are recapping the major themes from the last three months, and the key insights from earnings season.

We are also looking at the way consensus estimates typically evolve over time, and how you can incorporate them when assessing potential investments.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or our YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🤝 Analysts are skeptical about a Qualcomm - Intel Merger ( Barrons )

-

What’s our take?

-

Regulatory approval is just the first of many obstacles.

-

The market has been abuzz over reports that Qualcomm approached Intel about an acquisition or merger. Neither company has commented, so this is more an idea than something in motion.

-

A deal would combine Qualcomm’s leadership position in mobile technology and growing ARM PC segment, with Intel’s x86 design business and foundries. In theory, that could be a winning combination - in reality, there are reasons to be skeptical.

-

The first hurdle would be regulatory approval. It’s possible US regulators approve the deal in the interest of developing US chip manufacturing. But, mergers like this also need to be approved by regulators in other markets where the companies operate. Previous deals between chipmakers have been blocked by regulators in Europe and China.

-

The next factor is Intel’s foundry business (IFS) which is going to require a lot of capital before it turns a profit. Regulators might not approve the deal if the foundries are to be spun off. If IFS is included, it would be a very expensive and risky deal for Qualcomm shareholders.

-

Beyond those issues, integrating the two businesses could complicate the licensing deals both companies have with other chipmakers. Some analysts also point out that the corporate cultures at both companies would be a tricky fit.

-

When companies are doing well, as Qualcomm is, making big acquisitions by issuing stock (or taking on debt) is often tempting. But not every takeover or merger makes sense, and megamergers have proved to be the undoing of quite a few companies. AOL’s takeover of Time Warner in 2000 just about destroyed both companies.

-

📉 Total Debt Retreats From Record High For Rated US Companies ( S&P Global )

- What’s our take?

- On average, companies have slightly reduced their debt burdens, but the distribution isn’t what you might expect.

- The debt levels of investment grade companies (think, high-quality borrowers) decreased by 1% thanks to only 3 sectors being more fiscally responsible, mostly, the IT sector, which reduced debt by 12.7%, or $98bn. The remaining 7, mainly the energy sector, actually increased their leverage.

- Meanwhile, non-investment grade companies (think, lower quality borrowers) were a bit more fiscally responsible and reduced their debt by 1.2% overall. This was thanks to 8 out of 10 sectors reducing their leverage, while healthcare and energy were the only ones to increase their debt levels.

- In a time of higher interest rates and maturing corporate debt, it makes sense to see leverage reducing given the less appealing refinancing conditions. Make sure you monitor the financial health of any stock you’re considering in section 4 of the company report.

-

☢️Three Mile Island Nuclear Plant To Restart, Power Microsoft Data Centers ( Axios )

- What’s our take?

- The structural trend of AI continues to merge with nuclear energy.

- We’ve talked about it before when Amazon bought a nuclear-powered data center from Talen in March, but big tech companies are hungry for cheap, reliable power for their data centers.

- Constellation Energy has now signed a deal to provide power for 20 years to Microsoft from 2028. To do this, they need to restart the reactor that has been dormant since 2019 and sits adjacent to the reactor that was damaged in the 1979 accident.

- Constellation will have to invest $1.6bn to restart the reactor, and the deal needs approval from the Nuclear Regulatory Commission, as well as state and local permits.

- The nuclear industry still has hurdles to overcome, but this slowly increasing support is improving the narrative around uranium and nuclear businesses.

-

🇨🇳 China Unleashes Stimulus Blitz To Lift Growth ( FT )

- What’s our take?

- When growth isn’t happening, cut rates and print money.

- There needs to be more than just solid shipments of electric vehicles, batteries and other goods to offset current weakness in the Chinese economy.

- Consumer confidence is low given property troubles in the country, and so the government has taken more drastic measures to combat a slowdown in their economy.

- The government cut its benchmark rate, reduced lending reserve requirements, and provided cash to brokers, insurance companies and funds to buy stocks. The People’s Bank of China will provide RMB 300bn ($42bn USD) to help companies conduct buybacks. Hardly an encouraging sign when the central bank gives you money to buy back stock in a bid to increase share prices.

- Economists are still skeptical that even these measures would be enough to improve the growth outlook, and so some believe even more is necessary. They also said that reducing the vast stock of unsold housing is crucial to restoring confidence and revising domestic consumption.

-

🚢 As Possible East Coast Port Strike Nears, ‘Rerouting Potential Isn’t Too Great’ ( Yahoo Finance )

- What’s our take?

- Supply chain disruptions seem to be a normal part of business these days.

- On October 1st, dockworkers along the East and Gulf Coasts are expected to strike about pay raises and rules around automation.

- These ports are responsible for more than half the goods shipped in and out of the US in containers. So depending on how many days it lasts, consumers, truck drivers, factory and warehouse workers would all be impacted to some degree.

- The labor contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) is set to expire on September 30th. A growing list of trade associations including manufacturers, farmers, and other supply chain stakeholders have expressed grave concern over the issue and have urged the current government to step in , like they did in 2002.

- If a strike occurs, we could see huge disruptions in the economy like in 2021, and as a result, all else being equal - inflation could tick up again.

📈 Q3: Volatility and Record Highs

It’s been an eventful quarter, with plenty of news to give investors anxiety. To recap, here are just a few of the factors that caused volatility to spike:

- 🇯🇵 The sudden unwinding of the Japanese Yen carry trade , which led to a 20% correction for Japan’s Nikkei 225 index.

- 📉 Warning signs for a possible US recession and several weaker than expected employment reports.

- 🇺🇸 The tightest US presidential election race in decades , leading to significant policy uncertainty.

- 🛢️ The oil price fell as much as 26% during the quarter as demand fell short of expectations, while global production continued to rise. This is good news for inflation, but may also signal sluggish economic activity.

- 💻 The magnificent 7 stocks stumbled as investors began to question the ‘AI trade’. These stocks have since recovered some ground, although they have underperformed.

- 🚢 Israel’s war in Gaza has expanded to Lebanon , while the Houthi movement’s attacks on ships in the Red Sea continue.

Despite all these developments, equity markets continued to make new highs. The MSCI World index printed new all-time highs during 6 out of the last 12 weeks, and the majority of major equity indexes are trading close to record highs.

So what’s behind the strong stock market performance?

Interest rates have been the first catalyst. The US central bank’s 50 basis point cut came late in the quarter, but softer inflation and economic data earlier in the quarter gave investors more confidence that rate cuts were on the way. Investors are still anticipating more cuts than the Fed, but the decision to start with a 50 point cut may point to more aggressive cuts if the data supports it.

✨ The Fed’s move was seen as positive for cyclical sectors, as well as emerging markets (up 10% during the quarter), and gold.

The second catalyst was encouraging earnings reports, which also boosted cyclical sectors. That combination led to accelerated sector rotation, and cyclical stocks made up for weaker performance from tech and telecoms.

The US technology and telecom sectors are still the big winners over the last 12 months, up 49% and 38% respectively. However, there are now seven other sectors up 20% or more, and only one in the red - energy . A big chunk of the gains for those sectors came in the last three months.

📅 Earnings Season Highlights

Second quarter earnings season was underwhelming to start, but improved after big tech reported. Some of the highlights for S&P 500 companies, as reported by Factset , included:

- Earnings growth for S&P 500 companies was 11.3% vs the 8.9% estimate at the beginning of the quarter. This was the highest since Q4 2021.

- 67 of the 500 companies issued negative guidance - this was the lowest since Q4 2022.

- 80% of S&P 500 companies beat EPS estimates. This is well above average.

- The utilities, financials, consumer discretionary , and real estate reported year-on-year earnings growth that was significantly higher than consensus estimates at the beginning of the quarter.

- The telecom and energy sectors reported lower-than-expected earnings growth.

- The only sectors reporting negative growth were industrials and materials , however the industrial sector reported earnings that were well ahead of consensus estimates.

- During July and August, analysts cut EPS estimates for Q3 (the current quarter) by 2.8%. This is a little higher than the 2.6 -2.7% average over the past 5 and 10 years.

Perhaps more important, were the changes to consensus estimates for the FY 2025:

- The forecast earnings growth rate for S&P 500 companies during 2025 has risen from 14.5% to 15.2%. This compares to the current estimate of 10% for FY 2024.

- The largest increases in earnings estimates were for healthcare , materials and telecoms sectors. All three sectors, as well as tech and industrials, are also expected to outperform the market in 2025.

🧢 US Small Caps Are Having Their Moment

US Small Caps have begun to report the earnings recovery investors have been hoping for.

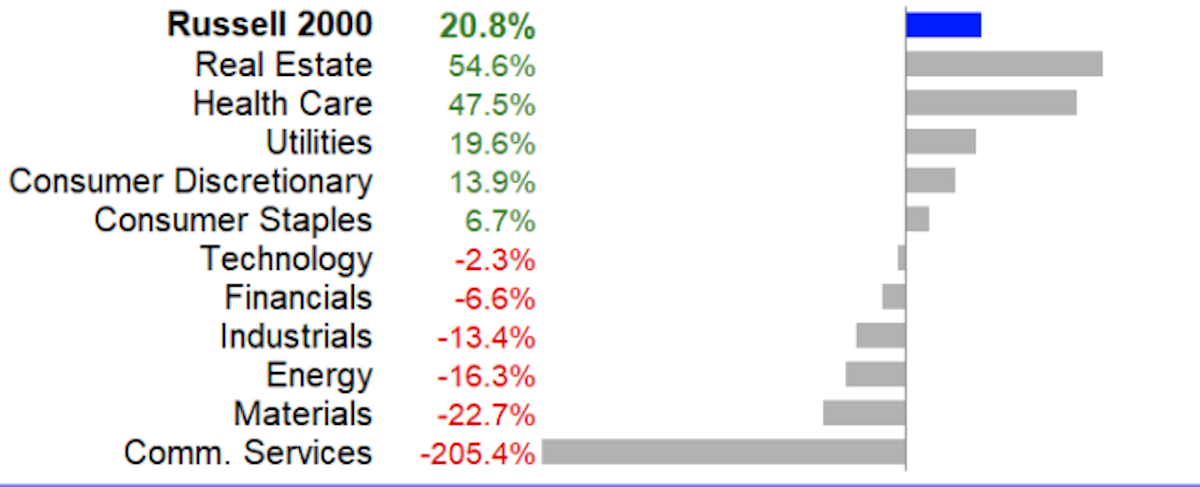

Companies in the Russell 2000 Index reported a 20.8% year-on-year increase in earnings, led by strong growth in the real estate and health care sectors.

If current estimates turn out to be correct, growth will accelerate to 34% during the current quarter and 66% in Q4. However, as the following chart reflects, growth rates are not evenly distributed.

🇪🇺 Europe And Elsewhere

Companies in the European Stoxx 600 index reported the first quarter of earnings growth since Q1 2023. At just 3%, their growth is still lagging the US, but the trend is heading in the right direction.

Elsewhere around the world, earnings growth has been far more country and sector-specific. Data from S&P Capital IQ showed some significant changes to consensus estimates for FY 2025.

Forecasts for energy companies in Australia, Canada, UK and Brazil fell in line with the oil price.

On the other hand, forecasts for cyclical sectors (and a few others) saw some substantial increases in expected earnings growth for 2025 during the last 3 months. Below are some that stood out:

🇦🇺 Australia

🇧🇷 Brazil

🇨🇦 Canada

🇮🇳 India

🇲🇽 Mexico

🇰🇷 South Korea

🇬🇧 UK

(Note: These observations are based on average expected growth rates for companies worth over $200 million, rather than market cap weighted growth rates)

💡 The Insight: Consensus Estimates Are A Good Place To Start - But Aren’t Enough To Make Smart Investment Decisions

You may have noticed that the majority of companies tend to beat consensus estimates for revenue and EPS. It may seem like analysts are just too pessimistic - but that isn’t the case at all.

Firstly, companies try to manage expectations during the three months leading up to a quarterly report. Falling short of estimates is a bad look, so companies like to set expectations that they are confident of beating.

Secondly, consensus estimates typically fall around 2% during the quarter leading up to an earnings report. This happens after analysts adjust their projections after the prior quarterly report and earnings call.

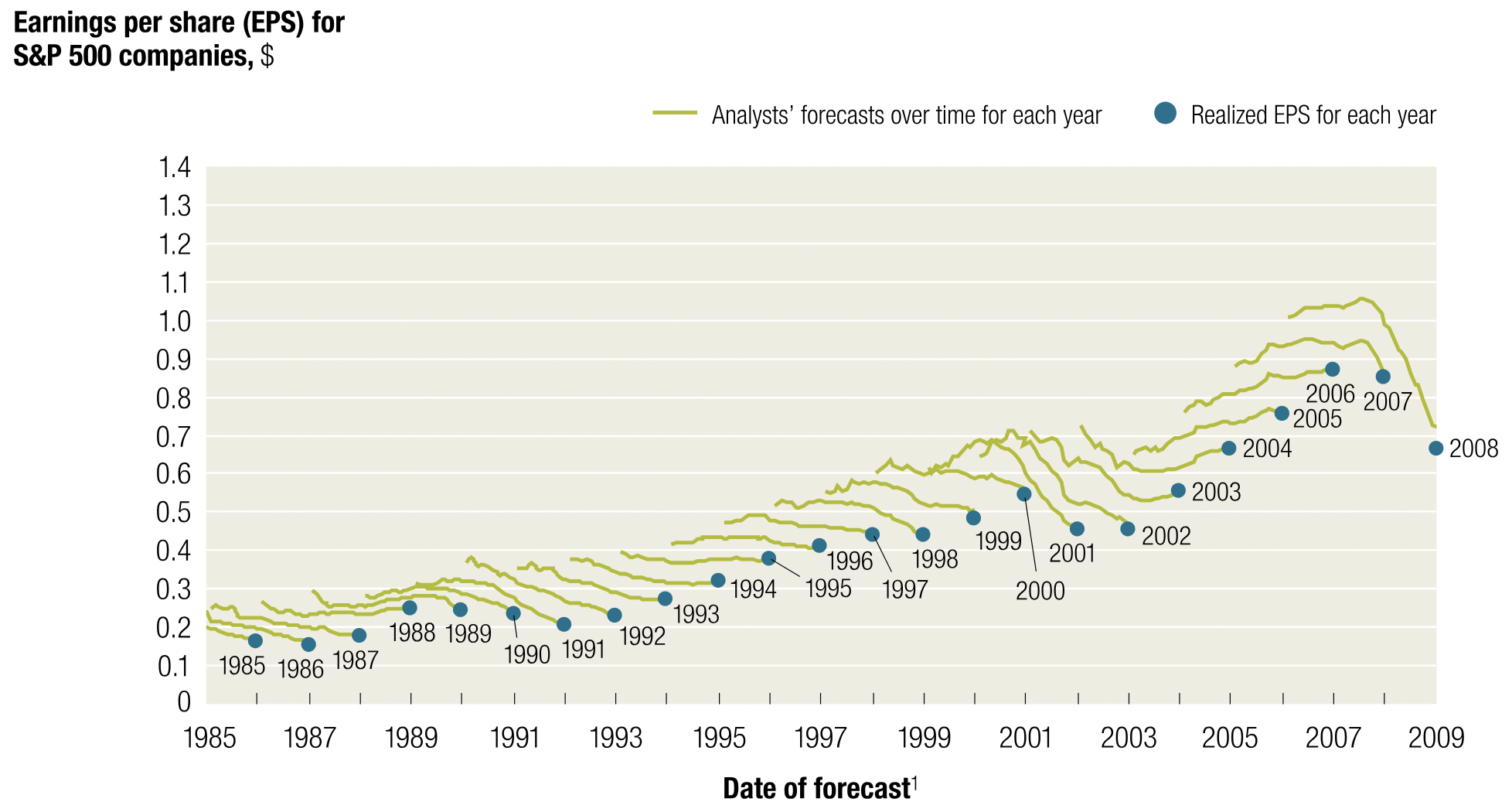

Lastly, the more important trend to note is that consensus estimates for a given quarter usually decline for the entire year (or longer) leading up to an earnings report.

In 2010

McKinsey published a report on this topic

which showed how common this phenomenon is:

You can view more recent studies here , showing that the same pattern still plays out in the typical year.

Why is this the case, you ask?

Research suggests that analysts may not actually be low-balling earnings forecasts , it instead comes down to how positive news is digested.

When positive news was published, analysts were more likely to issue alternative forecast signals rather than revising the current-quarter earnings forecast upwards. However, for negative news, they were more likely to revise their current-quarter estimates downward.

It’s unclear whether this phenomenon is intentional, to placate corporate interests and give companies more easier targets to hit, or if it’s a result of the difficulty in comprehending new information, but it’s interesting nonetheless.

The downward drift during a given 12-month period is usually the case - but not always. When earnings are recovering from a period of weakness, it’s common for the opposite to occur. Over the last few quarters, we have seen an upward drift in estimates 12 months out.

Consensus estimates are a good place to start when you are assessing a company, but it’s important to be aware that they often drift lower during periods of growth, and higher after an earnings recession.

It’s even more important to remember that the value of a company is based on far more than one or two years of earnings. Most analysts publish estimates one or two years ahead, but you’re actually paying for 10 or more years of earnings. When you create a narrative and valuation for a company, you need to estimate realistic growth rates for the next 5 to 10 years.

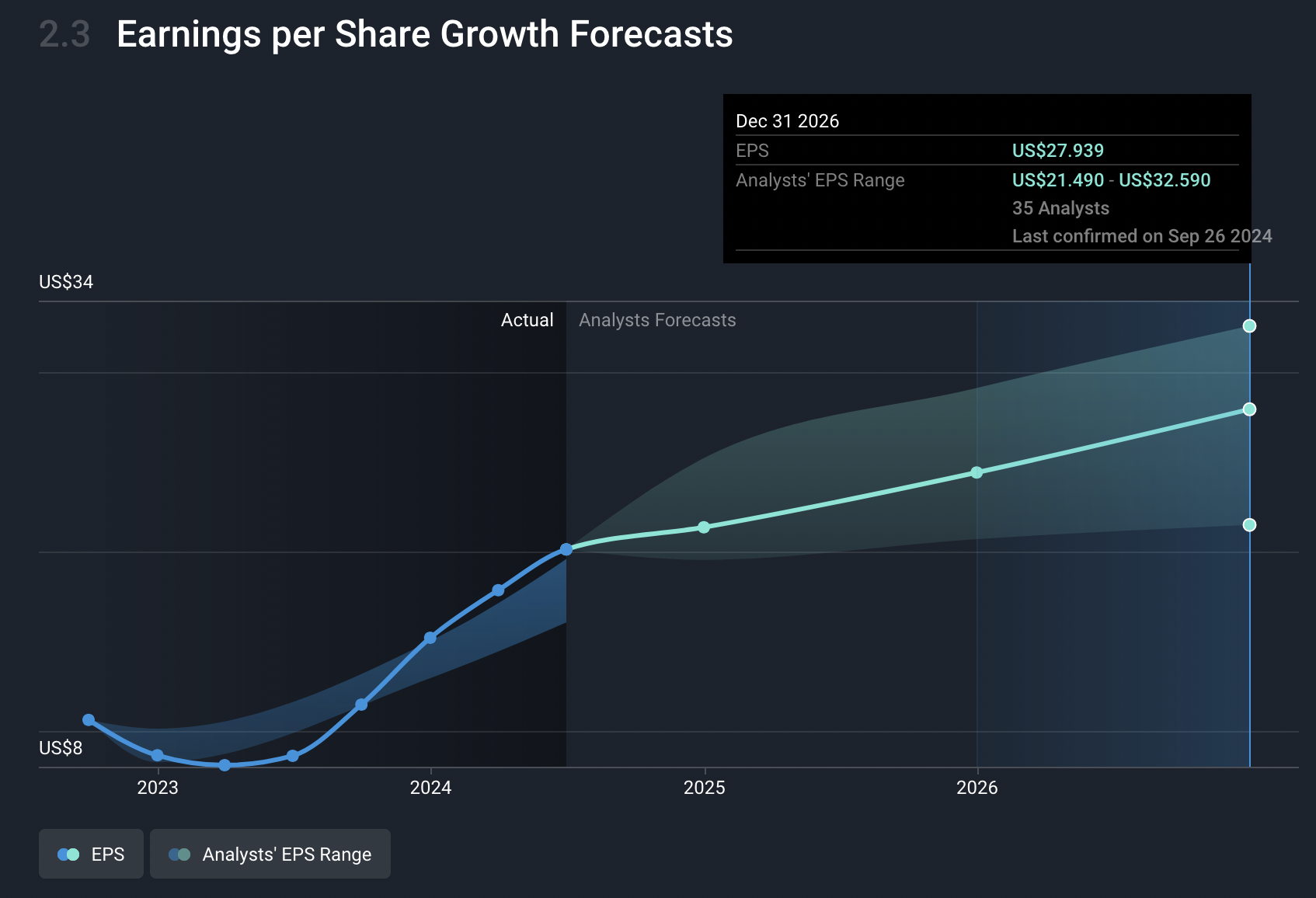

Reminder: You can see how a company’s earnings are tracking against the range of historical and future estimates in section 2.3 of the company report. Here’s how Meta has failed against those estimates recently:

The company mostly underperformed analysts EPS estimates in 2023, then has outperformed so far in 2024.

Key Events During the Next Week

Monday

- 🇨🇳 In China, the Chinese NBS Manufacturing PMI and Chinese Caixin Manufacturing PMI will be published. Both indexes are expected to be slightly higher as another round of stimulus takes effect.

- 🇩🇪 Germany’s inflation rate is expected to rise to 2.1% from 1.9%.

Tuesday

- 🇯🇵 Japan’s latest consumer confidence index is forecast to fall slightly, from 36.7 to 35.

- 🇪🇺 The Eurozone’s flash inflation reading is expected to fall to 1.9% from 2.2%.

- 🇺🇸 The US JOLTs Job Openings report is forecast to show the job market continuing to cool. Economists expect 7.65 million job openings, compared to 7.67 million in the prior report.

Wednesday

- 🇺🇸 The US ADP National Employment Report is projected to show 90,000 new jobs, down from 99,000.

Friday

- 🇺🇸 More US employment data rounds off the week. The unemployment rate is forecast to rise from 4.2% to 4.3%. Non-farm payrolls are expected to be 130k, down from 142k.

Third quarter earnings season kicks off at the end of next week. This week, just a few notable companies are due to report, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.