- United States

- /

- Banks

- /

- NYSE:SSB

3 US Stocks Estimated Up To 40.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a post-election rally with major indexes reaching record highs, investors are keenly observing the Federal Reserve's upcoming rate decision for further economic insights. In this climate of heightened market activity, identifying undervalued stocks can offer potential opportunities, particularly those estimated to be significantly below their intrinsic value amidst evolving monetary policies and economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.79 | $99.93 | 49.2% |

| UMB Financial (NasdaqGS:UMBF) | $125.68 | $243.52 | 48.4% |

| Synovus Financial (NYSE:SNV) | $58.47 | $114.84 | 49.1% |

| West Bancorporation (NasdaqGS:WTBA) | $24.35 | $46.56 | 47.7% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $273.01 | $545.05 | 49.9% |

| STAAR Surgical (NasdaqGM:STAA) | $30.86 | $59.97 | 48.5% |

| Snap (NYSE:SNAP) | $11.81 | $22.86 | 48.3% |

| AeroVironment (NasdaqGS:AVAV) | $216.32 | $416.09 | 48% |

| Carter Bankshares (NasdaqGS:CARE) | $20.00 | $38.28 | 47.8% |

| Rapid7 (NasdaqGM:RPD) | $41.60 | $80.91 | 48.6% |

Let's dive into some prime choices out of the screener.

Cadence Bank (NYSE:CADE)

Overview: Cadence Bank offers commercial banking and financial services, with a market cap of approximately $6.14 billion.

Operations: The company's revenue is derived from commercial banking and financial services.

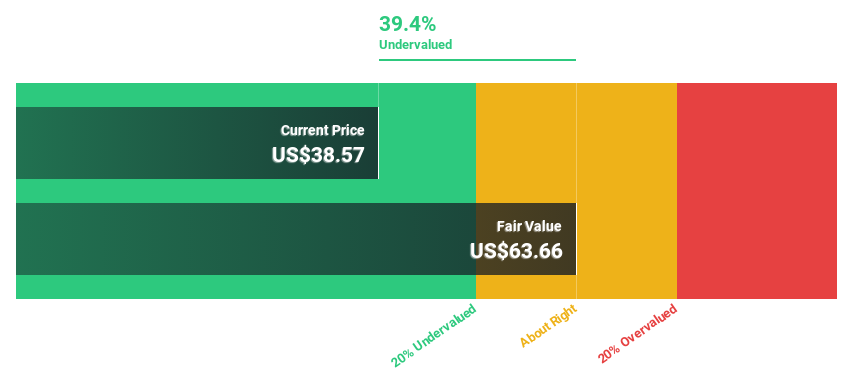

Estimated Discount To Fair Value: 39.4%

Cadence Bank, trading at US$38.57, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of US$63.66. Despite a decline in profit margins from 22.5% to 9.3%, earnings are forecast to grow significantly at 33.8% annually, outpacing the U.S. market's growth rate of 15.4%. Recent financial performance shows improved net income and interest income year-over-year, though dividend coverage remains a concern for sustainability.

- The growth report we've compiled suggests that Cadence Bank's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Cadence Bank.

Pinterest (NYSE:PINS)

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $22.45 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, amounting to $3.34 billion.

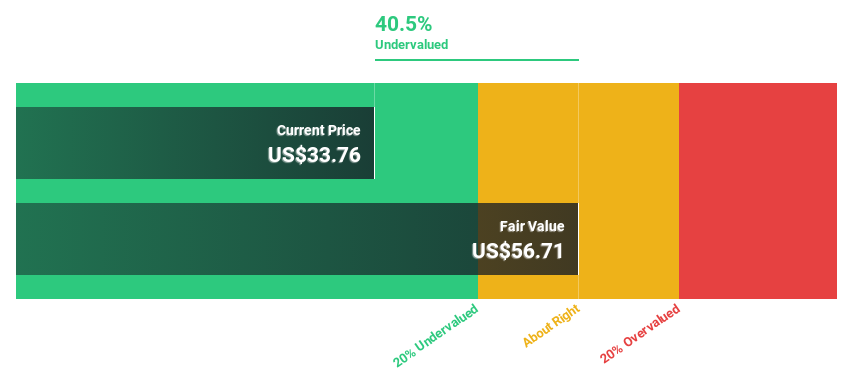

Estimated Discount To Fair Value: 40.5%

Pinterest, Inc., trading at US$33.76, is highly undervalued with a fair value estimate of US$56.71, according to discounted cash flow analysis. Earnings are expected to grow significantly at 34.1% annually, surpassing the U.S. market growth rate of 15.4%. Despite recent executive changes and large one-off items affecting results, analysts agree on a potential stock price increase of 26.5%. Revenue growth is projected at 13.6% per year, outpacing the market's average growth rate.

- The analysis detailed in our Pinterest growth report hints at robust future financial performance.

- Get an in-depth perspective on Pinterest's balance sheet by reading our health report here.

SouthState (NYSE:SSB)

Overview: SouthState Corporation, with a market cap of $7.46 billion, operates as the bank holding company for SouthState Bank, National Association, offering a variety of banking services and products to individuals and businesses.

Operations: The company generates revenue of $1.67 billion from its banking operations, providing a range of financial services and products to both individual and corporate clients.

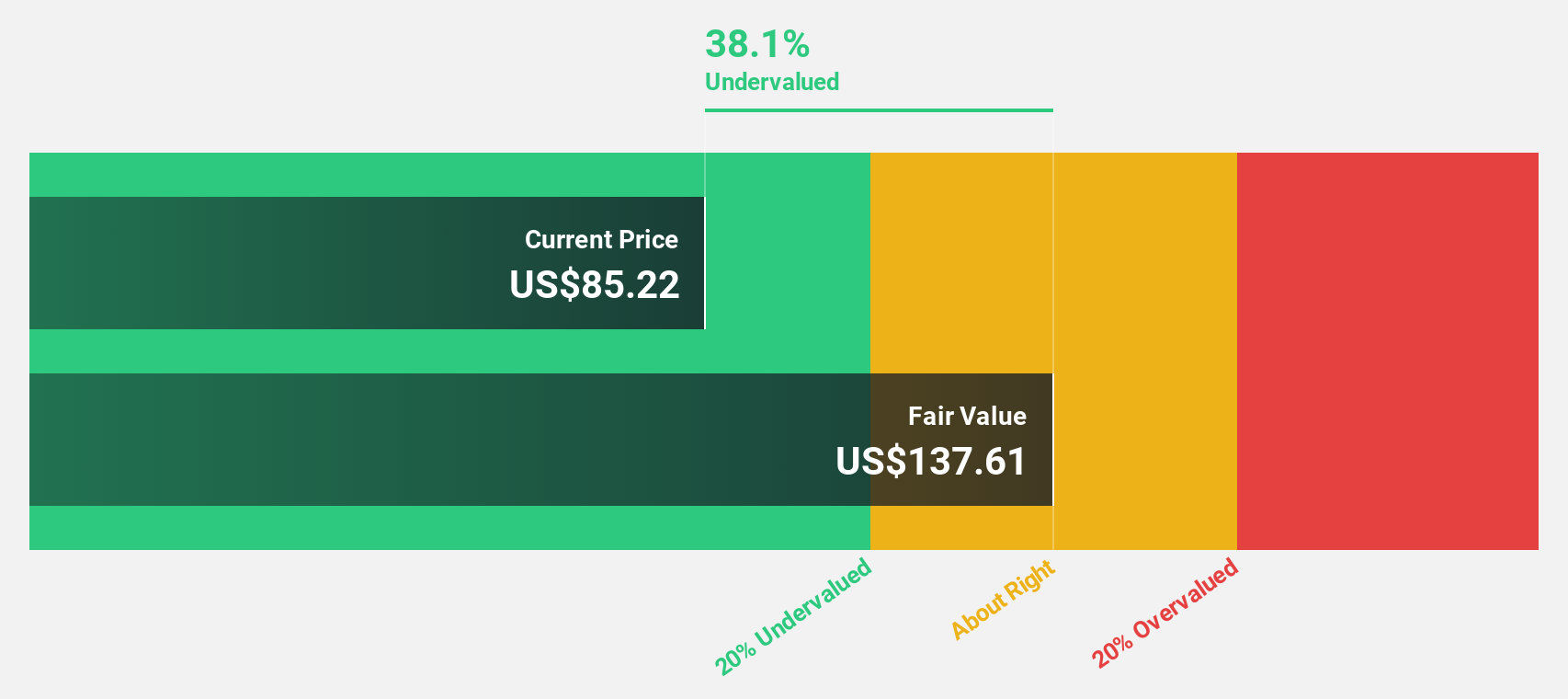

Estimated Discount To Fair Value: 14.7%

SouthState Corporation, trading at US$111.42, is undervalued with an estimated fair value of US$130.62 based on discounted cash flow analysis. Earnings are projected to grow significantly at 27.4% annually, outpacing the U.S. market's average growth rate of 15.4%. Despite a slight dip in net interest income for Q3 2024, net income increased to US$143.18 million from the previous year’s US$124.14 million, supporting its valuation appeal based on cash flows.

- According our earnings growth report, there's an indication that SouthState might be ready to expand.

- Dive into the specifics of SouthState here with our thorough financial health report.

Seize The Opportunity

- Gain an insight into the universe of 196 Undervalued US Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSB

SouthState

Operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies.

Flawless balance sheet with high growth potential and pays a dividend.