- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:ASLE

February 2025's US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As U.S. markets react to a hotter-than-expected inflation report, with major indices like the Dow Jones and S&P 500 experiencing declines, investors are closely monitoring the implications for monetary policy and interest rates. In this volatile environment, growth companies with strong insider ownership can offer unique insights into potential resilience and strategic alignment, making them an intriguing focus for those navigating these uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 64.3% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Ryan Specialty Holdings (NYSE:RYAN) | 15.8% | 43.9% |

| Zscaler (NasdaqGS:ZS) | 37.2% | 39.7% |

Let's uncover some gems from our specialized screener.

AerSale (NasdaqCM:ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to various clients including airlines and government contractors, while also offering maintenance services globally, with a market cap of $373.01 million.

Operations: The company's revenue segments include Tech Ops - MRO Services at $107.24 million, Tech Ops - Product Sales at $21.42 million, Asset Management Solutions - Engine at $158.66 million, and Asset Management Solutions - Aircraft at $57.43 million.

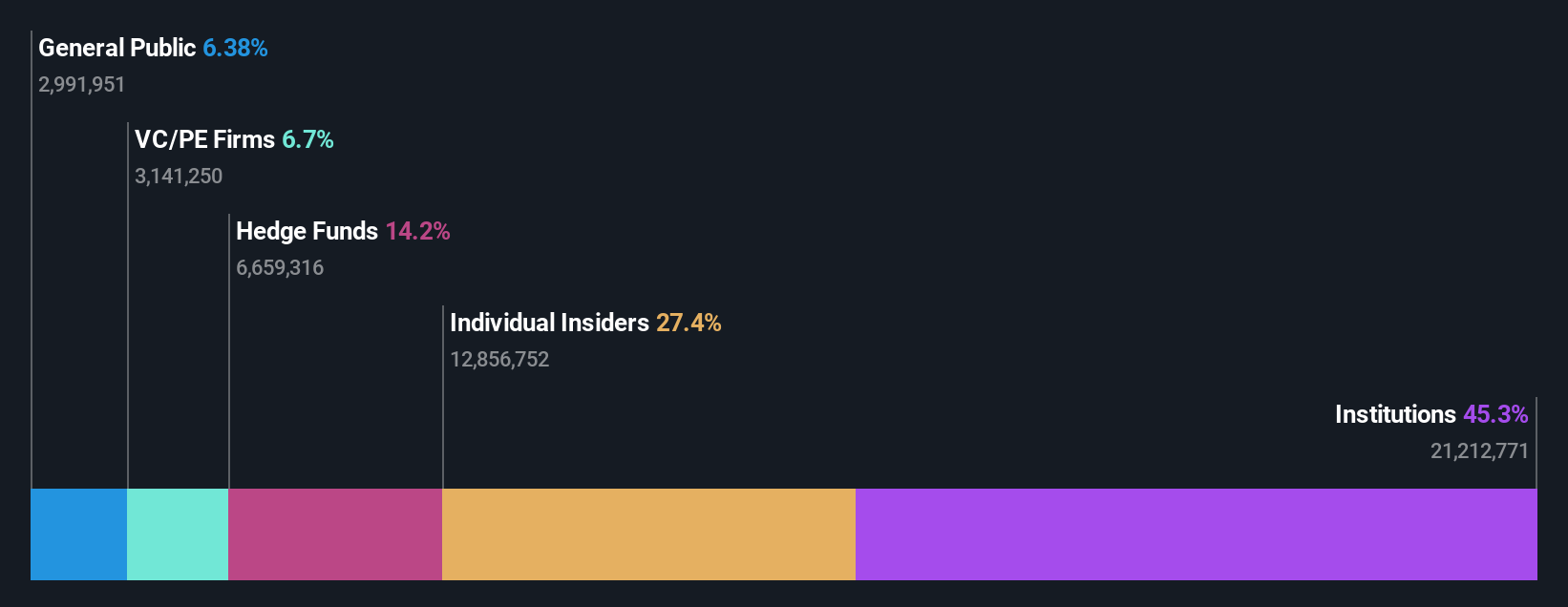

Insider Ownership: 24.1%

AerSale demonstrates potential as a growth company with high insider ownership. Its earnings are forecast to grow significantly, at 88.24% annually, outpacing the US market's average of 14.6%. Despite lower profit margins compared to last year and a modest revenue growth forecast of 12.8%, AerSale remains competitive against industry peers in terms of value. The upcoming presentation by CEO Nicolas Finazzo at an aerospace conference may provide further insights into its strategic direction.

- Delve into the full analysis future growth report here for a deeper understanding of AerSale.

- Our comprehensive valuation report raises the possibility that AerSale is priced lower than what may be justified by its financials.

Johnson Outdoors (NasdaqGS:JOUT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Johnson Outdoors Inc. designs, manufactures, and markets seasonal and outdoor recreation products for fishing worldwide, with a market cap of $299.38 million.

Operations: The company's revenue is primarily derived from its fishing segment, which accounts for $424.32 million, and its diving segment, contributing $71.83 million.

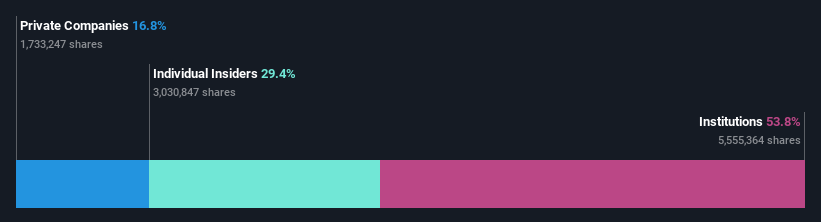

Insider Ownership: 29.4%

Johnson Outdoors faces challenges with a recent net loss of US$15.29 million for Q1 2025, compared to a profit last year. Despite this, the company is trading at 89.6% below its estimated fair value and has forecasted revenue growth of 10.1% annually, surpassing the US market average. Although its dividend yield of 4.53% is not fully covered by earnings, Johnson Outdoors is expected to become profitable within three years, reflecting above-average market growth potential.

- Dive into the specifics of Johnson Outdoors here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Johnson Outdoors is trading behind its estimated value.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China, with a market cap of approximately $745.41 million.

Operations: The company generates revenue primarily from its online retail operations, amounting to CN¥22.15 billion.

Insider Ownership: 28.2%

Dingdong (Cayman) is trading at 95.2% below its estimated fair value, highlighting potential undervaluation. The company became profitable this year and has a forecasted earnings growth of 44.22% annually over the next three years, significantly outpacing the US market's growth rate. However, its revenue growth of 8.8% per year is expected to lag behind the broader market average. No substantial insider trading activity was noted in recent months, and a buyback plan expired on January 28, 2025.

- Click here to discover the nuances of Dingdong (Cayman) with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Dingdong (Cayman)'s current price could be quite moderate.

Seize The Opportunity

- Click this link to deep-dive into the 195 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASLE

AerSale

Provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, and government and defense contractors, as well as maintenance, repair, and overhaul (MRO) service providers worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives