- United States

- /

- Banks

- /

- NYSE:BAC

Best Stocks for Rising Interest Rates - Bank of America (NYSE:BAC) Tops Our List

Key Takeaways

- The Federal Reserve has hiked interest rates by 0.5%. The biggest increase in over 20 years.

- Banks should benefit from the interest rate rise, as mortgage products become more expensive.

- Contrary to common belief, REITs have performed well historically in periods of rising interest rates.

As we emerge from a COVID impacted lifestyle, the effects of the pandemic on the economic landscape still linger. The follow-on effects of quantitative easing has led rising inflation to become an ongoing concern. One of the key ways the Federal Reserve combats this is by raising interest rates.

On the 4th May 2022, the Federal Reserve hiked its benchmark interest rate by 50 basis points to a range of 0.75% to 1%. Increasing interest rates raises the cost of borrowing for companies and individuals. The goal of this is to make these parties less willing to spend and more likely to save, slowing monetary velocity and stifling inflation. The recent interest rate rise is the Fed's biggest increase in over 20 years. While aggressive, this move is seen as necessary and is just the beginning of many expected rate hikes in near future.

While there are concerns that rising interest rates could substantially slow economic growth, there are some companies that are positioned to take advantage of these opportunities:

Bank of America

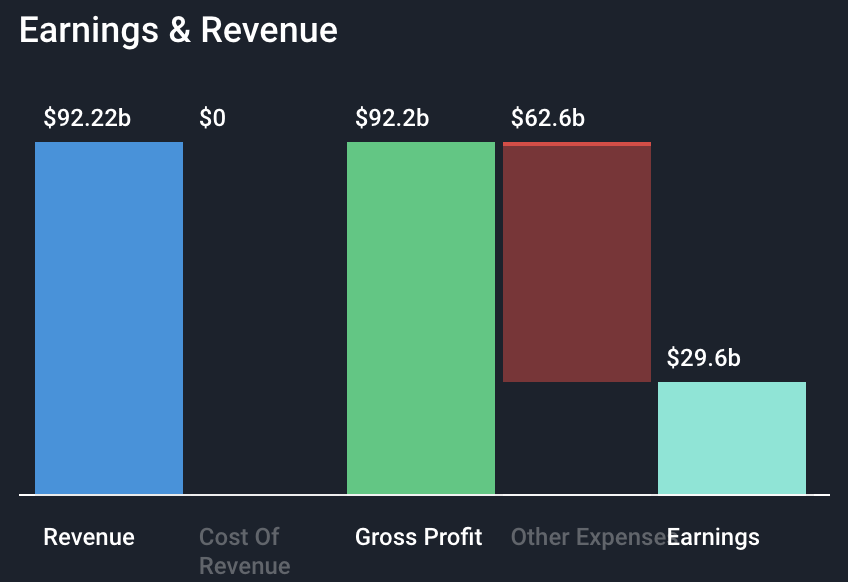

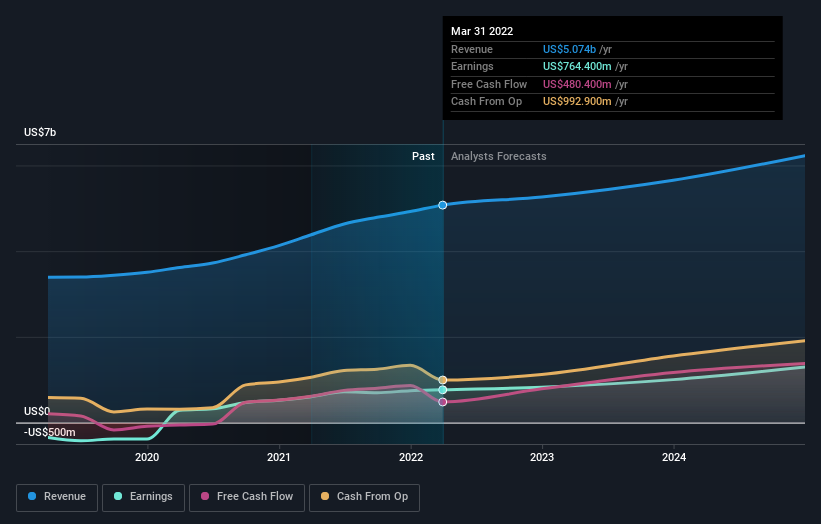

Bank of America (NYSE:BAC) is one of the largest banks in North America and is a key beneficiary of rising interest rates. Recent performance has been strong as customer deposits and loans on the balance sheet rose by US$8B and US$14B respectively, compared to Q4 2021. Importantly, Net interest income - the difference between revenue generated by the bank's interest-bearing products and the interest expenses paid to customers on deposits - is up 13% from the first quarter of 2021 to $11.6 billion. This result was driven by the aforementioned strong deposit growth and loan growth, further aided by the benefits from higher long-end interest rates.

Looking forward to the future, analysts are forecasting a 7.7% annualized earnings growth rate. A testament to the company’s strength during periods of interest rate volatility. Should Bank of America see continued growth in loan balances, they’ll provide plenty of opportunities for investors in a period where high debt and high growth companies suffer.

Here's why we see Bank of America being a top performer as interest rates rise:

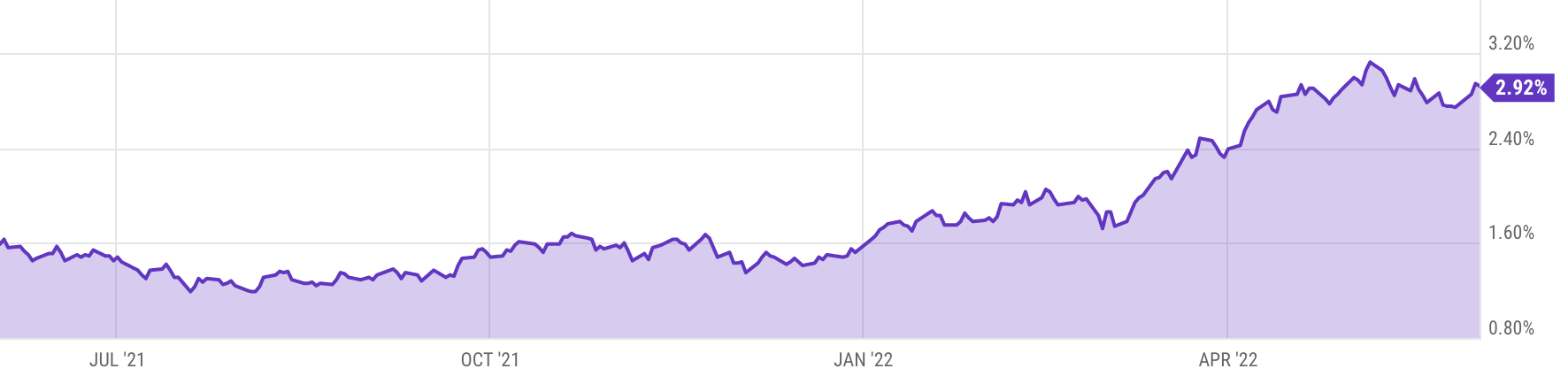

Rising Net Interest Margin

- During periods of interest rate rises, the difference in interest charged on interest-bearing assets like loans and the interest being paid on deposits grows. This is referred to as the Net Interest Margin or Yield. As Bank of America has seen growth in customer deposits and loans, a growing Net Interest Margin should mean that the company reaps the rewards. Although Bank of America’s Net Interest Margin currently sits at 1.69%, we should expect this to climb if the Federal Reserve continues to hike interest rates.

Bank of America has scored 6/6 in our assessment on Financial Health. However, our analysis has highlighted one significant risk. To find out more about our analysis of risks and rewards, head to the Bank of America Company Report on Simply Wall St.

Arch Capital Group

Arch Capital Group (NASDAQ:ACGL), together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products worldwide. Insurers have seen favorable business conditions as the recent pandemic has brought life insurance products into the spotlight and a looming economic slowdown has prompted lenders to explore mortgage insurance products.

Arch Capital’s underlying performance has been strong, as gross premiums written has risen to US$3.801B in Q1 2022, up 11.9% from US$3.397B in the same quarter last year; a testament to these favorable conditions. The company’s mortgage segment, which offers direct mortgage insurance and mortgage reinsurance to commercial customers, saw an appreciable rise in business recently owing to the financial stressors brought about by the pandemic. According to figures from Arch Capital, mortgage delinquencies rose during this period from 1.42% in March of 2020 to 5.42% in June, an unprecedented jump in a period of only three months. While the delinquency rate since has tapered off, rising interest rates and harsher borrowing conditions mean that delinquencies may soon rise again, creating greater demand for their mortgage insurance products.

Here's why we see Arch Capital being a top performer as interest rates rise:

Rising Rates Could Strengthen Investment Returns

- Insurers receive premiums on an upfront basis, yet insurance claims are paid out later or when a claimable event arises. In between, the funds held by the insurer are referred to as the ‘float’. This float can be invested to give an added kick to company earnings. Insurance companies like Arch Capital often invest this float in lower-risk securities like government and investment grade corporate bonds. When interest rates and bond yields rise, Arch Capital should expect to see greater investment returns as the risk-free rate increases.

The analysts covering Arch Capital have forecasted earnings to grow annually at 17.3%, outpacing both market and industry. It may also interest you to know that the company is also trading at a discount to our estimate of fair value. You can take a deeper dive into our valuation analysis for Arch Capital for free on our website .

Zillow Group

Zillow Group (NASDAQ:ZG) blurs the lines between technology and real estate, as it provides a leading online marketplace experience for users looking to buy, sell or rent. The hot property market in the last 24 months has been a boon for Zillow, who’s revenues are inextricably linked to the volume of housing sales.

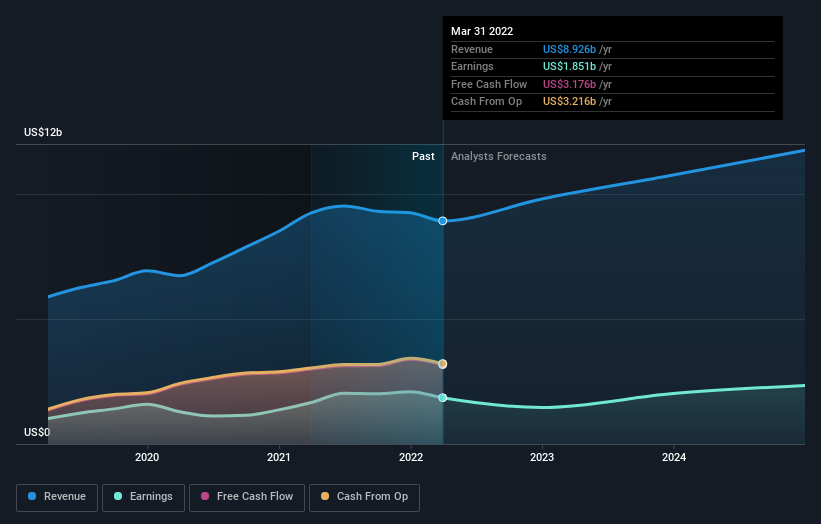

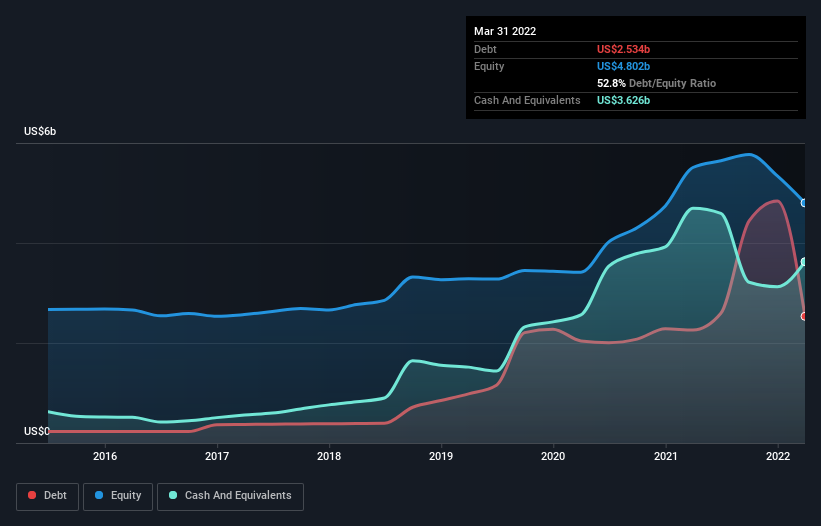

Recent comments from the CEO, Rich Barton, have indicated that Zillow expects a tumultuous period in the U.S. real estate market but he believes that a “strong cash position” and Zillow’s focus on developing new products and services will be of great benefit to the company during this time. As at March 31 2022, Zillow had reported cash and cash equivalents of US$3.626B, exceeding its current debt of US$2.534, which is great news for investors.

Zillow is backed by strong performance in its Internet, Media, and Technology (IMT) sector which saw revenue grow by 10% year over year to US$490 million, this was headlined by Zillow’s Premier Agent product which contributed US$363 million to the revenue growth figures over the last 12 months.

Here's why Zillow may provide an opportunity for investors as interest rates rise.

Rates Impacting Property Prices Could See Listings Rise

- As Zillow is an online property marketplace, its revenue stream is tied to the volume of property listings on the website. Interest rates and property prices tend to have an inverse relationship and so an increase in interest rates should yield a decline in property values. An anticipated decrease in property prices may lead homeowners and property investors to take advantage of the monumental rise in property value over the recent years and look to sell before property values drop, increasing listings volume on Zillow.

Zillow is currently loss-making, but based on our analysis of the company's future growht prospects, we can expect it to become profitable within the next 3 years. Our summary of Zillow's future earnings forecasts can be found on Simply Wall St's Zillow Company report.

Equifax

Equifax (NYSE:EFX) is a multinational credit reporting agency which provides a range of services to consumers and businesses. Equifax has performed incredibly well financially, recording first quarter 2022 revenue of $1.36 billion, up over 12% which is the ninth consecutive quarter of double-digit growth for the company. This result was the highest quarterly revenue in Equifax’s history, which it achieved despite the 24.5% decline in the U.S. mortgage market.

The company has provided revised guidance which reflects an expectation that the U.S. mortgage market, as measured by mortgage market credit inquiries, will decline by 37.5% over the remainder of 2022.

The impacts of this decline are partially offset by the strong performance of Equifax Workforce Solutions, which provides businesses with HR Compliance Management solutions, addressing the evolving HR, payroll, tax management, and compliance needs of employers.

Here's why Equifax could perform well as interest rates rise :

Rising Rates Make Credit Checks More Important

- Although the company expects a decline in the number of credit checks relating to mortgage inquiries, the volatile interest rate climate should mean that more business customers are engaging with Equifax to complete customer credit reports. When interest rates rise, so too does the credit risk for business customers and so there’s a greater need for businesses to undertake more stringent credit checks so businesses can ensure they aren't exposing themselves to excess risk.

While the rise in interest rates has the potential to yield good things for Equifax, our analysis of the company's liabilities has revealed that their debt are not well covered by operating cashflow. Head to our website to check out our Equifax Debt and Equity Analysis to find out more.

REIT Stocks as Interest Rates Rise

Common sense would dictate that rising interest rates have a negative effect on REITs as the underlying property value declines and the borrowing costs increase. However, empirical evidence has shown that this is not necessarily the case. Data from S&P Global details that - during times of rising 10-Year U.S. Treasury bond yields - U.S. REITs have performed remarkably well. There have been 6 such periods since the 1970s where the U.S. Treasury Bond yields rose and in four of those six periods, U.S. REITs have earned positive returns. More importantly, the S&P 500 outperformed REITs in only 2 of those 6 periods. Do these figures key us into an opportunity in REITS or should investors heed caution?

VICI properties

VICI Properties (NYSE:VICI) is a real estate investment trust which owns one of the largest property portfolios that specializes in Gaming, Hospitality and Entertainment destinations. Despite facing headwinds, the company has exhibited strength where other real estate companies have suffered, maintaining a 100% collection rate throughout the COVID-19 pandemic.

The company’s financial performance has also been a highlight, with total revenues increasing 23.17% year-over-year to US$1.510B and earnings increasing 13.7% year-on-year to US$1.014B for the period ended December 2021.

The company continues to expand its portfolio, recently completing the $4.0 billion acquisition of the land and real estate assets of The Venetian Resort Las Vegas. While large acquisitions like this could be considered a risk due to increased financing costs, the analysts covering VICI Properties are less phased, forecasting 15.8% annual earnings growth for the company over the next few years.

Many investors will shy away from REITs as further rate rises go from a possibility to a near certainty, but VICI Properties is actively working to offset this and provide value to speculators.

Here’s why VICI Properties could be a good REIT opportunity as interest rates rise:

Strong Property Portfolio Could Provide Opportunity

- VICI Properties entered into $2.0 billion of forward-starting interest rate swap agreements during the quarter to hedge a portion of interest exposure. This should help reduce the negative impacts of the rising interest rates. Furthemore, with Americans gambling at an unprecedented rate, VICI Properties’ expansive casino portfolio should ensure stability in rental income. The recent annoucement of the 2023 Las Vegas Formula 1 Grand Prix should also provide a much needed boost to the local economy, adding value to company's Las Vegas real estate holdings.

Analyst forecasts have painted a rosy picture for VICI Properties, yet we have seen shareholders experience significant dilution over the previous 12 months. To find out more, head to our summary of VICI Properties' Company Ownership on Simply Wall St.

The Bottom Line

Rising interest rates pose a danger to companies that have a high level of debt and insufficient cash-flow. Observers of the market will be aware that U.S. Tech has taken a battering, and they're not alone. While opportunities exist, all investors should be wary of the macroeconomic climate we find ourselves in. Inflation running hot across the globe has prompted foreign investors to look towards the U.S. economy for investment. The United States is seen as a relative safehaven due to its strength and investment capital has flooded in, causing the U.S. Dollar to soar. But what could this mean for the market? To see why Walmart (NYSE:WMT) is expected to perform so well, check out our list of Stocks Benefiting From the Rising U.S. Dollar.

We are looking for feedback on this article. Click HERE to complete a short survey to let us know how we did.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives