- United States

- /

- Banks

- /

- NYSEAM:TMP

US Undiscovered Gems to Watch in November 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of volatility, with major indices experiencing significant swings driven by tech sector fluctuations and mixed economic indicators, investors are keenly observing how these dynamics impact small-cap stocks. Amidst this backdrop, identifying undiscovered gems in the small-cap segment requires a focus on companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hingham Institution for Savings (HIFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hingham Institution for Savings offers a range of financial services to individuals and small businesses in the United States, with a market capitalization of $595.46 million.

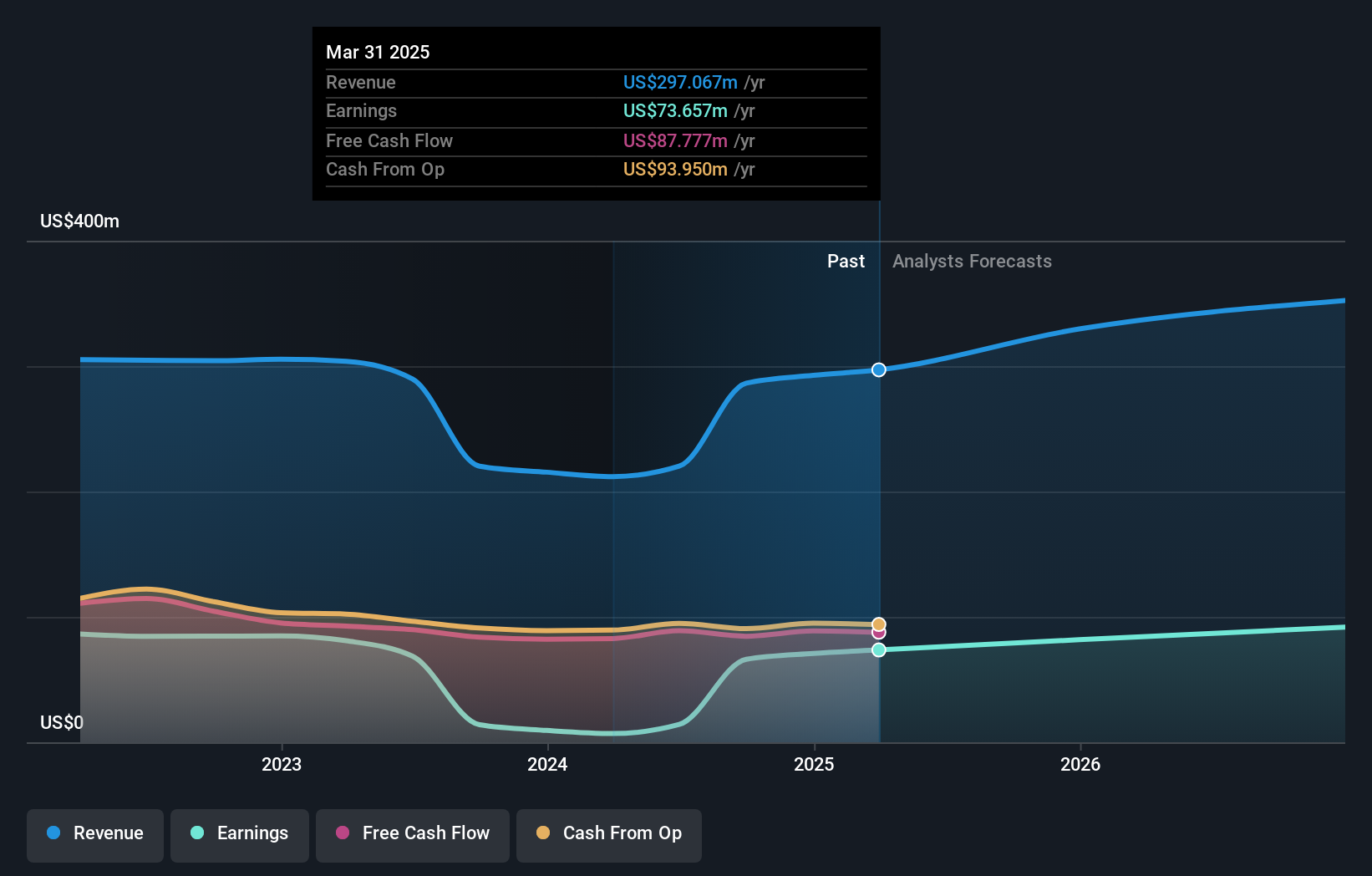

Operations: Hingham Institution for Savings generates revenue primarily through its financial services, totaling $90.53 million.

Hingham Institution for Savings, a relatively small player with total assets of US$4.5 billion, showcases a strong performance with its earnings surging 95.4% over the past year, outpacing the industry average of 18.1%. Despite a low allowance for bad loans at 87%, its non-performing loans remain appropriate at 0.8% of total loans, reflecting prudent risk management. The bank's liabilities are primarily funded by customer deposits (61%), indicating stability in funding sources. With a price-to-earnings ratio of 13.2x, lower than the US market average, HIFS seems attractively valued given its recent financial achievements and solid foundation.

- Click to explore a detailed breakdown of our findings in Hingham Institution for Savings' health report.

Understand Hingham Institution for Savings' track record by examining our Past report.

1st Source (SRCE)

Simply Wall St Value Rating: ★★★★★★

Overview: 1st Source Corporation is a bank holding company for 1st Source Bank, offering commercial and consumer banking services, trust and wealth advisory services, and insurance products to clients in the United States with a market cap of $1.52 billion.

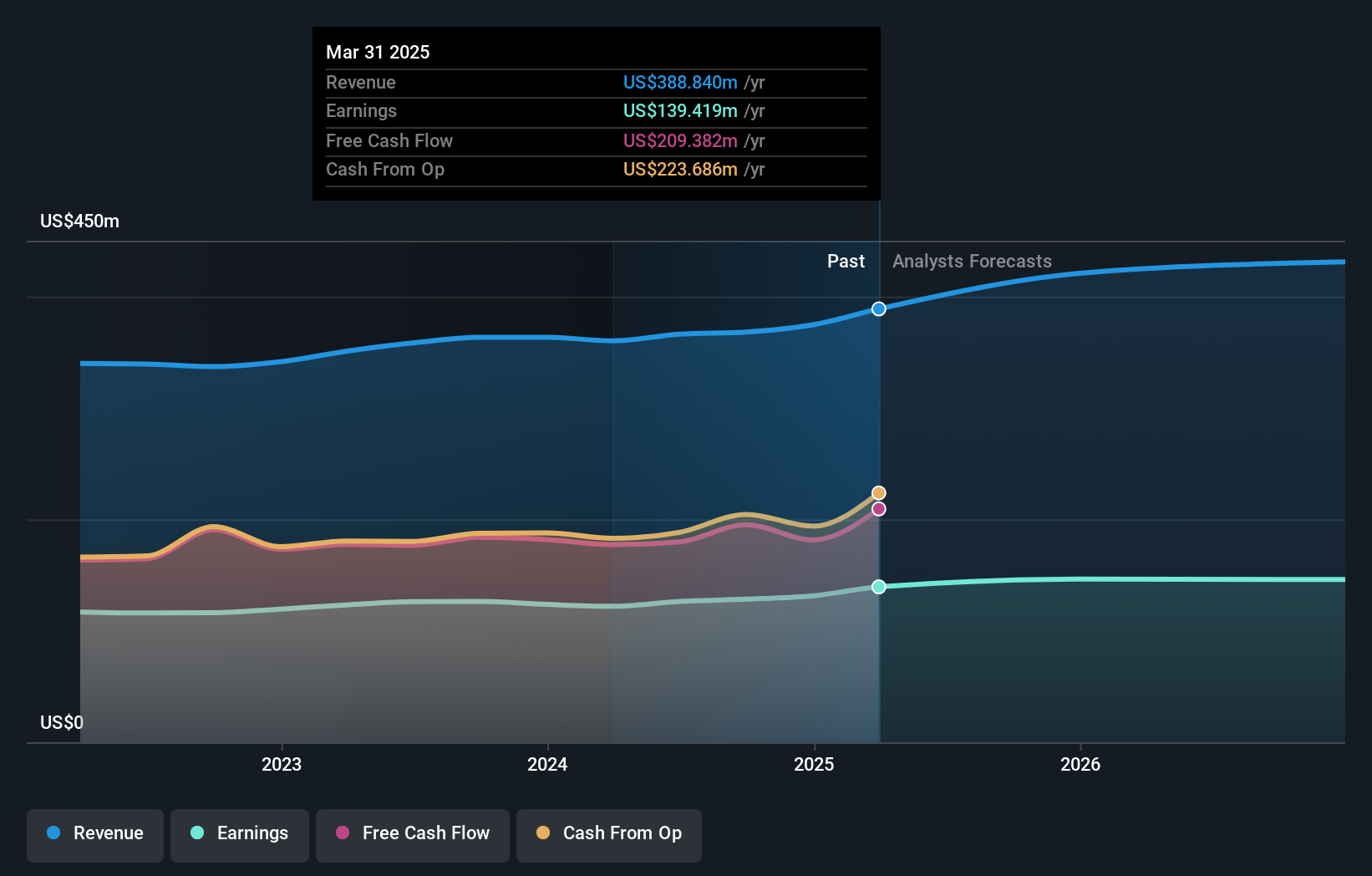

Operations: 1st Source derives its revenue primarily from commercial banking, generating $405.36 million. The company's market cap stands at approximately $1.52 billion.

With total assets of US$9.1 billion and equity standing at US$1.3 billion, 1st Source demonstrates a strong financial footing, bolstered by deposits totaling US$7.4 billion and loans amounting to US$6.8 billion. The bank's net interest margin is 3.6%, while its allowance for bad loans is a robust 0.9% of total loans, indicating prudent risk management practices with an allowance coverage of 258%. Recent activities include repurchasing shares worth US$6.32 million in the last quarter and increasing dividends to $0.40 per share, reflecting confidence in its continued stability and growth potential despite executive changes on the horizon.

- Get an in-depth perspective on 1st Source's performance by reading our health report here.

Gain insights into 1st Source's past trends and performance with our Past report.

Tompkins Financial (TMP)

Simply Wall St Value Rating: ★★★★★★

Overview: Tompkins Financial Corporation is a financial holding company offering services such as commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance, with a market cap of approximately $984.40 million.

Operations: Tompkins Financial generates revenue primarily from its banking segment, contributing $256.50 million, followed by insurance services at $41.62 million and wealth management at $21.01 million.

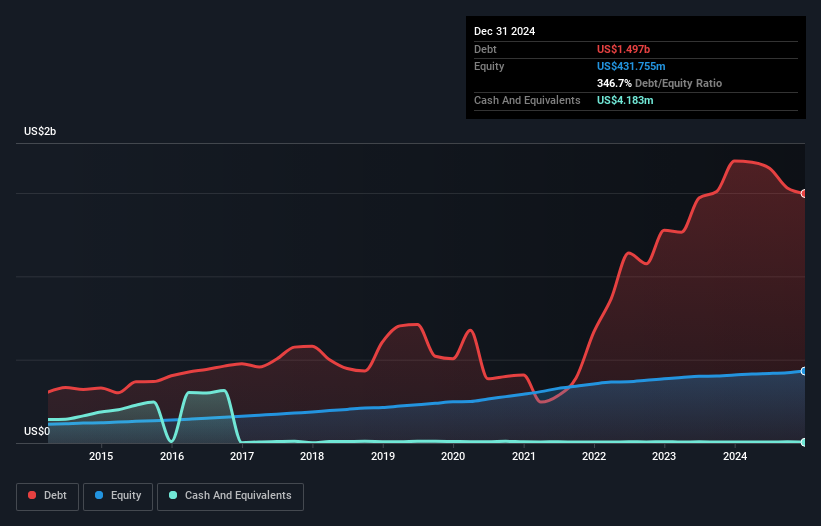

Tompkins Financial, with assets of US$8.5 billion and equity of US$788.8 million, has showcased robust performance in recent times. Its earnings grew by 27.6% over the past year, surpassing the banks industry average of 18.1%. The company trades at a good value, being 23.7% below its estimated fair value and maintains high-quality earnings with primarily low-risk funding sources—92% from customer deposits. Tompkins also has a sufficient allowance for bad loans at 113%, ensuring stability in its loan portfolio while keeping non-performing loans at an appropriate level of 0.8%.

- Delve into the full analysis health report here for a deeper understanding of Tompkins Financial.

Evaluate Tompkins Financial's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 294 more companies for you to explore.Click here to unveil our expertly curated list of 297 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tompkins Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TMP

Tompkins Financial

A financial holding company, provides commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives