- United States

- /

- Banks

- /

- NYSE:TFIN

How Will Margin Compression and Slowing Net Interest Income Shape Triumph Financial’s (TFIN) Profitability Outlook?

Reviewed by Sasha Jovanovic

- In recent days, Triumph Financial reported lower-than-expected net interest income growth and a decrease in net interest margins, intensifying concerns over its profitability outlook.

- This shift has drawn heightened investor attention to Triumph's core banking performance, even as it launched a new predictive analytics solution for freight brokers in September.

- We'll now consider how margin compression and waning net interest income are influencing Triumph Financial's current investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Triumph Financial Investment Narrative Recap

Triumph Financial’s investment thesis centers on its ability to drive fee-based growth from technology-driven solutions to freight finance, balancing the cyclical risks of its core transportation-focused segments. The recent shortfall in net interest income growth and margin compression has brought the company’s near-term earnings outlook into sharper focus, potentially impacting the pace at which fee-based services can offset these pressures, though the recent developments do not fundamentally alter the central catalyst or risk at the moment.

The launch of Triumph’s integrated pricing and performance intelligence solution in September stands out as especially relevant. By enhancing data-driven services for freight brokers, this new product directly connects to the growth catalyst of expanding Triumph’s intelligence segment, which management and analysts identify as crucial to supporting fee income if traditional lending margins remain under pressure.

In contrast, it remains essential for investors to consider how persistent freight cycle volatility could expose Triumph Financial to...

Read the full narrative on Triumph Financial (it's free!)

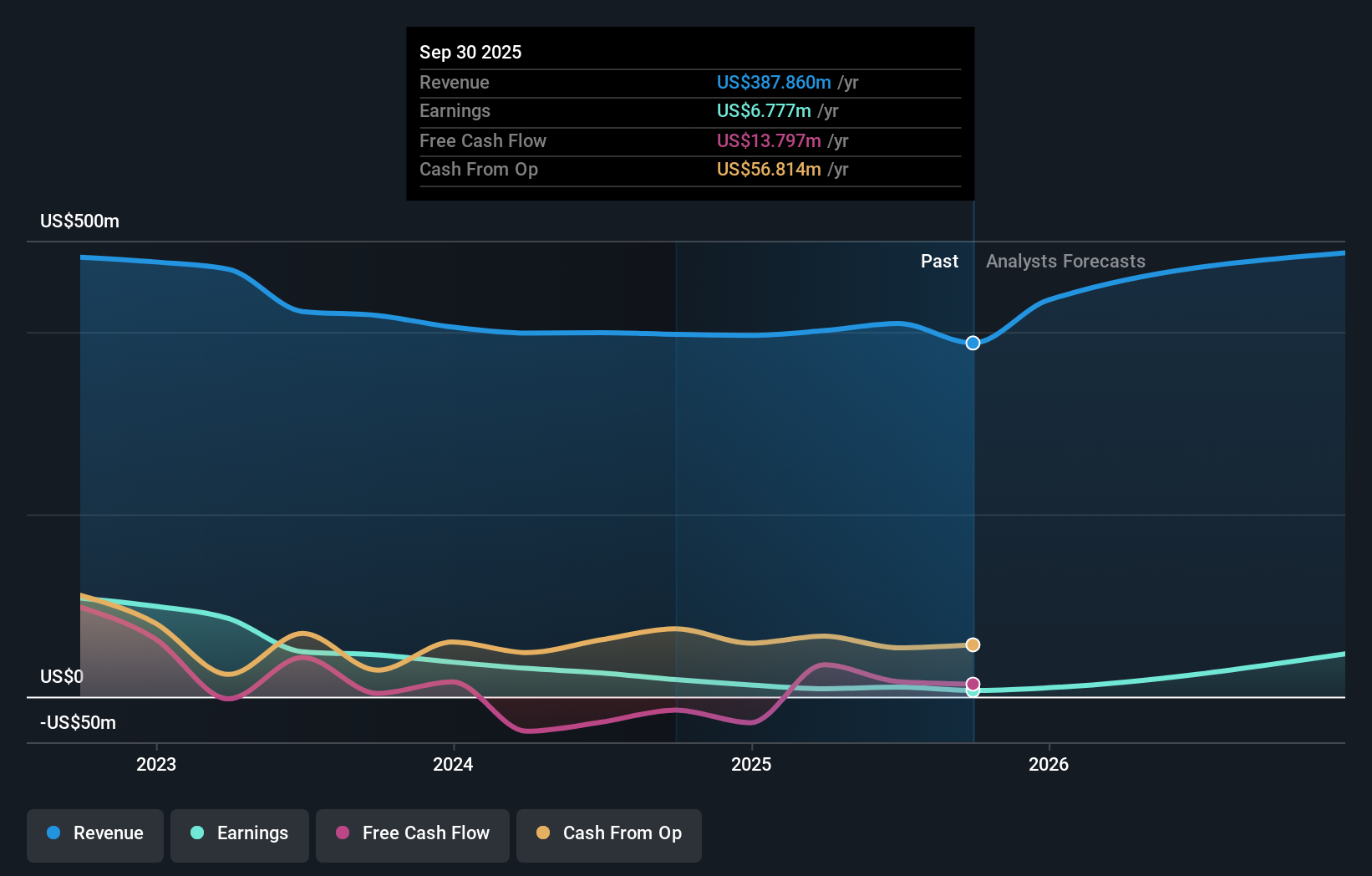

Triumph Financial's narrative projects $602.4 million revenue and $131.3 million earnings by 2028. This requires 13.8% yearly revenue growth and a $120.9 million earnings increase from current earnings of $10.4 million.

Uncover how Triumph Financial's forecasts yield a $60.50 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate Triumph Financial’s fair value between US$16.45 and US$60.50, based on two separate valuations. Amid this divergence, the potential for further margin compression highlights why thoughtful investors weigh both qualitative risks and a spectrum of price targets before forming an outlook.

Explore 2 other fair value estimates on Triumph Financial - why the stock might be worth less than half the current price!

Build Your Own Triumph Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Triumph Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Triumph Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Triumph Financial's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion