- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Sees 8% Stock Dip Despite Net Income Nearly Doubling To US$1,972M

Reviewed by Simply Wall St

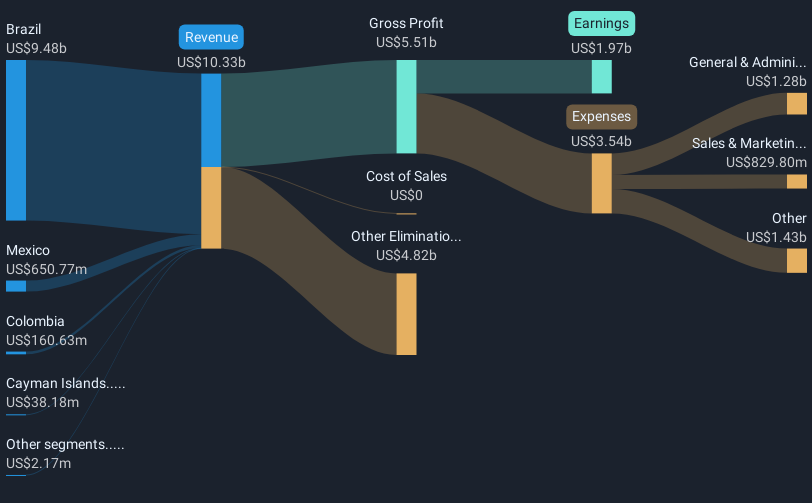

Nu Holdings (NYSE:NU) recently reported impressive financial growth for the full year 2024, with net income nearly doubling to $1,972 million and a significant rise in net interest income and earnings per share. Despite this, the company's stock price fell by 8% over the past quarter. This decline may be partly attributed to broader market trends, as major U.S. indexes like the Nasdaq Composite recently faced declines, influenced by uncertainty over economic policies and tariff announcements from the White House. Additionally, investor sentiment has been shaky, impacted by a mixed performance in tech stocks, with notable companies like Nvidia experiencing share price drops despite robust earnings. Overall, Nu Holdings' stock movement reflects a blend of its solid financial results, juxtaposed against a fluctuating broader market, focused on macroeconomic factors and sector-specific challenges.

Click to explore a detailed breakdown of our findings on Nu Holdings.

Over the past three years, Nu Holdings achieved a total return of 55.77%, despite recent short-term volatility. This performance can be attributed to several key developments. One significant factor was the company's consistent earnings growth. NU's net income increased substantially, such as jumping to nearly US$1.97 billion for the full year 2024 from US$1.03 billion in 2023. Similarly, net interest income rose considerably over the same period, reflecting the company's capacity for strong financial performance.

Despite this growth, the past year saw NU's shares underperform relative to the US Banks industry, which returned 31.6%. This discrepancy might relate to the company's removal from major indices like the Russell 1000 Value Index in July 2024, possibly affecting investor interest. The company's current Price-To-Earnings Ratio also highlights a valuation above industry norms, potentially resulting in cautious market sentiment. These factors, combined with broader market fluctuations, shaped NU's performance over the past three years.

- Discover whether Nu Holdings is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Nu Holdings and understand their potential impact—click to learn more.

- Shareholder in Nu Holdings? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, Cayman Islands, Germany, Argentina, the United States, and Uruguay.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives