- United States

- /

- Specialty Stores

- /

- NasdaqGM:ONEW

Denny's And 2 Other Undervalued Small Caps On US Exchange With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, and over the past year, it has climbed an impressive 24%, with earnings expected to grow by 15% annually in the coming years. In this thriving environment, identifying small-cap stocks that are undervalued and have insider buying can present intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 11.5x | 3.0x | 48.67% | ★★★★★☆ |

| McEwen Mining | 3.9x | 2.0x | 46.54% | ★★★★★☆ |

| OptimizeRx | NA | 1.4x | 28.49% | ★★★★★☆ |

| German American Bancorp | 14.1x | 4.7x | 46.69% | ★★★★☆☆ |

| First United | 12.8x | 3.4x | 31.82% | ★★★★☆☆ |

| Quanex Building Products | 30.5x | 0.8x | 40.17% | ★★★★☆☆ |

| Eagle Financial Services | 7.4x | 1.6x | 36.32% | ★★★★☆☆ |

| Arrow Financial | 15.1x | 3.3x | 38.57% | ★★★☆☆☆ |

| West Bancorporation | 15.7x | 4.8x | 39.44% | ★★★☆☆☆ |

| Limbach Holdings | 37.0x | 1.9x | 46.30% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

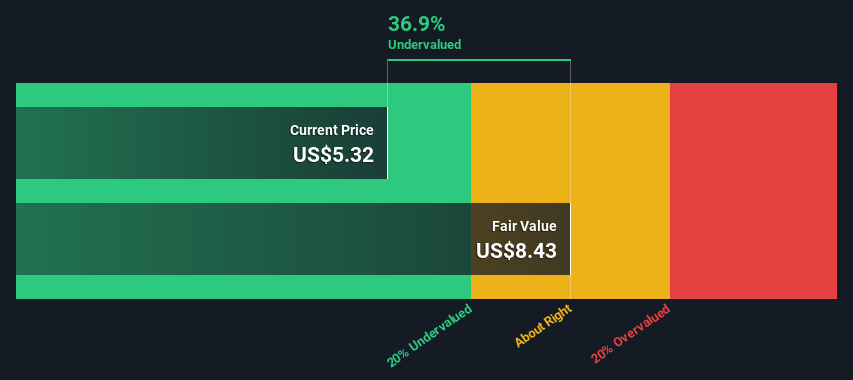

Denny's (NasdaqCM:DENN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Denny's is a well-known American diner-style restaurant chain offering a variety of breakfast, lunch, and dinner options with a market capitalization of approximately $0.53 billion.

Operations: Denny's revenue model is primarily driven by its sales, with cost of goods sold (COGS) forming a significant portion of expenses. The net income margin has shown variability, peaking at 22.79% in early 2020 before declining to 3.90% by late 2024. Over the years, the gross profit margin has generally fluctuated around the mid-to-high 30s percentage range, reaching as high as 41.77% in late 2021 but dropping to around 34.27% by the end of 2024.

PE: 12.2x

Denny's, a smaller U.S. company, recently reported an annual net income increase to US$21.57 million from US$19.95 million, despite a slight revenue dip to US$452.33 million for 2024. Earnings per share rose to US$0.41 from US$0.36, indicating potential value in its shares amidst insider confidence due to recent purchases over the past year. With plans for 25-40 new restaurant openings in 2025 and expected closures of 70-90 locations, strategic shifts are underway amid evolving consumer trends and macroeconomic factors impacting sales projections between -2% and +1%.

- Dive into the specifics of Denny's here with our thorough valuation report.

Review our historical performance report to gain insights into Denny's's past performance.

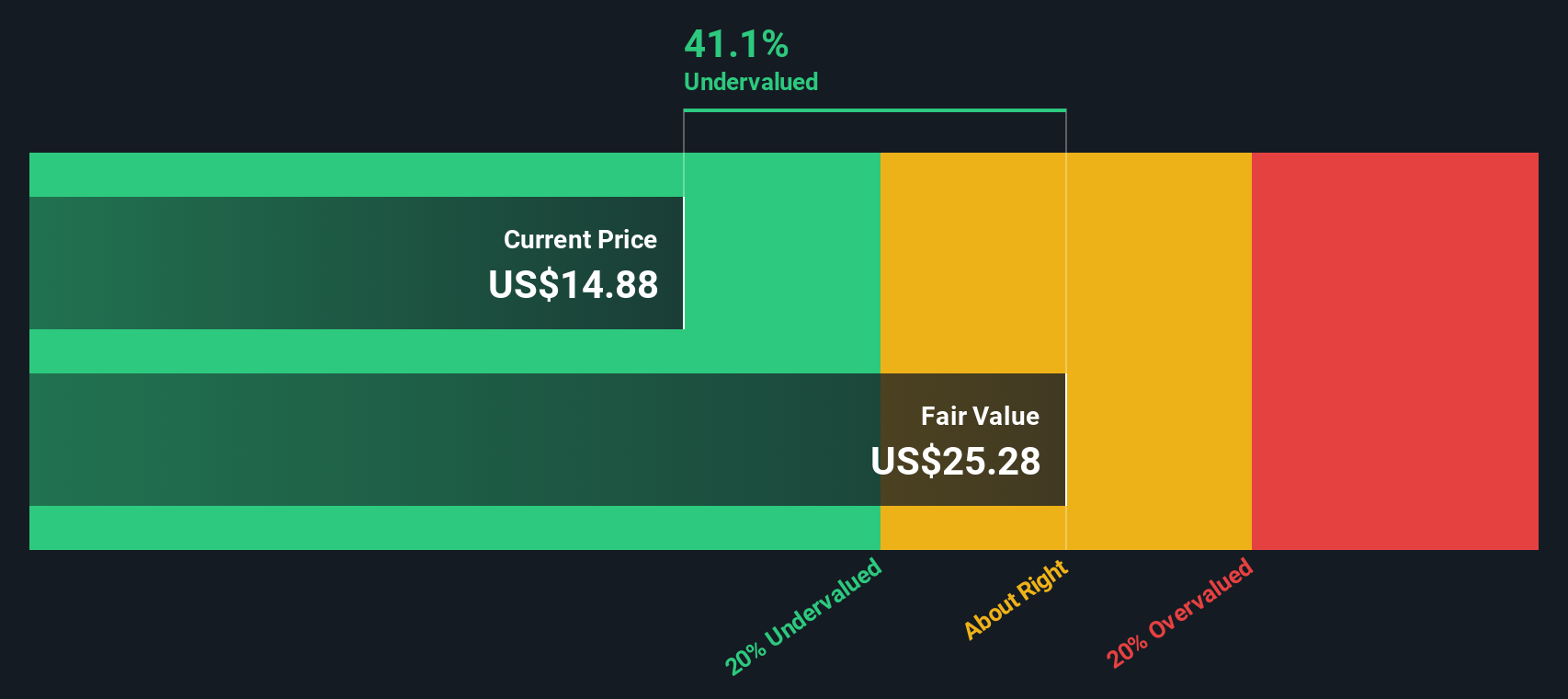

OneWater Marine (NasdaqGM:ONEW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: OneWater Marine is a company that operates in the recreational boat retail industry, focusing on dealerships and distribution, with a market cap of approximately $0.46 billion.

Operations: The company generates revenue primarily through its dealerships, contributing $1.63 billion, and distribution channels, adding $151.78 million. The gross profit margin has shown variability across periods, with a recent figure of 24.19%. Operating expenses are a significant cost component, including general and administrative expenses that reached $305.24 million in the latest period analyzed.

PE: -28.9x

OneWater Marine, a smaller player in the U.S. market, reported Q1 2025 revenue of US$375.81 million, up from US$364.01 million year-over-year, despite a net loss increase to US$11.97 million from US$7.17 million previously. Although interest payments are not well covered by earnings and funding is primarily external borrowing, insider confidence remains evident through share purchases over time. The company maintains fiscal 2025 revenue guidance between $1.7 billion and $1.85 billion with modest dealership sales growth expected.

- Get an in-depth perspective on OneWater Marine's performance by reading our valuation report here.

Understand OneWater Marine's track record by examining our Past report.

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Columbus McKinnon is a company specializing in machinery and industrial equipment, with a market capitalization of approximately $1.36 billion.

Operations: The company generates revenue primarily from the Machinery & Industrial Equipment segment, with recent figures indicating $981.64 million. Its cost of goods sold (COGS) is a significant expense, recently recorded at $625.71 million, impacting overall profitability. The gross profit margin has shown variability over time, most recently standing at 36.26%. Operating expenses include substantial allocations for sales and marketing as well as general and administrative costs.

PE: 63.4x

Columbus McKinnon, a smaller U.S. company, faces challenges with declining sales and net income, reporting US$234 million in Q3 2024 sales versus US$254 million the previous year. Net income also dropped to US$3.96 million from US$9.73 million year-over-year. Despite these setbacks, insider confidence is evident through significant private placements worth $800 million announced in February 2025. Although earnings guidance suggests a mid-single-digit decline in net sales for fiscal 2025, potential growth remains as earnings are forecasted to grow annually by over 78%.

- Unlock comprehensive insights into our analysis of Columbus McKinnon stock in this valuation report.

Taking Advantage

- Get an in-depth perspective on all 51 Undervalued US Small Caps With Insider Buying by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ONEW

OneWater Marine

Operates as a recreational marine retailer in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives