- United States

- /

- Biotech

- /

- NasdaqCM:ESLA

Spotlight On US Penny Stocks: Estrella Immunopharma And Two Others To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with major indices slipping ahead of anticipated comments from Federal Reserve Chair Jerome Powell, investors are keenly observing potential opportunities. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing possibilities for those willing to explore smaller or newer companies with growth potential. By focusing on strong financials and solid fundamentals, these stocks can present affordable entry points into promising ventures in today's dynamic market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81915 | $6.09M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.52M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $1.50 | $81.55M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.40 | $125.19M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $72.53M | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2482 | $9.05M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.22 | $54.16M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9278 | $87.69M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Estrella Immunopharma (NasdaqCM:ESLA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Estrella Immunopharma, Inc. is a clinical-stage biopharmaceutical company focused on developing T-cell therapies for blood cancers and solid tumors in the United States, with a market cap of $28.84 million.

Operations: Currently, Estrella Immunopharma does not report any revenue segments.

Market Cap: $28.84M

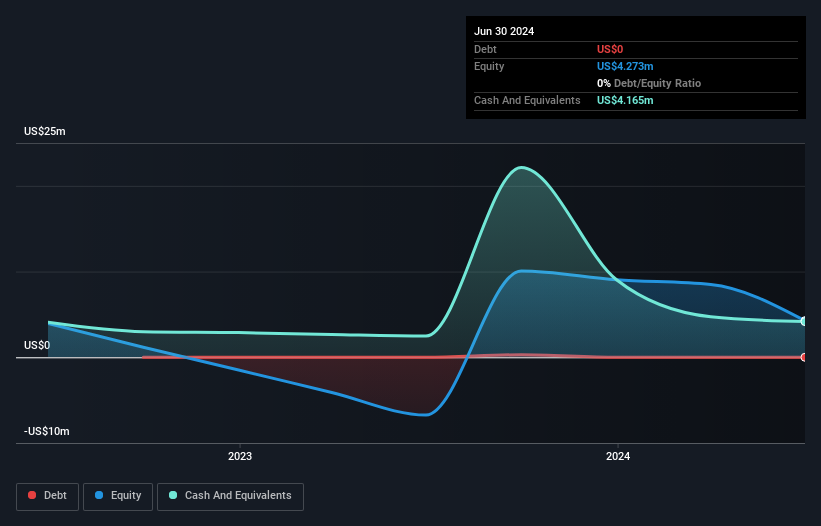

Estrella Immunopharma, Inc., a clinical-stage biopharmaceutical company with a market cap of US$28.84 million, remains pre-revenue as it focuses on developing T-cell therapies. Recent news highlights the promising complete response in its STARLIGHT-1 Phase I/II trial without serious adverse events, marking potential progress in its pipeline. However, financial challenges are evident with less than a year of cash runway and ongoing unprofitability. The company's debt-free status is positive, but shareholder dilution and high share price volatility pose risks. Leadership changes bring experienced strategic oversight but may also indicate transitional phases within the company’s governance structure.

- Unlock comprehensive insights into our analysis of Estrella Immunopharma stock in this financial health report.

- Examine Estrella Immunopharma's past performance report to understand how it has performed in prior years.

Sono-Tek (NasdaqCM:SOTK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sono-Tek Corporation designs and manufactures ultrasonic coating systems for various industries worldwide, including microelectronics, alternative energy, and medical sectors, with a market cap of $68.52 million.

Operations: The company's revenue is distributed across several regions, with $11.90 million from the United States and Canada, $5.13 million from Europe, the Middle East, and Asia (EMEA), $3.04 million from the Asia Pacific (APAC), and $0.58 million from Latin America.

Market Cap: $68.52M

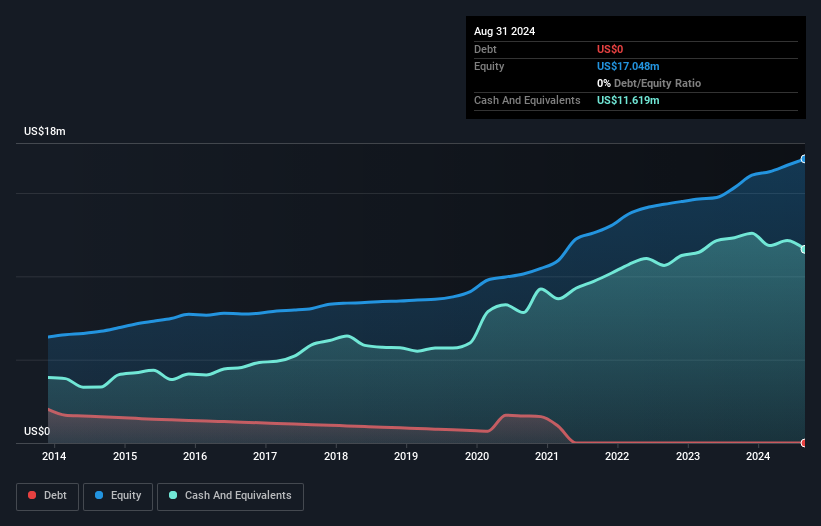

Sono-Tek Corporation, with a market cap of US$68.52 million, is actively engaging in strategic financial maneuvers like a US$2 million share repurchase program funded by existing cash and future cash flows. Recent earnings show mixed results; second-quarter sales declined to US$5.16 million from the previous year, though six-month figures rose to US$10.19 million. The company remains debt-free and maintains strong short-term asset coverage over liabilities, while its net profit margin improved to 7.4%. Despite these positives, earnings are forecasted to decline by 3.4% annually over the next three years, suggesting potential challenges ahead.

- Dive into the specifics of Sono-Tek here with our thorough balance sheet health report.

- Assess Sono-Tek's future earnings estimates with our detailed growth reports.

Koil Energy Solutions (OTCPK:KLNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Koil Energy Solutions, Inc. is an energy services company that offers equipment and support services to the energy and offshore industries, with a market cap of $19.82 million.

Operations: The company generates revenue of $20.80 million from its Oil Well Equipment & Services segment.

Market Cap: $19.82M

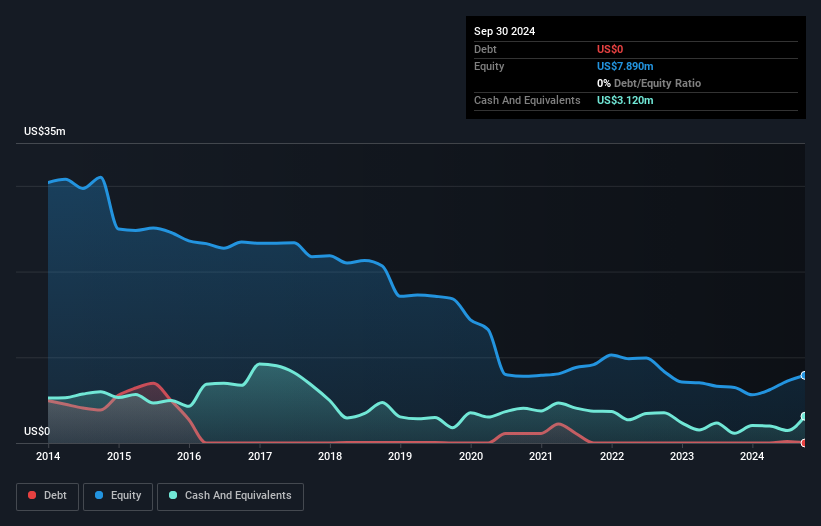

Koil Energy Solutions, with a market cap of US$19.82 million, has shown significant earnings growth, reporting net income of US$0.523 million for Q3 2024 compared to a loss the previous year. The company’s profitability is supported by its recent contract wins in offshore maintenance services, highlighting its expertise in subsea projects. Despite shareholder dilution over the past year and high share price volatility, Koil's financial health appears stable with short-term assets exceeding both short- and long-term liabilities. The company benefits from being debt-free and maintaining high-quality earnings amidst a volatile market environment.

- Click to explore a detailed breakdown of our findings in Koil Energy Solutions' financial health report.

- Explore historical data to track Koil Energy Solutions' performance over time in our past results report.

Turning Ideas Into Actions

- Embark on your investment journey to our 738 US Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Estrella Immunopharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Estrella Immunopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESLA

Estrella Immunopharma

A clinical-stage biopharmaceutical company, develops T-cell therapies for blood cancers and solid tumors in the United States.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives