- United States

- /

- Banks

- /

- NYSE:CFR

Community Financial System And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight uptick following a pause in its recent winning streak, investors are keenly observing how various sectors react to fluctuations in tech and crypto-tied shares. In this dynamic environment, dividend stocks like Community Financial System offer an appealing option for those looking to enhance their portfolios with steady income streams amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.94% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.49% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.71% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.67% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.69% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.99% | ★★★★★★ |

| Ennis (EBF) | 5.68% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.13% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.56% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Community Financial System (CBU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Financial System, Inc. is the bank holding company for Community Bank, N.A., with a market cap of $2.99 billion.

Operations: Community Financial System, Inc. generates revenue through its segments of Insurance ($54.20 million), Wealth Management ($39.61 million), Banking and Corporate ($547.45 million), and Employee Benefit Services ($139.56 million).

Dividend Yield: 3.2%

Community Financial System offers a reliable dividend yield of 3.24%, supported by a stable payout ratio of 47.6%. The company has consistently grown its dividends over the past decade, aligning with its earnings growth of 23.7% last year and a forecasted annual growth rate of 15.62%. Recent strategic expansion through acquiring seven branches from Santander Bank enhances its market presence, potentially bolstering future profitability and dividend sustainability amidst ongoing share buybacks worth US$10.99 million.

- Get an in-depth perspective on Community Financial System's performance by reading our dividend report here.

- Our valuation report unveils the possibility Community Financial System's shares may be trading at a discount.

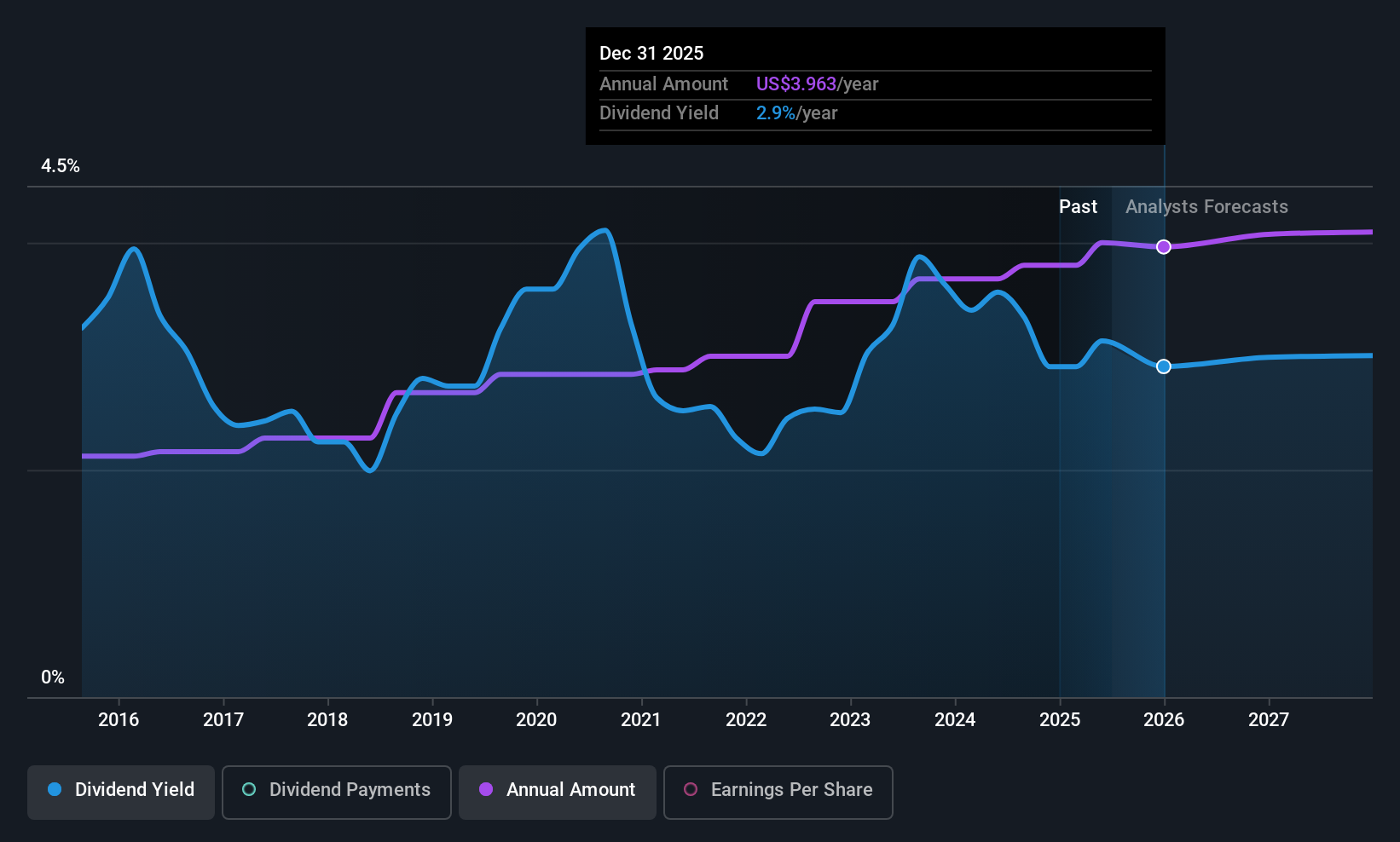

Cullen/Frost Bankers (CFR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cullen/Frost Bankers, Inc. is the bank holding company for Frost Bank, offering commercial and consumer banking services in Texas, with a market cap of approximately $7.91 billion.

Operations: Cullen/Frost Bankers, Inc. generates revenue primarily from its Banking segment at $1.94 billion and Frost Wealth Advisors at $216.27 million.

Dividend Yield: 3.2%

Cullen/Frost Bankers maintains a stable dividend, currently yielding 3.21%, supported by a payout ratio of 40.1%. The company's dividends have been reliable and growing over the past decade. Despite earnings forecasted to decline slightly, recent financial results show strong performance with net income rising to US$174.38 million in Q3 2025 from US$146.5 million a year ago. Additionally, the company has completed share buybacks worth US$69.26 million, potentially enhancing shareholder value further.

- Click here and access our complete dividend analysis report to understand the dynamics of Cullen/Frost Bankers.

- Our valuation report here indicates Cullen/Frost Bankers may be overvalued.

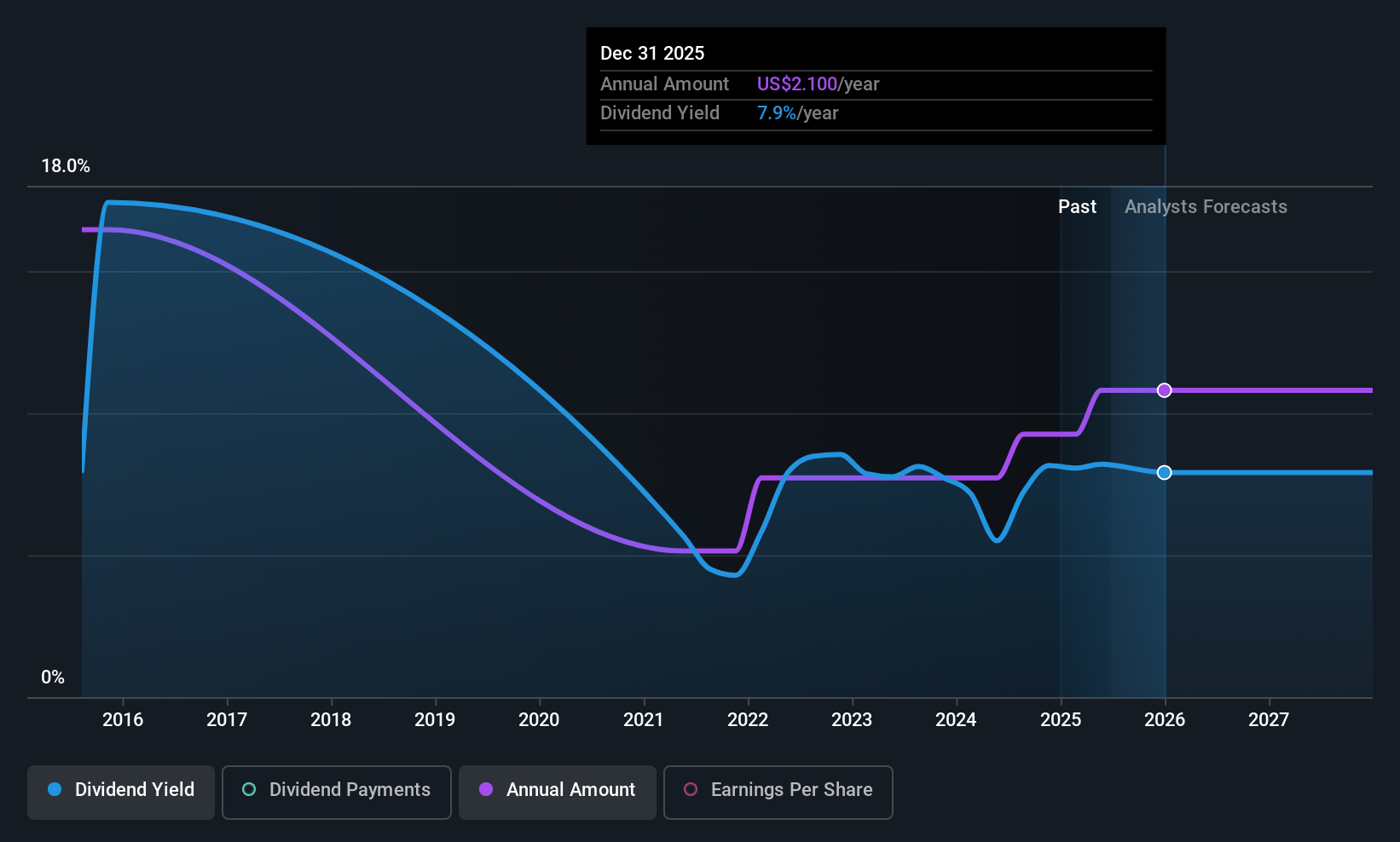

Global Ship Lease (GSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market cap of approximately $1.28 billion.

Operations: Global Ship Lease generates revenue of $747.04 million from its transportation and shipping activities.

Dividend Yield: 7.0%

Global Ship Lease offers a high dividend yield of 7.01%, placing it among the top 25% of US dividend payers, with dividends well-covered by earnings (19.1%) and cash flow (62.9%). Despite a volatile dividend history, recent earnings growth and strategic fleet expansion, including a $90 million acquisition of containerships, enhance its asset base. However, future earnings are projected to decline by an average of 12.9% annually over three years, posing potential challenges for sustained payouts.

- Take a closer look at Global Ship Lease's potential here in our dividend report.

- The analysis detailed in our Global Ship Lease valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Get an in-depth perspective on all 121 Top US Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFR

Cullen/Frost Bankers

Operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026