- United States

- /

- Banks

- /

- NasdaqCM:FMNB

Farmers National Banc And 2 Other High Yield Dividend Stocks In The US

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating major indices, with the S&P 500 and Nasdaq Composite showing recent declines, investors are navigating through a complex landscape marked by significant tech stock volatility and anticipations of Federal Reserve rate cuts. In such an environment, high-yield dividend stocks like Farmers National Banc present an appealing option for those seeking more stable returns in uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.95% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 5.32% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.87% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.13% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.52% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.77% | ★★★★★★ |

| OTC Markets Group (OTCPK:OTCM) | 4.53% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★☆ |

| Marine Products (NYSE:MPX) | 5.36% | ★★★★★☆ |

| Union Bankshares (NasdaqGM:UNB) | 5.98% | ★★★★★☆ |

Click here to see the full list of 168 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

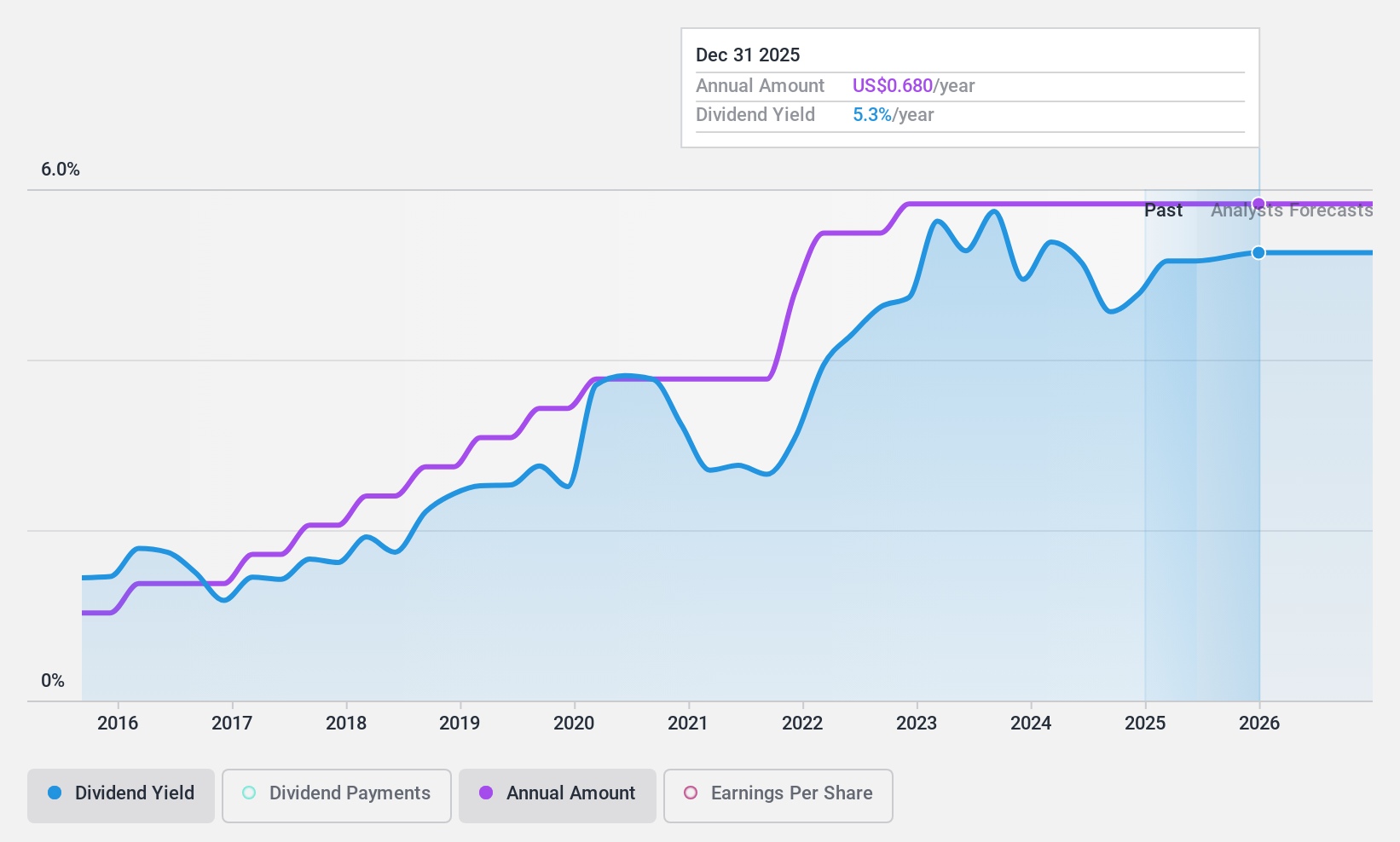

Farmers National Banc (NasdaqCM:FMNB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Farmers National Banc Corp., with a market cap of $559.12 million, operates as a bank holding company for The Farmers National Bank of Canfield, offering services in banking, trust, retirement consulting, insurance, and financial management.

Operations: Farmers National Banc Corp. generates its revenues through diverse financial services including banking, trust services, retirement consulting, insurance, and financial management.

Dividend Yield: 4.2%

Farmers National Banc recently reported a drop in net interest income and net income for Q2 2024, with earnings per share also decreasing from the previous year. Despite this downturn, the company has maintained a stable dividend payout of US$0.17 per share and continues to uphold its reputation for reliable dividends over the past decade. Trading at 47.8% below estimated fair value and with a low payout ratio of 49.8%, FMNB's dividends appear well-covered by earnings, although its yield of 4.23% is slightly below the top quartile for U.S dividend stocks.

- Dive into the specifics of Farmers National Banc here with our thorough dividend report.

- According our valuation report, there's an indication that Farmers National Banc's share price might be on the expensive side.

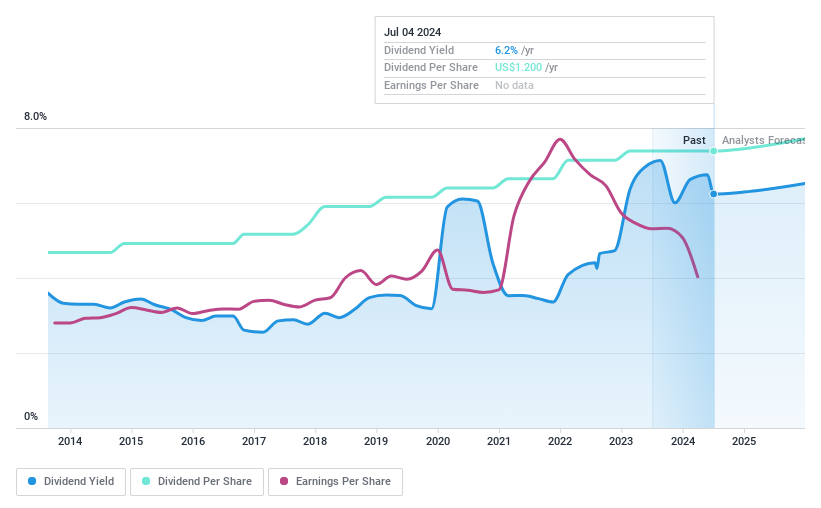

Financial Institutions (NasdaqGS:FISI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Institutions, Inc., functioning through its subsidiary Five Star Bank, offers banking and financial services in New York, with a market capitalization of approximately $367.02 million.

Operations: Financial Institutions, Inc. generates its revenue primarily through its banking segment, which accounted for $196.23 million.

Dividend Yield: 4.9%

Financial Institutions, Inc. has demonstrated a consistent commitment to dividends, with a 4.87% yield placing it in the top 25% of U.S dividend payers. Recent earnings show robust growth, with net income for Q2 2024 significantly higher year-over-year at US$25.63 million. The company's payout ratio stands at a manageable 47.6%, indicating that dividends are well-covered by earnings despite recent executive board changes and stable past dividend payments over the last decade suggest reliability in returning value to shareholders.

- Click here to discover the nuances of Financial Institutions with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Financial Institutions shares in the market.

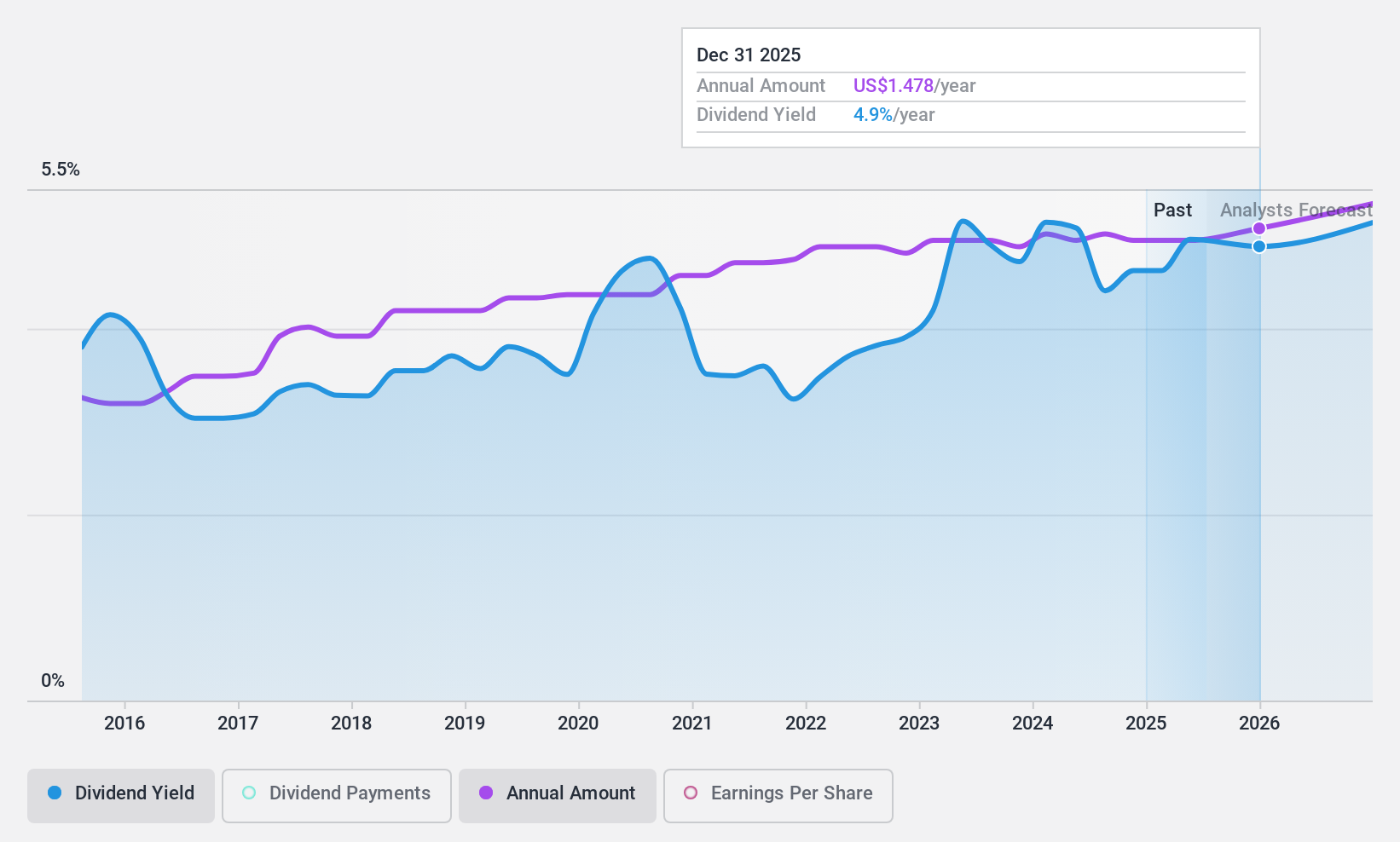

Southside Bancshares (NasdaqGS:SBSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southside Bancshares, Inc., functioning as the holding company for Southside Bank, offers various financial services to individuals, businesses, municipal entities, and nonprofit organizations with a market capitalization of approximately $956.85 million.

Operations: Southside Bancshares, Inc. generates its revenue primarily through banking services, amounting to $239.30 million.

Dividend Yield: 4.2%

Southside Bancshares has maintained a stable dividend over the last decade, with a current yield of 4.24%, slightly below the top quartile of U.S. dividend stocks. The dividends are well-supported by earnings, given a reasonable payout ratio of 52.2%. Recent leadership changes, including Keith Donahoe's appointment as President, could influence future strategic directions. Despite trading at 51.5% below its estimated fair value, questions remain about long-term dividend sustainability without more data on future coverage.

- Get an in-depth perspective on Southside Bancshares' performance by reading our dividend report here.

- Our valuation report unveils the possibility Southside Bancshares' shares may be trading at a premium.

Key Takeaways

- Click here to access our complete index of 168 Top US Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FMNB

Farmers National Banc

Operates as a bank holding company for The Farmers National Bank of Canfield engages in the banking, trust, retirement consulting, insurance, and financial management businesses.

Flawless balance sheet, undervalued and pays a dividend.