- United States

- /

- Banks

- /

- NasdaqCM:VABK

Here's Why We Think Virginia National Bankshares (NASDAQ:VABK) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Virginia National Bankshares (NASDAQ:VABK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Virginia National Bankshares with the means to add long-term value to shareholders.

View our latest analysis for Virginia National Bankshares

How Fast Is Virginia National Bankshares Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Virginia National Bankshares' EPS has grown 21% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

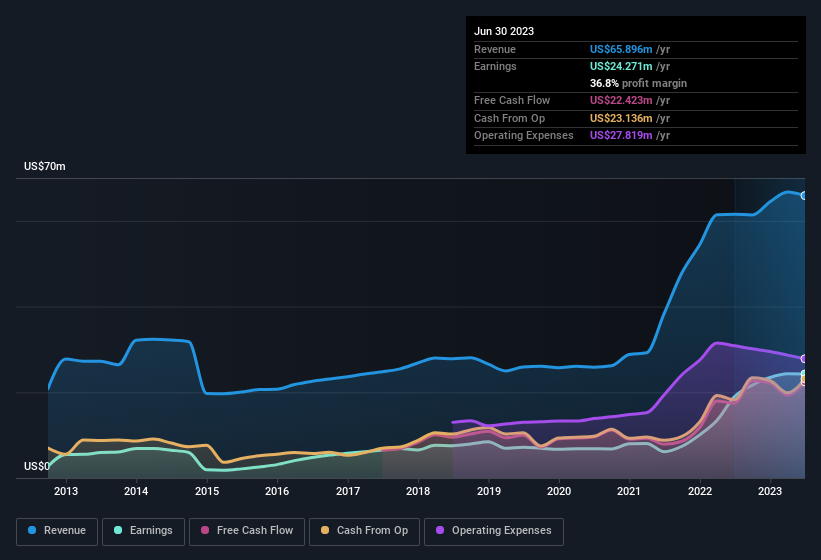

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Virginia National Bankshares' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Virginia National Bankshares achieved similar EBIT margins to last year, revenue grew by a solid 7.1% to US$66m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Virginia National Bankshares is no giant, with a market capitalisation of US$183m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Virginia National Bankshares Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Virginia National Bankshares shareholders can gain quiet confidence from the fact that insiders shelled out US$216k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Chairman of the Board, William Dittmar, who made the biggest single acquisition, paying US$93k for shares at about US$30.94 each.

Along with the insider buying, another encouraging sign for Virginia National Bankshares is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at US$21m. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 12% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Glenn Rust is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Virginia National Bankshares, with market caps between US$100m and US$400m, is around US$1.6m.

Virginia National Bankshares' CEO took home a total compensation package worth US$975k in the year leading up to December 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Virginia National Bankshares Deserve A Spot On Your Watchlist?

You can't deny that Virginia National Bankshares has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Virginia National Bankshares.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Virginia National Bankshares, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Virginia National Bankshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VABK

Virginia National Bankshares

Operates as the holding company for Virginia National Bank that provides a range of commercial and retail banking services.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives