- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Reports Q1 Earnings Growth to US$557 Million

Reviewed by Simply Wall St

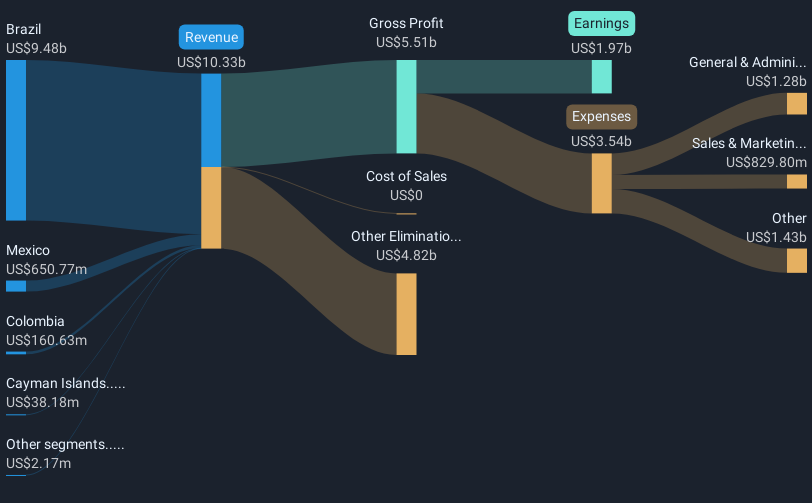

Nu Holdings (NYSE:NU) recently reported a strong first-quarter earnings performance, with net income reaching $557 million, up from $379 million the previous year. This financial uptick was complemented by the announcement of Roberto Campos Neto joining the management team, which could bolster the company's strategic positioning. Over the last month, Nu Holdings' stock price increased by 11.95%, a move that provides a counterweight to the broader market's 1.1% decline during the same period due to concerns over the U.S. budget bill. The earnings results and executive appointment may have added positive momentum to the company's stock performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nu Holdings' recent first-quarter earnings report and the appointment of Roberto Campos Neto could have a profound impact on its future prospects. The addition of Campos Neto to the management team may bring valuable expertise, enhancing Nu's strategic initiatives in secured lending and international markets. This aligns with Nu Holdings' broader narrative of diversifying its revenue streams and enhancing resilience. The company's shares have increased by a very large 234% over the past three years, providing substantial returns for long-term shareholders. This remarkable performance contrasts with its one-year underperformance relative to the US Banks industry, which delivered a 17.2% return in the same period.

Nu Holdings’ expansion into new markets and products, fueled by strong deposit growth, is projected to boost the company's earnings and revenue forecasts. Analysts anticipate significant revenue growth, with an estimated increase from $5.65 billion today to $26.3 billion by 2028, and earnings to reach $5.4 billion. With the stock currently priced at US$12.44, there is an 11.9% discount to the consensus price target of US$14.12, suggesting potential upside but emphasizing the need for careful consideration of execution risks. The market's response to recent developments, including the shift towards secured lending and enhanced product offerings, may provide further growth momentum for Nu Holdings.

Our valuation report unveils the possibility Nu Holdings' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives