- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GLBE

3 US Stocks Estimated To Be Up To 29.2% Undervalued Offering A Strategic Opportunity

Reviewed by Simply Wall St

As the U.S. stock market takes a pause following a post-election rally that pushed major indices to record highs, investors are keenly observing opportunities amid fluctuating conditions. In this environment, identifying undervalued stocks can offer strategic advantages, as these equities may present potential for growth when the broader market stabilizes or advances further.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.53 | $99.93 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | $125.81 | $245.91 | 48.8% |

| Synovus Financial (NYSE:SNV) | $58.27 | $115.23 | 49.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.82 | $63.93 | 48.7% |

| Datadog (NasdaqGS:DDOG) | $123.41 | $243.63 | 49.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.02 | $46.86 | 48.7% |

| Pinterest (NYSE:PINS) | $30.67 | $59.54 | 48.5% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $114.29 | $219.49 | 47.9% |

| LifeMD (NasdaqGM:LFMD) | $7.16 | $14.15 | 49.4% |

| Clearfield (NasdaqGM:CLFD) | $33.02 | $64.85 | 49.1% |

We'll examine a selection from our screener results.

Global-E Online (NasdaqGS:GLBE)

Overview: Global-E Online Ltd. offers a platform that facilitates and speeds up direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and other international markets, with a market cap of approximately $6.71 billion.

Operations: The company generates revenue of $507.01 million from its Internet Information Providers segment.

Estimated Discount To Fair Value: 16.2%

Global-E Online, trading at US$42.53, is considered undervalued with an estimated fair value of US$50.76, presenting a 16.2% discount based on discounted cash flow analysis. Despite recent lowered earnings guidance for 2024 and ongoing losses, the company shows promising revenue growth forecasts of 24.2% annually—outpacing the broader market—and aims to achieve profitability within three years, reflecting potential long-term value despite current challenges.

- The growth report we've compiled suggests that Global-E Online's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Global-E Online stock in this financial health report.

Texas Capital Bancshares (NasdaqGS:TCBI)

Overview: Texas Capital Bancshares, Inc. is the bank holding company for Texas Capital Bank, offering full-service financial solutions to businesses, entrepreneurs, and individual customers with a market cap of $4.06 billion.

Operations: The company's revenue segment includes Banking, which generated $826.52 million.

Estimated Discount To Fair Value: 19.6%

Texas Capital Bancshares, trading at US$89, is undervalued with an estimated fair value of US$110.72. Despite a recent net loss of US$61.32 million for Q3 2024 and reduced profit margins from last year, its earnings are forecast to grow significantly at 90.8% per year over the next three years—surpassing the broader market's growth rate. However, challenges persist with lower-than-expected return on equity forecasts and no recent share buybacks completed this quarter.

- Insights from our recent growth report point to a promising forecast for Texas Capital Bancshares' business outlook.

- Get an in-depth perspective on Texas Capital Bancshares' balance sheet by reading our health report here.

ServisFirst Bancshares (NYSE:SFBS)

Overview: ServisFirst Bancshares, Inc. is a bank holding company for ServisFirst Bank, offering a range of banking services to individual and corporate clients, with a market cap of approximately $5.39 billion.

Operations: The company's revenue is primarily generated from its Business and Personal Financial Services segment, which accounts for $426.98 million.

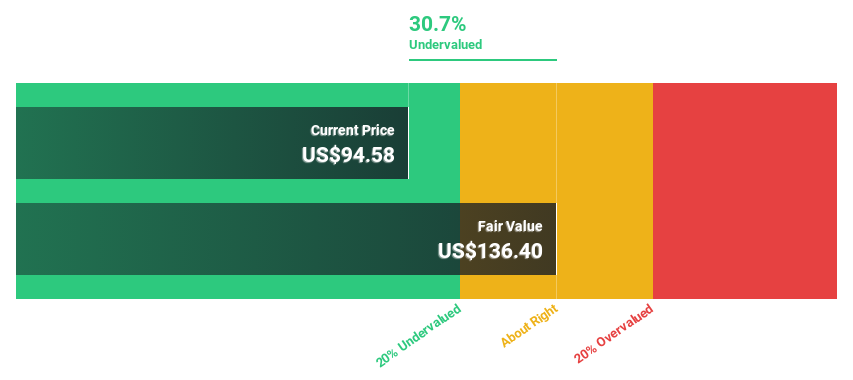

Estimated Discount To Fair Value: 29.2%

ServisFirst Bancshares, trading at US$96.61, is undervalued with a fair value estimate of US$136.4. Despite significant insider selling recently and CFO changes, the company shows strong fundamentals with net interest income rising to US$115.12 million in Q3 2024 from US$99.7 million a year ago. Earnings are forecast to grow significantly at 21.3% annually, outpacing the broader market's growth rate and supporting its undervaluation based on cash flows analysis.

- Our growth report here indicates ServisFirst Bancshares may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of ServisFirst Bancshares.

Turning Ideas Into Actions

- Discover the full array of 192 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLBE

Global-E Online

Provides a platform to enable and accelerate direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and internationally.

Flawless balance sheet with high growth potential.