- United States

- /

- Banks

- /

- NYSE:SFBS

Do ServisFirst Bancshares's (NYSE:SFBS) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like ServisFirst Bancshares (NYSE:SFBS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for ServisFirst Bancshares

ServisFirst Bancshares's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. ServisFirst Bancshares managed to grow EPS by 14% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

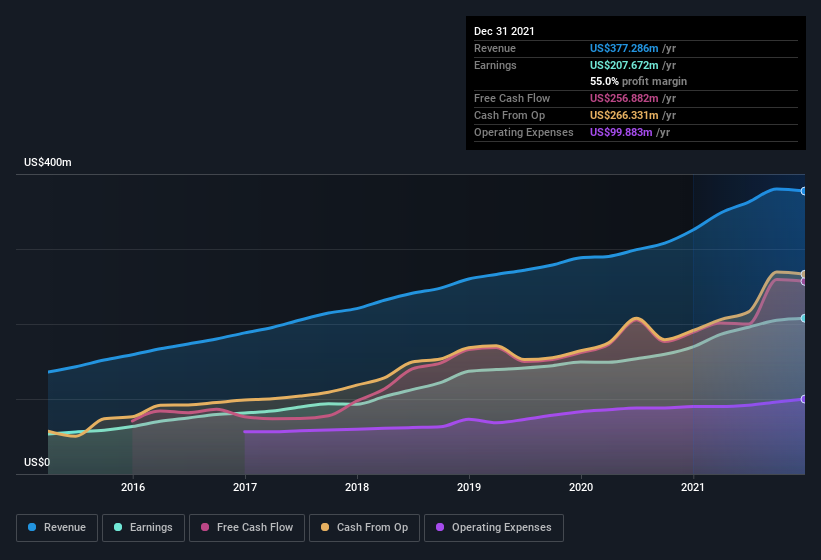

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that ServisFirst Bancshares's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. ServisFirst Bancshares maintained stable EBIT margins over the last year, all while growing revenue 16% to US$377m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for ServisFirst Bancshares's future profits.

Are ServisFirst Bancshares Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own ServisFirst Bancshares shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$566m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like ServisFirst Bancshares with market caps between US$4.0b and US$12b is about US$6.5m.

The CEO of ServisFirst Bancshares only received US$1.6m in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does ServisFirst Bancshares Deserve A Spot On Your Watchlist?

One important encouraging feature of ServisFirst Bancshares is that it is growing profits. Earnings growth might be the main game for ServisFirst Bancshares, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of ServisFirst Bancshares. You might benefit from giving it a glance today.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SFBS

ServisFirst Bancshares

Operates as the bank holding company for ServisFirst Bank that provides various banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.