- United States

- /

- Banks

- /

- NYSE:CFG

Citizens Financial Group (CFG): Exploring Valuation as Investors Weigh Recent Stock Volatility

Reviewed by Kshitija Bhandaru

Citizens Financial Group (CFG) shares have seen varied movement in recent weeks, capturing investor attention. The bank's stock has shifted around 5% lower over the past month, even as it maintains steady annual growth.

See our latest analysis for Citizens Financial Group.

While Citizen Financial Group’s 1-day and 7-day share price returns have been negative, momentum remains positive over the year. The company has delivered a 12.96% year-to-date share price return and a 20.14% total shareholder return for the past year, signaling that long-term holders are still well ahead despite recent volatility.

If you’re intrigued by how banking stocks like CFG are performing, it might be worth expanding your search and seeing what’s emerging among fast growing stocks with high insider ownership.

With shares still trading at a notable discount compared to analyst targets, the question emerges: Is Citizens Financial Group currently undervalued and offering investors a strategic entry point, or is the market fully reflecting its anticipated growth?

Most Popular Narrative: 16% Undervalued

At $49.25, Citizens Financial Group trades well below the most followed narrative's fair value estimate. This gap highlights expectations for substantial upside and sets the scene for a closer look at what could drive it.

The company's "Reimagining the Bank" initiative, focused on deploying advanced technologies such as AI and automation across customer service, operations, and risk management, is expected to unlock significant cost efficiencies and improve customer experience. These efforts are likely to drive down operating expenses, improve the efficiency ratio, and enhance net margins in the long term.

Want to understand what powers this bold price target? The projected transformation of Citizens' profits, margins, and scale plays a critical role behind the narrative’s future value. See exactly which financial forecasts underpin the valuation and get the full story that’s fueling investor intrigue.

Result: Fair Value of $58.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as exposure to commercial real estate or slower than expected digital transformation could undermine Citizens Financial Group’s bullish growth narrative.

Find out about the key risks to this Citizens Financial Group narrative.

Another View: Multiples Raise Questions

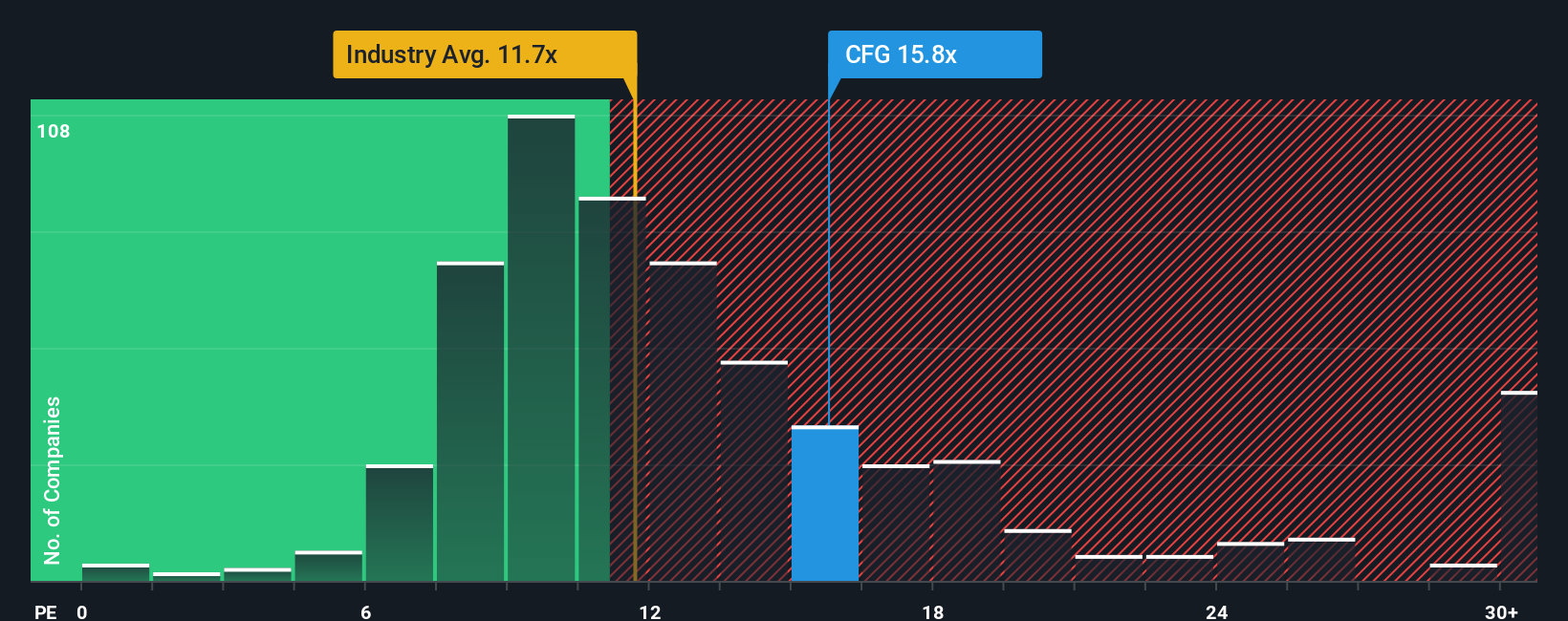

Looking at valuation through the lens of the price-to-earnings ratio, Citizens Financial Group trades at 14.6x, which is higher than both US bank peers (11.6x) and its peer set (11.3x). Compared to our fair ratio estimate of 17.1x, there may still be some runway, but such a gap could indicate that investors are paying a premium versus sector norms. Should investors be cautious about this premium, or could a rerating occur if performance improves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citizens Financial Group Narrative

If you want a different perspective or enjoy hands-on research, you can dive into the numbers and craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Citizens Financial Group.

Looking for more investment ideas?

Don’t let opportunity pass you by. Gain an edge by handpicking stocks perfectly matched to your investment goals using the Simply Wall Street Screener.

- Boost your portfolio’s income by targeting these 19 dividend stocks with yields > 3% offering attractive yields above 3% and steady payouts.

- Ride the AI innovation wave by examining these 24 AI penny stocks positioned at the forefront of automation and intelligent technologies.

- Tap into game-changing healthcare breakthroughs and spot potential market leaders with these 33 healthcare AI stocks driving medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives