- United States

- /

- Banks

- /

- NYSE:CADE

Cadence Bank (CADE): Assessing Valuation Following Multiple Analyst Upgrades and Growing Investor Confidence

Reviewed by Kshitija Bhandaru

Several major brokerages have upgraded their outlook on Cadence Bank (CADE), reflecting increased investor confidence in the company. This comes as Cadence builds a track record of surpassing earnings expectations and successfully navigating recent market volatility.

See our latest analysis for Cadence Bank.

Cadence Bank has notched a 20.38% total shareholder return over the past year, easily outpacing many regional peers. While recent volatility, driven by sector jitters over US-China trade tensions, sparked short-term share price pullbacks, the stock’s longer-term momentum and confidence in its growth prospects remain intact.

If you want to widen your scope beyond banks making headlines, now’s a great opportunity to discover fast growing stocks with high insider ownership.

With the share price still trading at a meaningful discount to analyst targets and the company consistently beating expectations, investors may wonder if Cadence Bank remains undervalued or if the market is already factoring in its future growth potential.

Most Popular Narrative: 9.1% Undervalued

With Cadence Bank’s most popular narrative setting fair value at $41.45, the current share price of $37.69 is positioned notably below that mark. This gap highlights a context where the market may be underestimating near-term growth drivers and operational improvements, sparking debate about upside potential.

Expansion in high-growth Sunbelt markets and successful M&A integration are driving organic growth, geographic diversification, and scalable earnings improvement. Investments in digital capabilities and treasury management are boosting operational efficiency, customer acquisition, and net margin expansion.

Want to know what’s fueling this bullish view? The secret lies in bold revenue growth assumptions, ambitious margin expansion, and a future earnings profile that hints at a step change in profitability. Curious about the math behind it all? The full narrative unpacks every key financial lever used to set this fair value.

Result: Fair Value of $41.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased reliance on the Texas market and the challenge of smoothly integrating recent acquisitions could affect Cadence Bank’s expected growth trajectory.

Find out about the key risks to this Cadence Bank narrative.

Another View: What About Profit Multiples?

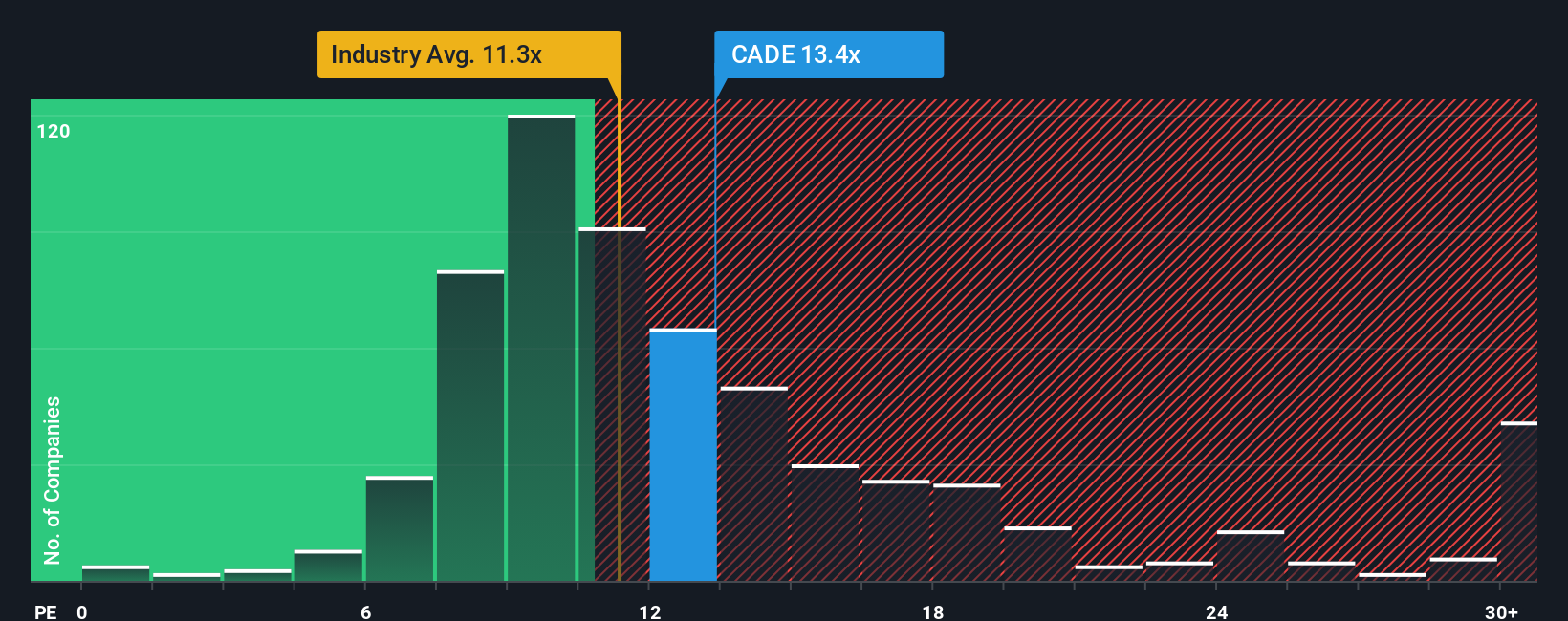

While the most popular narrative sees Cadence Bank as undervalued, another approach is to look at its price-to-earnings ratio. At 13.4x, Cadence is pricier than both US banks (11.3x) and its peers (11.9x). Its fair ratio sits even higher at 14.6x, which highlights mixed signals. Does this premium mean more risk, or room for upside if the market closes the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Bank Narrative

If you see the story differently or want to craft your own perspective, you can dive in and build a custom narrative in just a few minutes, right here: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cadence Bank.

Looking for more investment ideas?

Don’t wait for the market to make the next move. Smart investors like you always keep an eye on new trends and untapped opportunities.

- Unlock access to steady income streams and see which companies stand out for long-term payouts with these 19 dividend stocks with yields > 3%.

- Spot tomorrow’s AI leaders before the crowd. Check out these 24 AI penny stocks shaping smarter industries and bold innovation across the globe.

- Find rare bargains and seize value by exploring these 893 undervalued stocks based on cash flows, packed with companies still trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CADE

Cadence Bank

Provides commercial banking and financial services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives