- United States

- /

- Banks

- /

- NYSE:CFG

Where Does CFG Stand After Recent 8.8% Pullback and Valuation Review?

Reviewed by Bailey Pemberton

If you’re eyeing Citizens Financial Group, you’re not alone. The stock has been on investors’ radar thanks to its intriguing mix of solid long-term growth and more recent volatility. Just this year, shares are up 13.0%, and the past five years have seen an impressive 129.8% climb. But it has not been all smooth sailing. After a strong run, the price has pulled back 8.8% over the last week and sits 5.0% lower for the past month. These swings reflect shifting market sentiment as investors weigh changing interest rate expectations and broader economic signals that impact the banking sector.

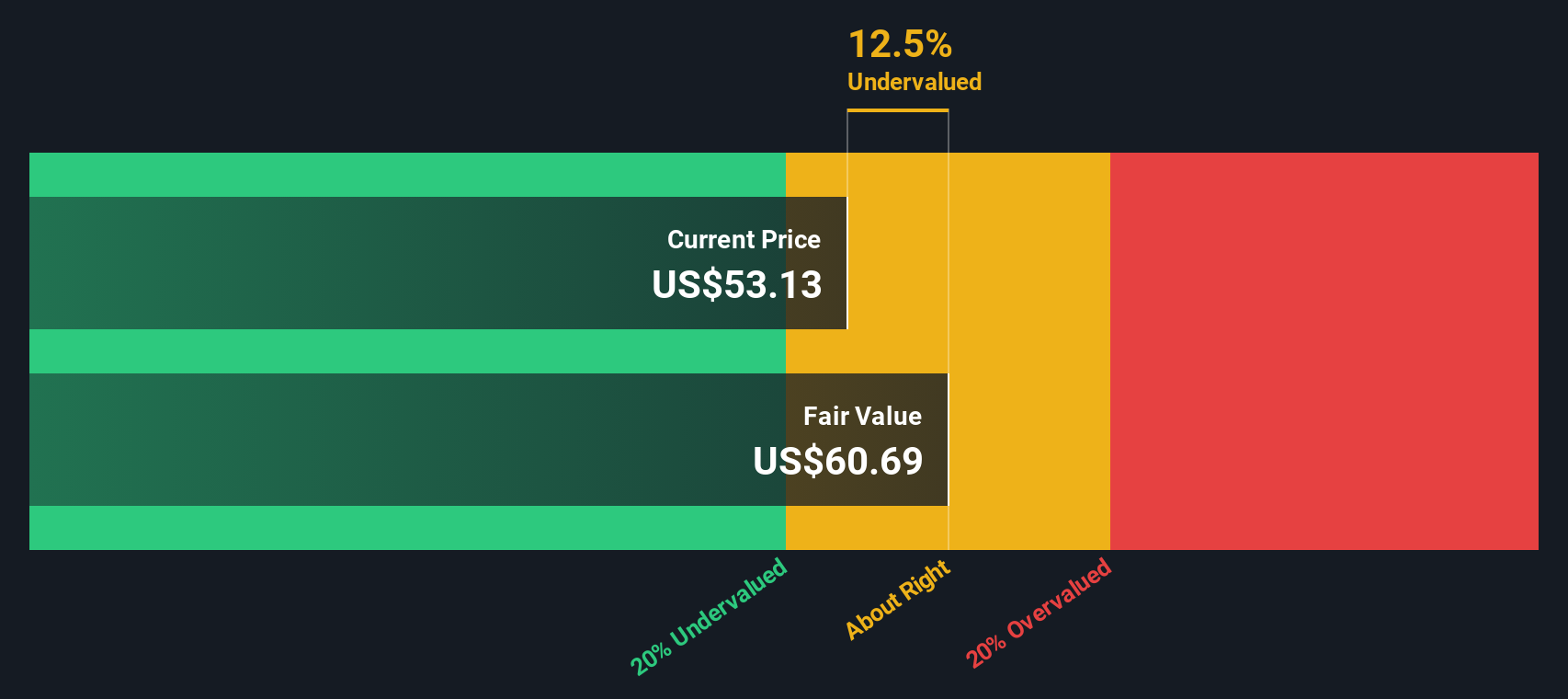

Despite these ups and downs, what truly matters for long-term investors is whether Citizens is undervalued now and could have room to run. It scores a 4 out of 6 on our value checklist, suggesting the company is undervalued across most key measures. Is this an overlooked bank with more potential than the market currently sees, or are there risks lurking beneath that recent outperformance?

Coming up, we will unpack how Citizens Financial Group stacks up on different valuation approaches, so you can decide if it deserves a spot in your portfolio. And if you’re looking for the smartest way to judge value, stay tuned, because we will cover that too before the end.

Why Citizens Financial Group is lagging behind its peers

Approach 1: Citizens Financial Group Excess Returns Analysis

The Excess Returns model examines how efficiently a company generates profit above its cost of equity, highlighting whether it adds value for shareholders beyond what could be achieved elsewhere. For Citizens Financial Group, this means analyzing its return on invested capital, projected book value, and earnings power over time.

Citizens Financial Group shows a book value of $53.43 per share, with a stable earnings per share (EPS) forecast at $4.98. This performance is supported by a projected average return on equity of 8.45% based on weighted estimates from analysts. The cost of equity is just below at $4.83 per share, which results in the company having an excess return of $0.14 per share, a positive margin, though not dramatic. The stable book value is expected to rise to $58.92 per share in coming years.

According to the Excess Returns model, the intrinsic value for Citizens Financial Group is $61.68 per share. With the current share price reflecting a 20.1% discount to this intrinsic value, the stock appears notably undervalued by this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citizens Financial Group is undervalued by 20.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

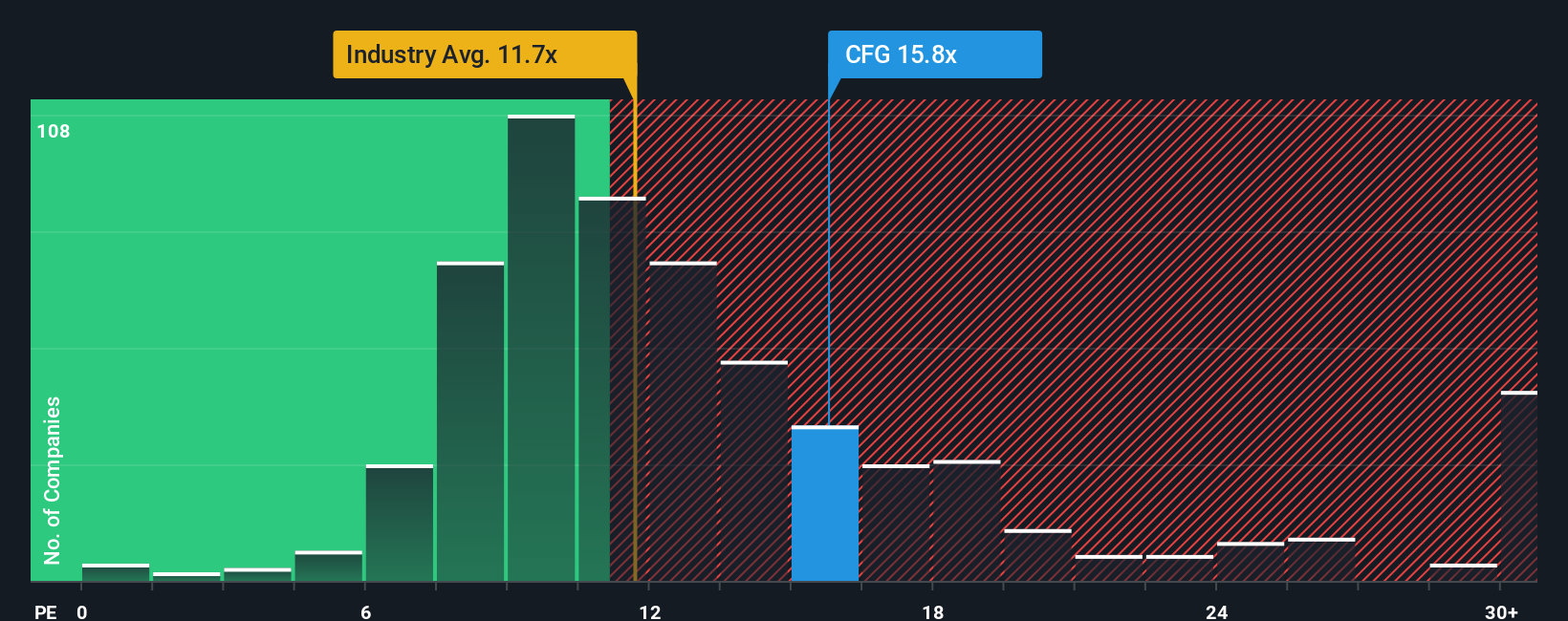

Approach 2: Citizens Financial Group Price vs Earnings

For profitable companies like Citizens Financial Group, the price-to-earnings (PE) ratio is a widely favored metric because it captures how much investors are willing to pay for each dollar of current earnings. This makes it especially relevant when the company is generating consistent profits, as is the case here.

Growth expectations and risk play a large role in determining what a "normal" or "fair" PE ratio should be. Higher expected future growth or lower perceived risk typically justifies a higher PE, while riskier or slower-growing businesses warrant a lower multiple.

Currently, Citizens Financial Group trades at a PE ratio of 14.6x. That is above the industry average of 11.3x and the peer average of 11.3x, suggesting on the surface a richer valuation than many of its competitors.

However, the "Fair Ratio," a proprietary metric from Simply Wall St, estimates that a PE of 17.0x would actually be justified for Citizens given a full range of factors such as the company’s earnings growth outlook, profitability, risk profile, industry standards, and market cap. This Fair Ratio provides more insight than traditional comparisons with peers or industry averages because it incorporates multiple company-specific elements that those often overlook.

Comparing Citizens Financial Group’s actual PE of 14.6x to its Fair Ratio of 17.0x, the stock appears undervalued on this basis and could leave room for a potential re-rating if market sentiment improves.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

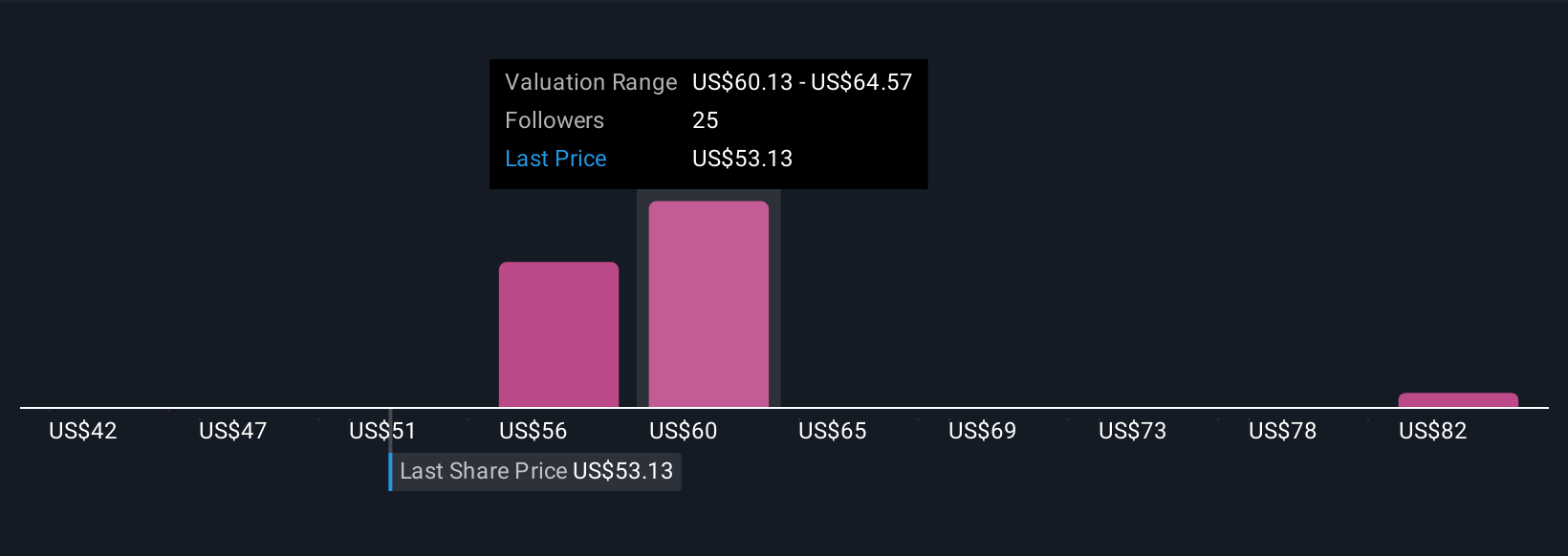

Upgrade Your Decision Making: Choose your Citizens Financial Group Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your story behind the stock: it is a simple, guided way to connect what you believe about a company’s future, such as its growth, risks, and profitability, with a clear, numbers-based forecast and a resulting fair value. Narratives are an accessible tool available on Simply Wall St’s Community page, used by millions of investors to clarify their investment case and see how their personal expectations compare to the market and other investors.

A Narrative works by blending your outlook, such as where you think revenue, margins, or earnings are headed, with fair value estimates and helping you easily decide if Citizens Financial Group is a buy, hold, or sell based on the gap between your estimated Fair Value and the current share price. Narratives automatically update as new information emerges, such as earnings releases or major news, so your forecast and decision are always relevant.

For example, some investors see strong growth from digital banking and believe Citizens is worth as much as $65 per share. More cautious investors focus on exposure to commercial real estate and set their fair value closer to $51. Narratives help you make smarter investment decisions, tailored to what you believe will actually drive the business forward.

Do you think there's more to the story for Citizens Financial Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives