- United States

- /

- Banks

- /

- NYSE:TFC

Truist Financial (NYSE:TFC) Slides 11% As Economic and Political Uncertainties Loom

Reviewed by Simply Wall St

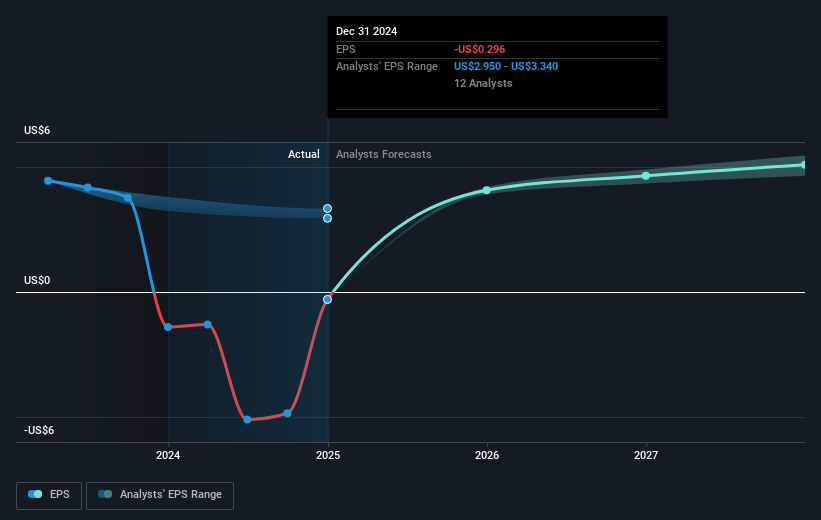

In the past week, Truist Financial (NYSE:TFC) experienced an 11% decline in its share price. During this period, the broader market was buffeted by economic and political uncertainties, specifically due to the effectiveness of new tariffs implemented by the Trump administration on Canadian steel and aluminum, which contributed to an overall slide in stock indices. These market conditions likely impacted investor sentiment across various sectors, including banking, as the general downturn in the market was marked by the Dow Jones and S&P 500 dropping 1.2% and 0.8%, respectively. Furthermore, the pervasive concerns about potential recessionary pressures and inflation could have exacerbated risk-aversion behaviors among investors, affecting stocks like Truist Financial. Despite an annual market growth over the past year and positive earnings forecasts, the immediate term was shadowed by these broader economic anxieties, which significantly influenced the company's stock performance.

Dig deeper into the specifics of Truist Financial here with our thorough analysis report.

Truist Financial's share performance over the last five years shows an impressive total return of 86.04%, reflecting the company's commitment to enhancing shareholder value beyond short-term market fluctuations. The period has witnessed significant corporate activity, including regular dividend announcements that have provided consistent returns for investors. Notably, on January 28, 2025, the Board declared a quarterly cash dividend of US$0.52 per common share, continuing its tradition of rewarding shareholders.

The company's broader financial maneuvers have also played a role. A significant share buyback was completed by the end of 2024, involving 23.41 million shares, which positively influenced shareholder return. Truist’s earnings have seen fluctuations, such as a net income of US$1.28 billion reported in Q4 2024, a recovery from the previous year's losses. These financial adjustments, complemented by strategic guidance and corporate changes, underscore Truist Financial's efforts to bolster investor confidence amid a challenging economic backdrop.

- See how Truist Financial measures up with our analysis of its intrinsic value versus market price.

- Gain insight into the risks facing Truist Financial and how they might influence its performance—click here to read more.

- Are you invested in Truist Financial already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives