- United States

- /

- Banks

- /

- NasdaqGS:UVSP

Univest Financial (UVSP) Buyback Expansion: What the Larger Share Repurchase Means for the Bank’s Valuation

Reviewed by Simply Wall St

Univest Financial (UVSP) just increased its share repurchase authorization by 2 million shares to a total of 3.8 million, indicating that management sees value in the current share price.

See our latest analysis for Univest Financial.

The larger buyback fits into a strong run for the stock, with a roughly 13 percent 1 month share price return and a 3 year total shareholder return of about 48 percent, suggesting building momentum as the market reassesses its prospects.

If you like the idea of management-backed momentum, this could also be a good moment to explore fast growing stocks with high insider ownership for more potential standouts.

But with shares already up strongly and trading slightly above the average analyst target, while still appearing roughly 40 percent below our estimate of intrinsic value, is Univest a genuine bargain today or is the market simply front running its next leg of growth?

Most Popular Narrative Narrative: 9.0% Overvalued

With Univest Financial last closing at $34.88 versus a narrative fair value of $32.00, the story leans cautious on upside from here.

The analysts have a consensus price target of $32.0 for Univest Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

Curious why modest revenue gains, easing margins, and steady earnings still support that valuation path. Want to unpack the growth, profitability, and multiple assumptions driving it.

Result: Fair Value of $32 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that path could be challenged if deposit competition keeps squeezing funding costs or if credit losses flare up again, forcing higher provisions and weaker earnings.

Find out about the key risks to this Univest Financial narrative.

Another View On Value

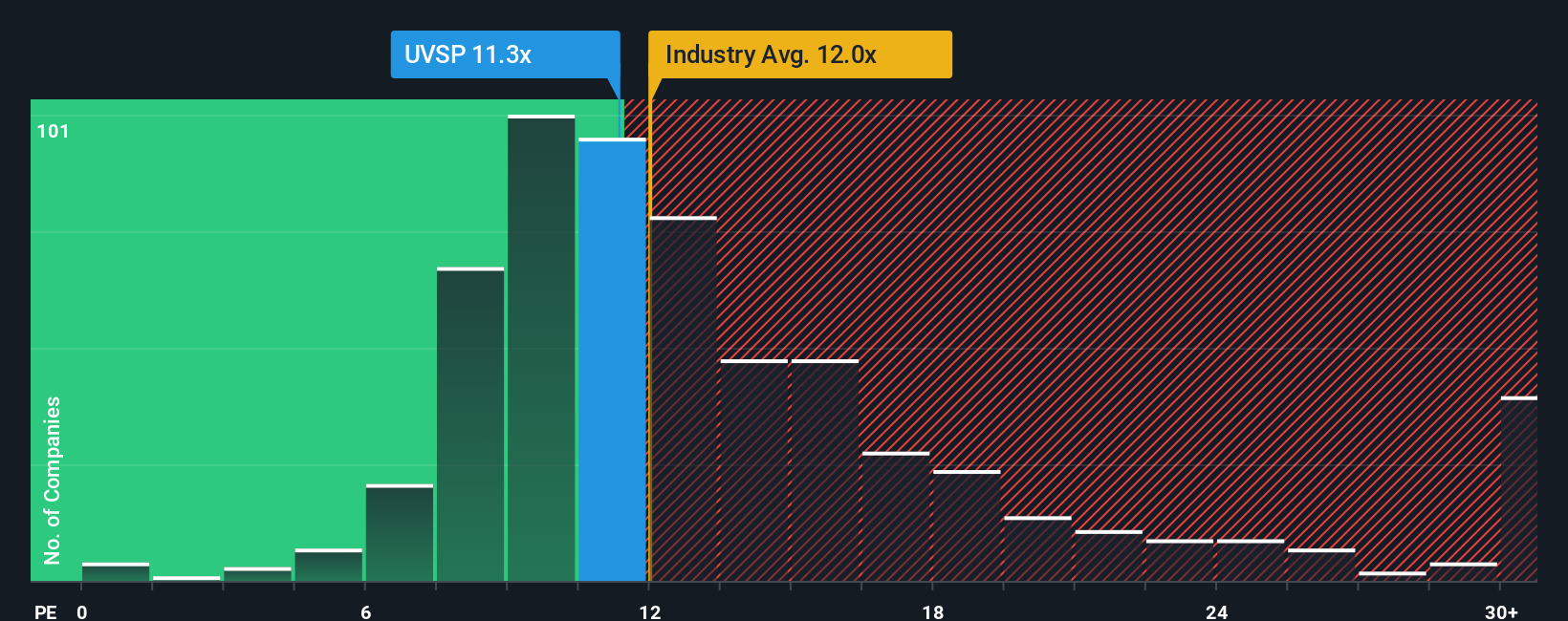

On earnings, Univest looks much cheaper, trading on 11.4 times profits versus peer banks at 22.6 times, even if the fair ratio points closer to 10.3 times. That mix of apparent discount and fair ratio caution leaves a tricky question: is this mispricing or justified risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Univest Financial Narrative

If this perspective does not quite match your own or you prefer to dig into the numbers yourself, you can craft a personal view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Univest Financial.

Looking for more investment ideas?

Act now to broaden your edge beyond Univest, and use the Simply Wall St Screener to uncover focused opportunities other investors may be overlooking today.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that could bolster your portfolio with reliable cash flows and potential long term resilience.

- Capitalize on innovation by assessing these 26 AI penny stocks that may be reshaping entire industries with rapid advances in automation and intelligent software.

- Position for future disruptions by evaluating these 27 quantum computing stocks that might benefit as quantum technology moves from concept to commercial reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UVSP

Univest Financial

Operates as the bank holding company for Univest Bank and Trust Co.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)