- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Top Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As the United States market experiences a slight downturn amid uncertainties about government policies and economic growth, investors are keenly observing dividend stocks as potential safe havens. In this fluctuating environment, a good dividend stock is often characterized by its stability and consistent payout history, offering investors a reliable income stream despite broader market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.91% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.85% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.99% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.23% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.57% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.37% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.94% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.57% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.75% | ★★★★★★ |

Click here to see the full list of 157 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

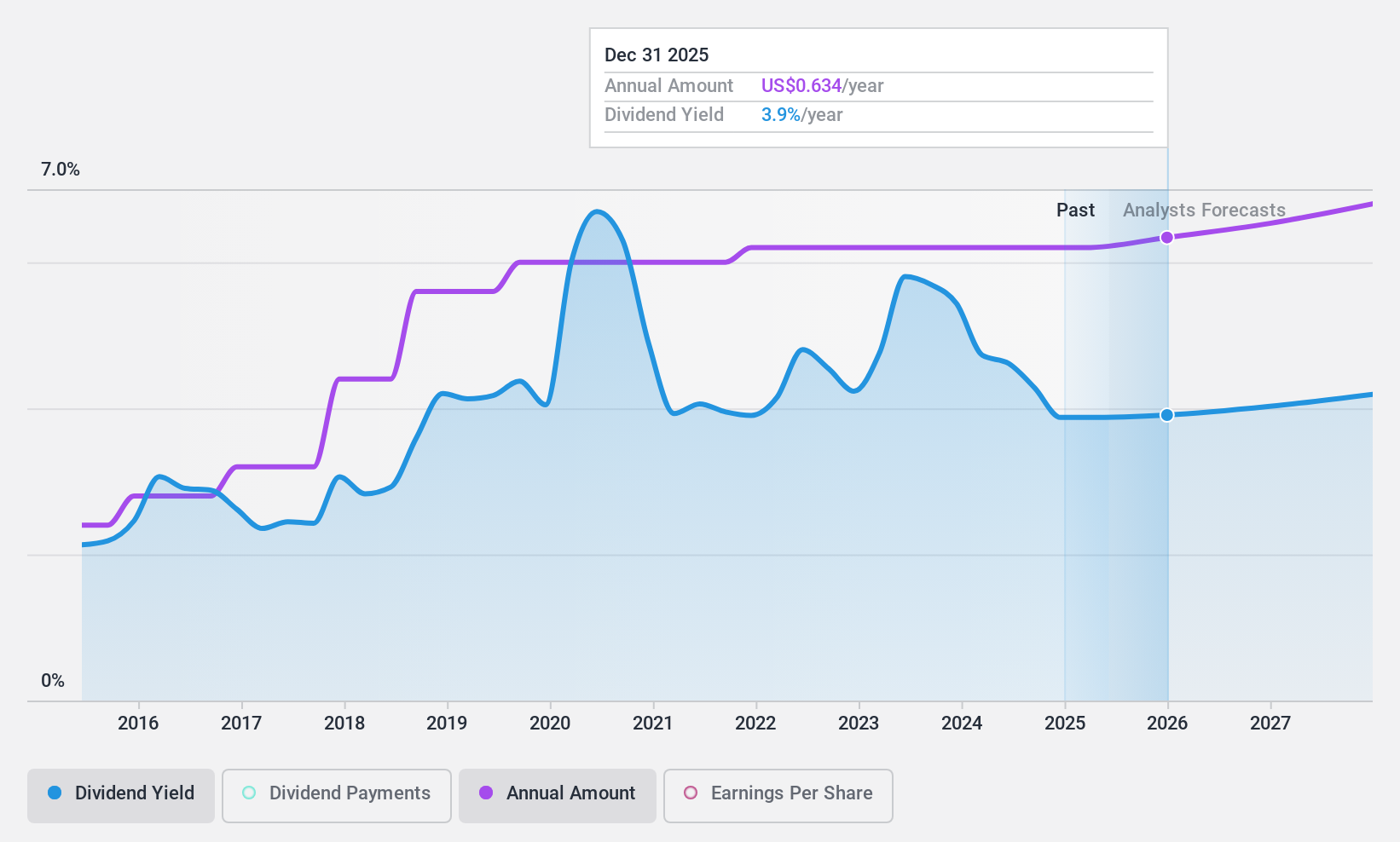

Huntington Bancshares (NasdaqGS:HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $21.76 billion.

Operations: Huntington Bancshares generates revenue through its segments, with Commercial Banking contributing $2.70 billion and Consumer & Regional Banking adding $5.09 billion.

Dividend Yield: 4.1%

Huntington Bancshares offers a stable dividend yield of 4.15%, which is reliable and has grown over the past decade. Despite trading at 50.2% below its estimated fair value, the dividends are well-covered by earnings with a current payout ratio of 50%. Recent announcements confirm unchanged common stock dividends and preferred stock payouts, indicating consistency in shareholder returns. The company’s recent shelf registration filing may suggest potential capital-raising activities or strategic flexibility for future investments.

- Click here to discover the nuances of Huntington Bancshares with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Huntington Bancshares is trading behind its estimated value.

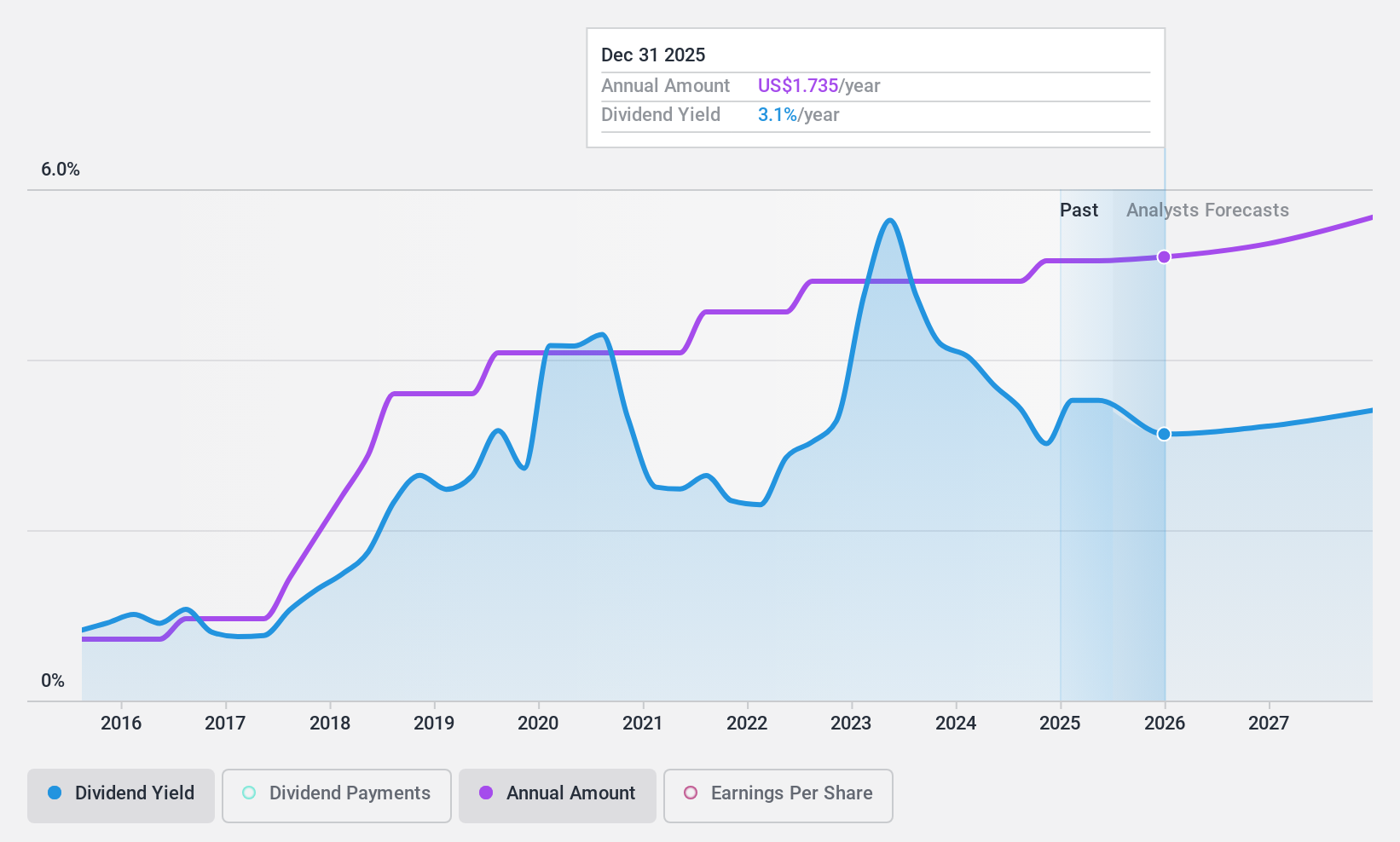

Zions Bancorporation National Association (NasdaqGS:ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several Western U.S. states, with a market cap of approximately $7.30 billion.

Operations: Zions Bancorporation, National Association generates revenue through its various banking subsidiaries, including Zions First National Bank ($887 million), California Bank & Trust ($663 million), Amegy Corporation ($649 million), National Bank of Arizona ($271 million), Nevada State Bank ($260 million), Vectra Bank Colorado ($174 million), and The Commerce Bank of Washington ($62 million).

Dividend Yield: 3.5%

Zions Bancorporation's dividends are well-covered by earnings, with a current payout ratio of 33.5%, and are forecast to remain sustainable over the next three years. The company offers a stable dividend yield of 3.46%, though it is below the top tier in the US market. Recent earnings growth and a $40 million share repurchase program underscore its financial stability, while trading at significant value compared to industry peers enhances its appeal for dividend investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Zions Bancorporation National Association.

- The valuation report we've compiled suggests that Zions Bancorporation National Association's current price could be quite moderate.

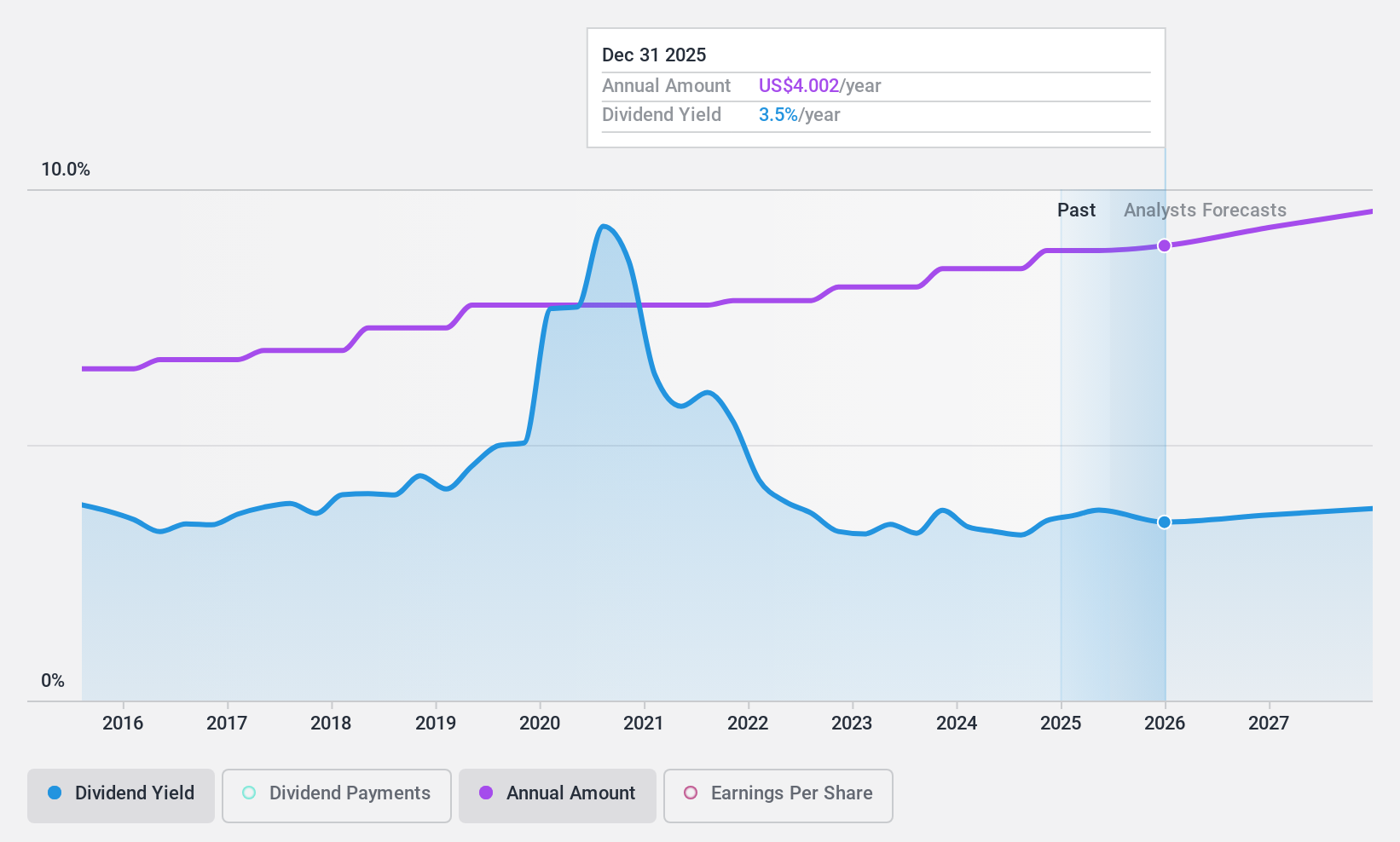

Exxon Mobil (NYSE:XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various countries, including the United States, Canada, and the United Kingdom, with a market cap of approximately $500.78 billion.

Operations: Exxon Mobil's revenue segments include Upstream operations in the United States ($47.56 billion) and internationally ($56.01 billion), Chemical operations in the United States ($15.89 billion) and internationally ($18.23 billion), Energy Products in the United States ($124.95 billion) and internationally ($185.57 billion), and Specialty Products in the United States ($8.25 billion) and internationally ($13.04 billion).

Dividend Yield: 3.4%

Exxon Mobil's dividend payments are well-covered by earnings, with a payout ratio of 49%, and have been reliably growing over the past decade. Despite a current yield of 3.42%, which is below the top tier in the US market, dividends remain sustainable due to solid cash flow coverage at 55.9%. The company trades at a notable discount to its estimated fair value and has completed significant share buybacks worth $51.67 billion since December 2021.

- Delve into the full analysis dividend report here for a deeper understanding of Exxon Mobil.

- Upon reviewing our latest valuation report, Exxon Mobil's share price might be too pessimistic.

Make It Happen

- Dive into all 157 of the Top US Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.