- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

Top 3 Undervalued Small Caps In United States With Insider Activity September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat. As for the longer term, the market has risen 32% in the past 12 months, with earnings forecast to grow by 15% annually. In this context, identifying undervalued small-cap stocks with insider activity can offer compelling opportunities for investors seeking growth potential amidst stable market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.1x | 2.1x | 49.72% | ★★★★★☆ |

| Columbus McKinnon | 22.3x | 1.0x | 39.88% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 25.58% | ★★★★★☆ |

| Citizens & Northern | 13.1x | 2.9x | 42.98% | ★★★★☆☆ |

| MYR Group | 34.5x | 0.5x | 42.01% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 1.9x | 39.07% | ★★★★☆☆ |

| German American Bancorp | 13.8x | 4.6x | 47.10% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -218.68% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -244.72% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

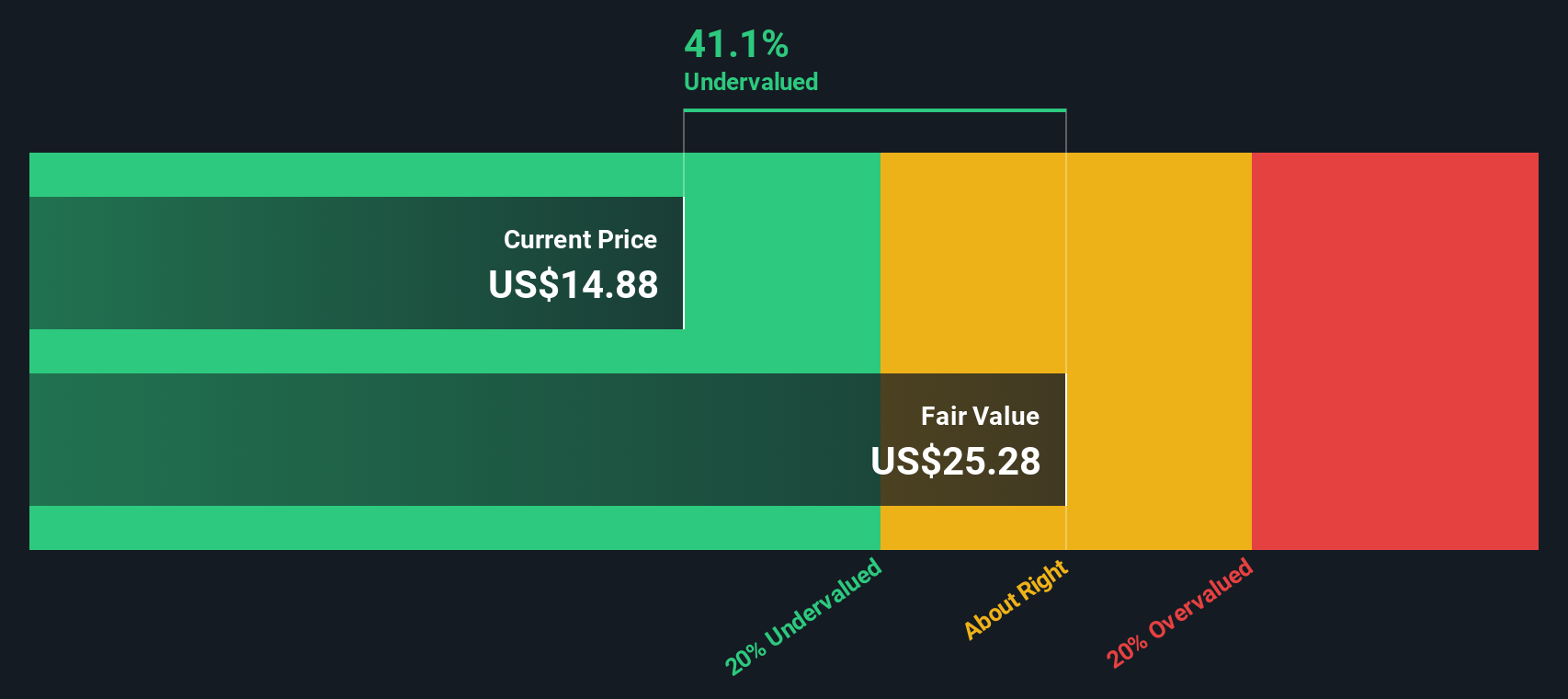

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Columbus McKinnon is a company specializing in machinery and industrial equipment, with operations generating $1.02 billion in revenue.

Operations: Columbus McKinnon generates revenue primarily from its Machinery & Industrial Equipment segment, which reported $1.02 billion in the latest period. The company's gross profit margin has shown an increasing trend, reaching 37.08% recently. Operating expenses include significant allocations to sales and marketing as well as general and administrative costs, with recent figures at approximately $108 million and $105 million respectively.

PE: 22.3x

Columbus McKinnon, a small cap stock, has shown insider confidence with recent purchases. In Q1 2024, the company reported sales of US$239.73 million and net income of US$8.63 million, slightly down from the previous year. Earnings per share stood at US$0.30 compared to US$0.32 a year ago. Despite this, earnings are forecasted to grow by 29.84% annually, indicating potential growth ahead for investors looking at undervalued opportunities in this sector.

- Take a closer look at Columbus McKinnon's potential here in our valuation report.

Assess Columbus McKinnon's past performance with our detailed historical performance reports.

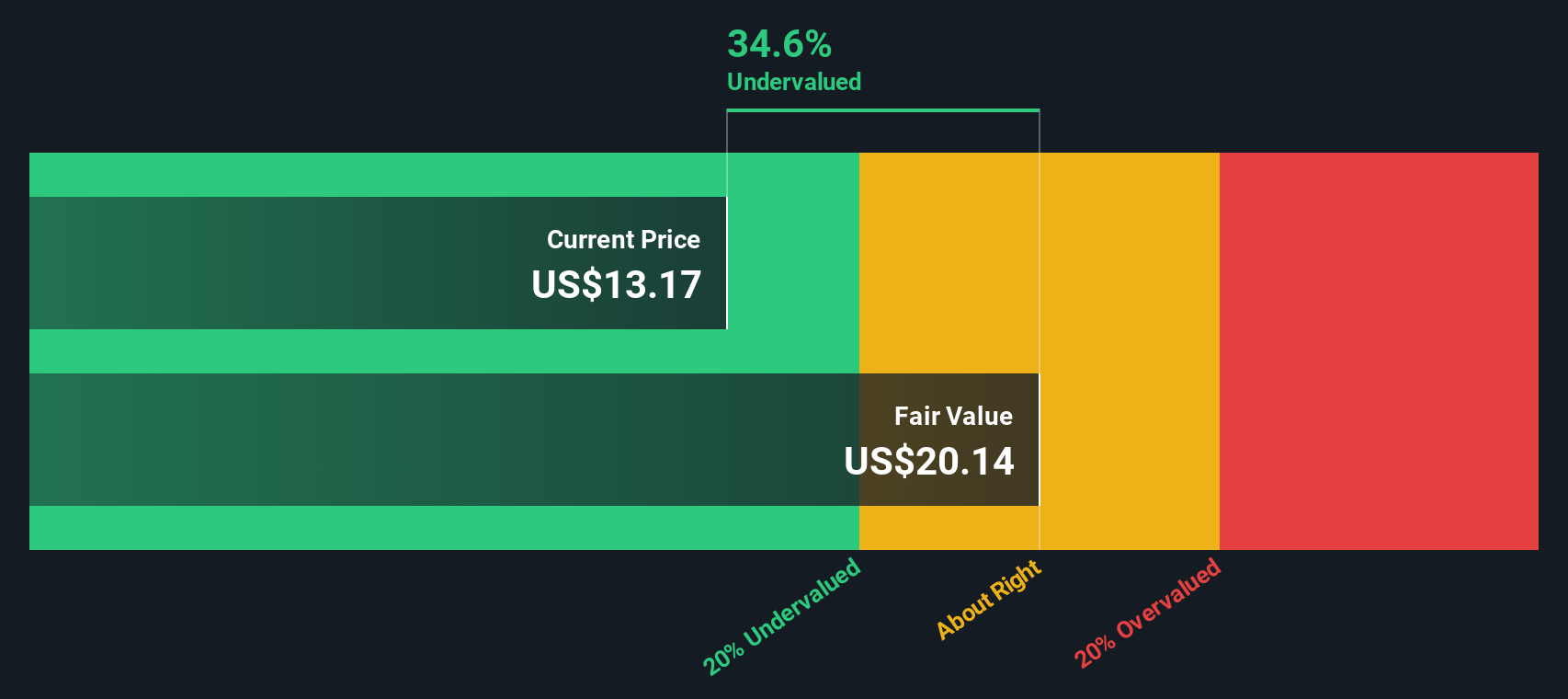

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company that designs and sells semiconductors, with a market cap of approximately $2.47 billion.

Operations: MaxLinear generates revenue primarily from its semiconductor segment, with the latest reported revenue at $448.14 million. The company's gross profit margin has shown fluctuations, with the most recent figure at 53.99%.

PE: -6.7x

MaxLinear, a small-cap stock, has shown insider confidence with Kishore Seendripu purchasing 108,303 shares worth US$1.4 million between June and September 2024. The company is making strides in data storage with its Panther III solution, which significantly reduces costs by minimizing CPU core usage and enhancing storage capacity through a 12:1 data reduction ratio. Despite recent volatility and financial challenges in the latest earnings report, MaxLinear's innovative products position it well for future growth in the expanding cloud storage market.

- Navigate through the intricacies of MaxLinear with our comprehensive valuation report here.

Evaluate MaxLinear's historical performance by accessing our past performance report.

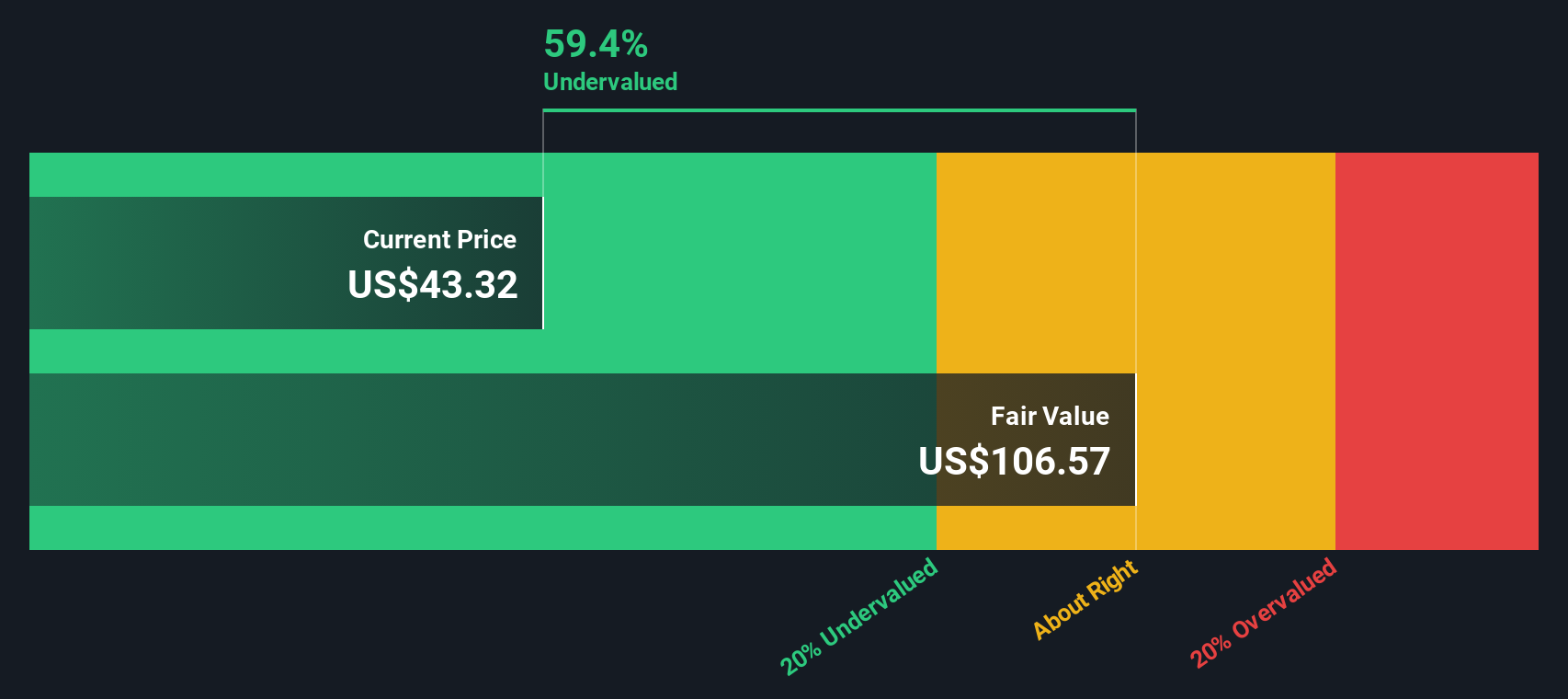

Stepan (NYSE:SCL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stepan is a chemical manufacturing company that produces polymers, surfactants, and specialty products with a market cap of approximately $2.43 billion.

Operations: Polymers, Surfactants, and Specialty Products contribute $622.09M, $1.51B, and $66.17M respectively to total revenue. The cost of goods sold (COGS) for the latest period is $1.92B with operating expenses at $204.89M and non-operating expenses at $37.79M. The net income margin has been observed at 1.58% recently while the gross profit margin stands at 12.60%.

PE: 50.6x

Stepan Company, a small-cap stock, reported Q2 2024 sales of US$556.41 million and net income of US$9.52 million, down from last year’s US$579.98 million and US$12.68 million respectively. Despite lower earnings per share (US$0.42 vs. US$0.56), insider confidence is evident with recent purchases by executives in the past six months, signaling potential value recognition within the company’s leadership ranks amidst ongoing dividend payouts of $0.375 per share quarterly.

- Delve into the full analysis valuation report here for a deeper understanding of Stepan.

Understand Stepan's track record by examining our Past report.

Taking Advantage

- Embark on your investment journey to our 55 Undervalued US Small Caps With Insider Buying selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Good value with moderate growth potential.