- United States

- /

- Banks

- /

- NYSE:SNV

US Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs with the S&P 500 and Dow Jones Industrial Average hitting new peaks, investors are increasingly looking at dividend stocks as a way to capitalize on this bullish momentum while securing steady income. In such an environment, selecting dividend stocks can be a strategic move for those seeking to balance growth potential with regular payouts, especially when major indices are buoyed by strong earnings and encouraging economic indicators.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.30% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.88% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.70% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 4.34% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.07% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.86% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

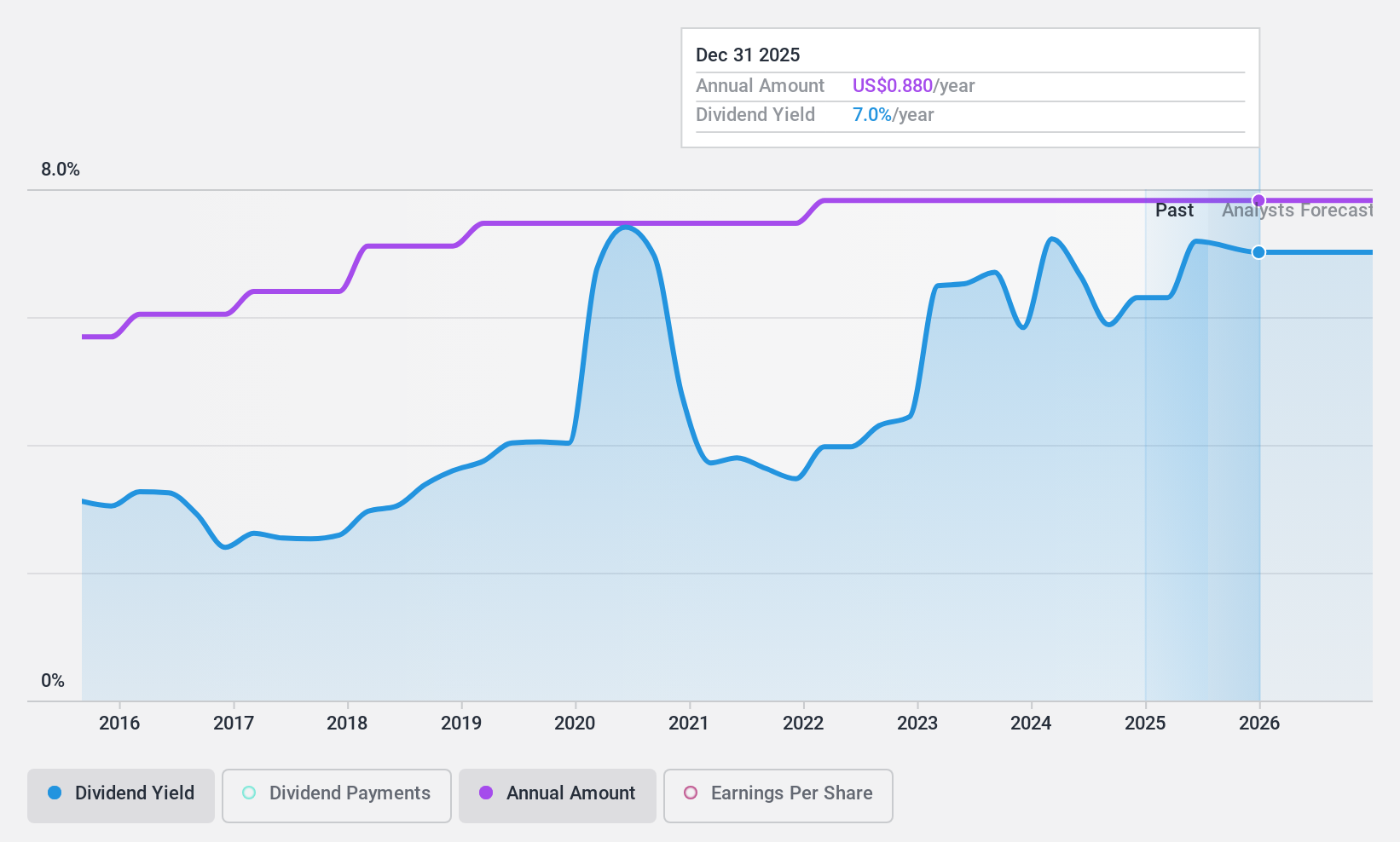

Flushing Financial (NasdaqGS:FFIC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Flushing Financial Corporation, with a market cap of $430.22 million, operates as the bank holding company for Flushing Bank, offering a range of banking products and services to consumers, businesses, and governmental units.

Operations: Flushing Financial Corporation's revenue is primarily derived from its Community Bank segment, which generated $190.70 million.

Dividend Yield: 5.9%

Flushing Financial has maintained stable and growing dividend payments over the past decade, with a current yield of 5.86%, placing it in the top 25% of US dividend payers. However, its high payout ratio (104.9%) raises concerns about sustainability. Recent activist pressure from investor Larry Seidman highlights ongoing performance issues despite a 40% increase in quarterly net income, suggesting potential strategic shifts or sale considerations for the $9.1 billion-asset bank.

- Delve into the full analysis dividend report here for a deeper understanding of Flushing Financial.

- Our comprehensive valuation report raises the possibility that Flushing Financial is priced higher than what may be justified by its financials.

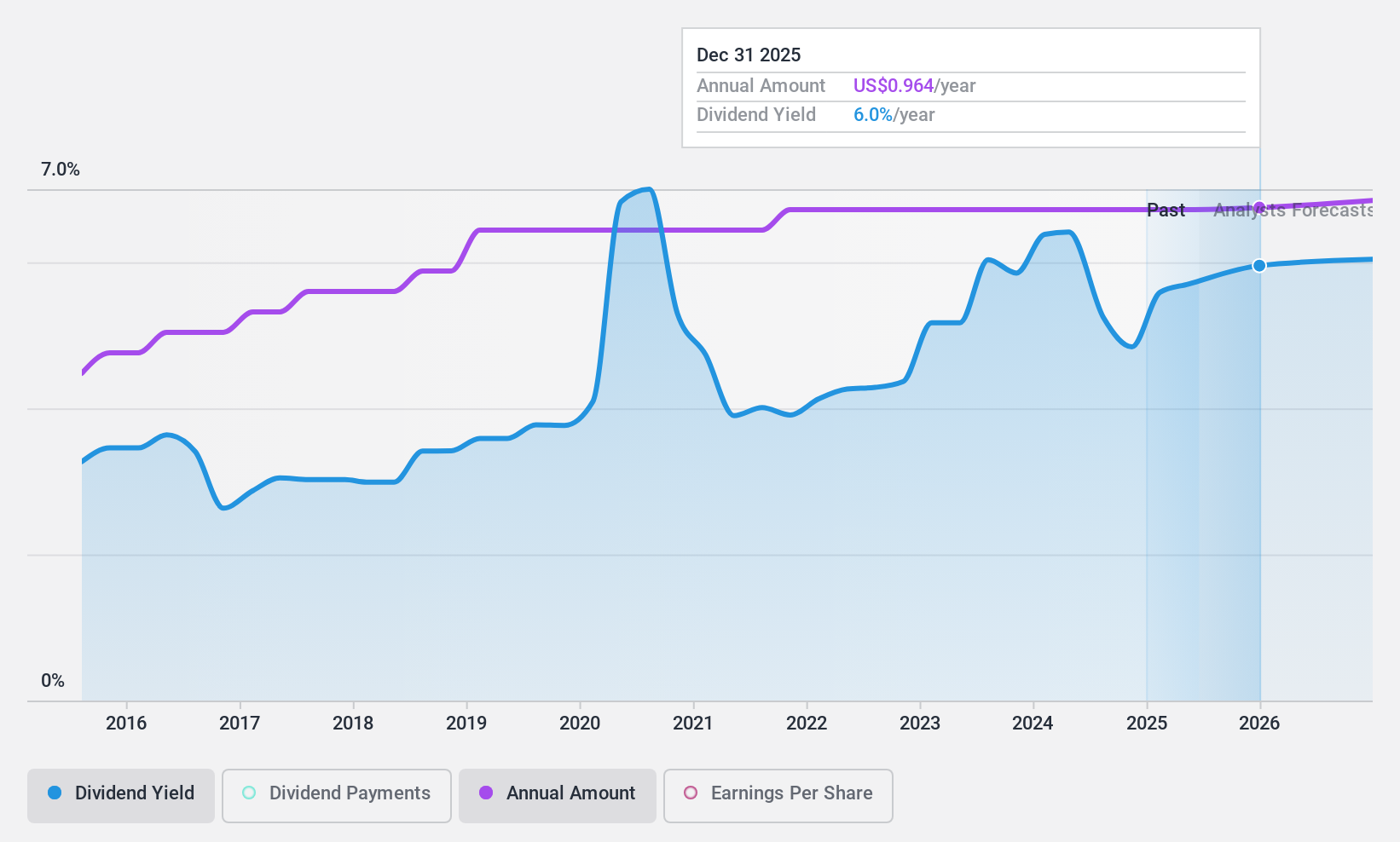

Provident Financial Services (NYSE:PFS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Provident Financial Services, Inc. is a bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of approximately $2.46 billion.

Operations: Provident Financial Services, Inc. generates revenue primarily through its Traditional Banking and Other Financial Services segment, which amounted to $427.77 million.

Dividend Yield: 5%

Provident Financial Services offers a dividend yield of 5.03%, ranking in the top 25% of US payers, with stable and growing dividends over the past decade. However, its high payout ratio of 103% raises concerns about sustainability. Recent financials show a net loss for Q2, impacted by large one-off items and increased loan charge-offs. Despite this, the company was added to the S&P Banks Select Industry Index and continues to affirm quarterly dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Provident Financial Services.

- The valuation report we've compiled suggests that Provident Financial Services' current price could be quite moderate.

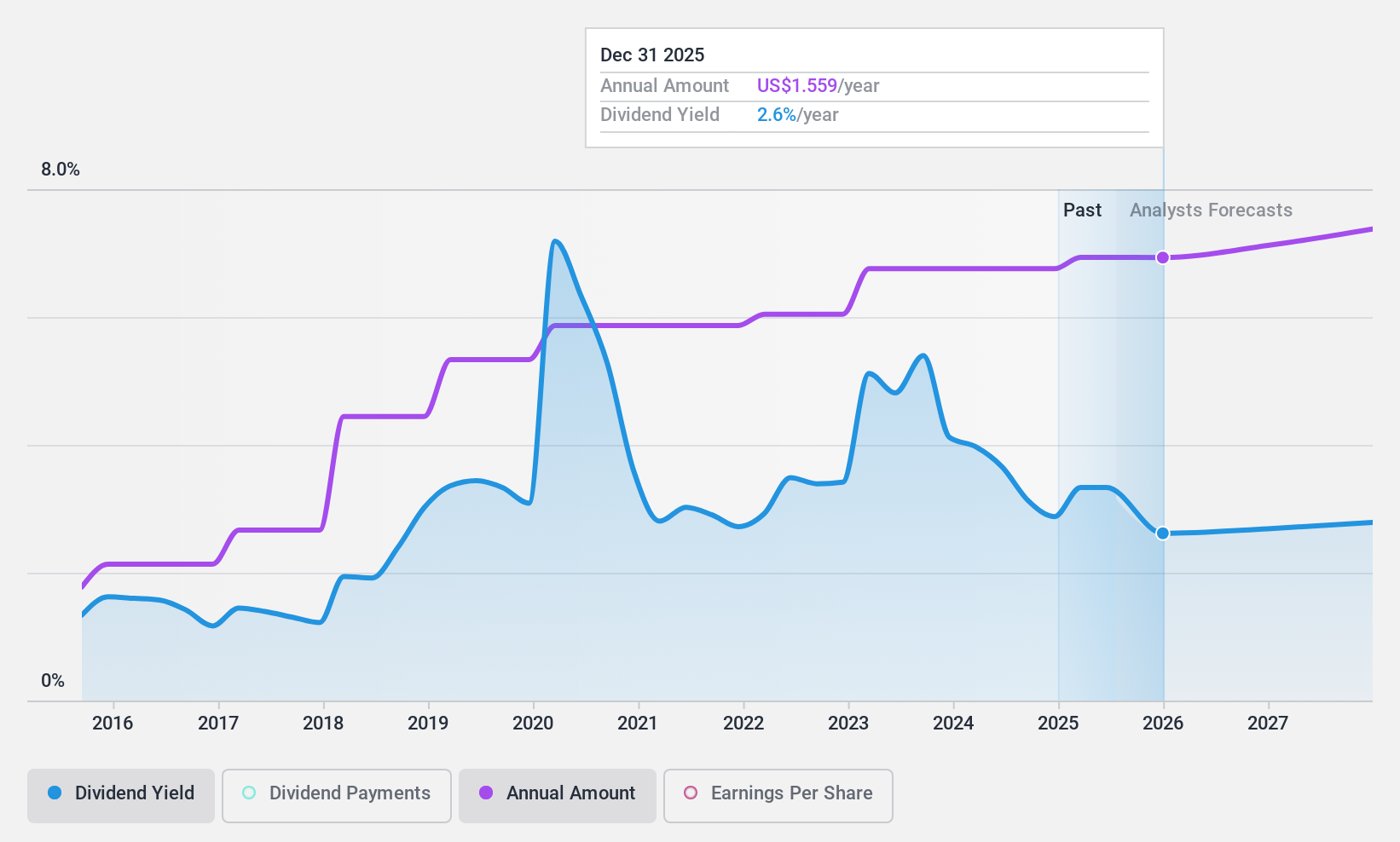

Synovus Financial (NYSE:SNV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Synovus Financial Corp. is a bank holding company for Synovus Bank, offering commercial and consumer banking products and services, with a market cap of approximately $6.60 billion.

Operations: Synovus Financial Corp.'s revenue segments include Consumer Banking at $651.18 million, Community Banking at $470.57 million, Wholesale Banking at $827.74 million, and Financial Management Services (FMS) at $274.30 million.

Dividend Yield: 3.3%

Synovus Financial's dividend yield of 3.27% is below the top 25% of US dividend payers, with a high payout ratio of 92.9%, raising sustainability concerns. Dividends have been stable and growing over the past decade. Recent earnings reveal a net loss for Q2, contrasting with last year's profit, impacting coverage prospects despite forecasted growth in earnings. The company continues to affirm quarterly dividends and has filed a $44.96 million shelf registration for its Dividend Reinvestment Plan.

- Unlock comprehensive insights into our analysis of Synovus Financial stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Synovus Financial shares in the market.

Turning Ideas Into Actions

- Unlock our comprehensive list of 170 Top US Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNV

Synovus Financial

Operates as the bank holding company for Synovus Bank that provides commercial and consumer banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives