- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:ASLE

Insider-Favored Growth Stocks To Watch Now

Reviewed by Simply Wall St

As the U.S. markets show signs of recovery with the S&P 500 and Nasdaq rising after an encouraging CPI inflation report, investors are keenly watching for growth opportunities amidst ongoing economic uncertainties. In this context, companies with high insider ownership often attract attention as they can signal confidence in future performance, making them intriguing options for those looking to navigate the current market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 36.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.9% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Kingstone Companies (NasdaqCM:KINS) | 17.9% | 24.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20.7% | 59.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's dive into some prime choices out of the screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation specializes in providing aftermarket commercial aircraft, engines, and parts to a diverse clientele including airlines and government contractors, with a market cap of approximately $424.10 million.

Operations: The company's revenue is primarily derived from Tech Ops - MRO Services at $107.97 million, Tech Ops - Product Sales at $21.63 million, Asset Management Solutions - Engine at $173.72 million, and Asset Management Solutions - Aircraft at $41.75 million.

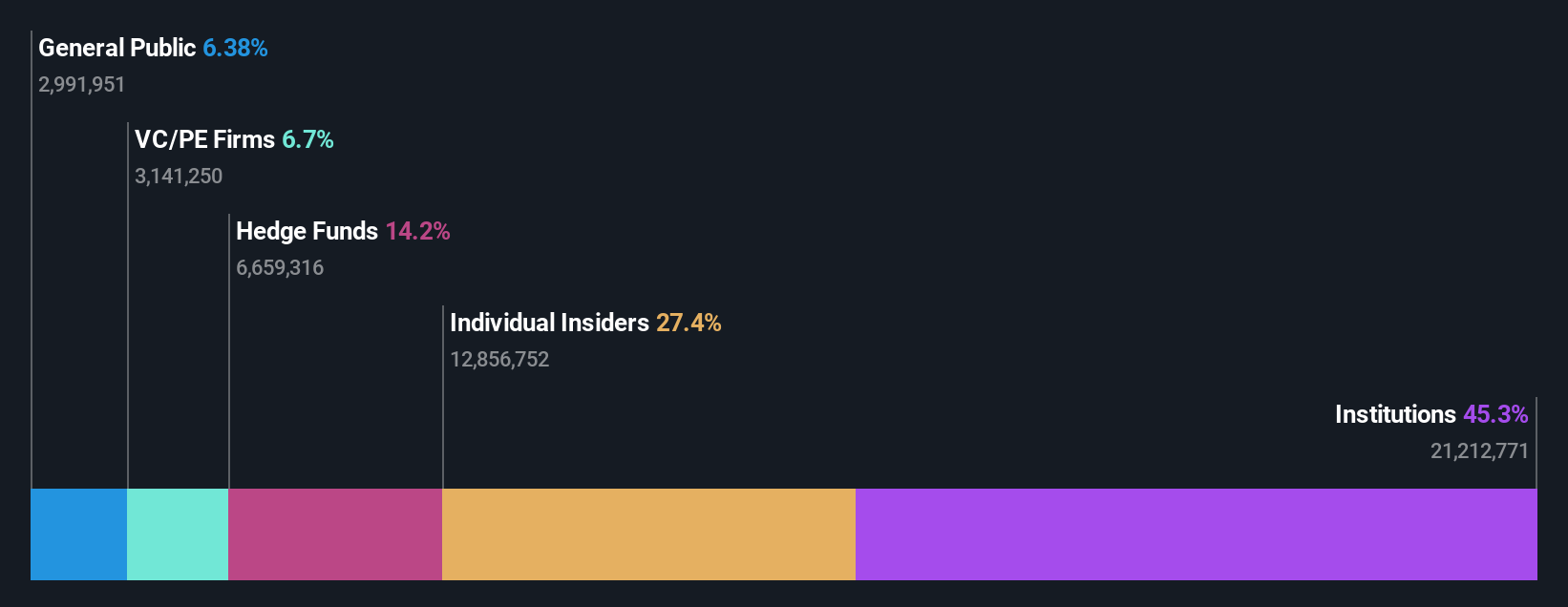

Insider Ownership: 24.1%

Earnings Growth Forecast: 57.6% p.a.

AerSale Corporation, with significant insider ownership, recently reported a return to profitability, achieving a net income of US$5.85 million for 2024 compared to a loss the previous year. Revenue grew modestly to US$345.07 million. Despite low forecasted Return on Equity at 2.8%, AerSale's earnings are expected to grow significantly at 57.58% annually over the next three years, outpacing both its revenue growth and the broader US market growth rates.

- Click here to discover the nuances of AerSale with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that AerSale is priced higher than what may be justified by its financials.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and other international markets with a market cap of $7.36 billion.

Operations: The company's revenue is primarily derived from its semiconductor segment, which generated $327.53 million.

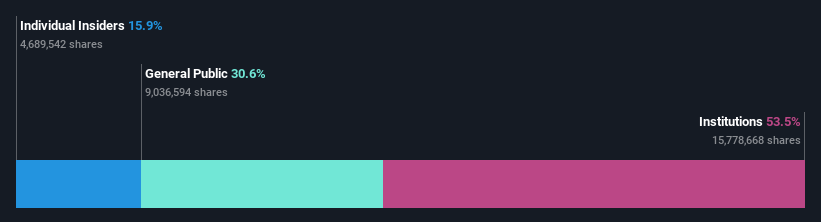

Insider Ownership: 12.6%

Earnings Growth Forecast: 65.3% p.a.

Credo Technology Group Holding, with high insider ownership, reported significant revenue growth in Q3 2025 to US$135 million from US$53.06 million a year ago, and net income of US$29.36 million. Despite recent substantial insider selling, the company forecasts robust earnings growth at 65.3% annually over the next three years, surpassing market averages. Recent product advancements and positive revenue guidance for Q4 further support its growth trajectory amidst volatile share prices.

- Dive into the specifics of Credo Technology Group Holding here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Credo Technology Group Holding's share price might be too optimistic.

Vitesse Energy (NYSE:VTS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vitesse Energy, Inc. is involved in acquiring, developing, and producing non-operated oil and natural gas properties in the United States, with a market cap of $794.40 million.

Operations: The company's revenue primarily comes from its oil and gas exploration and production segment, which generated $220.50 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 41.4% p.a.

Vitesse Energy, with high insider ownership, recently reported a return to profitability with a net income of US$21.06 million for 2024. The company forecasts significant annual earnings growth of 41.4%, outpacing the US market average. Vitesse's revenue is also expected to grow faster than the market at 20.5% annually. Recent acquisitions, like Lucero, are expected to enhance financial metrics and support strategic expansion plans despite concerns over dividend sustainability.

- Take a closer look at Vitesse Energy's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Vitesse Energy's current price could be quite moderate.

Make It Happen

- Access the full spectrum of 207 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade AerSale, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASLE

AerSale

Provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, government and defense contractors, and maintenance, repair, and overhaul service providers worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives