- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

US Exchange: 3 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market continues to flirt with record highs, driven by gains in major indices like the S&P 500 and Nasdaq Composite, investors are keenly observing potential opportunities amid a landscape of fluctuating futures and economic indicators. In this environment, identifying stocks that might be trading below their intrinsic value can offer strategic entry points for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $124.72 | $243.53 | 48.8% |

| First Solar (NasdaqGS:FSLR) | $207.92 | $399.87 | 48% |

| West Bancorporation (NasdaqGS:WTBA) | $23.84 | $46.82 | 49.1% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.98 | $63.88 | 48.4% |

| Privia Health Group (NasdaqGS:PRVA) | $22.31 | $43.17 | 48.3% |

| First Advantage (NasdaqGS:FA) | $19.37 | $38.63 | 49.9% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.408 | $30.26 | 49.1% |

| AeroVironment (NasdaqGS:AVAV) | $203.19 | $404.34 | 49.7% |

| Progress Software (NasdaqGS:PRGS) | $68.31 | $132.04 | 48.3% |

| Intuitive Machines (NasdaqGM:LUNR) | $14.56 | $28.63 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

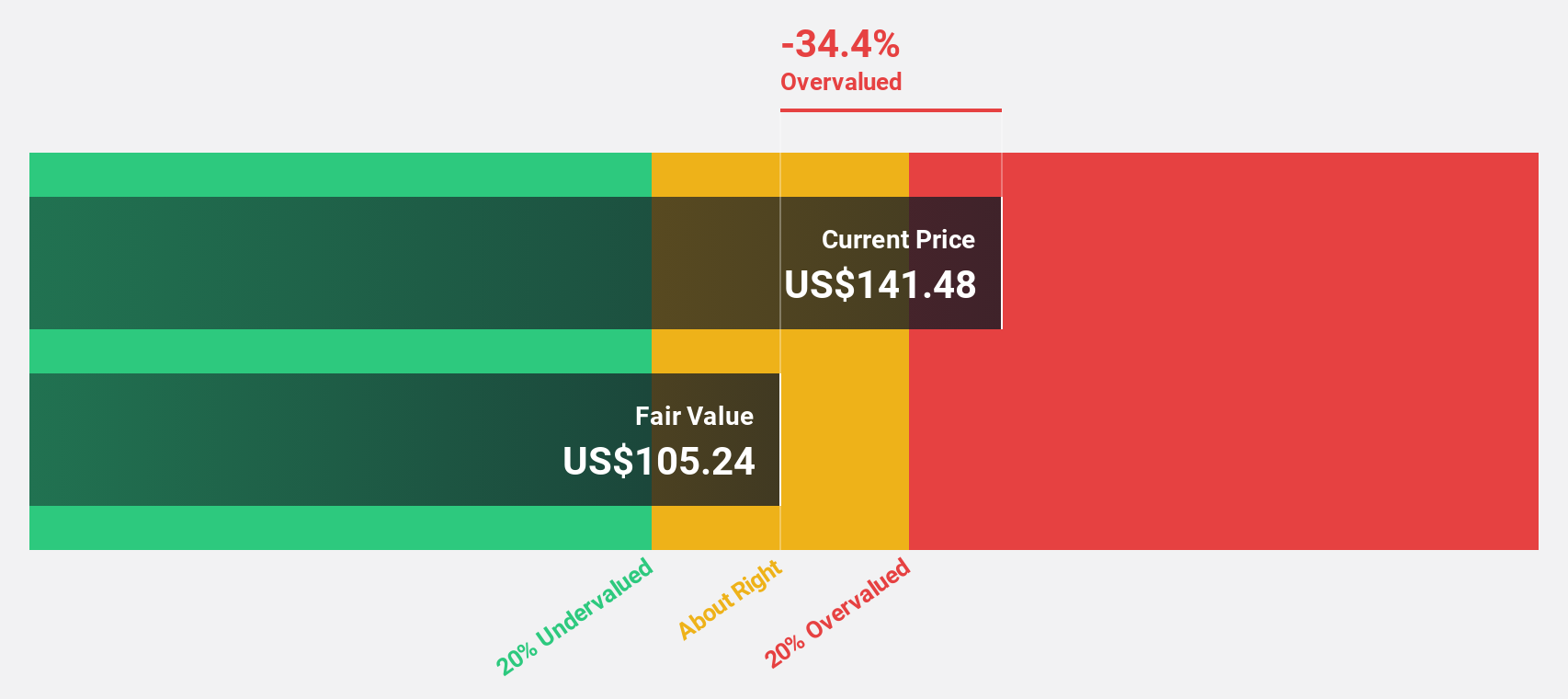

Advanced Energy Industries (NasdaqGS:AEIS)

Overview: Advanced Energy Industries, Inc. offers precision power conversion, measurement, and control solutions globally and has a market cap of approximately $4.33 billion.

Operations: The company's revenue is primarily derived from its Power Electronics Conversion Products segment, which generated $1.47 billion.

Estimated Discount To Fair Value: 45.9%

Advanced Energy Industries is trading at a significant discount, with its share price of US$118.7 well below the estimated fair value of US$219.54, suggesting it may be undervalued based on cash flows. Despite recent financial challenges, including a net loss in the third quarter and declining profit margins, earnings are expected to grow significantly at 71.7% annually over the next three years, surpassing market averages and indicating potential for recovery and growth.

- Our earnings growth report unveils the potential for significant increases in Advanced Energy Industries' future results.

- Click to explore a detailed breakdown of our findings in Advanced Energy Industries' balance sheet health report.

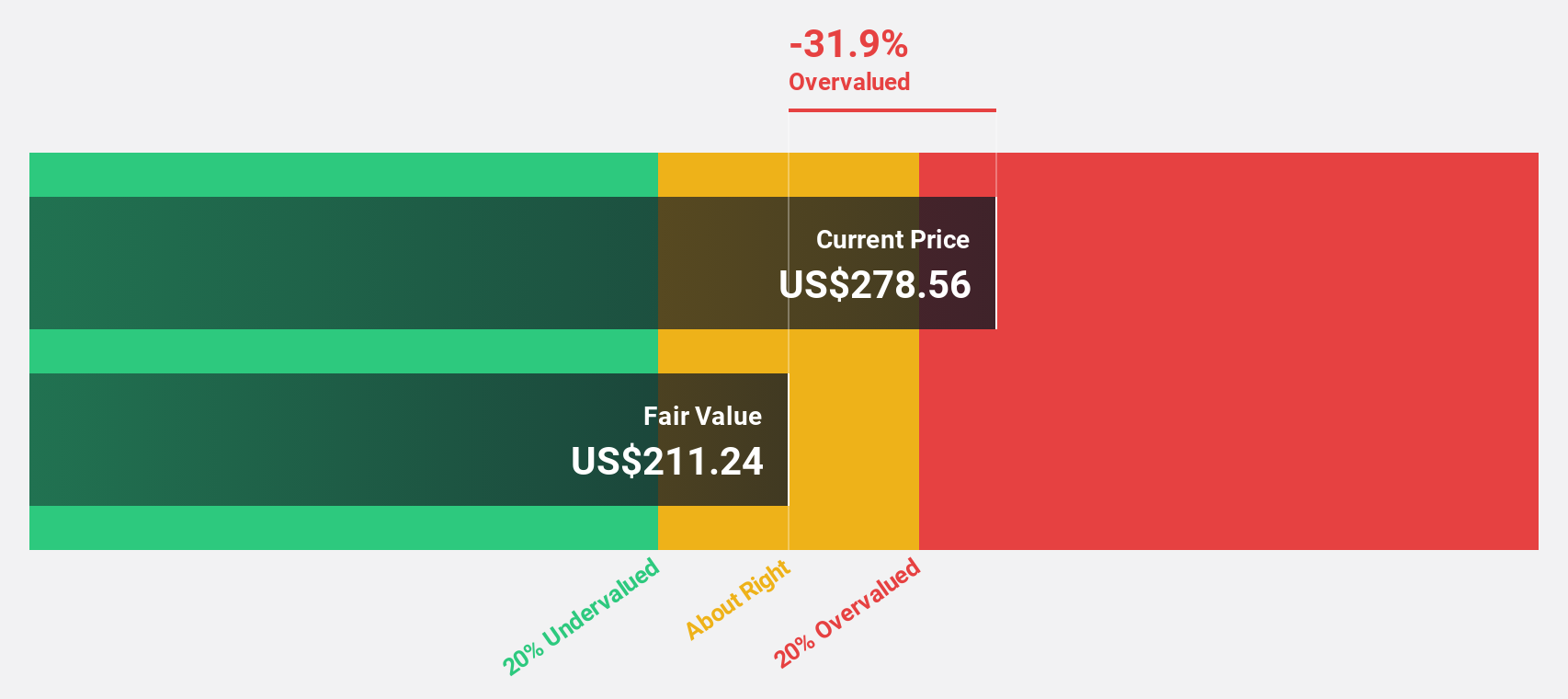

AeroVironment (NasdaqGS:AVAV)

Overview: AeroVironment, Inc. specializes in designing, developing, and supporting robotic systems and related services for government agencies and businesses globally, with a market cap of approximately $5.45 billion.

Operations: The company's revenue segments include Maccready Works at $70.44 million, UnCrewed Systems at $469.78 million, and Loitering Munitions Systems at $213.64 million.

Estimated Discount To Fair Value: 49.7%

AeroVironment is trading at a substantial discount, with its current price of US$203.19 significantly below the estimated fair value of US$404.34, highlighting potential undervaluation based on cash flows. Despite recent shareholder dilution, the company has become profitable and forecasts indicate robust earnings growth at 28.53% annually over the next three years, outpacing market averages. Recent strategic moves include acquiring BlueHalo LLC and enhancing product capabilities through software updates, which could bolster future performance.

- Our growth report here indicates AeroVironment may be poised for an improving outlook.

- Dive into the specifics of AeroVironment here with our thorough financial health report.

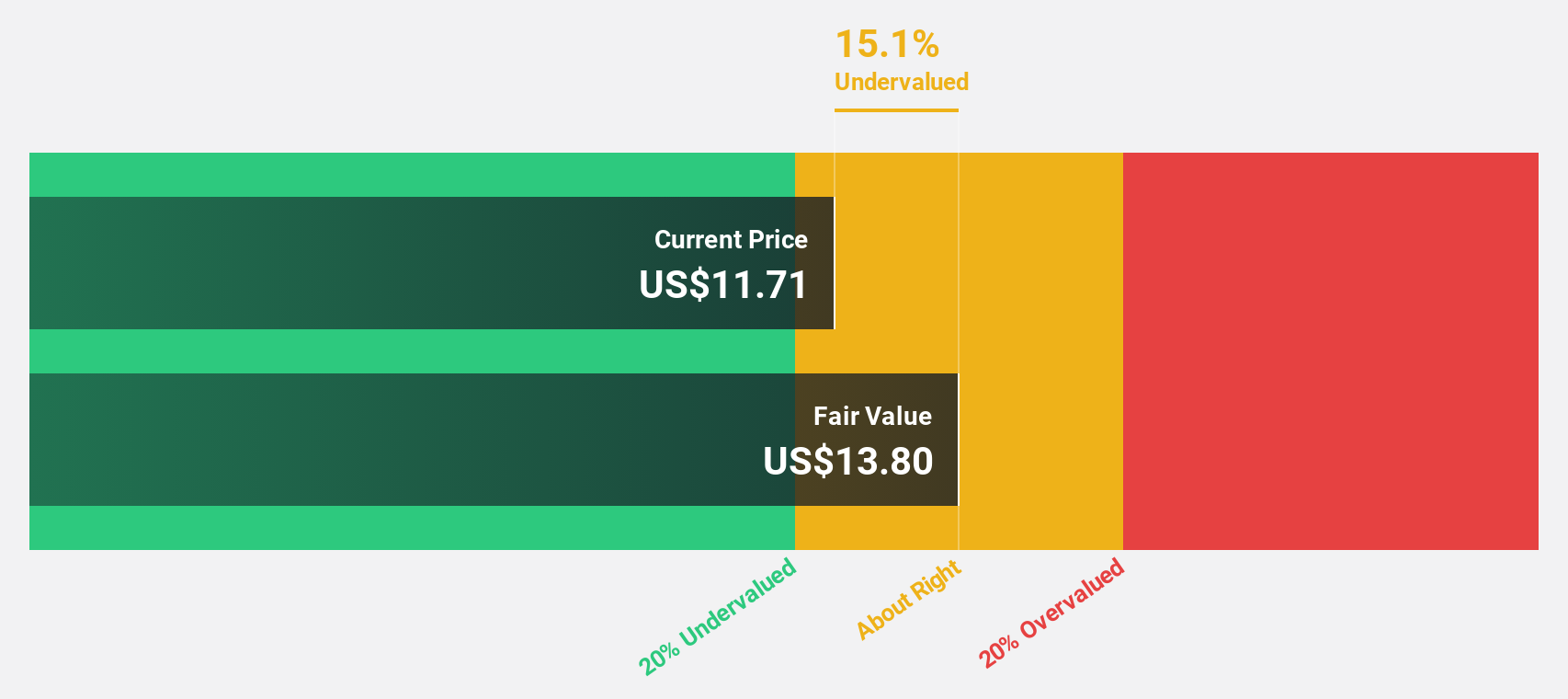

V.F (NYSE:VFC)

Overview: V.F. Corporation, along with its subsidiaries, focuses on designing, procuring, marketing, and distributing branded lifestyle apparel, footwear, and accessories for men, women, and children across the Americas, Europe, and the Asia-Pacific regions; it has a market cap of approximately $7.88 billion.

Operations: The company's revenue segments are divided into Work ($857.11 million), Active ($3.83 billion), and Outdoor ($5.41 billion).

Estimated Discount To Fair Value: 22.7%

V.F. Corporation is trading at US$20.87, below its estimated fair value of US$26.99, suggesting potential undervaluation based on cash flows. Despite a volatile share price and revenue forecasted to grow slower than the market, the company has returned to profitability with earnings expected to rise significantly over the next three years. Recent buyback completion and improved quarterly earnings underscore financial resilience, although dividends are not well covered by earnings presently.

- The growth report we've compiled suggests that V.F's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of V.F.

Next Steps

- Discover the full array of 186 Undervalued US Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Advanced Energy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives