- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing by 2.8% over the past week and achieving a 25% increase over the past year, with every sector contributing to this growth. In such a thriving environment, identifying stocks with strong fundamentals can be key to uncovering hidden opportunities, as they often possess the resilience and potential for sustained earnings growth amidst favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that supplies nuclear fuel components and services to the nuclear power industry globally, with a market cap of approximately $1.13 billion.

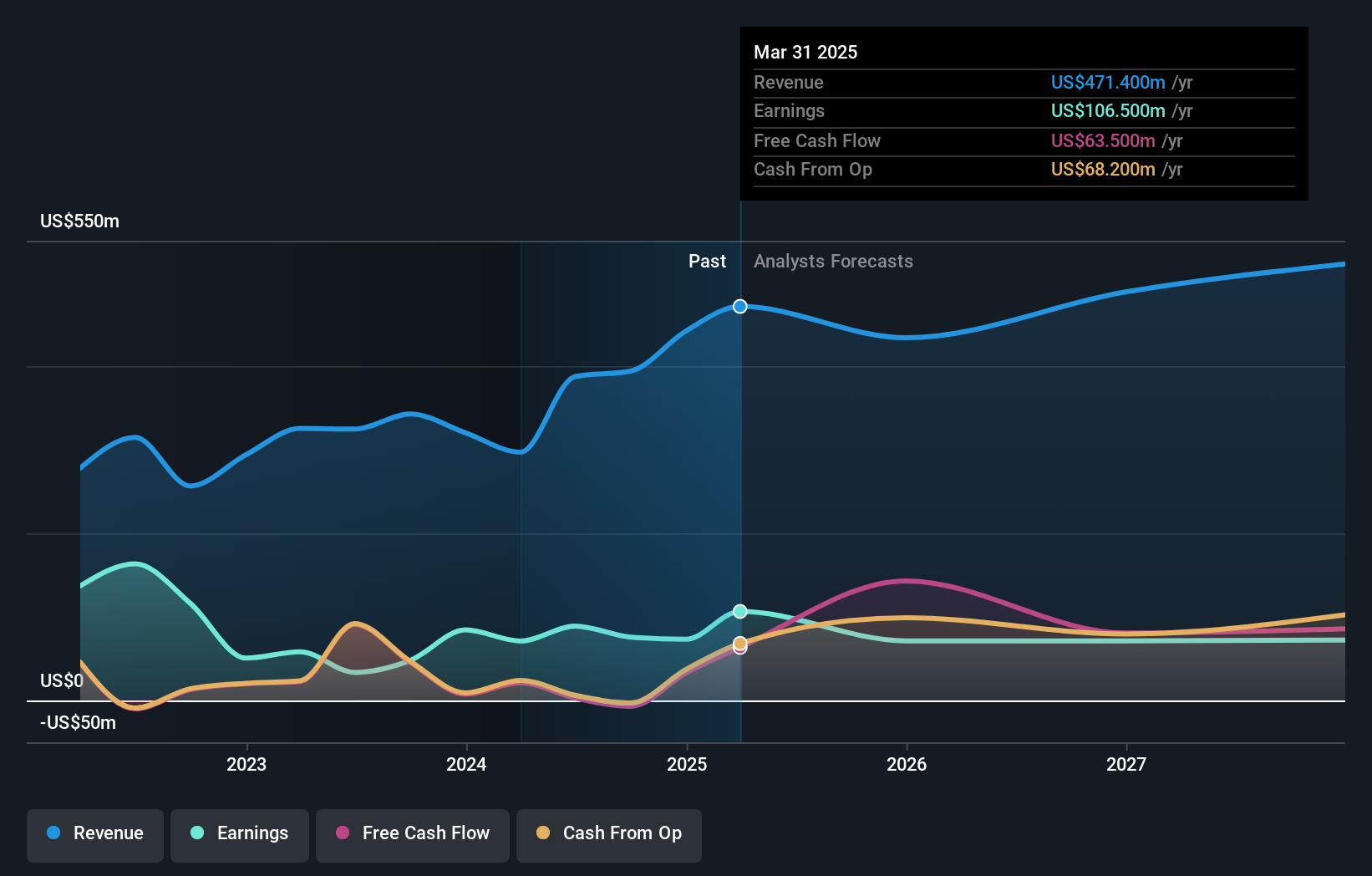

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $315.10 million, and Technical Solutions segment, adding $83.90 million.

Centrus Energy, a dynamic player in the nuclear fuel industry, has been making waves with its recent strategic moves. The company is trading at 57% below its estimated fair value, suggesting potential upside for investors. Over the past year, Centrus achieved impressive earnings growth of 58%, outpacing the oil and gas sector's performance. Despite recent volatility in its share price and a net loss of US$5 million for Q3 2024 compared to a net income of US$8 million last year, Centrus is expanding its manufacturing capacity with a US$60 million investment in Oak Ridge. This expansion aligns with securing over $2 billion in contingent purchase commitments and two U.S. Department of Energy awards aimed at enhancing uranium enrichment capabilities.

- Delve into the full analysis health report here for a deeper understanding of Centrus Energy.

Evaluate Centrus Energy's historical performance by accessing our past performance report.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tompkins Financial Corporation is a financial holding company offering a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services with a market cap of approximately $996.19 million.

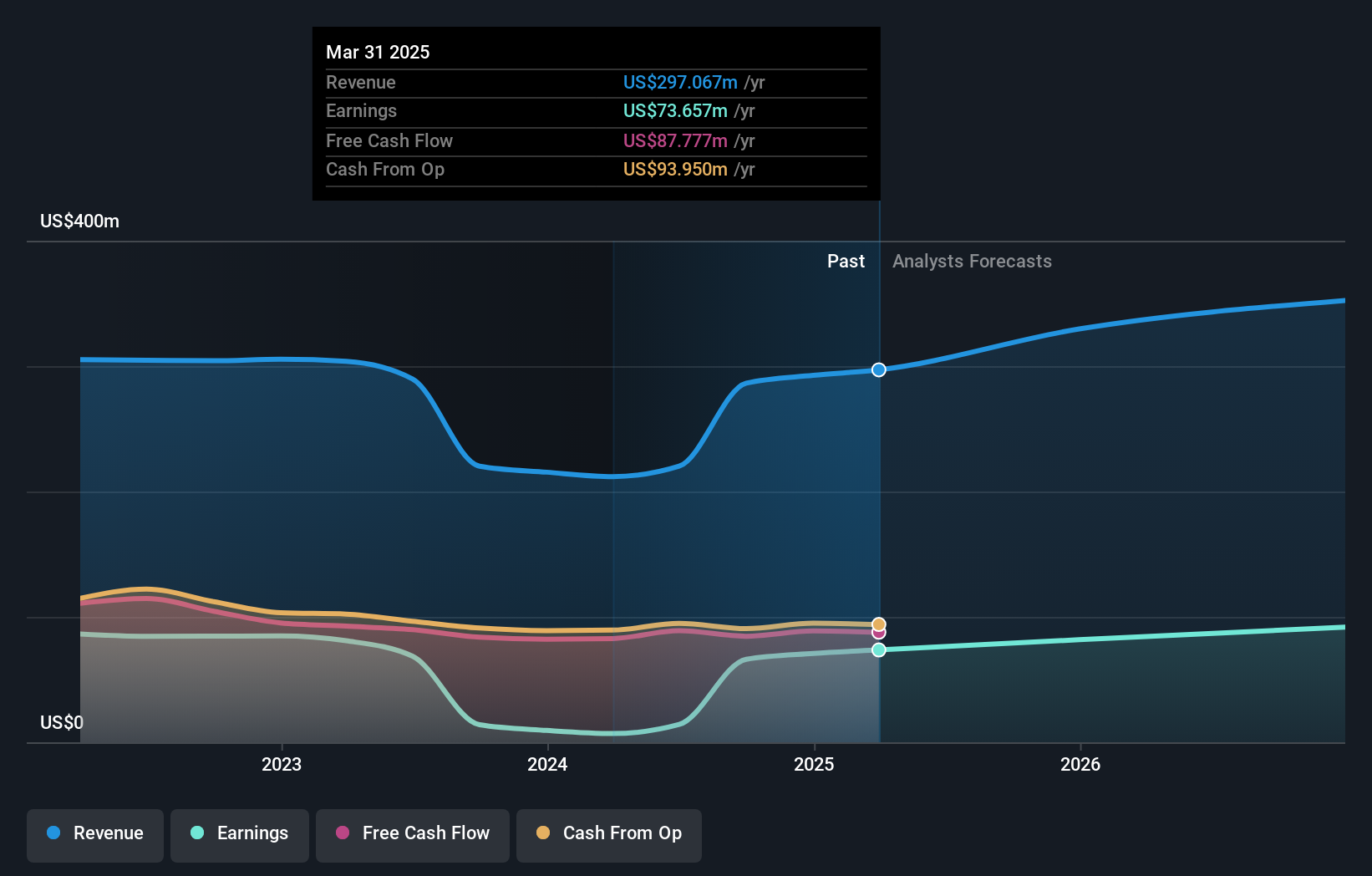

Operations: Tompkins Financial generates revenue primarily from its banking segment, contributing $229.63 million, followed by insurance services at $39.07 million and wealth management at $19.81 million. The company's net profit margin reflects its profitability trends over time.

With assets totaling US$8.0 billion and equity of US$721.3 million, Tompkins Financial stands out in the banking sector. The company's deposits amount to US$6.6 billion, with loans reaching US$5.8 billion, supported by a net interest margin of 2.8%. Despite an insufficient allowance for bad loans at 1.1% of total loans, its earnings surged by a remarkable 373% over the past year, surpassing industry averages significantly. Trading at nearly 44% below estimated fair value highlights potential undervaluation while maintaining primarily low-risk funding sources strengthens its financial stability and future growth prospects seem promising with forecasted earnings growth of nearly 13%.

- Get an in-depth perspective on Tompkins Financial's performance by reading our health report here.

Examine Tompkins Financial's past performance report to understand how it has performed in the past.

CTS (NYSE:CTS)

Simply Wall St Value Rating: ★★★★★★

Overview: CTS Corporation is engaged in the manufacturing and sale of sensors, actuators, and connectivity components across North America, Europe, and Asia with a market capitalization of approximately $1.61 billion.

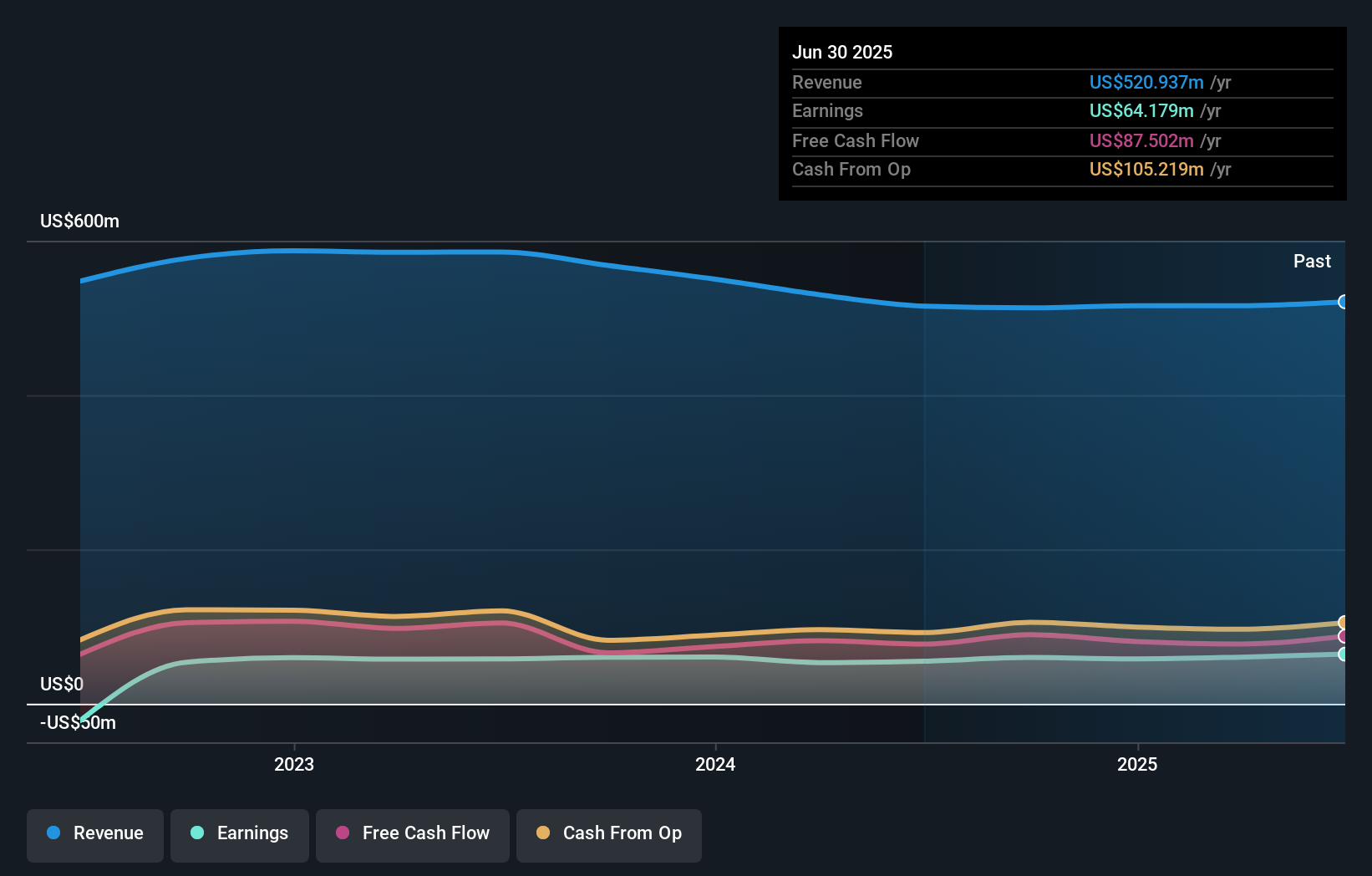

Operations: CTS generates revenue primarily from its Electronic Components & Parts segment, amounting to $513.03 million. The company's financial performance is reflected in its market capitalization of approximately $1.61 billion.

CTS Corporation, a small but noteworthy player, has shown resilience with a net debt to equity ratio of 1.9%, indicating satisfactory financial health. The company reported net income of US$18.68 million for Q3 2024, up from US$13.97 million the previous year, reflecting strong earnings quality despite a slight dip in sales to US$132.42 million from US$134.55 million year-over-year. Recent share repurchases totaling 644,314 shares for US$30.69 million suggest confidence in its market position while maintaining a positive free cash flow trajectory at US$89.36 million as of December 2024 enhances its investment appeal amidst industry challenges and evolving market dynamics.

Turning Ideas Into Actions

- Explore the 243 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally.

Solid track record with excellent balance sheet.