- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

Top US Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As the U.S. stock market continues to show resilience with the Dow Jones and S&P 500 hitting new record highs, investor optimism remains buoyed by expectations of a soft landing for the economy and further interest rate cuts from the Federal Reserve. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as it often signals strong confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We're going to check out a few of the best picks from our screener tool.

Byrna Technologies (NasdaqCM:BYRN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Byrna Technologies Inc. is a company specializing in less-lethal self-defense technology, developing and selling personal security solutions across multiple continents, with a market cap of $387.21 million.

Operations: Revenue from the Aerospace & Defense segment totals $59.65 million.

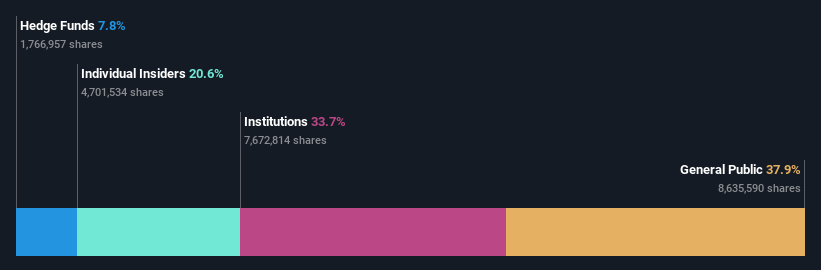

Insider Ownership: 20.6%

Return On Equity Forecast: N/A (2027 estimate)

Byrna Technologies has seen significant insider buying over the past three months, indicating strong internal confidence. The company’s revenue is forecast to grow at 23.8% per year, outpacing the US market average of 8.7%. Recent orders from Argentina and Uruguay highlight international expansion efforts. Byrna's addition to multiple indices like S&P Global BMI and Russell 3000 further underscores its growing market presence. However, shareholders have experienced dilution recently, and the stock price has been highly volatile.

- Dive into the specifics of Byrna Technologies here with our thorough growth forecast report.

- Our expertly prepared valuation report Byrna Technologies implies its share price may be too high.

LendingTree (NasdaqGS:TREE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LendingTree, Inc., with a market cap of $801.90 million, operates an online consumer platform in the United States through its subsidiary.

Operations: LendingTree generates revenue from three primary segments: Home ($121.12 million), Consumer ($224.11 million), and Insurance ($322.07 million).

Insider Ownership: 18%

Return On Equity Forecast: 36% (2027 estimate)

LendingTree's recent follow-on equity offering of US$50 million may impact shareholder value, but the company's Q2 2024 earnings show promising growth with sales rising to US$210.14 million and a net income of US$7.75 million. Despite some insider selling, the company is expected to achieve profitability within three years, with revenue forecasted to grow at 12.1% per year and earnings projected to increase by 74.87% annually, indicating robust future potential.

- Get an in-depth perspective on LendingTree's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that LendingTree's current price could be inflated.

Marcus (NYSE:MCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Marcus Corporation, with a market cap of $477.78 million, owns and operates movie theatres as well as hotels and resorts in the United States.

Operations: The company's revenue segments include $407.89 million from theatres and $238.52 million from hotels and resorts.

Insider Ownership: 23.3%

Return On Equity Forecast: N/A (2027 estimate)

Marcus Corporation, with substantial insider ownership, is forecasted to grow earnings by 107% annually and become profitable within three years. Despite a recent net loss of US$32.09 million for the first half of 2024, revenue is expected to grow at 8.9% per year, slightly outpacing the US market. The company declared a quarterly dividend but its sustainability is questionable due to current earnings coverage. Recent debt financing includes US$100 million in senior notes aimed at repaying existing debt and supporting corporate purposes.

- Navigate through the intricacies of Marcus with our comprehensive analyst estimates report here.

- Our valuation report here indicates Marcus may be undervalued.

Summing It All Up

- Discover the full array of 179 Fast Growing US Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, engages in the development, manufacture, and sale of less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Flawless balance sheet with reasonable growth potential.