- United States

- /

- Banks

- /

- NasdaqGS:INDB

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market grapples with volatility and mixed performances among major indices, investors are increasingly focused on strategies to mitigate risk and secure steady returns. In this climate, dividend stocks offer a compelling option by providing consistent income streams, making them an attractive consideration for those looking to bolster their portfolios amidst economic uncertainty.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.81% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.84% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.99% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.28% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.65% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.37% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.91% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.54% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.82% | ★★★★★★ |

Click here to see the full list of 157 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

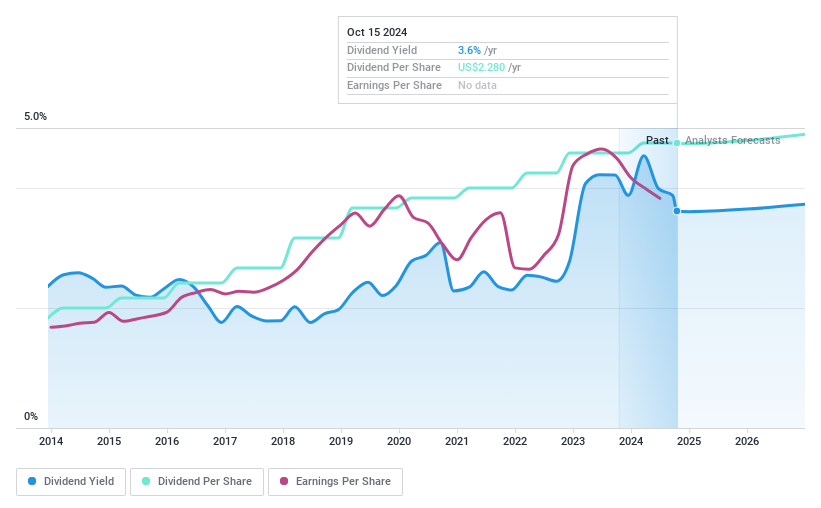

Dime Community Bancshares (NasdaqGS:DCOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dime Community Bancshares, Inc. is the holding company for Dime Community Bank, offering a range of commercial banking and financial services, with a market cap of approximately $1.22 billion.

Operations: Dime Community Bancshares, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $278 million.

Dividend Yield: 3.6%

Dime Community Bancshares has a history of stable and growing dividends over the past decade, with recent affirmations of quarterly dividends. However, the current dividend yield of 3.57% is lower than the top quartile in the US market and not well covered by earnings, indicated by a high payout ratio. Recent financial results show a net loss and increased charge-offs, raising concerns about sustainability despite forecasts for future earnings growth that may eventually support dividend coverage.

- Dive into the specifics of Dime Community Bancshares here with our thorough dividend report.

- The valuation report we've compiled suggests that Dime Community Bancshares' current price could be quite moderate.

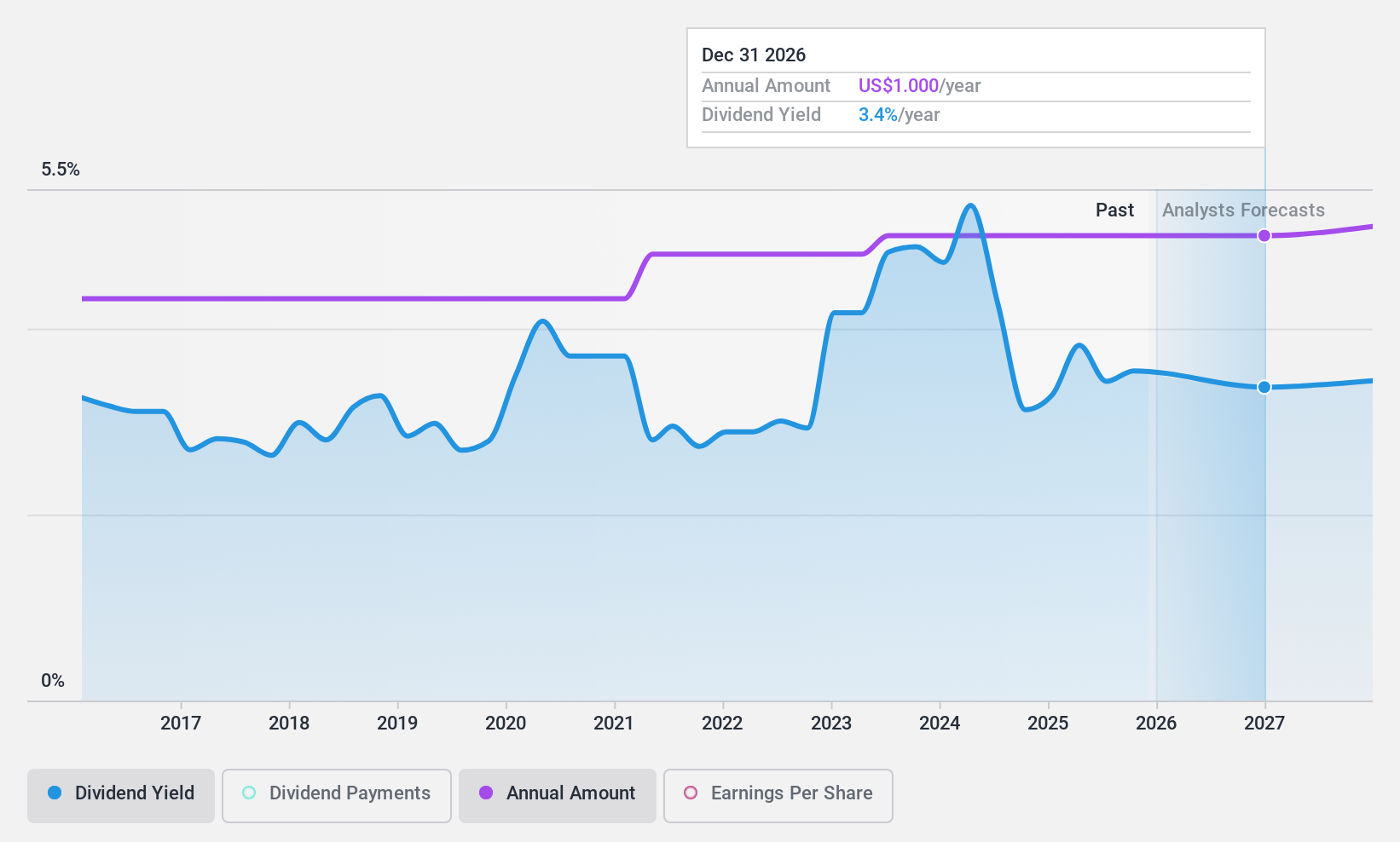

Independent Bank (NasdaqGS:INDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of approximately $2.71 billion.

Operations: Independent Bank Corp. generates revenue of $653.49 million through its Community Banking segment, providing financial services to individuals and small-to-medium sized businesses in the United States.

Dividend Yield: 3.6%

Independent Bank offers a stable dividend history with reliable payments and growth over the past decade. Its current payout ratio of 50.4% suggests dividends are well-covered by earnings, expected to improve to 33.2% in three years. However, its 3.58% yield is below top-tier US dividend payers. Recent financials show decreased net income and interest income compared to last year, but strategic board appointments may enhance governance and long-term growth potential.

- Click to explore a detailed breakdown of our findings in Independent Bank's dividend report.

- Our expertly prepared valuation report Independent Bank implies its share price may be lower than expected.

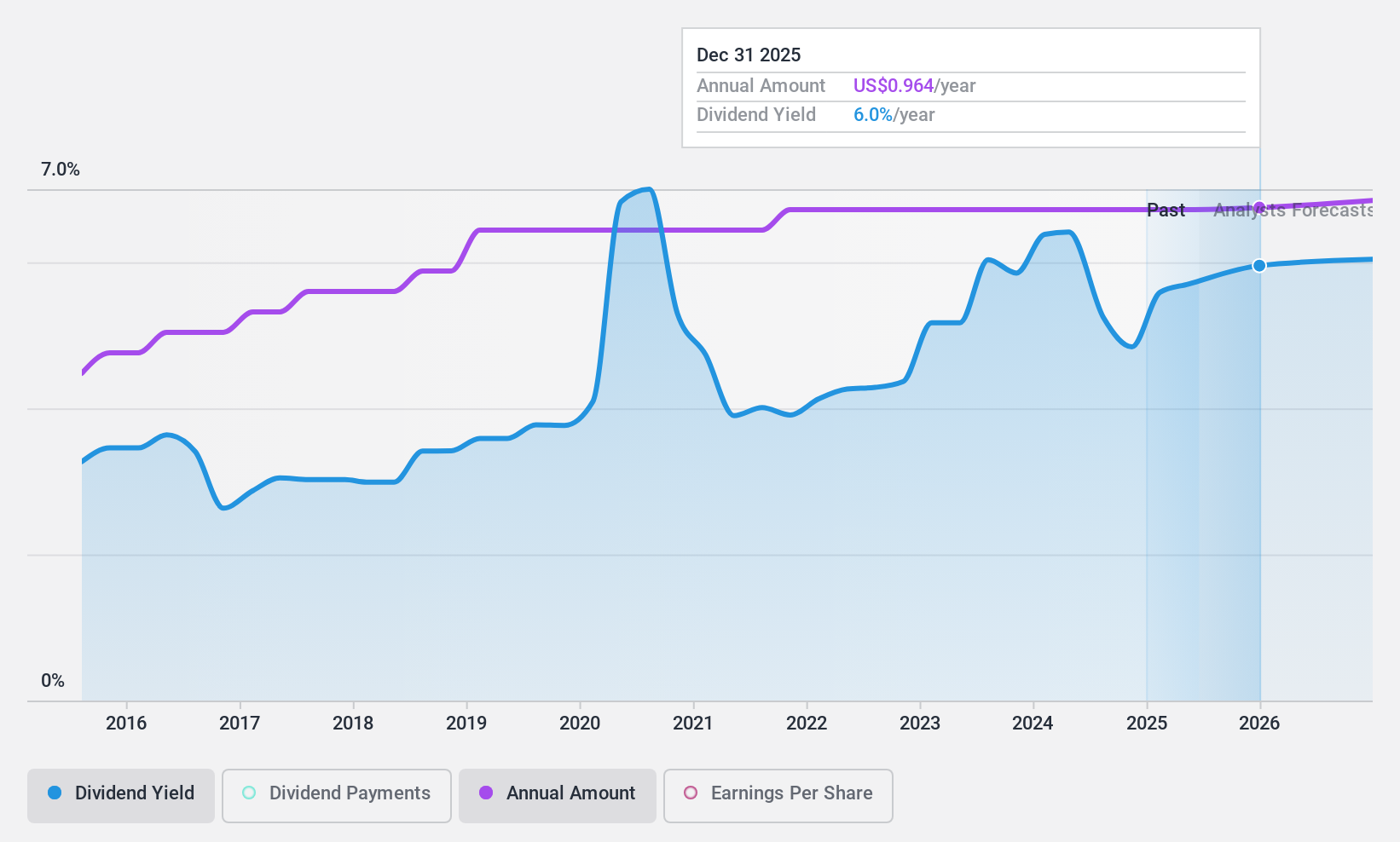

Provident Financial Services (NYSE:PFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc. is the bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of approximately $2.24 billion.

Operations: Provident Financial Services, Inc. generates revenue primarily through its Traditional Banking and Other Financial Services segment, which accounted for $607.16 million.

Dividend Yield: 5.6%

Provident Financial Services offers a 5.6% dividend yield, placing it among the top 25% of US dividend payers. However, its high payout ratio of 91.1% raises concerns about sustainability, as dividends are not currently covered by earnings and may remain uncovered for the next three years. Despite stable and growing dividends over the past decade, recent financials reveal declining profit margins and net income, with significant shareholder dilution impacting value perception.

- Get an in-depth perspective on Provident Financial Services' performance by reading our dividend report here.

- Our valuation report here indicates Provident Financial Services may be undervalued.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 154 Top US Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives