- United States

- /

- Banks

- /

- NasdaqGS:BPOP

3 Top Dividend Stocks Offering Up To 6.1% Yield

Reviewed by Simply Wall St

In a volatile market environment where the Dow Jones Industrial Average has recently surged over 1,000 points following steep declines, investors are keenly focused on finding stable income sources amidst uncertainty. Dividend stocks can offer a reliable stream of income and potential for capital appreciation, making them an attractive choice for those looking to navigate the current economic landscape with confidence.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.53% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.62% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.24% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.09% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.23% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.21% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.26% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.88% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.11% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Popular (NasdaqGS:BPOP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Popular, Inc. operates through its subsidiaries to offer retail, mortgage, and commercial banking products and services in Puerto Rico, the United States, and the British Virgin Islands with a market cap of approximately $5.95 billion.

Operations: Popular, Inc.'s revenue is primarily derived from Banco Popular De Puerto Rico (BPPR) at $2.30 billion and Popular U.S. at $380.88 million.

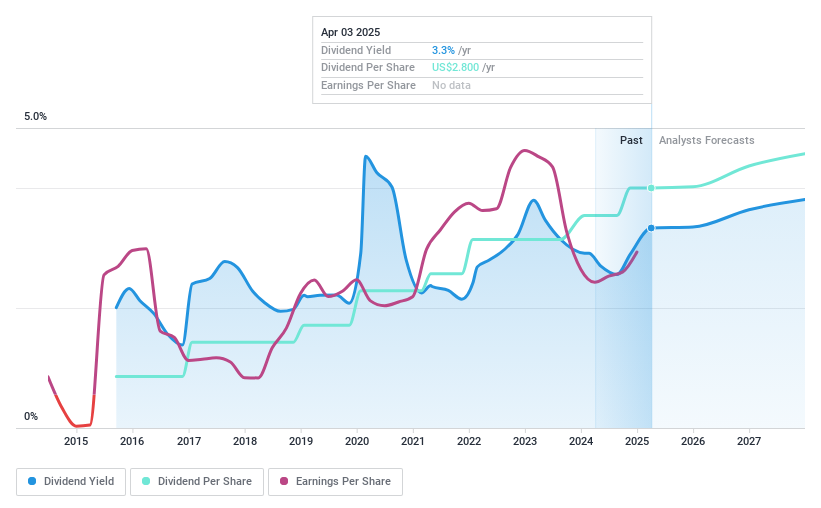

Dividend Yield: 3.3%

Popular's dividend strategy is underpinned by a stable and growing payout history, with dividends increasing over the past decade. The current dividend yield of 3.25% is lower than the top 25% of US dividend payers, but it remains well-covered by earnings at a payout ratio of 29.9%. Recent executive changes, including Javier Ferrer succeeding Ignacio Alvarez as CEO in July 2025, may influence future strategic directions impacting dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Popular.

- Our valuation report unveils the possibility Popular's shares may be trading at a discount.

National Bank Holdings (NYSE:NBHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank Holdings Corporation is a bank holding company for NBH Bank, offering a range of banking products and financial services to commercial, business, and consumer clients in the United States, with a market cap of approximately $1.35 billion.

Operations: National Bank Holdings Corporation generates revenue primarily through its banking segment, which accounts for $399.74 million.

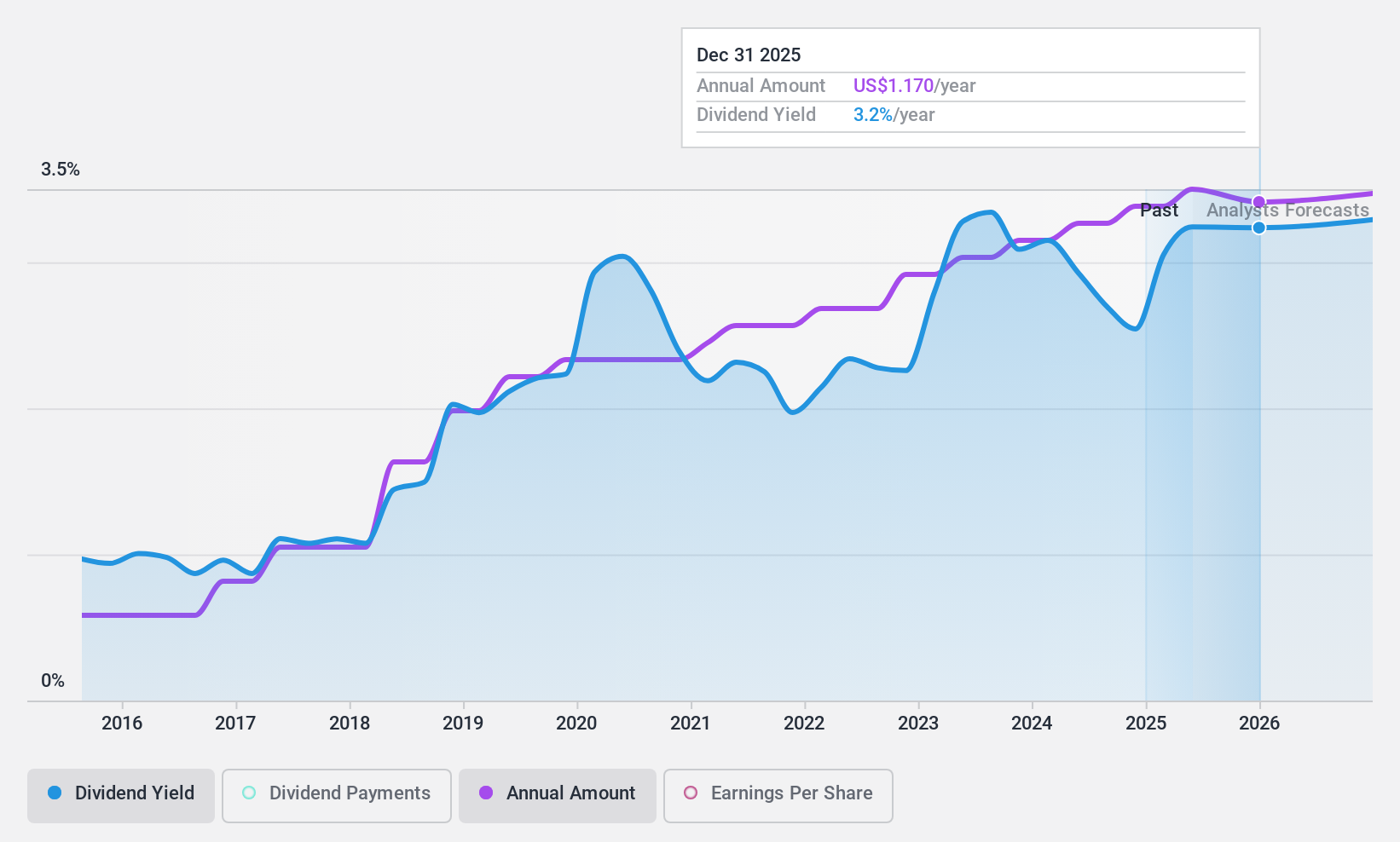

Dividend Yield: 3.2%

National Bank Holdings offers a stable dividend with a yield of 3.25%, backed by a low payout ratio of 36.8%, ensuring sustainability and growth over the past decade. However, this yield is below the top quartile in the US market. Recent board changes, including Patrick Sobers' resignation from key committees, might affect governance but not immediate dividend policy as dividends remain well-covered and forecasted to be sustainable in three years.

- Get an in-depth perspective on National Bank Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that National Bank Holdings is priced lower than what may be justified by its financials.

Provident Financial Services (NYSE:PFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc. is the bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of approximately $2.02 billion.

Operations: The company's revenue primarily stems from its Traditional Banking and Other Financial Services segment, totaling $607.16 million.

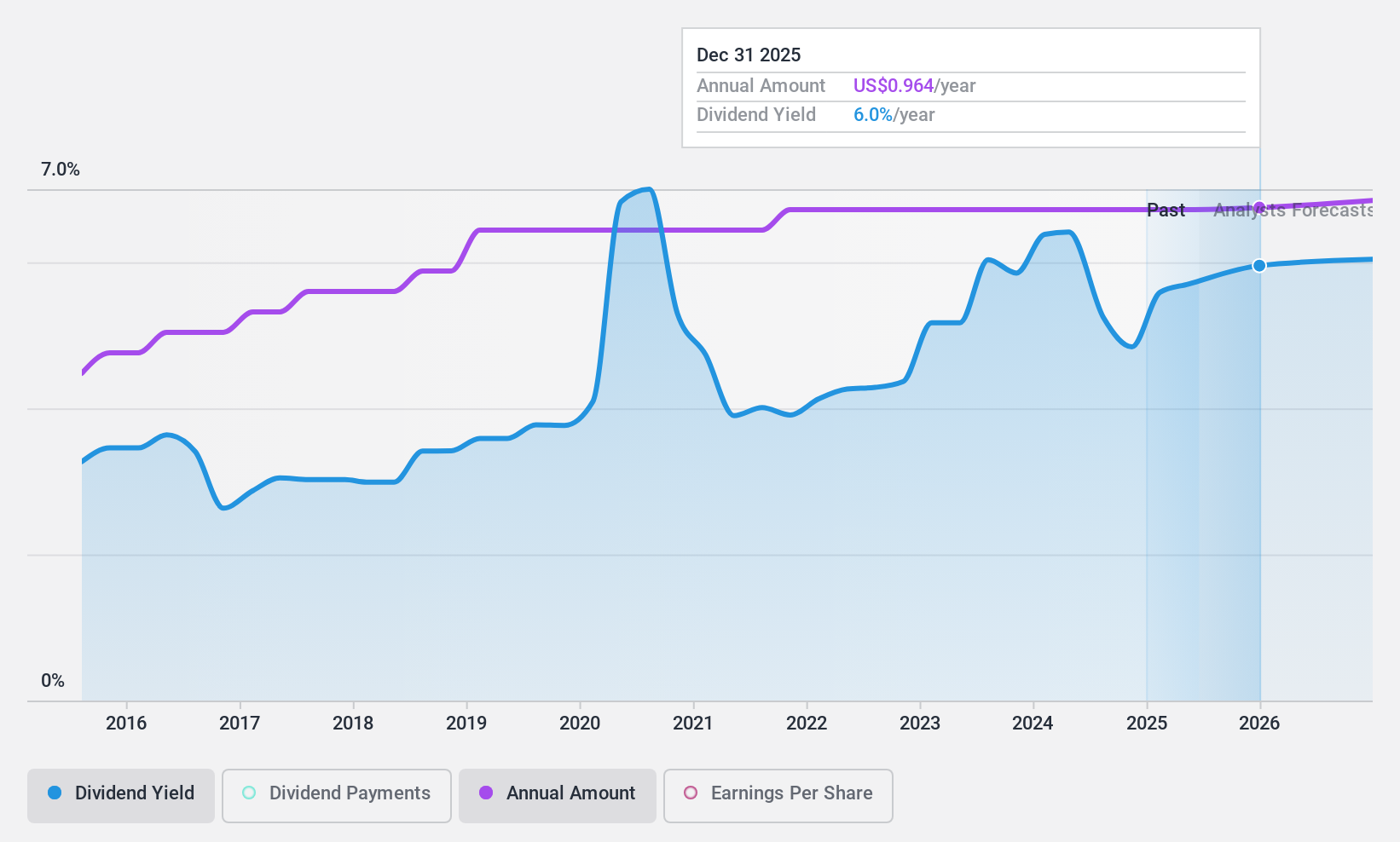

Dividend Yield: 6.2%

Provident Financial Services offers a high dividend yield of 6.19%, placing it in the top quartile of US dividend payers, although its current payout ratio of 91.1% raises sustainability concerns. Despite stable and reliable dividends over the past decade, earnings do not cover payouts currently but are expected to improve with a forecasted payout ratio of 43.2% in three years. Recent board changes include Frank L. Fekete's retirement, impacting governance oversight expertise.

- Click here to discover the nuances of Provident Financial Services with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Provident Financial Services is trading behind its estimated value.

Turning Ideas Into Actions

- Discover the full array of 170 Top US Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BPOP

Popular

Through its subsidiaries, provides various retail, mortgage, and commercial banking products and services in Puerto Rico, the United States, and the British Virgin Islands.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives