- United States

- /

- Banks

- /

- NasdaqGS:TCBI

If EPS Growth Is Important To You, Texas Capital Bancshares (NASDAQ:TCBI) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Texas Capital Bancshares (NASDAQ:TCBI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Texas Capital Bancshares

Texas Capital Bancshares' Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. To the delight of shareholders, Texas Capital Bancshares' EPS soared from US$4.65 to US$6.54, over the last year. That's a impressive gain of 41%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Texas Capital Bancshares' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Texas Capital Bancshares maintained stable EBIT margins over the last year, all while growing revenue 24% to US$1.2b. That's progress.

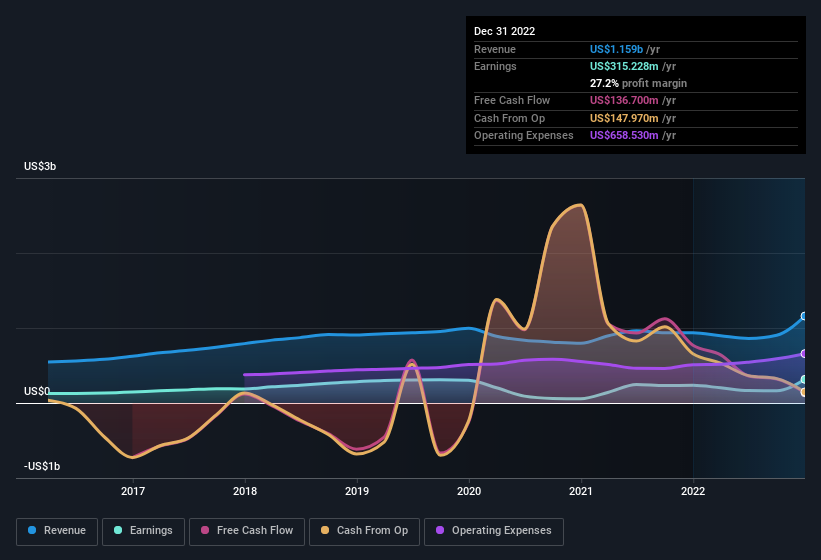

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Texas Capital Bancshares?

Are Texas Capital Bancshares Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent US$8.6m buying Texas Capital Bancshares shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Independent Director Robert Stallings who made the biggest single purchase, worth US$2.4m, paying US$56.57 per share.

The good news, alongside the insider buying, for Texas Capital Bancshares bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$32m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 1.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Texas Capital Bancshares Deserve A Spot On Your Watchlist?

For growth investors, Texas Capital Bancshares' raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 1 warning sign for Texas Capital Bancshares that we have uncovered.

The good news is that Texas Capital Bancshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Texas Capital Bancshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Capital Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TCBI

Texas Capital Bancshares

Operates as the bank holding company for Texas Capital Bank, is a full-service financial services firm that delivers customized solutions to businesses, entrepreneurs, and individual customers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives