- United States

- /

- Banks

- /

- NYSE:RF

Regions Financial (RF): Revisiting Valuation After Dividend Growth and Rising Investor Optimism

Reviewed by Simply Wall St

Most Popular Narrative: 5.5% Undervalued

The prevailing narrative points to Regions Financial being modestly undervalued, suggesting room for appreciation as the market weighs the company’s growth outlook and risk factors.

Early investments in digital banking infrastructure and a forthcoming cloud-based core platform are expected to drive customer acquisition, operational efficiency, and cost control. These initiatives could improve net margins and result in sustained positive operating leverage.

Curious how this relatively traditional bank earned a fair value typically reserved for growth stocks? Analysts are betting on a game-changing shift built around technology, operational efficiency, and forward-looking financial assumptions. Want to know which future milestones could propel the stock, and what the narrative isn't telling you yet? Stick around; the details might surprise you.

Result: Fair Value of $28.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regional competition and the rapid evolution of digital banking could challenge Regions Financial's momentum if growth or efficiency gains do not materialize.

Find out about the key risks to this Regions Financial narrative.Another View: Looking Beyond the Headlines

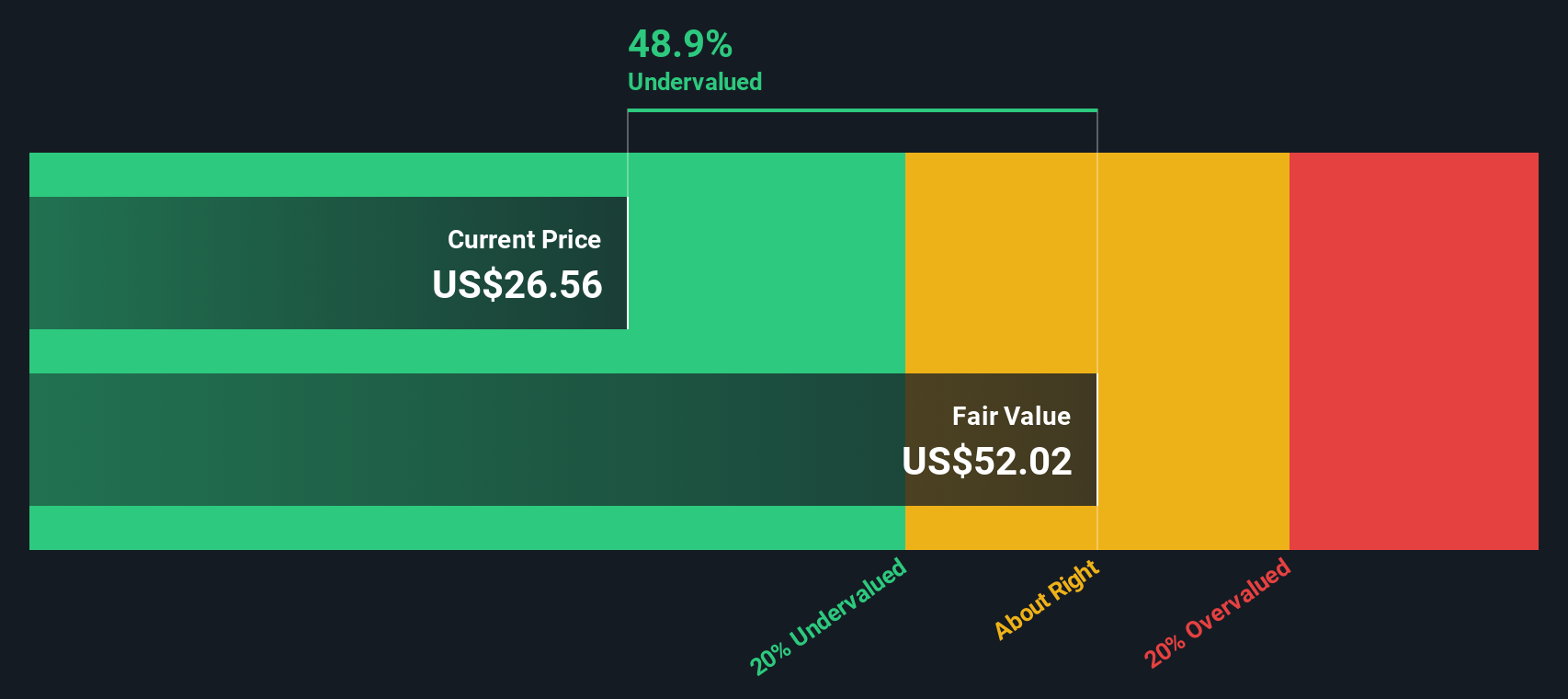

While the initial assessment shows Regions Financial as modestly undervalued, our DCF model presents an even more optimistic perspective. This suggests the stock could be priced more attractively than it appears at the moment. Is the market overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Regions Financial to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Regions Financial Narrative

If you see things differently or want to run your own analysis, you can craft your personal narrative with just a couple of minutes of exploration. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Regions Financial.

Looking for more investment ideas?

You shouldn’t let great opportunities pass you by. Turn your research into smart action by checking out these handpicked ideas, each designed to give your portfolio a potential edge.

- Spot high-yield opportunities and secure steady income streams with reliable dividend stocks with yields > 3%, delivering yields above 3%.

- Energize your strategy with breakthrough innovations from AI penny stocks, powering tomorrow's artificial intelligence landscape.

- Seize the chance to uncover undervalued gems that may be flying under the radar by exploring undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives