- United States

- /

- Banks

- /

- NYSE:FCF

Is There an Opportunity in FCF Stock After Recent Regional Bank Rally in 2025?

Reviewed by Bailey Pemberton

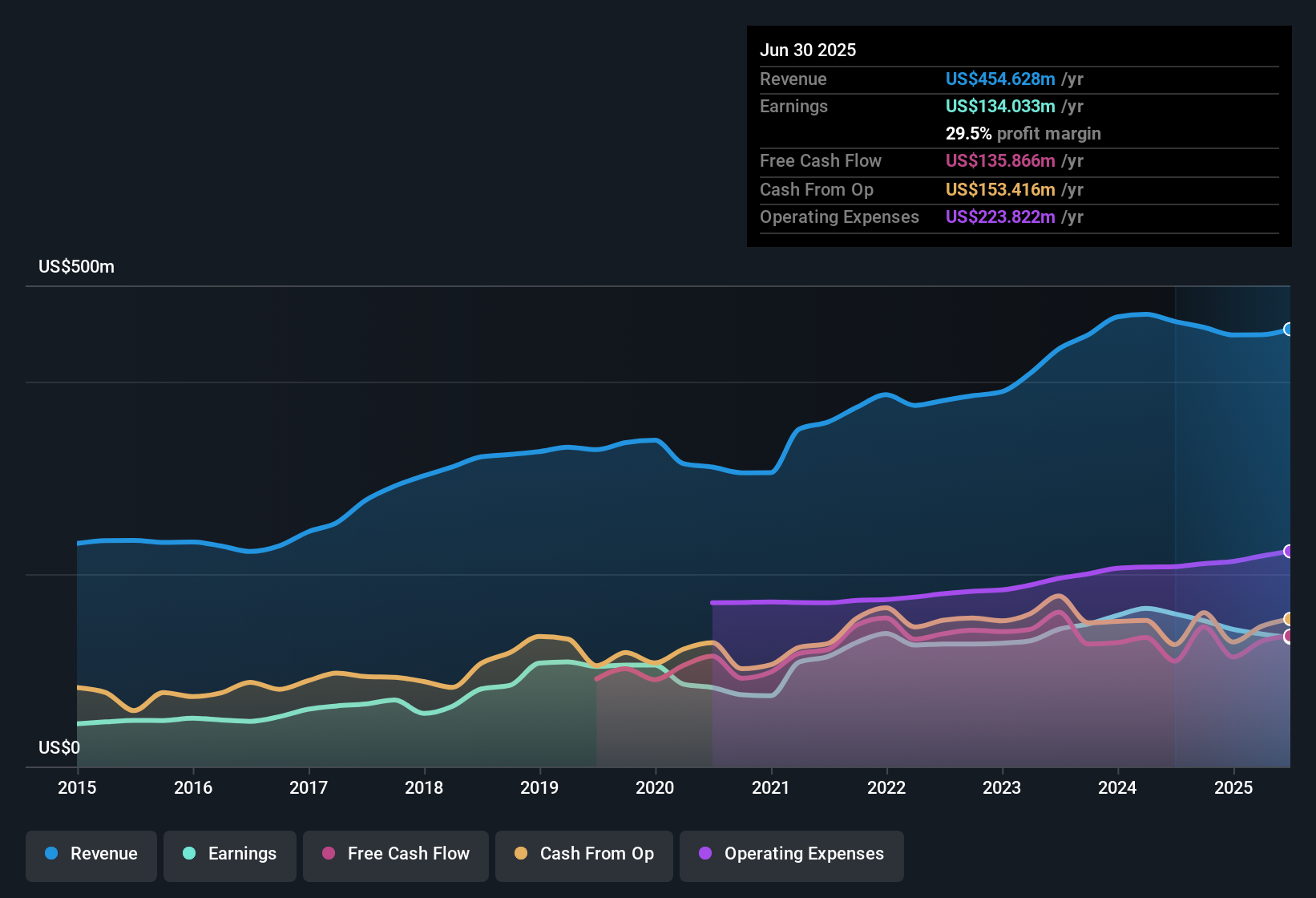

Curious about what to do with First Commonwealth Financial stock right now? If you have been eyeing this bank for a while, it is easy to see why. The share price has certainly caught some attention, climbing a strong 127.2% over the past five years. Even more recently, the stock is up 6.2% in the last year and up 1.6% year-to-date. However, it has taken a step back in the past month with a 6.0% slide. Short-term dips are not unusual, especially with shifting sentiment around regional banks and broader market developments creating both uncertainty and opportunity. Long-term holders will recognize the underlying growth trend.

Does that recent pullback open the door for value seekers, or is there a hidden risk? That is where a close look at the numbers comes in handy. By the standard measures investors use to spot bargains, First Commonwealth Financial scores a 3 out of 6 for undervaluation. In other words, there are reasons to dig deeper, but this stock is not screaming “cheap” across the board.

Let us break down what these valuation approaches actually say, and see if any tell a more compelling story than the headline numbers suggest. And before we wrap up, I will share a smarter way to think about valuation that could really change how you see companies like this.

Why First Commonwealth Financial is lagging behind its peers

Approach 1: First Commonwealth Financial Excess Returns Analysis

The Excess Returns model is designed to assess whether a company consistently generates profits above its cost of capital, focusing on the returns made on shareholders' equity and how sustainable these returns are over time. For First Commonwealth Financial, this model uses forward-looking estimates to project long-term profitability and value creation.

Key measures in this analysis include a Book Value of $14.51 per share and a Stable Earnings Per Share (EPS) of $1.70, both of which are based on weighted future estimates from five analysts. The Cost of Equity, or the expected return required by investors, stands at $1.06 per share. The company’s calculated Excess Return, essentially profits above what shareholders could expect elsewhere, is $0.64 per share. With an Average Return on Equity of 10.84% and a forecasted Stable Book Value of $15.71 per share, the company demonstrates a strong track record of generating returns that exceed its equity costs.

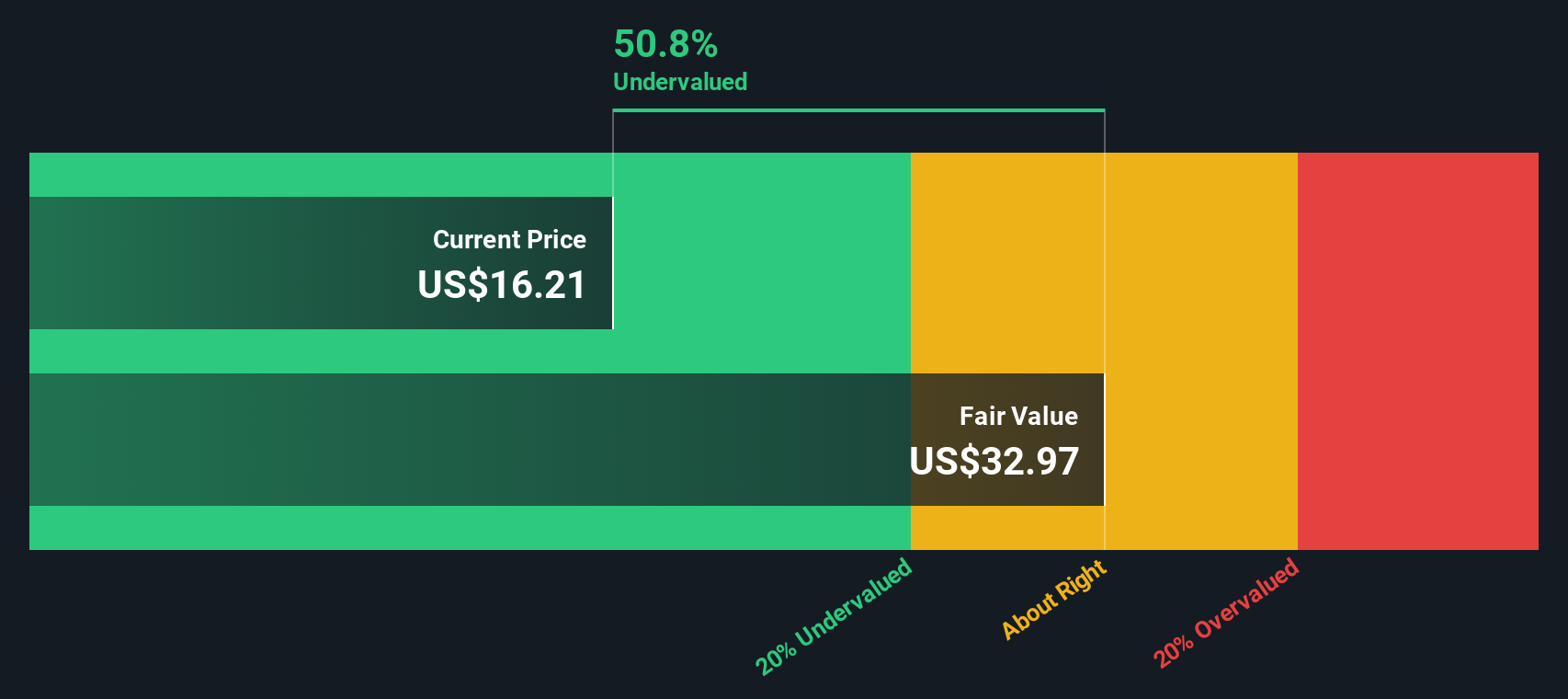

Based on these metrics, the model estimates that the fair value of First Commonwealth Financial stock is $32.97. Compared to the current market price, this implies the stock is 49.0% undervalued, a striking margin that suggests meaningful upside potential if these projections hold true.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Commonwealth Financial is undervalued by 49.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: First Commonwealth Financial Price vs Earnings

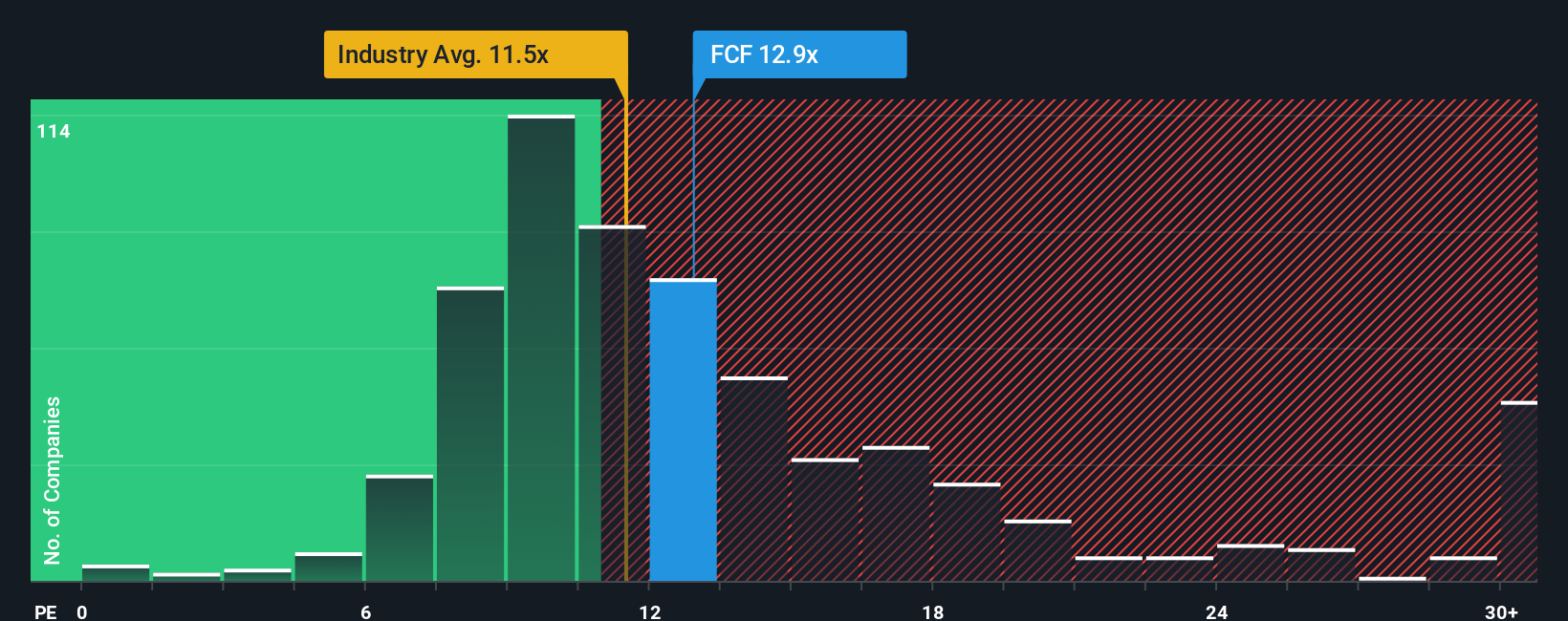

For a profitable company like First Commonwealth Financial, the Price-to-Earnings (PE) ratio is a widely accepted way to value its shares. This metric simplifies the comparison between a company’s stock price and its underlying earnings, making it useful for investors when assessing whether a stock may be a good value. The appropriate or “fair” PE ratio for any company is shaped by expectations about future growth and potential risks. Higher growth and lower risk typically warrant a higher ratio, while slower growth or higher uncertainty usually mean a lower figure is justified.

Currently, First Commonwealth Financial trades at a PE ratio of 13.1x. This is a bit higher than the average for other banks in its industry, which sits at 11.8x, and just above its peers’ average of 12.6x. However, numbers alone do not tell the whole story. Simply Wall St's Fair Ratio for the stock stands at 14.3x. The Fair Ratio is a proprietary metric that factors in more than just what other companies trade at. It incorporates the company’s growth outlook, risks, profit margins, industry conditions, and its size.

This approach avoids the pitfalls of relying on rough industry comparisons, offering a better sense of what a stock should be worth given its unique strengths and challenges. For First Commonwealth Financial, its current PE of 13.1x versus a Fair Ratio of 14.3x means the stock appears to be trading slightly below what a balanced model would suggest, signaling a modest undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Commonwealth Financial Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, yet powerful tool that invites you to look beyond just the numbers and create your own story for a company like First Commonwealth Financial. This approach connects your personal view of the business with a financial forecast and an estimated fair value.

Instead of only relying on historic metrics, Narratives allow you to combine your expectations for future revenue, earnings, margins, and risks into a tailored fair value. This process factors in the specific drivers you believe will shape the company’s future. Used by millions of investors within the Simply Wall St Community, Narratives make it easy to visualize whether the current share price is above or below what your outlook says is fair, helping you decide whether to buy, hold, or sell as new information emerges.

Best of all, these Narratives update dynamically. When fresh news or earnings reports are released, your story and valuation can adjust automatically, keeping your decision-making grounded in real time. For example, one perspective might value First Commonwealth Financial highly by focusing on its strong digital banking growth and fee-based revenue expansion, while a more cautious view might set a lower fair value by emphasizing competition, regulatory costs, and margin pressures. With Narratives, you are always empowered to invest with conviction, backed by both data and your own understanding.

Do you think there's more to the story for First Commonwealth Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives