- United States

- /

- Banks

- /

- NYSE:PFS

Three Stocks That May Be Trading Below Their Estimated Value In June 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.7%, contributing to a 13% climb over the past year, with earnings expected to grow by 15% annually in the coming years. In this environment of upward momentum and anticipated growth, identifying stocks that may be trading below their estimated value can offer investors potential opportunities for significant returns.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $31.85 | $62.26 | 48.8% |

| TXO Partners (TXO) | $15.28 | $29.91 | 48.9% |

| StoneCo (STNE) | $14.95 | $29.46 | 49.2% |

| Lincoln Educational Services (LINC) | $23.00 | $44.95 | 48.8% |

| Ligand Pharmaceuticals (LGND) | $115.69 | $225.70 | 48.7% |

| Incyte (INCY) | $70.81 | $139.73 | 49.3% |

| GeneDx Holdings (WGS) | $89.59 | $176.72 | 49.3% |

| Fiverr International (FVRR) | $29.18 | $56.98 | 48.8% |

| EQT (EQT) | $58.15 | $114.38 | 49.2% |

| ACNB (ACNB) | $42.97 | $84.59 | 49.2% |

Let's dive into some prime choices out of the screener.

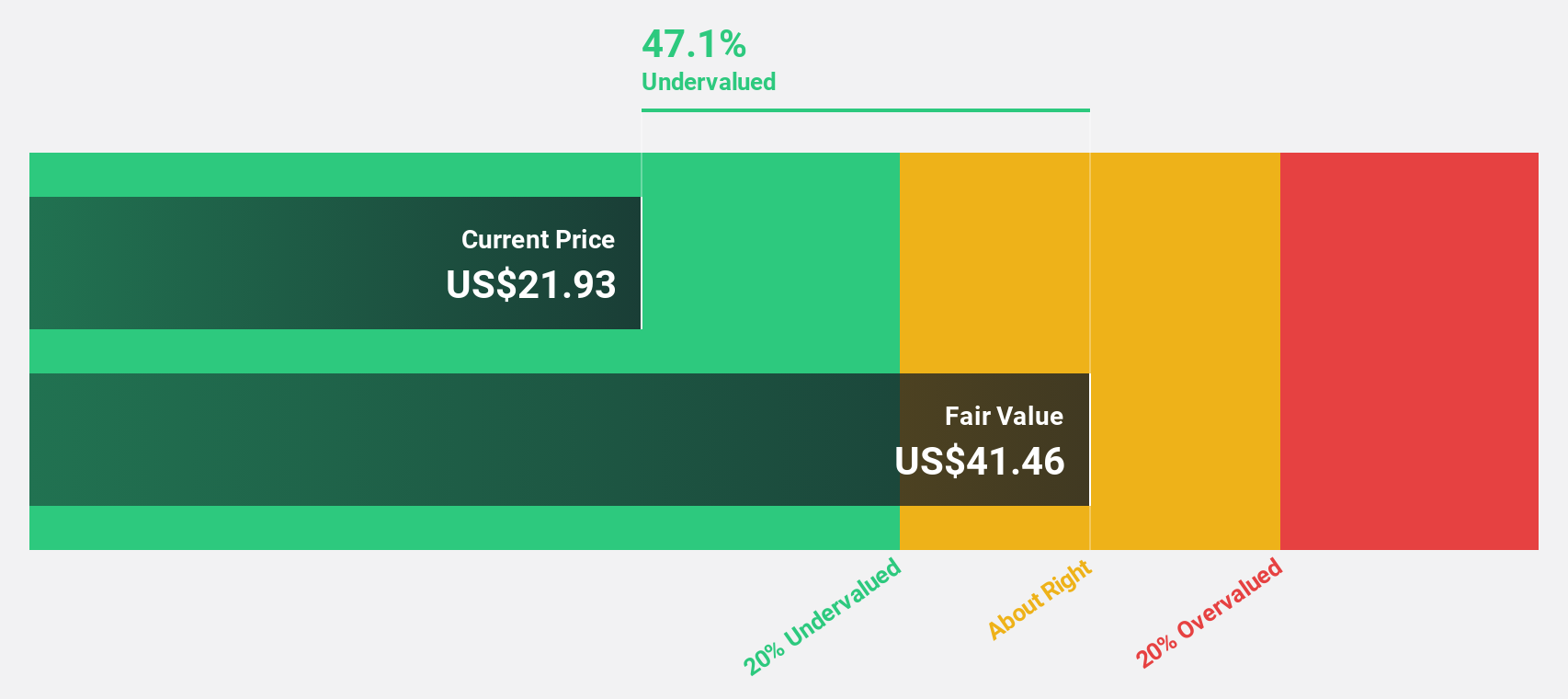

Hesai Group (HSAI)

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of approximately $2.57 billion.

Operations: Hesai Group generates revenue through the development, manufacturing, and sales of three-dimensional LiDAR solutions in Mainland China, Europe, North America, and other international markets.

Estimated Discount To Fair Value: 38.3%

Hesai Group's stock appears undervalued based on cash flows, trading significantly below its estimated fair value. Despite a volatile share price recently, the company has shown robust revenue growth and is expected to continue outperforming the US market. Recent legal victories have strengthened its IP position, while strategic partnerships and product innovations in lidar technology enhance its leadership in autonomous driving sectors. Hesai's projected profitability within three years further supports its potential as an investment opportunity.

- The analysis detailed in our Hesai Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Hesai Group stock in this financial health report.

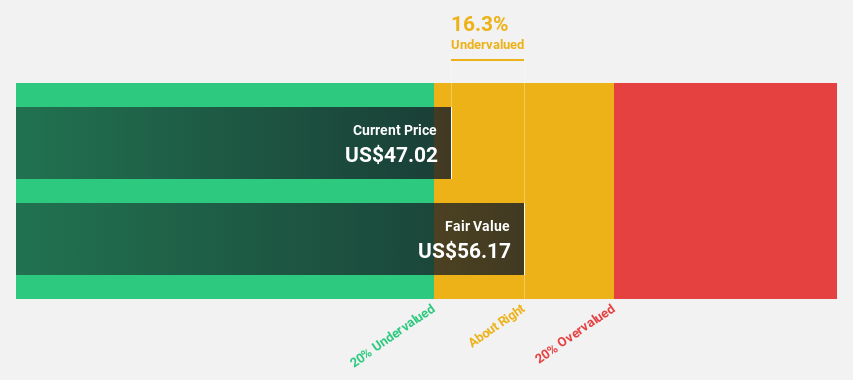

Calix (CALX)

Overview: Calix, Inc. offers cloud and software platforms, systems, and services globally with a market cap of $3.20 billion.

Operations: Calix generates revenue of $825.45 million from developing, marketing, and selling communications access systems and software across various global regions.

Estimated Discount To Fair Value: 11.5%

Calix, Inc. is trading at US$50.09, slightly below its estimated fair value of US$56.58, suggesting potential undervaluation based on cash flows. The company's revenue is projected to grow at 10.5% annually, surpassing the broader US market's growth rate of 8.8%. Recent product innovations like Calix Market Insights and successful technology trials position Calix well in competitive broadband markets, while a focus on subscriber experience could enhance long-term profitability prospects within three years.

- Insights from our recent growth report point to a promising forecast for Calix's business outlook.

- Navigate through the intricacies of Calix with our comprehensive financial health report here.

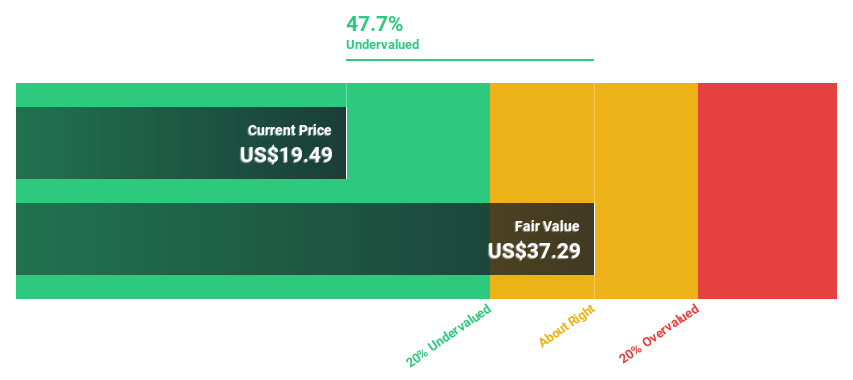

Provident Financial Services (PFS)

Overview: Provident Financial Services, Inc. is the bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of $2.21 billion.

Operations: The company's revenue is primarily derived from traditional banking and other financial services, totaling $700.49 million.

Estimated Discount To Fair Value: 47.6%

Provident Financial Services is trading at US$17.89, significantly below its estimated fair value of US$34.16, highlighting potential undervaluation based on cash flows. Despite recent net charge-offs of US$1.99 million, the company reported strong Q1 2025 earnings with net interest income of US$181.73 million and net income doubling to US$64.03 million year-over-year. Earnings are expected to grow at 34.8% annually over the next three years, outpacing the broader market growth rate of 14.7%.

- Our earnings growth report unveils the potential for significant increases in Provident Financial Services' future results.

- Take a closer look at Provident Financial Services' balance sheet health here in our report.

Seize The Opportunity

- Gain an insight into the universe of 172 Undervalued US Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFS

Provident Financial Services

Operates as the bank holding company for Provident Bank that provides various banking products and services to individuals, families, and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives