- United States

- /

- Banks

- /

- NYSE:FBK

FB Financial (FBK): Evaluating Valuation as Net Interest Income Growth Draws Investor Attention

Reviewed by Kshitija Bhandaru

FB Financial (FBK) is catching the eye of investors after consistently growing market share and reporting net interest income and earnings figures that stand out against its banking peers. This performance comes at a time when the company is already navigating changes at the executive level.

See our latest analysis for FB Financial.

FB Financial’s share price has drifted upward over the past year, with a latest trade at $59.24 and a one-year total shareholder return of 31.8%, pointing to growing investor confidence amid ongoing leadership changes and robust earnings momentum. Over both the short and long term, the stock’s performance suggests steady upward momentum rather than sudden spikes or dips.

If you want to broaden your horizons beyond the banking sector, now is a prime opportunity to discover fast growing stocks with high insider ownership

With FB Financial’s fundamentals strengthening and recent gains outpacing many peers, the key question now is whether the current stock price truly captures this momentum, or if there is still room for investors to benefit from further upside.

Most Popular Narrative: Fairly Valued

FB Financial’s most closely watched narrative considers the fair value at $59, aligning almost exactly with its last closing price of $59.24. This suggests the company is trading right at analyst expectations. This balance between current price and estimated value sets the tone for a closer look at what drives such conviction among market observers.

The planned combination with Southern States Bank is expected to enhance scale and market opportunities, potentially benefiting revenue growth through expanded market presence and improved margin stabilization. FB Financial's ability to adjust cost structures, such as repricing certificates of deposit at lower rates, indicates management's focus on improving net margins by reducing the cost of funds.

Want to know what bold growth plans lie beneath the surface of this seemingly “fair” valuation? This narrative only makes sense if you believe in aggressive top-line expansion and cost management success. The financial roadmap analysts are using isn’t for the faint-hearted. Uncover the big assumptions that make or break this price target.

Result: Fair Value of $59 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration risks with Southern States Bank and ongoing economic uncertainty could still disrupt FB Financial’s path to expanded profitability and consistent revenue growth.

Find out about the key risks to this FB Financial narrative.

Another View: What Does the SWS DCF Model Say?

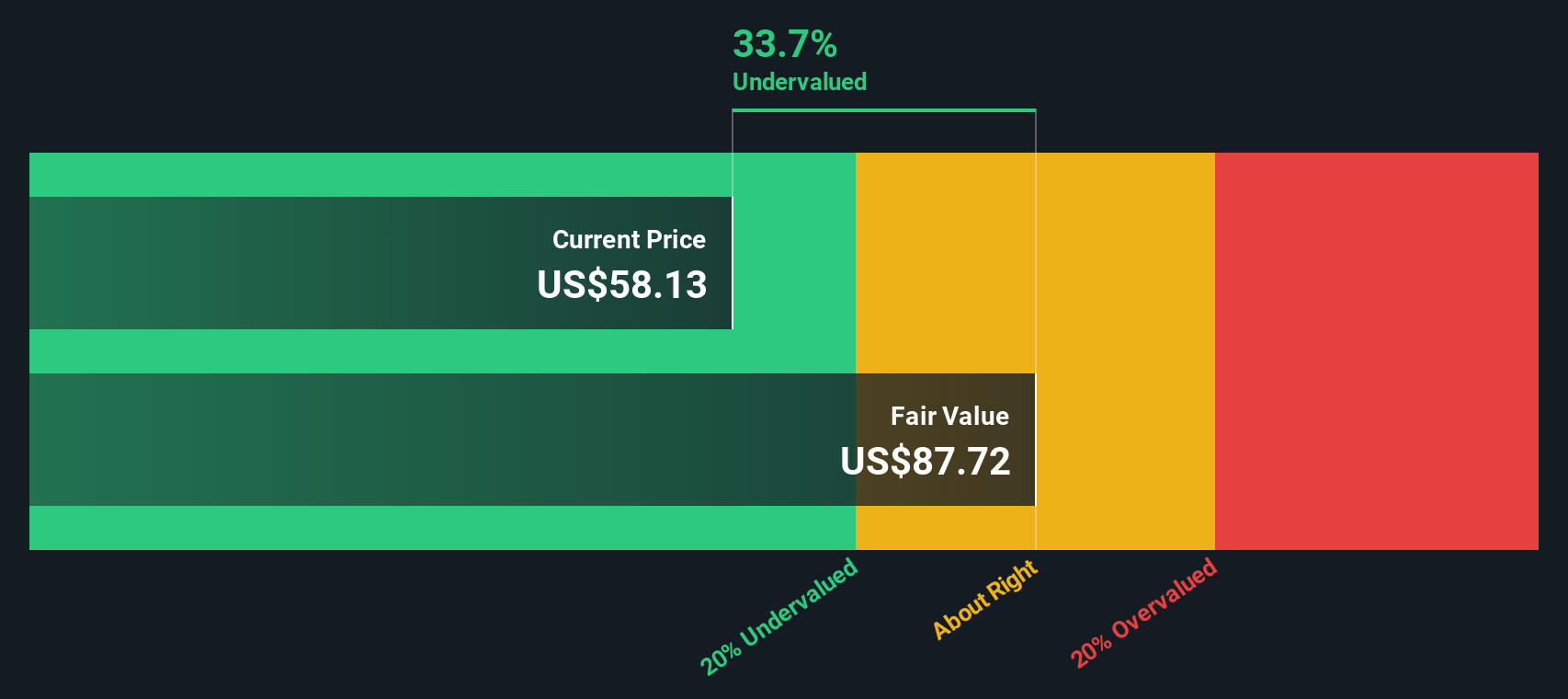

Looking through the lens of our DCF model, FB Financial is valued at $88.14 per share, about 32.8% higher than the current price. This method paints the stock as undervalued, at odds with the fair value narrative. Could market sentiment be missing something, or is this estimate too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FB Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FB Financial Narrative

If you want to test these assumptions for yourself or reach your own conclusion, it only takes a few minutes to investigate and build a personalized investment case. Do it your way

A great starting point for your FB Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make every move count by checking out hand-picked opportunities beyond FB Financial. Don’t let the market’s next big story pass you by. Smart investors act early.

- Unlock the potential of technology breakthroughs by tracking the latest quantum computing innovators through these 26 quantum computing stocks as they make headlines with transformative solutions.

- Secure reliable income streams by evaluating these 19 dividend stocks with yields > 3% that offer strong yields and a proven history of consistent returns.

- Get ahead of industry disruption by analyzing these 25 AI penny stocks that are redefining how businesses operate with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives