- United States

- /

- Mortgage Finance

- /

- NYSE:FBC

Do Flagstar Bancorp's (NYSE:FBC) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Flagstar Bancorp (NYSE:FBC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Flagstar Bancorp

Flagstar Bancorp's Improving Profits

In the last three years Flagstar Bancorp's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Flagstar Bancorp's EPS shot from US$3.85 to US$9.59, over the last year. You don't see 149% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

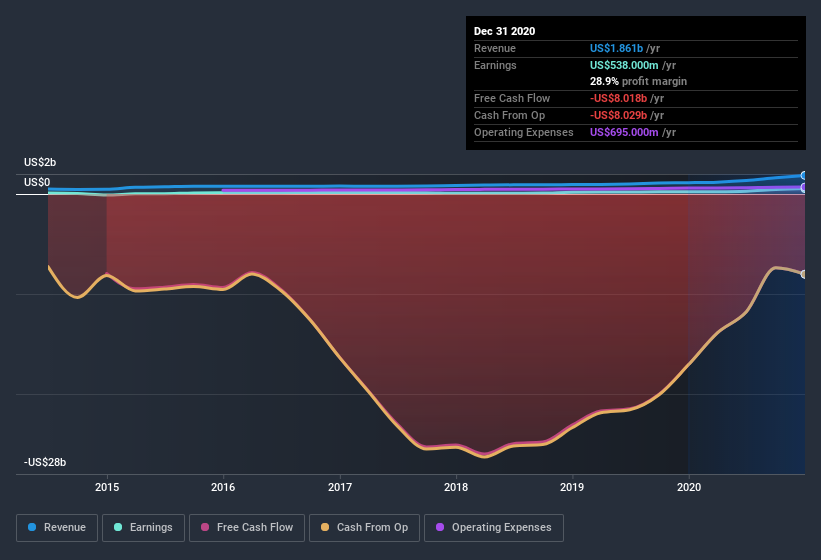

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Flagstar Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Flagstar Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 65% to US$1.9b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Flagstar Bancorp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Flagstar Bancorp Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Flagstar Bancorp insiders walking the walk, by spending US$438k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. We also note that it was the Independent Director, Jay Hansen, who made the biggest single acquisition, paying US$173k for shares at about US$34.56 each.

On top of the insider buying, it's good to see that Flagstar Bancorp insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$53m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Sandro DiNello, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Flagstar Bancorp with market caps between US$2.0b and US$6.4b is about US$5.0m.

Flagstar Bancorp offered total compensation worth US$3.5m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Flagstar Bancorp Deserve A Spot On Your Watchlist?

Flagstar Bancorp's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Flagstar Bancorp deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Flagstar Bancorp , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Flagstar Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Flagstar Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Flagstar Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:FBC

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives