- United States

- /

- IT

- /

- NasdaqCM:TSSI

Exploring 3 Undiscovered Gems In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.9%, contributing to a 12% increase over the past year, with earnings expected to grow by 14% annually. In this dynamic environment, identifying stocks that are poised for growth yet remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging potential in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

TSS (NasdaqCM:TSSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TSS, Inc. operates in the United States, focusing on the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems with a market cap of $386.44 million.

Operations: TSS generates revenue through its involvement in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems. The company's market capitalization stands at $386.44 million.

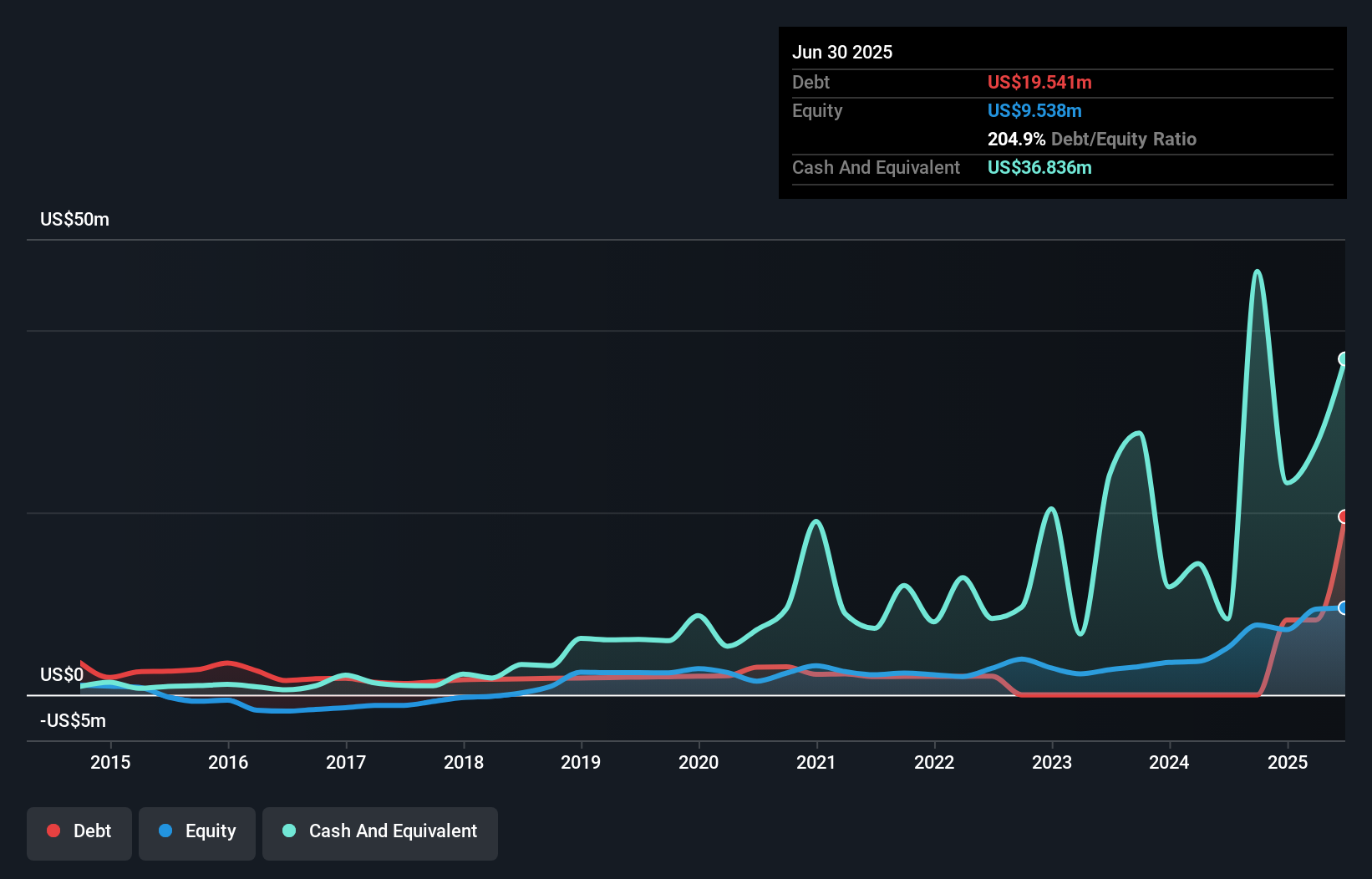

TSS, Inc. has been making waves with a staggering 921.7% earnings growth over the past year, significantly outpacing the IT industry's 2.5%. Despite its volatile share price recently, TSS is trading at an attractive 83.8% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. The company reported Q1 2025 revenue of US$98.96 million and net income of US$2.98 million, marking substantial improvements from last year’s figures of US$15.89 million and US$0.015 million respectively, reflecting strong operational performance and high-quality earnings amidst industry challenges.

IRADIMED (NasdaqGM:IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION specializes in developing, manufacturing, marketing, and distributing MRI-compatible medical devices and related accessories, disposables, and services globally with a market cap of $685.47 million.

Operations: The company generates revenue primarily from its patient monitoring equipment segment, which accounts for $75.15 million.

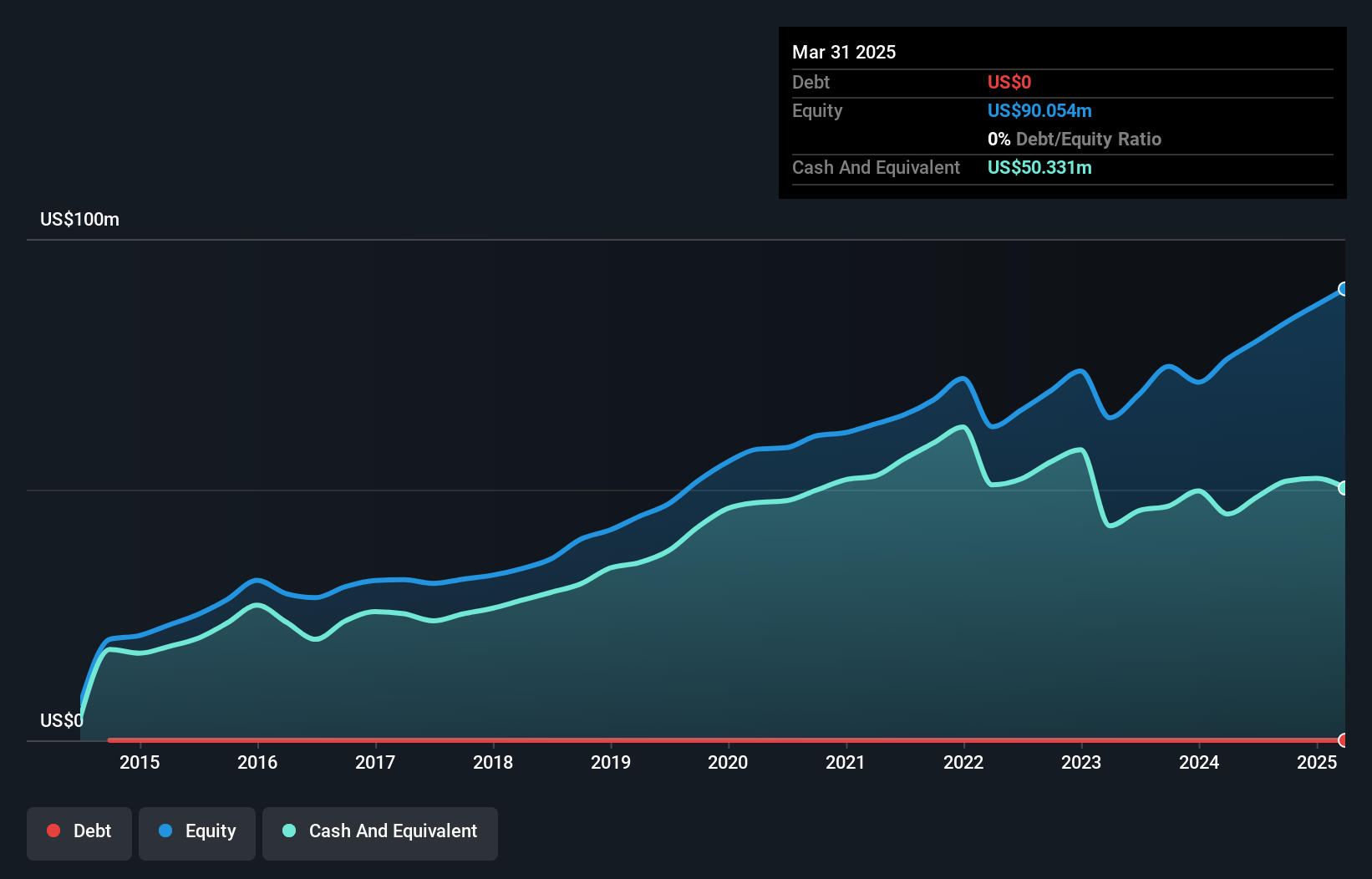

IRADIMED, a nimble player in the medical equipment sector, is making strides with its 3870 MR IV pump launch and facility expansion. The firm reported Q1 2025 sales of US$19.51 million, up from US$17.6 million last year, alongside net income rising to US$4.69 million from US$4.14 million. With no debt on its books for five years and earnings growing at an impressive 30% annually over the same period, IRADIMED's financial health appears robust. However, reliance on FDA approvals and U.S.-centric revenue streams could pose challenges as it navigates international market dynamics and capital expenditure impacts on margins.

Guaranty Bancshares (NYSE:GNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Guaranty Bancshares, Inc. serves as the bank holding company for Guaranty Bank & Trust, N.A., with a market capitalization of approximately $480.63 million.

Operations: Guaranty Bancshares generates revenue primarily through its banking segment, which accounts for $123.78 million.

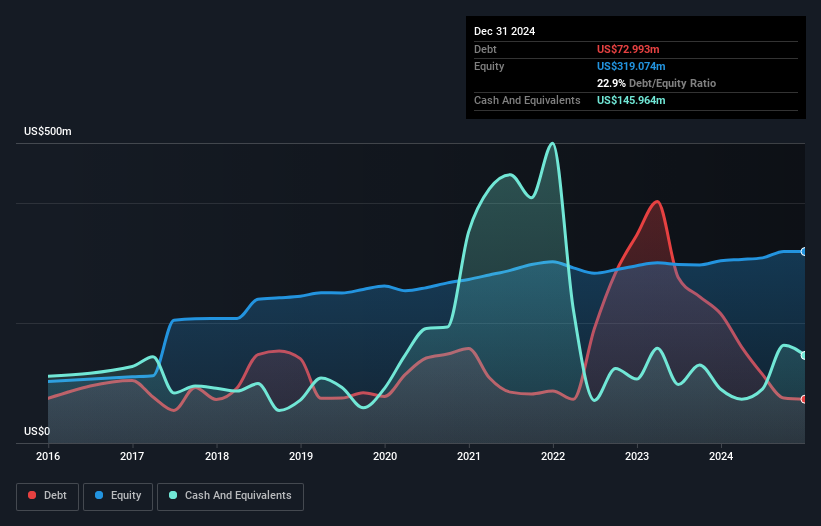

Guaranty Bancshares, with assets totaling US$3.2 billion and equity of US$325.8 million, is making strides in the financial sector. The bank's total deposits stand at US$2.7 billion against loans of US$2.1 billion, supported by a net interest margin of 3.3%. A robust allowance for bad loans at 0.2% underscores its prudent risk management strategy, while earnings grew by 17.7% last year, surpassing industry averages significantly and indicating strong operational health within the Texas economy despite national uncertainties like tariffs and rising expenses impacting future performance projections slightly negatively.

Turning Ideas Into Actions

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 278 more companies for you to explore.Click here to unveil our expertly curated list of 281 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Engages in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives