🇺🇸 The US Market’s ‘Exceptionalism’ Premium

Reviewed by Bailey Pemberton, Michael Paige

Quote of the Week: “Risk more than others think is safe. Dream more than others think is practical.” – Howard Schultz

You have probably noticed that US market volatility has increased. There are also several indications that the economy may be entering a recession at a time when US stocks are trading at a premium to many other markets.

You might be wondering whether it’s time to switch to other markets, many of which are trading at lower valuations. Hopefully, after this piece, you’ll know what works for you.

This week, we are taking a look at the US market’s premium valuation and whether it might be justified, as many believe. Next week, we'll follow up with some thoughts on global diversification.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🏠 Housing accounted for 70% of US consumer inflation over the last 12 months ( Bankrate )

- What’s our take?

- High interest rates won’t solve a housing shortage.

- Consumer price inflation fell to 2.5% in August, the lowest level since February 2021. The bad news was that the shelter component of the index rose during the month, and shows the cost of housing rising 5.2% in the US over the last year. That means 70% of the rise in prices over 12 months can be explained by shelter. There are two slightly absurd aspects to this:

- Firstly, a major component of shelter prices is Owners’ Equivalent Rent (OER). This is an estimate of the amount a homeowner would pay if they were renting the property they own and live in. This component of inflation is based on estimates rather than actual data.

- Secondly, central banks use higher interest rates to combat inflation by reducing demand. That makes sense when it comes to discretionary purchases. It doesn’t make a lot of sense when rising accommodation costs are the result of a shortage of accommodation. Maybe central bankers should add home building to their arsenal of tools.

🛍️ America’s Dollar Stores Margins Are Temu’s Opportunity ( FT )

- What’s our take?

- They’ll be happy to hear about Temu's new business strategy - but local competition is also increasing.

- Discount stores like Dollar General and Dollar Tree have been having a tough time lately, and both slashed guidance when they released second-quarter financials. PDD’s Temu is one of the reasons for this, as the low-cost online retailer continues to sign up new customers in North America and Europe.

- Interestingly, PDD is planning to change tack and focus on premium brands, which would make it less of a threat to those dollar stores. Unfortunately for those stores, Amazon is setting up its own discount online store, while Walmart and Target are expanding their online efforts. As Jeff Bezos said, “Your margin is my opportunity”. That’s gotta sting when you have razor-thin margins to start with.

🍎 Apple Announces New iPhones, Watches, AirPods, AI Features and More ( CNBC )

- What’s our take?

- Some announcements raised eyebrows, but most others were expected. The new iPhone lineup has improved cameras, functionality and of course, plenty of features from Apple Intelligence (when iOS 18 comes out and depending on which region you’re in - sorry Europe and Asia!). Apple Watch is now thinner, with a bigger display and better performance, while Airpod Pros Max simply got new colors and USB-C cables. The more interesting announcements were the health features on the Apple Watch and AirPods. Apple Watch can now detect and notify if the wearer has sleep apnea, and the AirPods Pro 2 can become a clinical-grade hearing aid (both pending FDA clearance).

- Regardless, Apple will be hoping that the products from this event will be enough to maintain or spur sales growth, but the only marginal improvements make us cautious as to whether that will actually occur.

🏢 Commercial Real Estate Loan Delinquencies Reaccelerate As Loan Growth Slows ( S&P Global )

- What’s our take?

- Refinancing against impaired assets is a whole lot harder when interest rates are higher.

- Borrowers in the commercial real estate (CRE) space are facing pressure as their loans mature in this higher interest rate environment compared to when they were created.

- The research says that the issue remains concentrated in offices where vacancy has soared while property values have plummeted.

- There are trillions of CRE loans maturing in the next few years. S&P Global found that $950bn worth of CRE loans are due to mature in 2024, followed by $1trn in 2025, $1.15trn in 2026 and peaking at $1.26trn in 2027.

- Smaller US banks are the ones with the most exposure here as a % of their book, but that doesn’t mean the big banks aren’t exposed.

- The most promising sign on the horizon is the fact that the Fed is beginning to ease monetary policy given it’s happy with where inflation is heading, and the jobs market is weakening.

- If you’re investing in a bank, check their exposure to CRE in their filings, especially office real estate and make sure that as a percentage of their total book, it’s not too much.

🇪🇺 Europe Looks Across The Atlantic For Economic Inspiration ( Axios )

- What’s our take?

- When your neighbor has greener grass, it pays to see what they’re doing.

- Europe is experiencing some shortcomings with its economy, and the European Commission asked Mario Draghi (former Italian president and former European central banker) for advice.

- He came back with over 300 pages of findings and used the US as a key example of what Europe should try to emulate for economic growth to have a chance.

- A few of the areas that he cites as highly important are innovation, dynamism, trade and demographics.

- While every country has its pros and cons, what matters for economic growth is getting a few key things right, and not getting in the way.

💵 Is An ‘Exceptionalism’ Premium Justified For US Equities?

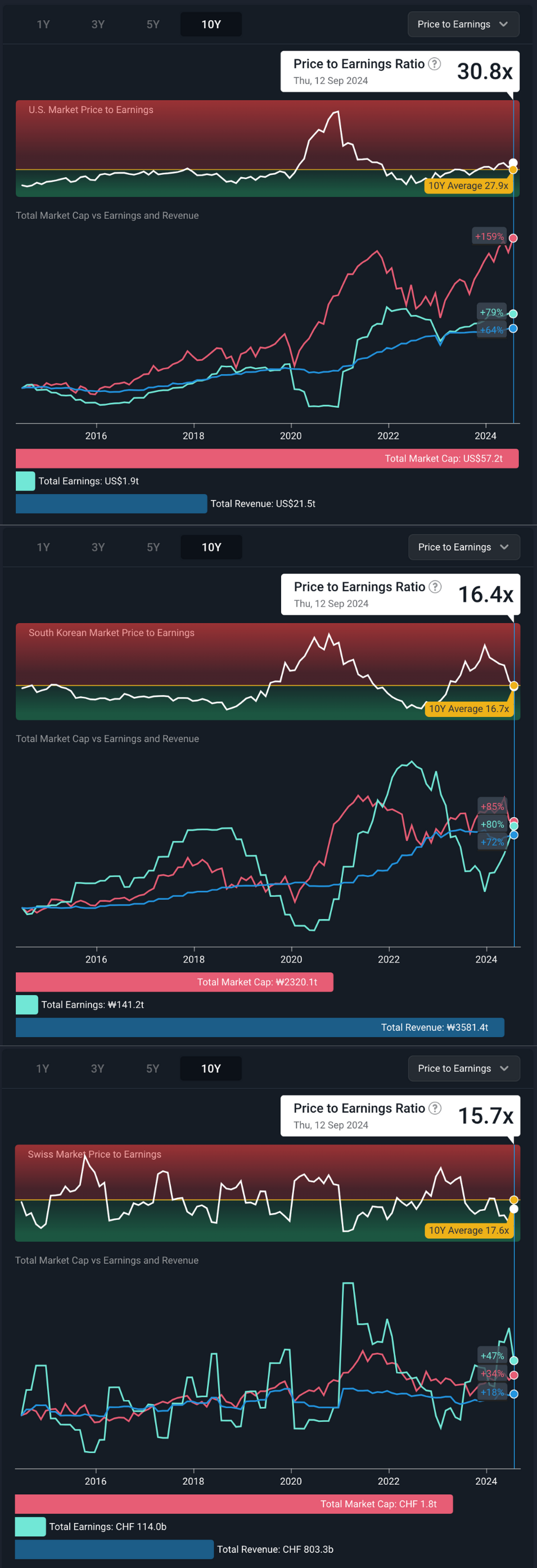

The US market is trading at around 30x earnings, which is a little higher than the 10-year average. It’s also a lot higher than most countries and nearly twice the current multiple for markets like the UK, Switzerland and South Korea. Companies in those markets have a much lower bar to achieve to justify their valuations or re-rate to higher valuations.

✨ Some analysts believe US stocks, particularly large caps, deserve to trade at a premium. After all, this is the country that’s produced over 90% of the 50 most profitable companies in the world. While Silicon Valley has produced most of those companies, US companies also lead in nearly every other sector.

So, why is it that so many of the most innovative and profitable companies are based in America?

Here are some reasons.

♾️ The Virtuous Cycle Of Investment And Innovation

The emergence of numerous innovative companies is often attributed to culture and attributes, things like entrepreneurial spirit and the propensity to take risks. But there’s also a virtuous cycle that ensures that capital and entrepreneurs keep finding one another.

The cycle goes something like this:

- 📈 Markets with innovative, profitable and growing companies attract investors ,

- 💸 Thus making more capital available to companies and lowering the cost of capital,

- 👷 Which attracts more companies , ambitious entrepreneurs, and skilled workers,

- 📊 And leads to more innovation, productivity and earnings growth ,

- 💰 Which attracts more investment capital - and so the cycle repeats.

✨ For this virtuous cycle to occur, the right environment needs to exist. Just like a plant won’t grow well if its environment isn’t supportive (soil, sunlight, water, etc), businesses need the right environment to thrive too.

Some of the key catalysts for the right type of business environment include:

- 🚓 Respect for property rights and the rule of law.

- 🧾 Respected accounting standards , listing requirements and transparency.

- 🧑💼 Corporate governance standards that favor the rights of shareholders .

- 🧑⚖️ Low levels of bureaucracy .

- ❌ Low levels of corruption .

- 🏦 An independent central bank that is free to pursue sound monetary policy. This helps to ensure a stable currency.

- ⚖️ An independent judiciary that is free of political interference.

- 🪙 Economic policies that are receptive to foreign investment .

- 💰 Competitive tax rates .

Most countries probably fall short on quite a few of these points - but it's all relative.

Capital tends to flow to countries that score higher on a relative basis. Incidentally, the Freedom 100 Emerging Markets ETF uses these factors and others to allocate its portfolio across 24 emerging markets. You can check out the methodology here.

✨ America isn’t the only country that ticks a lot of the above boxes. Switzerland, the UK, Singapore and Hong Kong have also become financial centers over the last 100 years.

The cycle of investment and innovation also acts like a set of network effects, which means the benefits compound as scale increases. America’s size has therefore helped it become a seemingly unstoppable force when it comes to innovation and productivity growth.

London isn’t the financial center it once was, but network effects have helped it remain the most important center for the global mining industry. Switzerland is still a major center for the banking industry and several large multinational companies for similar reasons.

📈 The Pipeline Of Value Creation

With the right corporate environment in place, the US has produced a long list of incredible companies over the last 150 years, from General Electric to IBM, Intel, and more recently the ‘magnificent seven’.

Most of the companies that dominated more than 50 years ago are no longer on top, in fact, many have become ‘mega-underperformers’. But, if you were invested in the S&P 500 index, you would have still done very well because the underperformers were replaced by a pipeline of even bigger and more profitable companies.

✨ So, as long as the US has the right corporate environment in place and a pipeline of emerging innovative companies, it could continue to outperform other markets when it comes to earnings growth.

💸 What Do Premium Valuations Mean For Returns?

If you had to pick a stock to hold for one or two years, you would probably look at the immediate outlook for earnings. If you had to pick a stock to hold for ten years, you would probably place more weight on things like competitive advantage, the track record of the management team and the strength of the balance sheet. That’s why investors pay a premium for companies that are regarded as ‘high quality’.

The same applies to each stock market. Investors pay a premium to invest in markets where they would be happy to have their cash tied up for longer periods. As long as global investors believe the US market can outperform, it’s likely to trade at a premium.

All that this means is that we shouldn’t assume that a market trading on a higher valuation will underperform a market trading on a lower valuation. But valuations can still re-rate if or when the outlook changes.

Looking at the more immediate situation, there are a few key factors to consider:

- 🤖 The ‘AI trade’: The question here is whether momentum slows before the investments being made in compute power begin to deliver earnings growth.

- 🔁 Sector rotation: If the AI trade does unwind, it is possible that rotation into other sectors makes up for underperformance from the AI-related companies. The Magnificent 7 plus Broadcom (which is now a sizable part of that group), accounts for about 28% of the US market value. So the other sectors might have to do quite a lot of heavy lifting to keep the current premium in place.

- 💹 Re-rating in other markets: If the outlook improves in other markets, they really could start to look more attractive on a relative basis.

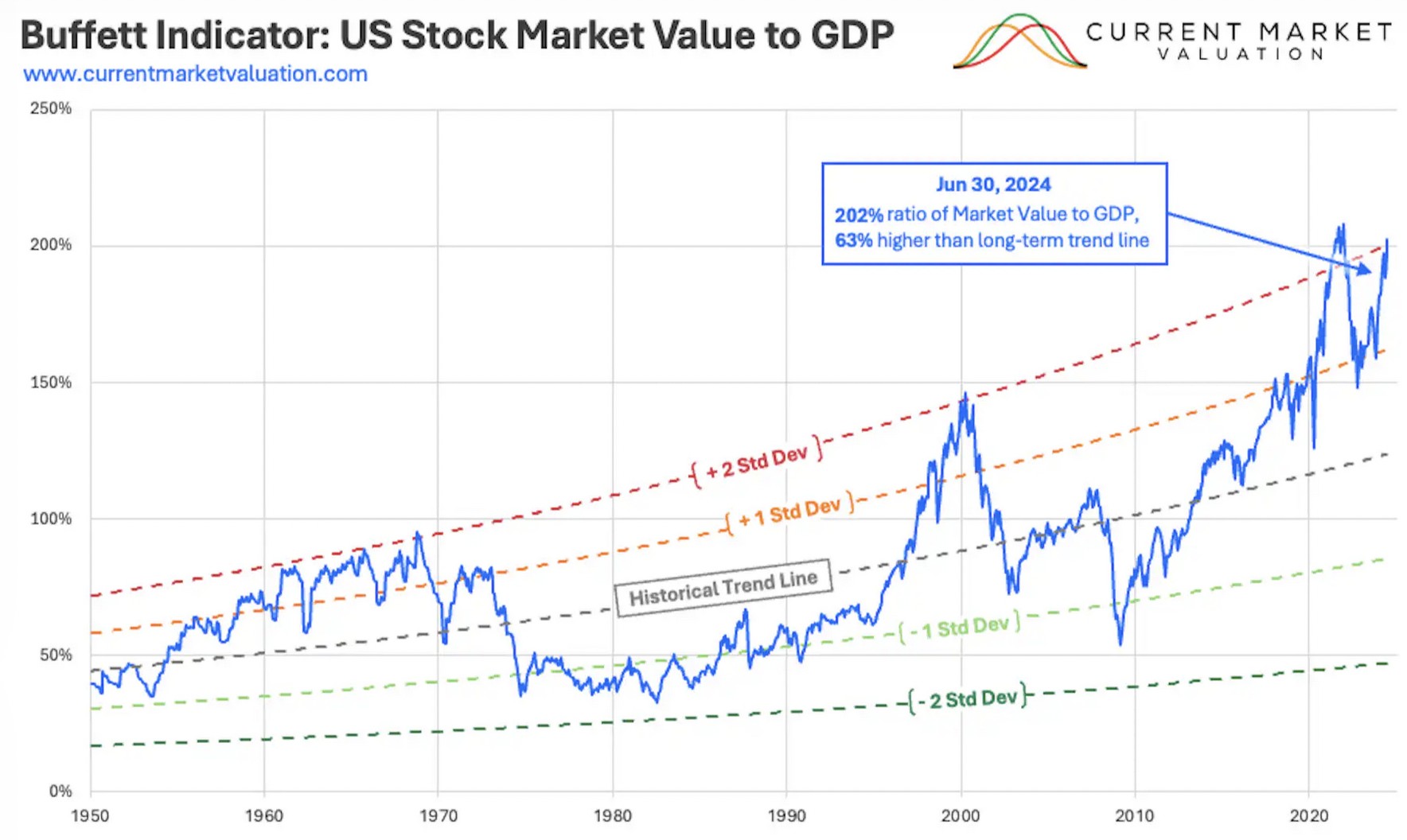

Another metric that puts the valuation of a market in context is the so-called Buffett Indicator. This indicator expresses the total value of a stock market as a percentage of annual GDP.

The average ratio varies widely from one market to the next, so it’s only really useful when compared to the historical ratio for the same market.

As you can see, it’s high by most measures. But the long-term trend is also rising, and it has stayed at elevated levels for long periods of time. Nevertheless, it does suggest the potential for a significant re-rating.

The US market could simply remain at a premium, or earnings growth could catch up with the current valuation. But, given the current set-up, some global diversification probably makes sense for most investors.

✨ Next week, we will take a look at some of the ways investors can approach global diversification, as well as the pros and cons of home-country bias.

💡 The Insight: Your Stock Returns Are Determined By Three Important Numbers

Okay, strictly speaking, dividends also factor into the return, but when it comes to price appreciation your returns come down to:

- the price multiple you pay for the share,

- the EPS growth that follows, and

- the price multiple that another investor pays when you sell the share.

The company is responsible for the increase (or decrease) in EPS, while the price multiple is determined by the market. As an investor, you need to do the following:

- estimate the likely EPS growth,

- estimate the price multiple the market will pay for the share at some point in the future,

- calculate the multiple you can pay now to earn an acceptable return based on those two estimates.

Unless you plan to hold a share forever, you need to anticipate a realistic future multiple to calculate a likely return on your investment.

The following are some of the things that typically influence the multiple:

- 🌎 The market where the company is listed, headquartered or conducts most of its business

- Some markets, like the US, typically trade at a premium, meaning the average share trades at a higher multiple than similar companies listed elsewhere. Other markets tend to run hot and cold, depending on recent or expected performance. If you bought shares in China five years ago, the multiple was probably a lot higher than it is now relative to the growth rate.

- 💻 The sector it operates in

- The average P/E in a given sector can also rise and fall depending on whether the sector is in favor or not. Sentiment and hype can play a big role here.

- 📈 The company’s expected and recent earnings growth

- Markets tend to focus on expected earnings growth over the next 12 months and over the last few years.

- 💰 Earnings quality

- As mentioned, investors tend to pay a premium for shares that are regarded as quality . As an example, Apple’s current valuation probably has more to do with the company’s track record than its recent or expected earnings growth.

The Simply Wall St platform provides several ways to give a share’s current P/E ratio context:

On each company report, under section 1 (Valuation):

- Section 1.3 compares the P/E ratio to the company’s peers

- Section 1.4 compares the P/E ratio to its historical levels

- Section 1.5 compares the P/E ratio to companies in the same industry.

On the markets page, you can view the market P/E, and then drill down to view the ratio for each sector and each industry within the sector.

Just remember: To determine a fair price to pay today, you need to consider where earnings could get to in the future (based on its earnings growth) as well as what price multiple it could be trading on at that time in the future.

Don’t forget! You can record your perspective on a company’s future earnings and price multiples in your Watchlist with our new Narrative fair value tool!

Key Events During the Next Week

It’s Fed Fund rate week, and this is a big one: The US central bank is expected to cut rates for the first time since June 2019.

Tuesday

- 🇨🇦 Canada’s YoY inflation rate will be published, and is forecast to fall from 2.5% to 2.4%.

- 🇺🇸 US Retail sales data will be released. Overall retail sales are expected to be down 0.3% for the month, compared to a 1% increase in July.

Wednesday

- 🇯🇵 Japan’s trade data is forecast to show a slight decrease in the trade deficit.

- 🇬🇧 UK Inflation is due. The headline inflation rate is forecast to be 2%, down from 2.2% in July.

- 🇺🇸 The Federal Open Market Committee is expected to cut the benchmark rate from 5.5% to 5.25%. The Fed Fund futures market is implying an 85% probability of a 0.25% cut, vs a 15% chance of a 0.5% cut.

Thursday

- 🇬🇧 The UK’s central bank will announce its interest rate decision. Economists are anticipating the benchmark rate remaining at 5%.

- 🇺🇸 US initial jobless claims data will be published.

Friday

- 🇯🇵 Japan’s inflation rate is expected to rise from 2.8% to 3%. The BOJ will also announce its interest rate decision but is expected to keep the key rate at 0.25%

- 🇬🇧 UK retail sales are forecast to show sales declining 0.6% in August, after a 0.5% bump in July.

Just a few companies are due to report second-quarter earnings:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.