Key Takeaways

- Focus on the 3870 MR IV pump is expected to drive long-term revenue growth, with expanded sales and market penetration enhancing future earnings.

- New facility and increased infrastructure investments aim to boost capacity and efficiency, supporting stable margins and long-term revenue growth despite initial expenses.

- Heavy reliance on the U.S. market and FDA clearance introduces risks, while international sales decline and capital expenditures could pressure margins and revenue diversity.

Catalysts

About IRADIMED- Develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally.

- The company is focusing on a new pump, the 3870 MR IV pump, which is expected to drive significant revenue growth beginning in 2026, replacing older models and expanding sales as they move into 2027 and beyond. This new product line is projected to have a positive long-term impact on revenues.

- The sales team has been significantly increasing domestic market penetration, particularly in pump sales, which grew by 34% for the quarter and 36% for the year. This focus on domestic sales is expected to continue bolstering revenue growth as they garner a larger share of the domestic market.

- The company plans to expand its sales force and infrastructure in preparation for the new pump launch, which suggests increased operating expenses initially, but it is expected to enhance revenue and market reach in the long term, leading to improved earning potential.

- Incremental margins are expected to remain robust, as Jack Glenn, CFO, mentions maintaining gross margin in the 76-77% range with potential leverage in General & Administrative costs, suggesting a stable margin profile despite expansion costs, ultimately bolstering net margins.

- The construction of a new facility, projected to be completed by June, anticipates bolstered capacity and efficiency, reducing operational constraints and potentially increasing revenue and earnings by enabling higher product throughput in alignment with future demand.

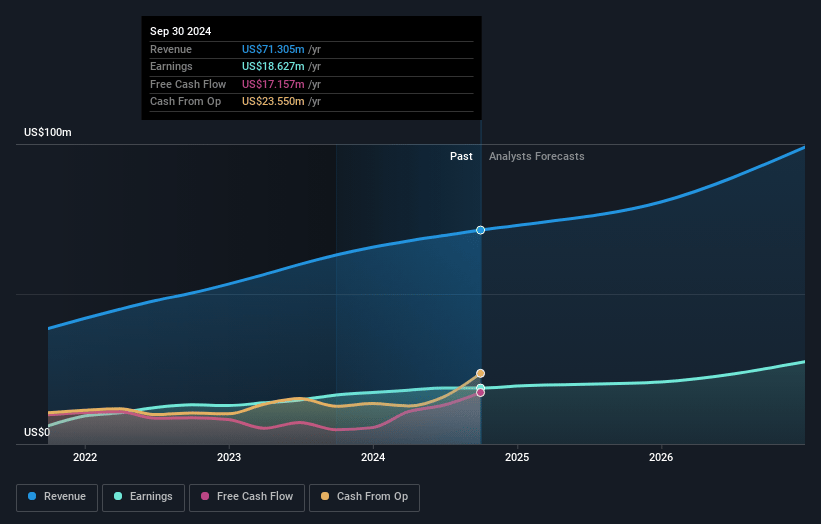

IRADIMED Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IRADIMED's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.3% today to 26.7% in 3 years time.

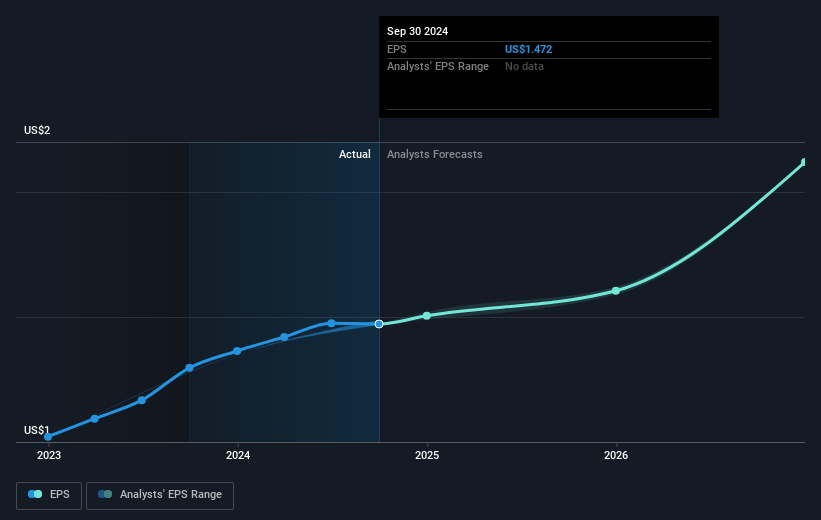

- Analysts expect earnings to reach $28.1 million (and earnings per share of $2.16) by about May 2028, up from $19.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.1x on those 2028 earnings, up from 35.5x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

IRADIMED Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The dependence on FDA clearance for the new 3870 MR IV pump poses a risk, as delays or unforeseen complications in regulatory approval could impact the company's ability to generate expected revenue from the new product in 2025, leading to potential shortfalls in projected earnings.

- A significant portion of the company's revenue is generated from domestic sales (85% of total revenue in Q4 2024), indicating a heavy reliance on the U.S. market. This concentration risk could impact revenue and earnings negatively if there are adverse changes in domestic market conditions or regulatory environments.

- The company's international sales decreased by 24%, highlighting challenges in global market expansion and potential impacts on revenue diversity, which could affect long-term growth and earnings stability.

- The new facilities under construction have contributed to a decline in free cash flow, with ongoing capital expenditures impacting cash reserves. Continued expenditures without corresponding revenue increases could pressure net margins and limit financial flexibility.

- Tariffs on imported components, even if minor, present a risk of increased costs and potential impacts on gross margins. While the impact is stated to be negligible, any miscalculation or increase in tariff costs could eat into profits if not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $71.0 for IRADIMED based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $105.0 million, earnings will come to $28.1 million, and it would be trading on a PE ratio of 37.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $53.7, the analyst price target of $71.0 is 24.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.